Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 18 2021 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission File Number: 001-34238

THE9 LIMITED

17 Floor, No. 130 Wu Song Road

Hong Kou District, Shanghai 200080

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On April 9, 2021, The9

Limited. (the “Company”) entered into certain share purchase agreements (the “SPAs”) with three

sellers (the “Sellers”) of bitcoin mining equipment separately, pursuant to which, the Company agreed to issue an aggregate

of 5,883,750 Class A ordinary shares, par value US$0.01 per share, to the Sellers as “preliminary subject shares” and

to issue additional Class A ordinary shares in case that, the aggregate market value of the preliminary subject shares as of the

day prior to the six-month anniversary of entering into such SPAs, is lower than the sum of the market value of the bitcoin mined and

the increased market value of such bitcoin mining equipment during such six months, less the electricity cost, operation and maintenance

service fee charged by mining facility and repair and spare parts’ cost for the bitcoin mining equipment.

On

April 10, 2021, the Company issued to the Sellers an aggregate of 5,883,750 Class A ordinary shares as the preliminary subject

shares under the SPAs. On June 28, 2021, we entered into an amendment with one of the Seller as certain 5,000 units of the bitcoin

mining equipment have defects and are not suitable for the intended use. Pursuant to the amendment, the Company shall be deemed to have

issued an aggregate of 5,346,020 Class A ordinary shares to the Sellers as the preliminary subject shares. These preliminary subject

shares qualify for sale pursuant to Rule 144 under the Securities Act.

Upon the six month’s

anniversary, the Company has determined to issue to all the Sellers a total of additional 12,501,150 Class A ordinary shares, in

the form of 416,705 American Depositary Shares (the “ADSs” or the “Shares”), pursuant to the SPAs

and the Company’s effective shelf registration statement on Form F-3ASR (File No. 333-254878) filed with the Securities

and Exchange Commission (the “SEC”) on March 30, 2021 and an accompanying prospectus supplement dated November 17, 2021.

Pursuant

to the terms of the SPAs, the Sellers transferred and assigned, and the Company obtained, certain bitcoin mining equipment and all manufacturer

warranties, insurance policies, if any, in effect for such bitcoin mining equipment, in favor of the Sellers, free and clear of all encumbrances

and suitable for intended use under the SPAs. The SPAs contain customary representations, warranties, and covenants by the Company

and each of the Sellers.

A copy of the legal opinion

of Maples and Calder (Hong Kong) LLP relating to the legality of the issuance and sale of the Shares is filed as Exhibit 5.1 to this

Current Report on Form 6-K.

Forward-Looking Statements

This Current Report on Form 6-K

contains forward-looking statements that involve risks and uncertainties, such as statements related to the anticipated amount of net

proceeds from the Offering and the intended use of such proceeds. The risks and uncertainties involved include the Company’s ability

to satisfy certain conditions to closing on a timely basis or at all, as well as other risks detailed from time to time in the Company’s

filings with the SEC. You are cautioned not to place undue reliance on forward-looking statements, which are based on the Company’s

current expectations and assumptions and speak only as of the date of this report. The Company does not intend to revise or update any

forward-looking statement in this report to reflect events or circumstances arising after the date hereof, except as may be required by

law.

Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Dated: November 18, 2021

|

|

THE9 LIMITED

|

|

|

|

|

|

By:

|

/s/ George Lai

|

|

|

Name:

|

George Lai

|

|

|

Title:

|

Director and Chief Financial Officer

|

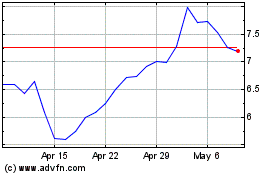

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

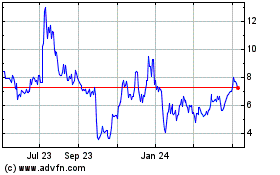

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2023 to Apr 2024