MarketAxess Announces Monthly Volume Statistics for June 2020

July 06 2020 - 8:00AM

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading

electronic trading platform for fixed-income securities, and the

provider of market data and post-trade services for the global

fixed-income markets, today announced monthly trading volume for

June 2020 of $578.5 billion consisting of $266.5 billion in credit

volume and $312.0 billion in rates volume.

Records for trading volume and fully electronic

estimated market share were achieved in June 2020 for the following

categories:

- U.S. high-grade total monthly

trading volume of $143.6 billion

- U.S. high-yield average daily

trading volume of $1.8 billion and total monthly trading volume of

$39.8 billion

- U.S high-yield trading volume of

$4.1 billion on June 30, 2020

- Fully electronic estimated U.S.

high-grade market share of FINRA TRACE trading volume of 22.8%,

compared to an estimated 19.2% in June 2019

- Fully electronic estimated U.S.

high-yield market share of FINRA TRACE trading volume of 16.1%,

compared to an estimated 11.4% in June 2019

The Company also reported preliminary variable

transaction fees per million (“FPM”) for the quarter ended June 30,

2020 of $181 for U.S. high-grade, $205 for other credit, $192 for

total credit and $4.00 for rates. The FPM for the quarter ended

June 30, 2020 are preliminary and may be revised in subsequent

updates and public filings. The Company undertakes no

obligation to update any fee information in future press

releases.

Reported MarketAxess volume in all product

categories includes only fully electronic trading volume.

MarketAxess trading volumes, TRACE reported volumes and Trax®

processed volumes are available on the Company’s website at

investor.marketaxess.com/volume.cfm

Cautionary Note Regarding Forward-Looking

Statements

This press release may contain forward-looking

statements, including statements about the outlook and prospects

for Company and industry growth, as well as statements about the

Company’s future financial and operating performance. These

and other statements that relate to future results and events are

based on MarketAxess’ current expectations. The Company’s

actual results in future periods may differ materially from those

currently expected or desired because of a number of risks and

uncertainties, including: risks relating to the COVID-19 pandemic,

including the possible effects of the economic conditions worldwide

resulting from the COVID-19 pandemic; global economic, political

and market factors; the volatility of financial services markets

generally; the level of trading volume transacted on the

MarketAxess platform; the absolute level and direction of interest

rates and the corresponding volatility in the corporate

fixed-income market; the level and intensity of competition in the

fixed-income electronic trading industry and the pricing pressures

that may result; the variability of our growth rate; the rapidly

evolving nature of the electronic financial services industry; our

ability to introduce new fee plans and our clients’ response; our

exposure to risks resulting from non-performance by counterparties

to transactions executed between our clients in which we act as an

intermediary in matched principal trades; our dependence on our

broker-dealer clients; the loss of any of our significant

institutional investor clients; our ability to develop new products

and offerings and the market’s acceptance of those products; the

effect of rapid market or technological changes on us and the users

of our technology; our ability to successfully maintain the

integrity of our trading platform and our response to system

failures, capacity constraints and business interruptions; our

vulnerability to cyber security risks; our ability to protect our

intellectual property rights or technology and defend against

intellectual property infringement or other claims; our ability to

enter into strategic alliances and to acquire other businesses and

successfully integrate them with our business; our ability to

comply with new and existing laws, rules and regulations both

domestically and internationally; our ability to maintain effective

compliance and risk management methods; the strain of growth

initiatives on management and other resources; our future capital

needs and our ability to obtain capital when needed; limitations on

our operating flexibility contained in our credit agreement; and

other factors. The Company undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise. More information

about these and other factors affecting MarketAxess’ business and

prospects is contained in MarketAxess’ periodic filings with the

Securities and Exchange Commission and can be accessed at

www.marketaxess.com.

About MarketAxess

MarketAxess operates a leading, institutional

electronic trading platform delivering expanded liquidity

opportunities, improved execution quality and significant cost

savings across global fixed-income markets. A global network of

over 1,700 firms, including the world’s leading asset managers and

institutional broker-dealers, leverages MarketAxess’ patented

trading technology to efficiently trade bonds. MarketAxess’

award-winning Open Trading™ marketplace is regarded as the

preferred all-to-all trading solution in the global credit markets,

creating a unique liquidity pool for a broad range of credit market

participants. Drawing on its deep data and analytical resources,

MarketAxess provides automated trading solutions, market data

products and a range of pre- and post-trade services.

MarketAxess is headquartered in New York and has

offices in London, Amsterdam, Boston, Chicago, Los Angeles, Miami,

Salt Lake City, San Francisco, São Paulo, Hong Kong and Singapore.

For more information, please visit www.marketaxess.com.

Investor Relations Contact:

David CresciMarketAxess Holdings Inc.+1-212-813-6027

Media Relations Contacts:

Kyle WhiteMarketAxess Holdings Inc.+1-212-813-6355

William McBrideRF | Binder +1-917-239-6726

MarketAxess Holdings

Inc.Monthly Volume Statistics

| |

Average Daily Volume |

|

Total Trading Volume |

| |

Jun-20 |

|

Jun-19 |

|

% Change |

|

Jun-20 |

|

Jun-19 |

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

($ in millions) |

| U.S

High-Grade |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Rate |

$ |

6,296 |

|

$ |

4,275 |

|

47.3 |

% |

|

$ |

138,517 |

|

$ |

85,490 |

|

62.0 |

% |

|

Floating Rate |

|

233 |

|

|

293 |

|

-20.5 |

% |

|

|

5,132 |

|

|

5,850 |

|

-12.3 |

% |

|

Total U.S. High-Grade |

|

6,529 |

|

|

4,568 |

|

42.9 |

% |

|

|

143,649 |

|

|

91,340 |

|

57.3 |

% |

| Other

Credit |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. High-Yield |

|

1,811 |

|

|

1,058 |

|

71.2 |

% |

|

|

39,839 |

|

|

21,159 |

|

88.3 |

% |

|

Emerging Markets |

|

2,392 |

|

|

2,103 |

|

13.7 |

% |

|

|

52,622 |

|

|

42,053 |

|

25.1 |

% |

|

Eurobonds |

|

1,329 |

|

|

1,130 |

|

17.6 |

% |

|

|

29,232 |

|

|

22,606 |

|

29.3 |

% |

|

Other Credit Products |

|

52 |

|

|

33 |

|

57.6 |

% |

|

|

1,136 |

|

|

659 |

|

72.4 |

% |

|

Total Other Credit |

|

5,584 |

|

|

4,324 |

|

29.1 |

% |

|

|

122,829 |

|

|

86,477 |

|

42.0 |

% |

|

Total Credit1 |

|

12,113 |

|

|

8,892 |

|

36.2 |

% |

|

|

266,478 |

|

|

177,817 |

|

49.9 |

% |

| Rates |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Government Bonds 2 |

|

13,969 |

|

|

- |

|

n/a |

|

|

307,311 |

|

|

- |

|

n/a |

|

Agencies and Other Government Bonds 1 |

|

214 |

|

|

252 |

|

-15.1 |

% |

|

|

4,705 |

|

|

5,047 |

|

-6.8 |

% |

|

Total Rates |

|

14,183 |

|

|

252 |

|

NM |

|

|

312,016 |

|

|

5,047 |

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Number of

U.S. Trading Days 3 |

|

22 |

|

|

20 |

|

|

|

|

|

|

|

|

| Number of

U.K. Trading Days 4 |

|

22 |

|

|

20 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NOTES: |

|

|

|

|

|

|

|

|

|

|

|

| 1 Consistent with

FINRA TRACE reporting standards, both sides of trades are included

in the Company's reported volumes when the Company executes trades

on a matched principal basis between two counterparties. |

| 2 U.S. Government

Bonds represent U.S. treasury volume traded through the MarketAxess

Rates platform, formerly known as LiquidityEdge, which was acquired

by the Company on November 1, 2019. Consistent with industry

standards, U.S. Government Bond trades are single-counted. |

| 3 The number of

U.S. trading days is based on the SIFMA holiday recommendation

calendar. |

| 4 The number of

U.K. trading days is based on the U.K. Bank holiday schedule. |

MarketAxess Holdings

Inc.Quarterly Volume Statistics

| |

Average Daily Volume |

|

Total Trading Volume |

| |

2Q20 |

|

2Q19 |

|

% Change |

|

2Q20 |

|

2Q19 |

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

($ in

millions) |

| U.S

High-Grade |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Rate |

$ |

6,318 |

|

$ |

3,953 |

|

59.8 |

% |

|

$ |

398,006 |

|

$ |

249,025 |

|

59.8 |

% |

|

Floating Rate |

|

263 |

|

|

259 |

|

1.4 |

% |

|

|

16,574 |

|

|

16,335 |

|

1.5 |

% |

|

Total U.S. High-Grade |

|

6,581 |

|

|

4,212 |

|

56.2 |

% |

|

|

414,580 |

|

|

265,360 |

|

56.2 |

% |

| Other

Credit |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. High-Yield |

|

1,670 |

|

|

904 |

|

84.8 |

% |

|

|

105,241 |

|

|

56,926 |

|

84.9 |

% |

|

Emerging Markets |

|

2,252 |

|

|

1,969 |

|

14.4 |

% |

|

|

141,899 |

|

|

124,024 |

|

14.4 |

% |

|

Eurobonds |

|

1,256 |

|

|

1,071 |

|

17.3 |

% |

|

|

76,589 |

|

|

65,312 |

|

17.3 |

% |

|

Other Credit Products |

|

56 |

|

|

36 |

|

55.6 |

% |

|

|

3,537 |

|

|

2,241 |

|

57.8 |

% |

|

Total Other Credit |

|

5,234 |

|

|

3,979 |

|

31.5 |

% |

|

|

327,266 |

|

|

248,503 |

|

31.7 |

% |

|

Total Credit1 |

|

11,815 |

|

|

8,191 |

|

44.2 |

% |

|

|

741,846 |

|

|

513,863 |

|

44.4 |

% |

| Rates |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Government Bonds 2 |

|

14,972 |

|

|

- |

|

n/a |

|

|

943,223 |

|

|

- |

|

n/a |

|

Agencies and Other Government Bonds 1 |

|

197 |

|

|

209 |

|

-5.7 |

% |

|

|

12,371 |

|

|

13,174 |

|

-6.1 |

% |

|

Total Rates |

|

15,169 |

|

|

209 |

|

NM |

|

|

955,594 |

|

|

13,174 |

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Number of

U.S. Trading Days 3 |

|

63 |

|

|

63 |

|

|

|

|

|

|

|

|

| Number of

U.K. Trading Days 4 |

|

61 |

|

|

61 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NOTES: |

|

|

|

|

|

|

|

|

|

|

|

| 1 Consistent with

FINRA TRACE reporting standards, both sides of trades are included

in the Company's reported volumes when the Company executes trades

on a matched principal basis between two counterparties. |

| 2 U.S. Government

Bonds represent U.S. treasury volume traded through the MarketAxess

Rates platform, formerly known as LiquidityEdge, which was acquired

by the Company on November 1, 2019. Consistent with industry

standards, U.S. Government Bond trades are single-counted. |

| 3 The number of

U.S. trading days is based on the SIFMA holiday recommendation

calendar. |

| 4 The number of

U.K. trading days is based on the U.K. Bank holiday schedule. |

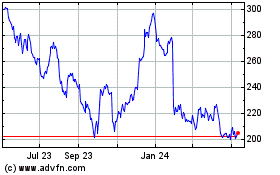

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

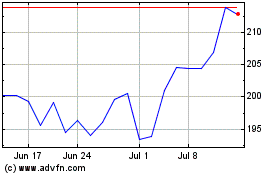

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024