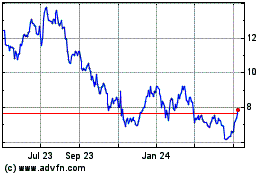

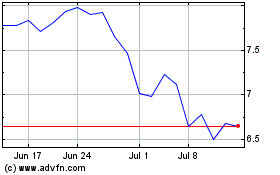

Melco Resorts & Entertainment Limited (Nasdaq: MLCO) (“Melco”

or the “Company”), a developer, owner, and operator of integrated

resort facilities in Asia and Europe, today reported its unaudited

financial results for the third quarter of 2022.

Total operating revenues for the third quarter

of 2022 were US$241.8 million, representing a decrease of

approximately 46% from US$446.4 million for the comparable period

in 2021. The decrease in total operating revenues was primarily

attributable to the government mandated temporary closure of our

casinos in Macau in July and heightened travel restrictions in

Macau and mainland China related to COVID-19 during the quarter

which led to softer performance in the rolling chip and mass market

table games segments.

Melco generated negative Adjusted Property

EBITDA(1) of US$34.9 million in the third quarter of 2022, compared

with Adjusted Property EBITDA of US$ 31.9 million in the third

quarter of 2021.

Operating loss for the third quarter of 2022 was

US$198.5 million, compared with operating loss of US$182.2 million

in the third quarter of 2021.

Net loss attributable to Melco Resorts &

Entertainment Limited for the third quarter of 2022 was US$243.8

million, or US$0.53 per ADS, compared with net loss attributable to

Melco Resorts & Entertainment Limited of US$233.2 million, or

US$0.49 per ADS, in the third quarter of 2021. The net loss

attributable to noncontrolling interests was US$42.8 million and

US$35.3 million during the third quarters of 2022 and 2021,

respectively, all of which were related to Studio City, City of

Dreams Manila, and the Cyprus Operations.

Mr. Lawrence Ho, our Chairman and Chief

Executive Officer, commented, “Our results for the third quarter of

2022 were impacted by the casino closures in July and the travel

restrictions imposed across mainland China and Macau. In July, the

Macau government implemented preventative measures against the

pandemic and our casinos were closed for 12 days. Following the

re-opening, the operating environment remained challenging given

the continuing tight travel restrictions, but we are encouraged by

the recent re-opening of Macau to international tourists from

designated countries as well as the increase in visitation over the

October Golden Week. We are also cautiously optimistic that the

granting of e-visas and group visas, which commenced on November 1,

2022, will lead to a gradual increase in visitation.

“We submitted our proposal to the public tender

for the award of new gaming concessions on September 14, 2022 and

it has been a smooth and transparent process. We fully support the

Macau government’s initiatives to further develop Macau as Asia’s

premier destination for international tourism. Our integrated

resorts offer a wide range of unique non-gaming amenities, and we

plan to leverage our experience to provide additional tourist

attractions in Macau. Our proposal reinforces our commitment to

Macau, and we look forward to playing a leadership role in

partnering with the Macau government to execute on its vision.

“In the Philippines, gaming volumes continue to

track towards pre-pandemic levels. We expect to see further growth

as travel restrictions around Asia continue to be lifted and travel

returns to more normal levels. Gaming volumes in Cyprus exceeded

pre-pandemic levels driven by further easing of COVID-19 related

restrictions in the third quarter.

“In respect to our development projects, the

construction of Studio City Phase 2 is progressing on schedule. We

will monitor the market closely to determine the appropriate time

to open and currently anticipate the opening to be conducted in

stages beginning in the second quarter of 2023. In Cyprus, as we

have previously announced, the City of Dreams Mediterranean project

is expected to open in the second quarter of 2023, subject to

regulatory approvals.

“I am pleased to report that we are making

appreciable progress to reach our 2030 goals in environmental

sustainability. The energy-efficiency measures that have been

progressively adopted at our properties in Macau and Manila since

2018 have resulted in annualized savings of over 46.8 million kWh,

equivalent to energy savings in over 4,000 homes. We continue to

strive to reduce single-use plastic in our operations with the

NORDAQ water filtration and bottling system which is now

operational in all of our properties in Macau and Manila. In

addition, we are undergoing an extensive plastic inventory exercise

to report and continue to implement plans to reduce problematic

plastic usage.”

City of Dreams Third Quarter

Results

For the quarter ended September 30, 2022, total

operating revenues at City of Dreams were US$66.4 million, compared

to US$252.0 million in the third quarter of 2021. City of Dreams

generated negative Adjusted EBITDA of US$40.2 million in the third

quarter of 2022, compared with Adjusted EBITDA of US$32.7 million

in the third quarter of 2021. The year-over-year decline in

Adjusted EBITDA was primarily a result of softer performance in the

rolling chip and mass market table games segments, as well as

non-gaming operations.

Rolling chip volume was US$332.2 million for the

third quarter of 2022 versus US$2.79 billion in the third quarter

of 2021. The rolling chip win rate was 4.53% in the third quarter

of 2022 versus 3.46% in the third quarter of 2021. The expected

rolling chip win rate range is 2.85% - 3.15%.

Mass market table games drop decreased to

US$133.5 million in the third quarter of 2022, compared with

US$617.7 million in the third quarter of 2021. The mass market

table games hold percentage was 28.6% in both the third quarters of

2022 and 2021.

Gaming machine handle for the third quarter of

2022 was US$137.4 million, compared with US$376.9 million in the

third quarter of 2021. The gaming machine win rate was 4.3% in the

third quarter of 2022 versus 3.1% in the third quarter of 2021.

Total non-gaming revenue at City of Dreams in

the third quarter of 2022 was US$19.3 million, compared with

US$39.5 million in the third quarter of 2021.

Altira Macau Third Quarter

Results

For the quarter ended September 30, 2022, total

operating revenues at Altira Macau were US$2.4 million, compared to

US$10.2 million in the third quarter of 2021. Altira Macau

generated negative Adjusted EBITDA of US$12.9 million in the third

quarter of 2022, compared with negative Adjusted EBITDA of US$6.9

million in the third quarter of 2021.

In the mass market table games segment, drop was

US$18.4 million in the third quarter of 2022 versus US$28.7 million

in the third quarter of 2021. The mass market table games hold

percentage was 4.8% in the third quarter of 2022, compared with

25.8% in the third quarter of 2021.

Gaming machine handle for the third quarter of

2022 was US$33.2 million, compared with US$59.1 million in the

third quarter of 2021. The gaming machine win rate was 2.9% in the

third quarter of 2022 versus 3.6% in the third quarter of 2021.

Total non-gaming revenue at Altira Macau in the

third quarter of 2022 was US$1.3 million, compared with US$2.0

million in the third quarter of 2021.

Mocha and Other Third Quarter

Results

Total operating revenues from Mocha and Other

were US$18.8 million in the third quarter of 2022, compared to

US$22.2 million in the third quarter of 2021. Mocha and Other

generated Adjusted EBITDA of US$1.7 million in the third quarter of

2022, compared with Adjusted EBITDA of US$4.8 million in the third

quarter of 2021.

Mass market table games drop was US$17.8 million

in the third quarter of 2022 and the mass market table games hold

percentage was 20.3% for the third quarter of 2022.

Gaming machine handle for the third quarter of

2022 was US$327.6 million, compared with US$491.3 million in the

third quarter of 2021. The gaming machine win rate was 4.7% in the

third quarter of 2022 versus 4.5% in the third quarter of 2021.

Studio City Third Quarter

Results

For the quarter ended September 30, 2022, total

operating revenues at Studio City were US$25.6 million, compared to

US$81.8 million in the third quarter of 2021. Studio City generated

negative Adjusted EBITDA of US$31.5 million in the third quarter of

2022, compared with negative Adjusted EBITDA of US$14.0 million in

the third quarter of 2021. The year-over-year decline in Adjusted

EBITDA was primarily a result of softer performance in all gaming

segments and non-gaming operations.

Studio City’s rolling chip volume was US$42.1

million in the third quarter of 2022 versus US$472.4 million in the

third quarter of 2021. The rolling chip win rate was 4.18% in the

third quarter of 2022 versus 2.35% in the third quarter of 2021.

The expected rolling chip win rate range is 2.85% - 3.15%.

Mass market table games drop decreased to

US$61.9 million in the third quarter of 2022, compared with

US$250.5 million in the third quarter of 2021. The mass market

table games hold percentage was 25.6% in the third quarter of 2022,

compared to 26.4% in the third quarter of 2021.

Gaming machine handle for the third quarter of

2022 was US$98.2 million, compared with US$271.5 million in the

third quarter of 2021. The gaming machine win rate was 3.1% in the

third quarter of 2022, compared to 2.9% in the third quarter of

2021.

Total non-gaming revenue at Studio City in the

third quarter of 2022 was US$9.0 million, compared with US$19.6

million in the third quarter of 2021.

City of Dreams Manila Third Quarter

Results

For the quarter ended September 30, 2022, total

operating revenues at City of Dreams Manila were US$102.6 million,

compared to US$52.5 million in the third quarter of 2021. City of

Dreams Manila generated Adjusted EBITDA of US$41.4 million in the

third quarter of 2022, compared with Adjusted EBITDA of US$11.7

million in the comparable period of 2021. The year-over-year

improvement in Adjusted EBITDA was primarily the result of the

relaxation of COVID-19 related restrictions in Manila combined with

effective cost controls. Casinos were temporarily closed for

approximately 1.5 months during the third quarter of 2021 due to

government-mandated restrictions.

City of Dreams Manila’s rolling chip volume was

US$513.2 million in the third quarter of 2022 versus US$25.3

million in the third quarter of 2021. The rolling chip win rate was

2.91% in the third quarter of 2022 versus 6.75% in the third

quarter of 2021. The expected rolling chip win rate range is 2.85%

- 3.15%.

Mass market table games drop increased to

US$153.3 million in the third quarter of 2022, compared with

US$82.0 million in the third quarter of 2021. The mass market table

games hold percentage was 33.1% in the third quarter of 2022,

compared to 28.1% in the third quarter of 2021.

Gaming machine handle for the third quarter of

2022 was US$930.8 million, compared with US$527.8 million in the

third quarter of 2021. The gaming machine win rate was 5.2% in the

third quarter of 2022 versus 5.5% in the third quarter of 2021.

Total non-gaming revenue at City of Dreams

Manila in the third quarter of 2022 was US$28.5 million, compared

with US$9.8 million in the third quarter of 2021.

Cyprus Operations Third Quarter

Results

The Company is licensed to operate a temporary

casino, the first casino in the Republic of Cyprus, and four

satellite casinos. Upon the completion and opening of City of

Dreams Mediterranean, the Company will continue to operate the

satellite casinos while operation of the temporary casino will

cease.

Total operating revenues at Cyprus Casinos for

the quarter ended September 30, 2022 was US$24.8 million, compared

to US$20.2 million in the third quarter of 2021. Cyprus Casinos

generated Adjusted EBITDA of US$6.7 million in the third quarter of

2022, compared with Adjusted EBITDA of US$3.6 million in the third

quarter of 2021.

Rolling chip volume was US$1.7 million in the

third quarter of 2022, compared with US$2.7 million in the third

quarter of 2021. The rolling chip win rate was 14.19% in the third

quarter of 2022, compared to 22.33% in the third quarter of 2021.

The expected rolling chip win rate range is 2.85% - 3.15%.

Mass market table games drop was US$39.0 million

in the third quarter of 2022, compared with US$31.3 million in the

third quarter of 2021. The mass market table games hold percentage

was 19.8% in the third quarter of 2022, compared to 17.0% in the

third quarter of 2021.

Gaming machine handle for the third quarter of

2022 was US$346.2 million, compared with US$293.1 million in the

third quarter of 2021. The gaming machine win rate was 5.1% in the

third quarter of 2022 versus 5.0% in the third quarter of 2021.

Other Factors Affecting

Earnings

Total net non-operating expenses for the third

quarter of 2022 were US$86.0 million, which mainly included

interest expenses of US$93.7 million, net of amounts capitalized,

partially offset by interest income of US$8.8 million.

Depreciation and amortization costs of US$122.0

million were recorded in the third quarter of 2022 of which US$2.8

million related to the amortization expense for our gaming

subconcession and US$5.7 million related to the amortization

expense for the land use rights.

The negative Adjusted EBITDA for Studio City for

the three months ended September 30, 2022 referred to above is

US$8.1 million less than the negative Adjusted EBITDA of Studio

City contained in the earnings release for Studio City

International Holdings Limited (“SCIHL”) dated November 2, 2022

(the “Studio City Earnings Release”). The Adjusted EBITDA of Studio

City contained in the Studio City Earnings Release includes certain

intercompany charges that are not included in the Adjusted EBITDA

for Studio City contained in this press release. Such intercompany

charges include, among other items, fees and shared service charges

billed between SCIHL and its subsidiaries and certain subsidiaries

of Melco. Additionally, Adjusted EBITDA of Studio City included in

this press release does not reflect certain intercompany costs

related to the table games operations at Studio City Casino.

Financial Position and Capital

Expenditures

Total cash and bank balances as of September 30,

2022 aggregated to US$1.57 billion, including US$51.1 million of

restricted cash. Total debt, net of unamortized deferred financing

costs and original issue premiums, was US$7.73 billion at the end

of the third quarter of 2022.

Available liquidity, including cash and undrawn

revolving credit facilities, as of September 30, 2022, was US$2.32

billion.

US$154.4 million of ADSs were repurchased in the

third quarter of 2022, of which US$152.7 million were repurchased

through a privately-negotiated transaction with Melco Leisure and

Entertainment Group Limited, a wholly-owned subsidiary of Melco

International Development Limited.

Capital expenditures for the third quarter of

2022 were US$167.2 million, which primarily related to the

construction projects at Studio City Phase 2 and City of Dreams

Mediterranean.

Recent Developments

Uncertainty around COVID-19 outbreaks and

related restrictions continue to have a material effect on our

operations, financial position, and future prospects into the

fourth quarter of 2022.

On August 2, 2022, the validity of nucleic acid

tests to enter Macau was set at 48 hours for entry from Zhuhai and

reduced to 24 hours from October 30, 2022. Since September 1, 2022,

tourists became eligible to enter Macau without prior approval

provided they held passports issued by the 41 countries specified

by the Macau government or comply with certain conditions imposed

by the Macau government, subject to valid nucleic acid tests, 7-day

quarantine at a government designated facility and a 3-day

self-monitoring period. On November 1, 2022, China’s National

Immigration Administration commenced electronic processing of visa

applications for individual or group travel to Macau.

As of May 30, 2022, restrictions for inbound

travelers into the Philippines were eased and negative RT-PCR test

results no longer required for people fully vaccinated. In

addition, as of October 28, 2022, the mandatory wearing of masks in

the Philippines has been limited to healthcare facilities, medical

transport vehicles and public transport. In Cyprus, as of June 1,

2022, passengers travelling to Cyprus were no longer required to

present any sort of vaccination or recovery certificates, nor a

negative COVID-19 test result. Furthermore, masks were no longer

mandatory other than in healthcare facilities, pharmacies and

public transport. Although travel restrictions have eased in the

Philippines and Cyprus, the respective governments continue to

closely monitor the status.

Uncertainty around COVID-19 outbreaks is

expected to continue for at least the remainder of 2022 with travel

bans or restrictions, visa restrictions, and quarantine

requirements being key factors impacting performance for the

year.

Conference Call Information

Melco Resorts & Entertainment Limited will

hold a conference call to discuss its third quarter 2022 financial

results on Wednesday, November 2, 2022 at 8:30 a.m. Eastern Time

(or 8:30 p.m. Singapore Time).

To join the conference call, please register in

advance using the below Online Registration Link. Upon registering,

each participant will receive the dial-in numbers and a unique

Personal PIN which can be used to join the conference.

Online Registration Link:

https://register.vevent.com/register/BI5c7f384a910b44edb61725cce41316d0

An audio webcast and replay of the conference

call will also be available at http://www.melco-resorts.com.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Melco Resorts & Entertainment Limited (the “Company”) may

also make forward-looking statements in its periodic reports to the

U.S. Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from

those contained in any forward-looking statement. These factors

include, but are not limited to, (i) the global COVID-19 outbreak,

caused by a novel strain of the coronavirus, and the continued

impact of its consequences on our business, our industry and the

global economy, (ii) risks associated with the newly adopted gaming

law in Macau and its implementation by the Macau government and our

ability to obtain a new concession under the public tender to be

conducted by the Macau government and the terms and conditions of a

new concession, if we are granted one, (iii) growth of the gaming

market and visitations in Macau, the Philippines and the Republic

of Cyprus, (iv) capital and credit market volatility, (v) local and

global economic conditions, (vi) our anticipated growth strategies,

(vii) gaming authority and other governmental approvals and

regulations, and (viii) our future business development, results of

operations and financial condition. In some cases, forward-looking

statements can be identified by words or phrases such as “may”,

“will”, “expect”, “anticipate”, “target”, “aim”, “estimate”,

“intend”, “plan”, “believe”, “potential”, “continue”, “is/are

likely to” or other similar expressions. Further information

regarding these and other risks, uncertainties or factors is

included in the Company’s filings with the SEC. All information

provided in this press release is as of the date of this press

release, and the Company undertakes no duty to update such

information, except as required under applicable law.

Non-GAAP Financial Measures

|

(1) |

“Adjusted EBITDA” is net income/loss before interest, taxes,

depreciation, amortization, pre- opening costs, development costs,

property charges and other, share-based compensation, payments to

the Philippine parties under the cooperative arrangement (the

“Philippine Parties”), land rent to Belle Corporation and other

non-operating income and expenses. “Adjusted Property EBITDA” is

net income/loss before interest, taxes, depreciation, amortization,

pre-opening costs, development costs, property charges and other,

share-based compensation, payments to the Philippine Parties, land

rent to Belle Corporation, Corporate and Other expenses and other

non- operating income and expenses. Adjusted EBITDA and Adjusted

Property EBITDA are presented exclusively as supplemental

disclosures because management believes they are widely used to

measure the performance, and as a basis for valuation, of gaming

companies. Management uses Adjusted EBITDA and Adjusted Property

EBITDA as measures of the operating performance of its segments and

to compare the operating performance of its properties with those

of its competitors. |

| |

|

| |

The

Company also presents Adjusted EBITDA and Adjusted Property EBITDA

because they are used by some investors as ways to measure a

company’s ability to incur and service debt, make capital

expenditures, and meet working capital requirements. Gaming

companies have historically reported Adjusted EBITDA and Adjusted

Property EBITDA as supplements to financial measures in accordance

with U.S. GAAP. However, Adjusted EBITDA and Adjusted Property

EBITDA should not be considered as alternatives to operating

income/loss as indicators of the Company’s performance, as

alternatives to cash flows from operating activities as measures of

liquidity, or as alternatives to any other measure determined in

accordance with U.S. GAAP. Unlike net income/loss, Adjusted EBITDA

and Adjusted Property EBITDA do not include depreciation and

amortization or interest expense and, therefore, do not reflect

current or future capital expenditures or the cost of capital. The

Company compensates for these limitations by using Adjusted EBITDA

and Adjusted Property EBITDA as only two of several comparative

tools, together with U.S. GAAP measurements, to assist in the

evaluation of operating performance. |

| |

|

| |

Such U.S.

GAAP measurements include operating income/loss, net income/loss,

cash flows from operations and cash flow data. The Company has

significant uses of cash flows, including capital expenditures,

interest payments, debt principal repayments, taxes and other

recurring and nonrecurring charges, which are not reflected in

Adjusted EBITDA or Adjusted Property EBITDA. Also, the Company’s

calculation of Adjusted EBITDA and Adjusted Property EBITDA may be

different from the calculation methods used by other companies and,

therefore, comparability may be limited. Reconciliations of

Adjusted EBITDA and Adjusted Property EBITDA with the most

comparable financial measures calculated and presented in

accordance with U.S. GAAP are provided herein immediately following

the financial statements included in this press release. |

| |

|

| (2) |

“Adjusted

net income/loss” is net income/loss before pre-opening costs,

development costs, property charges and other and loss on

extinguishment of debt, net of noncontrolling interests and taxes

calculated using specific tax treatments applicable to the

adjustments based on their respective jurisdictions. Adjusted net

income/loss attributable to Melco Resorts & Entertainment

Limited and adjusted net income/loss attributable to Melco Resorts

& Entertainment Limited per share (“EPS”) are presented as

supplemental disclosures because management believes they are

widely used to measure the performance, and as a basis for

valuation, of gaming companies. These measures are used by

management and/or evaluated by some investors, in addition to

income/loss and EPS computed in accordance with U.S. GAAP, as an

additional basis for assessing period-to- period results of our

business. Adjusted net income/loss attributable to Melco Resorts

& Entertainment Limited and adjusted net income/loss

attributable to Melco Resorts & Entertainment Limited per share

may be different from the calculation methods used by other

companies and, therefore, comparability may be limited.

Reconciliations of adjusted net income/loss attributable to Melco

Resorts & Entertainment Limited with the most comparable

financial measures calculated and presented in accordance with U.S.

GAAP are provided herein immediately following the financial

statements included in this press release. |

About Melco Resorts & Entertainment

Limited

The Company, with its American depositary shares

listed on the Nasdaq Global Select Market (Nasdaq: MLCO), is a

developer, owner and operator of integrated resort facilities in

Asia and Europe. The Company currently operates Altira Macau

(www.altiramacau.com), an integrated resort located at Taipa, Macau

and City of Dreams (www.cityofdreamsmacau.com), an integrated

resort located in Cotai, Macau. Its business also includes the

Mocha Clubs (www.mochaclubs.com), which comprise the largest

non-casino based operations of electronic gaming machines in Macau.

The Company also majority owns and operates Studio City

(www.studiocity-macau.com), a cinematically-themed integrated

resort in Cotai, Macau. In the Philippines, a Philippine subsidiary

of the Company currently operates and manages City of Dreams Manila

(www.cityofdreamsmanila.com), an integrated resort in the

Entertainment City complex in Manila. In Europe, the Company is

currently developing City of Dreams Mediterranean

(www.cityofdreamsmed.com.cy) in the Republic of Cyprus, which is

expected to be the largest and premier integrated destination

resort in Europe. The Company is currently operating a temporary

casino, the first authorized casino in the Republic of Cyprus, and

is licensed to operate four satellite casinos (“Cyprus Casinos”).

Upon the opening of City of Dreams Mediterranean, the Company will

continue to operate the satellite casinos while operation of the

temporary casino will cease. For more information about the

Company, please visit www.melco-resorts.com.

The Company is strongly supported by its single

largest shareholder, Melco International Development Limited, a

company listed on the Main Board of The Stock Exchange of Hong Kong

Limited and is substantially owned and led by Mr. Lawrence Ho, who

is the Chairman, Executive Director and Chief Executive Officer of

the Company.

For the investment community, please

contact:Jeanny KimSenior Vice President, Group

TreasurerTel: +852 2598 3698Email: jeannykim@melco-resorts.com

For media enquiries, please

contact:Chimmy LeungExecutive Director, Corporate

CommunicationsTel: +852 3151 3765Email:

chimmyleung@melco-resorts.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Condensed Consolidated Statements of Operations

(Unaudited) |

|

(In thousands of U.S. dollars, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Casino |

$ |

181,962 |

|

|

$ |

373,170 |

|

|

$ |

808,930 |

|

|

$ |

1,285,604 |

|

|

Rooms |

|

25,976 |

|

|

|

33,428 |

|

|

|

89,277 |

|

|

|

112,835 |

|

|

Food and beverage |

|

17,973 |

|

|

|

20,529 |

|

|

|

62,238 |

|

|

|

72,024 |

|

|

Entertainment, retail and other |

|

15,926 |

|

|

|

19,259 |

|

|

|

52,444 |

|

|

|

61,285 |

|

|

Total operating revenues |

|

241,837 |

|

|

|

446,386 |

|

|

|

1,012,889 |

|

|

|

1,531,748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Casino |

|

(173,805 |

) |

|

|

|

(297,847 |

) |

|

|

(685,591 |

) |

|

|

(1,034,602 |

) |

|

Rooms |

|

(10,863 |

) |

|

|

(11,592 |

) |

|

|

(35,057 |

) |

|

|

(37,270 |

) |

|

Food and beverage |

|

(17,279 |

) |

|

|

(20,967 |

) |

|

|

(61,091 |

) |

|

|

(68,775 |

) |

|

Entertainment, retail and other |

|

(5,145 |

) |

|

|

(7,110 |

) |

|

|

(16,836 |

) |

|

|

(23,108 |

) |

|

General and administrative |

|

(98,819 |

) |

|

|

(112,011 |

) |

|

|

(302,483 |

) |

|

|

(326,401 |

) |

|

Payments to the Philippine Parties |

|

(8,417 |

) |

|

|

(3,176 |

) |

|

|

(26,878 |

) |

|

|

(20,269 |

) |

|

Pre-opening costs |

|

(3,313 |

) |

|

|

(650 |

) |

|

|

(8,915 |

) |

|

|

(2,774 |

) |

|

Development costs |

|

- |

|

|

|

(24,648 |

) |

|

|

- |

|

|

|

(31,979 |

) |

|

Amortization of gaming subconcession |

|

(2,844 |

) |

|

|

(14,307 |

) |

|

|

(29,932 |

) |

|

|

(42,990 |

) |

|

Amortization of land use rights |

|

(5,653 |

) |

|

|

(5,703 |

) |

|

|

(16,990 |

) |

|

|

(17,137 |

) |

|

Depreciation and amortization |

|

(113,549 |

) |

|

|

|

(127,663 |

) |

|

|

(353,142 |

) |

|

|

(375,592 |

) |

|

Property charges and other |

|

(696 |

) |

|

|

(2,945 |

) |

|

|

(19,595 |

) |

|

|

(23,937 |

) |

|

Total operating costs and expenses |

|

(440,383 |

) |

|

|

|

(628,619 |

) |

|

|

(1,556,510 |

) |

|

|

(2,004,834 |

) |

|

Operating loss |

|

(198,546 |

) |

|

|

|

(182,233 |

) |

|

|

(543,621 |

) |

|

|

(473,086 |

) |

|

Non-operating income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

8,814 |

|

|

|

1,580 |

|

|

|

17,025 |

|

|

|

5,161 |

|

|

Interest expenses, net of amounts capitalized |

|

(93,747 |

) |

|

|

(87,387 |

) |

|

|

(272,055 |

) |

|

|

(265,096 |

) |

|

Other financing costs |

|

(1,755 |

) |

|

|

(3,473 |

) |

|

|

(5,439 |

) |

|

|

(9,953 |

) |

|

Foreign exchange (losses) gains, net |

|

(505 |

) |

|

|

1,441 |

|

|

|

2,857 |

|

|

|

3,050 |

|

|

Other income, net |

|

1,145 |

|

|

|

741 |

|

|

|

2,713 |

|

|

|

2,372 |

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(28,817 |

) |

|

Total non-operating expenses, net |

|

(86,048 |

) |

|

|

(87,098 |

) |

|

|

(254,899 |

) |

|

|

(293,283 |

) |

|

Loss before income tax |

|

(284,594 |

) |

|

|

|

(269,331 |

) |

|

|

(798,520 |

) |

|

|

(766,369 |

) |

|

Income tax (expense) credit |

|

(2,028 |

) |

|

|

837 |

|

|

|

(4,618 |

) |

|

|

(154 |

) |

|

Net loss |

|

(286,622 |

) |

|

|

|

(268,494 |

) |

|

|

(803,138 |

) |

|

|

(766,523 |

) |

|

Net loss attributable to noncontrolling interests |

|

42,780 |

|

|

|

35,273 |

|

|

|

124,553 |

|

|

|

114,709 |

|

|

Net loss attributable to Melco Resorts & Entertainment

Limited |

$ |

(243,842 |

) |

|

|

$ |

(233,221 |

) |

|

$ |

(678,585 |

) |

|

$ |

(651,814 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Melco Resorts & Entertainment Limited

per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.176 |

) |

|

$ |

(0.162 |

) |

|

$ |

(0.481 |

) |

|

$ |

(0.454 |

) |

|

Diluted |

$ |

(0.176 |

) |

|

$ |

(0.162 |

) |

|

$ |

(0.482 |

) |

|

$ |

(0.454 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Melco Resorts & Entertainment Limited

per ADS: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.528 |

) |

|

$ |

(0.487 |

) |

|

$ |

(1.444 |

) |

|

$ |

(1.362 |

) |

|

Diluted |

$ |

(0.528 |

) |

|

$ |

(0.487 |

) |

|

$ |

(1.446 |

) |

|

$ |

(1.362 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding used in net loss attributable

to Melco Resorts & Entertainment Limited per share

calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

1,386,720,527 |

|

|

|

|

1,437,651,448 |

|

|

|

1,409,983,323 |

|

|

|

1,435,941,037 |

|

|

Diluted |

|

1,386,720,527 |

|

|

|

|

1,437,651,448 |

|

|

|

1,409,983,323 |

|

|

|

1,435,941,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Condensed Consolidated Balance Sheets |

|

(In thousands of U.S. dollars, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

2022 |

|

2021 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,522,395 |

|

|

$ |

1,652,890 |

|

|

Restricted cash |

|

50,994 |

|

|

|

285 |

|

|

Accounts receivable, net |

49,591 |

|

|

|

54,491 |

|

|

Receivables from affiliated companies |

|

211,169 |

|

|

|

384 |

|

|

Inventories |

|

27,117 |

|

|

|

29,589 |

|

|

Prepaid expenses and other current assets |

|

112,178 |

|

|

|

109,330 |

|

|

Assets held for sale |

|

12,314 |

|

|

|

21,777 |

|

|

Total current assets |

|

1,985,758 |

|

|

|

1,868,746 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

5,835,074 |

|

|

|

5,910,684 |

|

|

Gaming subconcession, net |

2,843 |

|

|

|

27,065 |

|

|

Intangible assets, net |

|

45,723 |

|

|

|

51,547 |

|

|

Goodwill |

|

81,185 |

|

|

|

81,721 |

|

|

Long-term prepayments, deposits and other assets |

|

147,570 |

|

|

|

177,142 |

|

|

Restricted cash |

|

140 |

|

|

|

140 |

|

|

Deferred tax assets, net |

879 |

|

|

|

4,029 |

|

|

Operating lease right-of-use assets |

|

59,761 |

|

|

|

68,034 |

|

|

Land use rights, net |

|

673,067 |

|

|

|

694,582 |

|

|

Total assets |

$ |

8,832,000 |

|

|

$ |

8,883,690 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

5,745 |

|

|

$ |

5,992 |

|

|

Accrued expenses and other current liabilities |

|

780,936 |

|

|

|

935,483 |

|

|

Income tax payable |

|

11,192 |

|

|

|

11,913 |

|

|

Operating lease liabilities, current |

|

11,837 |

|

|

|

16,771 |

|

|

Finance lease liabilities, current |

|

35,502 |

|

|

|

48,551 |

|

|

Current portion of long-term debt, net |

|

127 |

|

|

|

128 |

|

|

Payables to affiliated companies |

|

1,316 |

|

|

|

1,548 |

|

|

Liabilities related to assets held for sale |

|

1,199 |

|

|

|

1,497 |

|

|

Total current liabilities |

|

847,854 |

|

|

|

1,021,883 |

|

|

|

|

|

|

|

|

|

Long-term debt, net |

|

7,727,749 |

|

|

|

6,559,854 |

|

|

Other long-term liabilities |

32,577 |

|

|

|

30,520 |

|

|

Deferred tax liabilities, net |

40,179 |

|

|

|

41,030 |

|

|

Operating lease liabilities, non-current |

|

56,982 |

|

|

|

62,889 |

|

|

Finance lease liabilities, non-current |

|

228,868 |

|

|

|

347,629 |

|

|

Total liabilities |

|

8,934,209 |

|

|

|

8,063,805 |

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Ordinary shares, par value $0.01; 7,300,000,000 shares

authorized; |

|

1,445,052,143 and 1,456,547,942 shares issued; |

|

|

|

1,335,266,470 and 1,423,370,314 shares outstanding,

respectively |

|

14,451 |

|

|

|

14,565 |

|

|

Treasury shares, at cost; 109,785,673 and 33,177,628 shares,

respectively |

|

(241,908 |

) |

|

|

(132,856 |

) |

|

Additional paid-in capital |

3,210,907 |

|

|

|

3,238,600 |

|

|

Accumulated other comprehensive losses |

|

(173,510 |

) |

|

|

(76,008 |

) |

|

Accumulated losses |

|

(3,478,011 |

) |

|

|

(2,799,555 |

) |

|

Total Melco Resorts & Entertainment Limited shareholders’

(deficit) equity |

|

(668,071 |

) |

|

|

244,746 |

|

|

Noncontrolling interests |

|

565,862 |

|

|

|

575,139 |

|

|

Total (deficit) equity |

|

(102,209 |

) |

|

|

819,885 |

|

|

Total liabilities and (deficit) equity |

$ |

8,832,000 |

|

|

$ |

8,883,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Reconciliation of Net Loss Attributable to Melco Resorts

& Entertainment Limited to |

|

Adjusted Net Loss Attributable to Melco Resorts &

Entertainment Limited (Unaudited) |

|

(In thousands of U.S. dollars, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Melco Resorts & Entertainment

Limited |

$ |

(243,842 |

) |

|

$ |

(233,221 |

) |

|

$ |

(678,585 |

) |

|

$ |

(651,814 |

) |

|

Pre-opening costs |

|

3,313 |

|

|

|

650 |

|

|

|

8,915 |

|

|

|

2,774 |

|

|

Development costs |

|

- |

|

|

|

24,648 |

|

|

|

- |

|

|

|

31,979 |

|

|

Property charges and other |

|

696 |

|

|

|

2,945 |

|

|

|

19,595 |

|

|

|

23,937 |

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

28,817 |

|

|

Income tax impact on adjustments |

|

(210 |

) |

|

|

(739 |

) |

|

|

(598 |

) |

|

|

(2,133 |

) |

|

Noncontrolling interests impact on adjustments |

|

(1,275 |

) |

|

|

(440 |

) |

|

|

(4,781 |

) |

|

|

(16,185 |

) |

|

Adjusted net loss attributable to Melco Resorts & Entertainment

Limited |

$ |

(241,318 |

) |

|

$ |

(206,157 |

) |

|

$ |

(655,454 |

) |

|

$ |

(582,625 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss attributable to Melco Resorts & Entertainment

Limited per share: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.174 |

) |

|

$ |

(0.143 |

) |

|

$ |

(0.465 |

) |

|

$ |

(0.406 |

) |

|

Diluted |

$ |

(0.174 |

) |

|

$ |

(0.143 |

) |

|

$ |

(0.465 |

) |

|

$ |

(0.406 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss attributable to Melco Resorts & Entertainment

Limited per ADS: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.522 |

) |

|

$ |

(0.430 |

) |

|

$ |

(1.395 |

) |

|

$ |

(1.217 |

) |

|

Diluted |

$ |

(0.522 |

) |

|

$ |

(0.430 |

) |

|

$ |

(1.396 |

) |

|

$ |

(1.217 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding used in adjusted net loss

attributable to Melco Resorts & Entertainment Limited per share

calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

1,386,720,527 |

|

|

|

1,437,651,448 |

|

|

|

1,409,983,323 |

|

|

|

1,435,941,037 |

|

|

Diluted |

|

1,386,720,527 |

|

|

|

1,437,651,448 |

|

|

|

1,409,983,323 |

|

|

|

1,435,941,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

|

Reconciliation of Operating Loss to Adjusted EBITDA and

Adjusted Property EBITDA (Unaudited) |

|

|

(In thousands of U.S. dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2022 |

|

|

|

Altira Macau |

|

Mocha and Other(3) |

|

City of Dreams |

|

Studio City |

|

City of Dreams Manila |

|

Cyprus Operations |

|

Corporate and Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

$ |

(18,401 |

) |

|

$ |

359 |

|

|

$ |

(105,943 |

) |

|

$ |

(66,752 |

) |

|

$ |

18,649 |

|

|

$ |

2,715 |

|

|

$ |

(29,173 |

) |

|

$ |

(198,546 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments to the Philippine Parties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

8,417 |

|

|

|

- |

|

|

|

- |

|

|

|

8,417 |

|

|

Land rent to Belle Corporation |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

555 |

|

|

|

- |

|

|

|

- |

|

|

|

555 |

|

|

Pre-opening costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

699 |

|

|

|

- |

|

|

|

2,614 |

|

|

|

- |

|

|

|

3,313 |

|

|

Depreciation and amortization |

|

5,202 |

|

|

|

1,305 |

|

|

|

59,362 |

|

|

|

33,800 |

|

|

|

13,417 |

|

|

|

1,379 |

|

|

|

7,581 |

|

|

|

122,046 |

|

|

Share-based compensation |

|

136 |

|

|

|

(90 |

) |

|

|

3,787 |

|

|

|

425 |

|

|

|

288 |

|

|

|

16 |

|

|

|

5,419 |

|

|

|

9,981 |

|

|

Property charges and other |

|

145 |

|

|

|

85 |

|

|

|

2,558 |

|

|

|

370 |

|

|

|

43 |

|

|

|

(1 |

) |

|

|

(2,504 |

) |

|

|

696 |

|

|

Adjusted EBITDA |

|

(12,918 |

) |

|

|

1,659 |

|

|

|

(40,236 |

) |

|

|

(31,458 |

) |

|

|

41,369 |

|

|

|

6,723 |

|

|

|

(18,677 |

) |

|

|

(53,538 |

) |

|

Corporate and Other expenses |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

18,677 |

|

|

|

18,677 |

|

|

Adjusted Property EBITDA |

$ |

(12,918 |

) |

|

$ |

1,659 |

|

|

$ |

(40,236 |

) |

|

$ |

(31,458 |

) |

|

$ |

41,369 |

|

|

$ |

6,723 |

|

|

$ |

- |

|

|

$ |

(34,861 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, 2021 |

| |

|

Altira Macau |

|

Mocha |

|

City of Dreams |

|

Studio City |

|

City of Dreams Manila |

|

Cyprus Operations |

|

Corporate and Other |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

$ |

(12,725 |

) |

|

$ |

3,296 |

|

|

$ |

(35,542 |

) |

|

$ |

(49,810 |

) |

|

$ |

(12,639 |

) |

|

$ |

541 |

|

|

$ |

(75,354 |

) |

|

$ |

(182,233 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments to the Philippine Parties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,176 |

|

|

|

- |

|

|

|

- |

|

|

|

3,176 |

|

|

Land rent to Belle Corporation |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

672 |

|

|

|

- |

|

|

|

- |

|

|

|

672 |

|

|

Pre-opening costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6 |

|

|

|

- |

|

|

|

644 |

|

|

|

- |

|

|

|

650 |

|

|

Development costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

24,648 |

|

|

|

24,648 |

|

|

Depreciation and amortization |

|

5,542 |

|

|

|

1,420 |

|

|

|

62,736 |

|

|

|

34,327 |

|

|

|

19,844 |

|

|

|

2,205 |

|

|

|

21,599 |

|

|

|

147,673 |

|

|

Share-based compensation |

|

365 |

|

|

|

115 |

|

|

|

4,307 |

|

|

|

1,137 |

|

|

|

517 |

|

|

|

238 |

|

|

|

10,840 |

|

|

|

17,519 |

|

|

Property charges and other |

|

(128 |

) |

|

|

15 |

|

|

|

1,212 |

|

|

|

347 |

|

|

|

130 |

|

|

|

- |

|

|

|

1,369 |

|

|

|

2,945 |

|

|

Adjusted EBITDA |

|

(6,946 |

) |

|

|

4,846 |

|

|

|

32,713 |

|

|

|

(13,993 |

) |

|

|

11,700 |

|

|

|

3,628 |

|

|

|

(16,898 |

) |

|

|

15,050 |

|

|

Corporate and Other expenses |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

16,898 |

|

|

|

16,898 |

|

|

Adjusted Property EBITDA |

$ |

(6,946 |

) |

|

$ |

4,846 |

|

|

$ |

32,713 |

|

|

$ |

(13,993 |

) |

|

$ |

11,700 |

|

|

$ |

3,628 |

|

|

$ |

- |

|

|

$ |

31,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Effective from June 27, 2022, the Grand Dragon Casino,

which focuses on mass market table games and was previously

reported under the Corporate and Other segment, has been included

in the Mocha and Other segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Reconciliation of Operating Loss to Adjusted EBITDA and

Adjusted Property EBITDA (Unaudited) |

|

(In thousands of U.S. dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2022 |

|

|

Altira Macau |

|

|

Mocha and Other(3) |

|

City of Dreams |

|

|

Studio City |

|

|

City of Dreams Manila |

|

|

Cyprus Operations |

|

Corporate and Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

$ |

(51,146 |

) |

|

$ |

4,476 |

|

$ |

(221,971 |

) |

|

$ |

(188,603 |

) |

|

$ |

47,745 |

|

|

$ |

402 |

|

|

$ |

(134,524 |

) |

|

$ |

(543,621 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments to the Philippine Parties |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

26,878 |

|

|

|

- |

|

|

|

- |

|

|

|

26,878 |

|

|

Land rent to Belle Corporation |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

1,851 |

|

|

|

- |

|

|

|

- |

|

|

|

1,851 |

|

|

Pre-opening costs |

|

- |

|

|

|

- |

|

|

- |

|

|

|

1,512 |

|

|

|

- |

|

|

|

7,403 |

|

|

|

- |

|

|

|

8,915 |

|

|

Depreciation and amortization |

|

16,037 |

|

|

|

3,813 |

|

|

179,486 |

|

|

|

101,228 |

|

|

|

45,387 |

|

|

|

4,865 |

|

|

|

49,248 |

|

|

|

400,064 |

|

|

Share-based compensation |

|

845 |

|

|

|

153 |

|

|

12,075 |

|

|

|

2,229 |

|

|

|

1,256 |

|

|

|

527 |

|

|

|

26,775 |

|

|

|

43,860 |

|

|

Property charges and other |

|

744 |

|

|

|

40 |

|

|

6,060 |

|

|

|

3,794 |

|

|

|

257 |

|

|

|

3 |

|

|

|

8,697 |

|

|

|

19,595 |

|

|

Adjusted EBITDA |

|

(33,520 |

) |

|

|

8,482 |

|

|

(24,350 |

) |

|

|

(79,840 |

) |

|

|

123,374 |

|

|

|

13,200 |

|

|

|

(49,804 |

) |

|

|

(42,458 |

) |

|

Corporate and Other expenses |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

49,804 |

|

|

|

49,804 |

|

|

Adjusted Property EBITDA |

$ |

(33,520 |

) |

|

$ |

8,482 |

|

$ |

(24,350 |

) |

|

$ |

(79,840 |

) |

|

$ |

123,374 |

|

|

$ |

13,200 |

|

|

$ |

- |

|

|

$ |

7,346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2021 |

|

|

Altira Macau |

|

|

Mocha |

|

City of Dreams |

|

|

Studio City |

|

|

City of Dreams Manila |

|

|

Cyprus Operations |

|

Corporate and Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

$ |

(72,608 |

) |

|

$ |

7,241 |

|

$ |

(52,024 |

) |

|

$ |

(129,172 |

) |

|

$ |

(28,303 |

) |

|

$ |

(14,375 |

) |

|

$ |

(183,845 |

) |

|

$ |

(473,086 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments to the Philippine Parties |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

20,269 |

|

|

|

- |

|

|

|

- |

|

|

|

20,269 |

|

|

Land rent to Belle Corporation |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

2,179 |

|

|

|

- |

|

|

|

- |

|

|

|

2,179 |

|

|

Pre-opening costs |

|

- |

|

|

|

- |

|

|

195 |

|

|

|

739 |

|

|

|

- |

|

|

|

1,840 |

|

|

|

- |

|

|

|

2,774 |

|

|

Development costs |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

31,979 |

|

|

|

31,979 |

|

|

Depreciation and amortization |

|

16,518 |

|

|

|

4,641 |

|

|

186,130 |

|

|

|

101,893 |

|

|

|

53,187 |

|

|

|

8,586 |

|

|

|

64,764 |

|

|

|

435,719 |

|

|

Share-based compensation |

|

618 |

|

|

|

187 |

|

|

7,217 |

|

|

|

1,974 |

|

|

|

1,298 |

|

|

|

350 |

|

|

|

28,262 |

|

|

|

39,906 |

|

|

Property charges and other |

|

1,630 |

|

|

|

203 |

|

|

10,769 |

|

|

|

4,212 |

|

|

|

5,732 |

|

|

|

- |

|

|

|

1,391 |

|

|

|

23,937 |

|

|

Adjusted EBITDA |

|

(53,842 |

) |

|

|

12,272 |

|

|

152,287 |

|

|

|

(20,354 |

) |

|

|

54,362 |

|

|

|

(3,599 |

) |

|

|

(57,449 |

) |

|

|

83,677 |

|

|

Corporate and Other expenses |

|

- |

|

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

57,449 |

|

|

|

57,449 |

|

|

Adjusted Property EBITDA |

$ |

(53,842 |

) |

|

$ |

12,272 |

|

$ |

152,287 |

|

|

$ |

(20,354 |

) |

|

$ |

54,362 |

|

|

$ |

(3,599 |

) |

|

$ |

- |

|

|

$ |

141,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Reconciliation of Net Loss Attributable to Melco Resorts

& Entertainment Limited to |

|

Adjusted EBITDA and Adjusted Property EBITDA

(Unaudited) |

|

(In thousands of U.S. dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Melco Resorts & Entertainment

Limited |

$ |

(243,842 |

) |

|

$ |

(233,221 |

) |

|

$ |

(678,585 |

) |

|

$ |

(651,814 |

) |

|

Net loss attributable to noncontrolling interests |

|

(42,780 |

) |

|

|

(35,273 |

) |

|

|

(124,553 |

) |

|

|

(114,709 |

) |

|

Net loss |

|

(286,622 |

) |

|

|

(268,494 |

) |

|

|

(803,138 |

) |

|

|

(766,523 |

) |

|

Income tax expense (credit) |

|

2,028 |

|

|

|

(837 |

) |

|

|

4,618 |

|

|

|

154 |

|

|

Interest and other non-operating expenses, net |

|

86,048 |

|

|

|

87,098 |

|

|

|

254,899 |

|

|

|

293,283 |

|

|

Property charges and other |

|

696 |

|

|

|

2,945 |

|

|

|

19,595 |

|

|

|

23,937 |

|

|

Share-based compensation |

|

9,981 |

|

|

|

17,519 |

|

|

|

43,860 |

|

|

|

39,906 |

|

|

Depreciation and amortization |

|

122,046 |

|

|

|

147,673 |

|

|

|

400,064 |

|

|

|

435,719 |

|

|

Development costs |

|

- |

|

|

|

24,648 |

|

|

|

- |

|

|

|

31,979 |

|

|

Pre-opening costs |

|

3,313 |

|

|

|

650 |

|

|

|

8,915 |

|

|

|

2,774 |

|

|

Land rent to Belle Corporation |

|

555 |

|

|

|

672 |

|

|

|

1,851 |

|

|

|

2,179 |

|

|

Payments to the Philippine Parties |

|

8,417 |

|

|

|

3,176 |

|

|

|

26,878 |

|

|

|

20,269 |

|

|

Adjusted EBITDA |

(53,538 |

) |

|

|

15,050 |

|

|

|

(42,458 |

) |

|

|

83,677 |

|

|

Corporate and Other expenses |

|

18,677 |

|

|

|

16,898 |

|

|

|

49,804 |

|

|

|

57,449 |

|

|

Adjusted Property EBITDA |

$ |

(34,861 |

) |

|

$ |

31,948 |

|

|

$ |

7,346 |

|

|

$ |

141,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melco Resorts & Entertainment Limited and

Subsidiaries |

|

Supplemental Data Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Room

Statistics(4): |

|

|

|

|

|

|

|

|

|

|

Altira Macau |

|

|

|

|

|

|

|

|

|

|

|

Average daily rate(5) |

$ |

91 |

|

|

$ |

104 |

|

|

$ |

97 |

|

|