Current Report Filing (8-k)

November 05 2019 - 9:47AM

Edgar (US Regulatory)

false 0001058057 0001058057 2019-11-04 2019-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2019

MARVELL TECHNOLOGY GROUP LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Bermuda

|

|

000-30877

|

|

77-0481679

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

(Address of principal executive offices)

(441) 296-6395

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Shares

|

|

MRVL

|

|

The Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement.

|

On November 4, 2019, Marvell Technology Group Ltd. (the “Company”) entered into a 90-Day Term Credit Agreement (the “Bridge Credit Agreement”) with the lenders named therein (the “Bridge Lenders”), Wells Fargo Bank, National Association, as Administrative Agent, and Wells Fargo Securities, LLC and Citibank, N.A., as Joint Lead Arrangers and Joint Bookrunners. The Bridge Credit Agreement provides for borrowings under a term loan facility of up to $600 million with a maturity date of February 3, 2020. The Bridge Credit Agreement is unsecured. The obligations of the Bridge Lenders to fund loans under the Bridge Credit Agreement expire on the earlier of (a) immediately after the making of the loan by the Bridge Lenders on the closing date of the Bridge Credit Agreement and (b) November 4, 2019.

The Bridge Credit Agreement is available to the Company to (i) finance the Avera Semiconductor acquisition and (ii) pay fees and expenses related to the Transactions (as defined in the Bridge Credit Agreement).

Any advance by the Bridge Lenders to the Company as part of the borrowings may be available, at the Company’s option, at either (1) the Adjusted LIBO Rate (as defined in the Bridge Credit Agreement) which is an interest rate per annum equal to (a) the LIBO Rate (as defined in the Bridge Credit Agreement) multiplied by (b) the Statutory Reserve Rate (as defined in the Bridge Credit Agreement), or (2) at the Alternate Base Rate which is an interest rate per annum equal to the greatest of (a) the Prime Rate (as defined in the Bridge Credit Agreement), (b) the Federal Funds Effective Rate (as defined in the Bridge Credit Agreement) plus 0.50% and (c) the Adjusted LIBO Rate plus 1.00% per annum. If the Alternate Base Rate is less than 1.00%, such rate shall be 1.00%.

The Bridge Credit Agreement contains customary affirmative and negative covenants (each with customary exceptions), including limitations on the ability of subsidiaries of the Company to incur debt and limitations on the Company’s ability to incur liens, engage in certain fundamental changes, change the nature of its business, and use the proceeds of the borrowings for certain purposes. Additionally, the Bridge Credit Agreement requires the Company to maintain a Leverage Ratio (as defined in the Bridge Credit Agreement) of not greater than 3.0 to 1.0.

The foregoing summary of the Bridge Credit Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Bridge Credit Agreement, which is attached as Exhibit 10.1 hereto and incorporated herein by reference.

On May 20, 2019, the Company issued a press release announcing that it had entered into a definitive agreement to purchase Avera Semiconductor, the Application Specific Integrated Circuit (ASIC) business of GLOBALFOUNDRIES for $650 million in cash, subject to certain closing adjustments specified in the purchase agreement, at closing plus an additional $90 million in cash if certain business conditions are satisfied within the next 15 months. On November 5, 2019, the Company issued a press release announcing that it had closed the transaction. A copy of the press release is filed herewith as Exhibit 99.1 and is incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Bridge Credit Agreement dated as of November 4, 2019, among Marvell Technology Group Ltd., the Lenders party thereto, Wells Fargo Bank, National Association, as Administrative Agent, and Wells Fargo Securities, LLC and Citibank, N.A., as Joint Lead Arrangers and Joint Bookrunners

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release dated November 5, 2019

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 5, 2019

|

|

|

|

|

MARVELL TECHNOLOGY GROUP LTD

|

|

|

|

|

|

By:

|

|

/s/ Jean Hu

|

|

|

|

Jean Hu

|

|

|

|

Chief Financial Officer

|

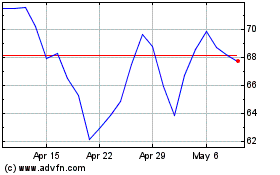

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024