Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

August 27 2021 - 5:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2021

Commission File Number: 001-34238

THE9 LIMITED

17 Floor, No. 130 Wu Song Road

Hong Kou District, Shanghai 200080

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Entry into Material Definitive Agreements

As previously disclosed, The9

Limited (the “Company”) entered into a standby equity distribution agreement (the “SEDA”) with YA

II PN, Ltd., a Cayman Islands exempt limited partnership managed by Yorkville Advisor Global LP (the “Purchaser”),

dated February 5, 2021, pursuant to which the Company would be able to sell up to US$100.0 million of its American Depositary Shares (“ADSs”)

solely at the Company’s request based on the Company’s funding requirement at any time during the 36 months following the

date of the SEDA.

On August 27, 2021, the Company

and the Purchaser agreed to terminate the SEDA and entered into a new standby equity distribution agreement (the “August SEDA”).

The Company did not issue any securities pursuant to the SEDA. Pursuant to the August SEDA, the Company will be able to sell up to US$100.0

million of its ADSs solely at the Company’s request at any time during the 36 months following the date of the August SEDA. The

ADSs would be purchased at a price per ADS that is the greater of (i) 85% of the average of the five daily VWAPs (as defined below) during

the pricing period, or (ii) 90% of the average of the 3 lowest daily VWAPs during the pricing period, rounded to the nearest 100th.

“VWAP” means, for any trading day, the daily volume weighted average price of the Company’s ADSs for such date on the

principal market as reported by Bloomberg L.P. during regular trading hours.

Pursuant to the August SEDA,

the Company is required to register the ADSs acquired by the Purchaser as set forth in each settlement document (“Settlement

Document”) provided by the Purchaser in response to each advance notice issued by the Company. The Company shall file with the

Securities and Exchange Commission (the “SEC”) prospectus supplements to the Company’s prospectus, dated March

30, 2021, filed as part of the Company’s effective shelf registration statement on Form F-3ASR (File No. 333-254878) registering

all of the ADSs indicated in each Settlement Document that are offered and sold to the Purchaser prior to each closing pursuant to the

August SEDA.

Pursuant to the August SEDA,

the Company shall use the net proceeds from any sale of the ADSs for working capital and other general corporate purposes, or, if different,

in a manner consistent with the application thereof described in the prospectus supplements to be filed with the SEC in connection with

the August SEDA.

The Purchaser has agreed that

neither it nor any of its affiliates shall engage in any short-selling or hedging of the Company’s ADSs, but may sell the ADSs indicated

in each Settlement Document prior to receiving such ADSs to be issued to the Purchaser.

The foregoing is a summary

description of certain terms of the August SEDA. For a full description of all terms, please refer to the copy of the August SEDA that

is furnished herewith as Exhibit 99.1 to this Form 6-K and is incorporated herein by reference.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

THE9 LIMITED

|

|

|

|

|

|

|

|

By:

|

|

/s/ George Lai

|

|

|

Name:

|

|

George Lai

|

|

|

Title:

|

|

Director and Chief Financial Officer

|

Date: August 27, 2021

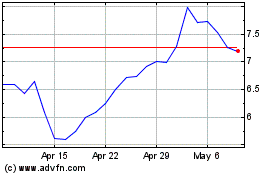

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

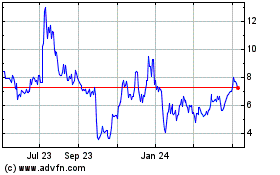

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2023 to Apr 2024