Current Report Filing (8-k)

April 26 2022 - 7:25AM

Edgar (US Regulatory)

0001094038

false

Marker Therapeutics, Inc.

0001094038

2022-04-21

2022-04-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

April 21, 2022

MARKER

THERAPEAUTICS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-37939 |

45-4497941 |

(State or Other Jurisdiction

of

Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification

No.) |

|

3200 Southwest Freeway

Suite 2500

Houston, Texas |

|

77027 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(713 )400-6400

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| |

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

MRKR |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On April 21, 2022, Marker

Therapeutics, Inc. (the “Company”) entered into a binding services agreement (the “Agreement”), effective

April 12, 2022, with Wilson Wolf Manufacturing Corporation (“Wilson Wolf”). Wilson Wolf is in the business of creating

products and services intended to simply and expedite the transition of cell therapies and gene-modified cell therapies to mainstream

society (the “Wilson Wolf Mission”). Pursuant to the Agreement, Wilson Wolf made a cash payment to the Company in the amount

of $8.0 million, allocated as follows:

| · | $2.0 million as a prepaid expense for non-exclusive training of Wilson Wolf to make, use, and sell Marker’s

cell culture non-proprietary media formulation that has been cleared in an FDA investigational new drug application in pursuit of the

Wilson Wolf Mission; |

| · | $1.0 million as a prepaid expense for non-exclusive training of Wilson Wolf to replicate Marker’s

quality management system inclusive of all underlying documents related thereto, none of which shall include unique information specific

to the manufacture of Marker’s MultiTAA product candidates such as direct peptide stimulation, which Wilson Wolf shall use as it

sees fit in pursuit of the Wilson Wolf Mission; |

| · | $2.0 million as a prepaid expense for non-exclusive training of Wilson Wolf to be able to replicate Marker’s

cGMP-compliant, linearly scalable, G-Rex based T-cell manufacturing process which Wilson Wolf shall use as it sees fit in pursuit of the

Wilson Wolf Mission; and |

| · | $3.0 million as a prepaid expense under the hired to invent doctrine for Marker to train Wilson Wolf on

its expertise in the optimization of T-cell therapy manufacturing processes using G-Rex and to conduct CAR T and TCR G-Rex Optimization

Work under the direction of Wilson Wolf (the “Work Direction”), whereunder all intellectual property provided by Wilson Wolf

or created or derived by Marker will be solely owned by Wilson Wolf, and whereby Marker will make good faith efforts to complete the conduct

of such work as soon as practicable within 18 months from the date of the agreement. Wilson Wolf has agreed to pay Marker an additional

$1.0 million if the Work Direction is completed within one year from the onset of the Agreement. |

The Agreement shall continue

until the fulfillment of all of Marker’s obligations set forth in the Agreement or in any mutually agreed upon subsequent agreements.

All intellectual property created or derived under the Work Direction will be owned by Wilson Wolf. The Agreement contains certain representations

made by Marker, as well as a mutual confidentiality provision and an indemnification provision by Wilson Wolf in favor of Marker. Pursuant

to the Agreement, in the event that Marker becomes insolvent, goes out of business, or an event other than force majeure occurs that cannot

allow the Agreement to be fulfilled, Wilson Wolf will have right of first offer and right of first refusal for Marker’s manufacturing

facility provided it is able and willing to meet whatever financial obligations are required to do so and provided further that such clause

will not apply in the event of a merger, reorganization or consolidation of Marker with a third party that results in the outstanding

voting securities of Marker immediately prior thereto ceasing to represent, or being converted into or exchanged for voting securities

that do not represent, at least fifty percent (50%) of the combined voting power of the voting securities of the surviving entity or the

parent corporation of the surviving entity immediately after such merger, reorganization or consolidation, or the sale or other transfer

of all or substantially all of Marker’s business or assets. Marker agrees to assist as needed to the extent permitted under any

applicable law (including bankruptcy or insolvency statutes). Further, prior to Marker undertaking any financing that would encumber any

of Marker’s assets necessary for Marker’s performance under this Agreement, Wilson Wolf shall have the first right to provide

such financing on equal terms to what Marker can obtain elsewhere.

The foregoing summary of the Agreement is not complete

and is qualified in their entirety by reference to the text of the Agreement, a copy of which is filed herewith as Exhibit 10.1 to

this Current Report on Form 8-K (the “Form 8-K”) and is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On April 26, 2022, the Company issued a press

release (the “Press Release”) announcing the Agreement. A copy of this Press Release is furnished herewith as Exhibit 99.1

to this Form 8-K and is incorporated herein by reference.

The information contained in this Item 7.01 of

the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of

the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof,

except as shall be expressly set forth by specific reference in any such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Marker Therapeutics, Inc. |

| Dated: April 26, 2022 |

By:

|

/s/ Anthony Kim

|

| |

|

Anthony Kim

Chief Financial Officer |

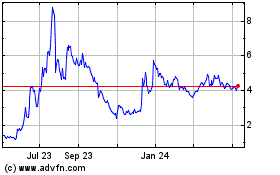

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

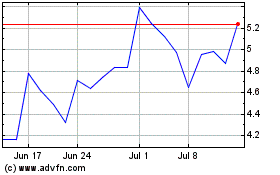

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024