Report of Foreign Issuer (6-k)

December 20 2019 - 5:03PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2019

MMTEC,

INC.

(Translation

of registrant’s name into English)

AF,

16/F, Block B, Jiacheng Plaza, 18 Xiaguangli, Chaoyang District, Beijing, 100027

People’s

Republic of China.

Tel:

+86 10 5617 2312

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________.

EXPLANATORY

NOTE

This

Report of Foreign Private Issuer on Form 6-K filed by MMtec, Inc. (together with our subsidiaries, unless the context indicates

otherwise, “we,” “us,” “our,” or the “Company”) contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These statements relate to future events or the Company’s future financial performance. The Company has

attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “expects,”

“can,” “continue,” “could,” “estimates,” “intends,” “may,”

“plans,” “potential,” “predict,” “should” or “will” or the negative

of these terms or other comparable terminology. These statements are only predictions, uncertainties and other factors may cause

the Company’s actual results, levels of activity, performance or achievements to be materially different from any future

results, levels or activity, performance or achievements expressed or implied by these forward-looking statements. The information

in this Report on Form 6-K is not intended to project future performance of the Company. Although the Company believes that the

expectations reflected in the forward-looking statements are reasonable, the Company does not guarantee future results, levels

of activity, performance or achievements. The Company expectations are as of the date this Form 6-K is filed, and the Company

does not intend to update any of the forward-looking statements after the date this Report on Form 6-K is filed to confirm these

statements to actual results, unless required by law.

MMTEC, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS)

(UNAUDITED)

|

|

|

As of

|

|

|

|

|

June 30,

2019

|

|

|

December 31,

2018

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

4,934,595

|

|

|

$

|

93,625

|

|

|

Prepaid rent

|

|

|

-

|

|

|

|

101,298

|

|

|

Other receivable

|

|

|

17,379

|

|

|

|

-

|

|

|

Loan to employee

|

|

|

43,638

|

|

|

|

-

|

|

|

Security deposits - current

|

|

|

52,114

|

|

|

|

51,107

|

|

|

Prepaid expenses and other current assets

|

|

|

171,703

|

|

|

|

84,430

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

5,219,429

|

|

|

|

330,460

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Security deposit - noncurrent

|

|

|

500,000

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

38,854

|

|

|

|

32,428

|

|

|

Operating lease right-of-use assets

|

|

|

151,367

|

|

|

|

|

|

|

Long-term Investment

|

|

|

44,560

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-current Assets

|

|

|

734,781

|

|

|

|

32,428

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

5,954,210

|

|

|

$

|

362,888

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' (DEFICIT) EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

$

|

45,154

|

|

|

$

|

79,182

|

|

|

Salary payable

|

|

|

112,858

|

|

|

|

185,434

|

|

|

Accrued liabilities and other payables

|

|

|

388

|

|

|

|

283,496

|

|

|

Investee losses in excess of investment controlled by major shareholders

|

|

|

-

|

|

|

|

19,426

|

|

|

Due to Related Parties

|

|

|

72,501

|

|

|

|

239,635

|

|

|

Lease liabilities, current

|

|

|

42,722

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

273,623

|

|

|

|

807,173

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

273,623

|

|

|

|

807,173

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' (DEFICIT) EQUITY:

|

|

|

|

|

|

|

|

|

|

Common shares ($0.001 par value; 500,000,000 shares authorized; 56,070,000 shares issued and 20,700,000 shares outstanding at June 30,2019 54,000,000 shares issued and 18,000,000 outstanding at December 31, 2018)

|

|

|

56,070

|

|

|

|

54,000

|

|

|

Additional paid-in capital

|

|

|

11,229,339

|

|

|

|

3,759,008

|

|

|

Less: treasury stock, at cost; (36,000,000 shares at June 30,2019 and December 31, 2018)

|

|

|

(36,000

|

)

|

|

|

(36,000

|

)

|

|

Accumulated deficit

|

|

|

(5,459,010

|

)

|

|

|

(4,132,069

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(109,812

|

)

|

|

|

(89,224

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders' (Deficit) Equity

|

|

|

5,680,587

|

|

|

|

(444,285

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders' (Deficit) Equity

|

|

$

|

5,954,210

|

|

|

$

|

362,888

|

|

MMTEC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS

(IN U.S. DOLLARS)

(UNAUDITED)

|

|

|

For the

Six Months Ended

|

|

|

For the

Six Months Ended

|

|

|

|

|

June 30,

2019

|

|

|

June 30,

2018

|

|

|

|

|

|

|

|

|

|

|

REVENUE

|

|

$

|

177,543

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUE

|

|

|

66,215

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT

|

|

|

111,328

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

157,440

|

|

|

|

-

|

|

|

General and administrative

|

|

|

|

|

|

|

|

|

|

Payroll and related benefits

|

|

|

404,405

|

|

|

|

404,644

|

|

|

Professional fees

|

|

|

472,638

|

|

|

|

470,190

|

|

|

Other general and administrative

|

|

|

385,428

|

|

|

|

189,411

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses

|

|

|

1,419,911

|

|

|

|

1,064,245

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS

|

|

|

(1,380,583

|

)

|

|

|

(1,064,245

|

)

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE):

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

1,768

|

|

|

|

251

|

|

|

Interest expense

|

|

|

-

|

|

|

|

(12

|

)

|

|

Other income (expense)

|

|

|

(114

|

)

|

|

|

4,581

|

|

|

Foreign currency transaction gain

|

|

|

3764

|

|

|

|

23,682

|

|

|

Loss on equity method investment controlled by major shareholders

|

|

|

(23,776

|

)

|

|

|

(26,506

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income

|

|

|

(18,358

|

)

|

|

|

1,996

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES

|

|

|

(1,326,941

|

)

|

|

|

(1,062,249

|

)

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAXES

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$

|

(1,326,941

|

)

|

|

$

|

(1,062,249

|

)

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE LOSS:

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

|

(1,326,941

|

)

|

|

|

(1,062,249

|

)

|

|

OTHER COMPREHENSIVE LOSS

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

(20,588

|

)

|

|

|

(26,200

|

)

|

|

COMPREHENSIVE LOSS

|

|

$

|

(1,347,529

|

)

|

|

$

|

(1,088,449

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER COMMON SHARE

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(0.07

|

)

|

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING:

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

19,955,635

|

|

|

|

54,000,000

|

|

MMTEC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN U.S. DOLLARS)

(UNAUDITED)

|

|

|

For the

Six Months Ended

|

|

|

For the

Six Months Ended

|

|

|

|

|

June 30,

2019

|

|

|

June 30,

2018

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,326,941

|

)

|

|

$

|

(1,062,249

|

)

|

|

Adjustments to reconcile net loss from operations to

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation expense

|

|

|

10,315

|

|

|

|

13,181

|

|

|

Loss on equity method investment controlled by major shareholders

|

|

|

23,776

|

|

|

|

26,506

|

|

|

Noncash lease expense

|

|

|

150,011

|

|

|

|

—

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Security deposit

|

|

|

(1,107

|

)

|

|

|

(47

|

)

|

|

Prepaid expenses and other current assets

|

|

|

(104,903

|

)

|

|

|

(51,224

|

)

|

|

Advance from customer

|

|

|

(34,363

|

)

|

|

|

—

|

|

|

Salary payable

|

|

|

(73,471

|

)

|

|

|

(30,389

|

)

|

|

Accrued liabilities and other payables

|

|

|

(162,144

|

)

|

|

|

60,710

|

|

|

Lease liabilities, current

|

|

|

(157,631

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH USED IN OPERATING ACTIVITIES

|

|

|

(1,676,458

|

)

|

|

|

(1,043,512

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(16,885

|

)

|

|

|

(12,408

|

)

|

|

Loan to employee

|

|

|

(44,243

|

)

|

|

|

—

|

|

|

Payment in equity method investment

|

|

|

(87,762

|

)

|

|

|

(12,450

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES

|

|

|

(148,890

|

)

|

|

|

(24,858

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Proceeds received from issuance of common stock

|

|

|

6,851,401

|

|

|

|

1,661,420

|

|

|

Capital contribution from shareholders

|

|

|

—

|

|

|

|

5,448

|

|

|

Repayments to related parties

|

|

|

(168,728

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

|

|

6,682,673

|

|

|

|

1,666,868

|

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH AND CASH EQUIVALENTS

|

|

|

(16,355

|

)

|

|

|

(24,143

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

|

|

4,840,970

|

|

|

|

574,355

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS - beginning of year

|

|

|

93,625

|

|

|

|

237,561

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS - end of year

|

|

$

|

4,934,595

|

|

|

$

|

811,916

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

|

|

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Income taxes

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-CASH INVESTING AND FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stocks directly deposited in escrow

|

|

$

|

500,000

|

|

|

$

|

—

|

|

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date:

December 20, 2019

|

|

MMtec,

Inc.

|

|

|

|

|

|

|

By:

|

/s/ Zhen Fan

|

|

|

|

Zhen Fan, Chief Executive Officer

|

5

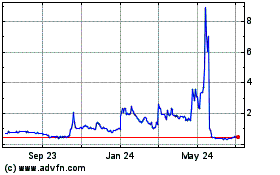

MMTec (NASDAQ:MTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

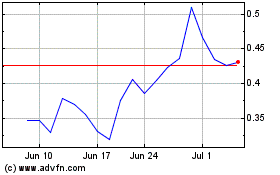

MMTec (NASDAQ:MTC)

Historical Stock Chart

From Apr 2023 to Apr 2024