Medallion Financial Corp. (Nasdaq: MFIN, “Medallion” or the

“Company”), a finance company that originates and services loans in

various consumer and commercial niche industries, announced today

its 2019 fourth quarter and full year results.

2019 Fourth Quarter Highlights

- Net income was $2.8 million, or $0.11 per share, compared to

$9.2 million, or $0.38 per share, in the prior year period, which

included a gain of $25.3 million as a result of the Company

successfully deconsolidating Trust III in the 2018 fourth

quarter

- Net interest income was $26.6 million, primarily reflective of

the contributions of the consumer lending segments

- Net interest margin was 8.82% in the 2019 fourth quarter, up

from 8.07% in the year ago quarter, reflecting the greater

contribution of the higher yielding consumer and commercial

segments

- Net interest margins for the recreation and home improvement

segments were 12.98% and 7.13%

- Net income from the consumer and commercial segments totaled

$7.2 million in the quarter

- The total interest yield on the Company’s loan portfolio was

12.69% in the 2019 fourth quarter

- Medallion loan exposure continued to be reduced, with the net

portfolio at $109.4 million at quarter end which represented 7% of

total assets

- Total assets were $1.55 billion as of December 31, 2019

2019 Full Year Highlights

- 2019 earnings were $1.5 million compared to a loss of $25.0

million in 2018

- 2019 net income from Medallion’s consumer and commercial

segments was $31.9 million

- Net consumer loans grew 23% year over year

- Consumer originations were $443.5 million for the year, up from

$408.4 million in 2018

- 2019 net interest margin was 8.64%

- Net cash flow from operations was $64.9 million

- Total medallion loans 90 days or more past due were $2.6

million, or 2.0% of total medallion loans at the end of 2019

- Net medallion loans dropped 30% from $155.9 million to $109.4

million at year end

Andrew Murstein, President of Medallion, stated, “2019 was a

significant year for us as we turned the corner and moved forward

with a profitable year, and delivered on the strategy we have laid

out. We continued to reduce the Company’s medallion losses and

portfolio, raised capital, and began the process to provide loan

origination services to the fintech industry. Losses from our

medallion exposure, in particular in the second half of the year,

have been lower than in recent years. We completed both a private

placement at Medallion Financial of investment grade debt, and an

initial public offering of perpetual preferred stock at Medallion

Bank, raising over $82 million in total during 2019. This will

allow us to grow our consumer portfolio. This past July, we hired

an experienced executive at Medallion Bank to build-out its

Strategic Partnership Program with financial technology companies,

which we hope will ultimately provide new opportunities for profits

and growth through the generation of fee income, as well as

providing portfolio diversification. We look forward to providing

updates on our progress in building out this new program throughout

the year, as we hope to have our first partnership established and

operational in the next few months.

"Our consumer and commercial segments had a record breaking year

after coming off a strong 2018, as net income before taxes from our

mezzanine, home improvement and recreation lending divisions

totaled $43 million in 2019. Specifically, we saw the consumer

segments continue to thrive in the 2019 second half, as for the

first time since the inception of Medallion Bank, we recorded back

to back quarters of over $9 million of net income. Looking ahead,

we forecast our consumer segments to experience solid growth in

2020, while maintaining good credit quality for the portfolio.

"At the end of the year, Medallion Capital, the lead driver in

our commercial lending segment, had $40 million in capital, and

Medallion Bank had $230 million in capital.”

Mr. Murstein continued: “The medallion loan portfolio remains at

the lowest level since going public in 1996. We continue to monitor

industry news, both from a legislative and regulatory standpoint,

and remain optimistic that the recommendations and proposals being

reviewed by the City of New York will stabilize the industry, and

help alleviate the pressure put on the borrowers as a result of the

e-hail industry.”

“Lastly, we were pleased to have been recognized in the

broad-market Russell 3000® Index in June 2019. This has allowed us

to strengthen our position within the investment community.”

Larry Hall, Chief Financial Officer, stated, “We recorded a net

interest margin of 8.82% in the 2019 fourth quarter, the highest in

12 years, which resulted in the Company being able to end the year

with a net interest margin of 8.64%. The total interest yield on

the Company’s loan portfolio was 12.69% in the 2019 fourth quarter,

the highest it has been since we withdrew our BDC election and

consolidated Medallion Bank. As a result of the Bank’s public

offering of preferred shares, the Bank ended 2019 with a Tier 1

leverage ratio of 19.56%. The fourth quarter income tax provision

included a charge of $1.5 million or $0.06 per share, attributable

to the change in the Company’s effective state income tax rate and

its impact on the deferred tax liability.”

Consumer Lending Segments

Medallion’s net consumer lending portfolio as of December 31,

2019 was $940.0 million, compared to $761.5 million at the end of

2018. Net interest income for the 2019 fourth quarter was $27.0

million, compared to $23.6 million in the prior year period. The

average interest rate on the portfolio was 14.54% at December 31,

2019, compared to 15.06% at the end of 2018. Consumer loan

delinquencies 90 days or more past due as of December 31, 2019 were

0.64%, compared to 0.57% a year ago.

Commercial Lending Segment

The Company’s net commercial lending portfolio as of December

31, 2019 was $66.4 million, compared to $60.0 million at the end of

the prior year period. The yield on the portfolio was 10.74% in the

2019 fourth quarter, compared to 14.33% in the 2018 fourth quarter.

Net income for the 2019 fourth quarter was $0.366 million.

Medallion Lending Segment

The Company’s net medallion lending portfolio as of December 31,

2019 was $109.4 million, compared to $155.9 million at the end of

2018. The average interest rate on the medallion portfolio was

4.17%, compared to 4.43% a year ago. Total medallion loan

delinquencies 90 days or more past due were $2.6 million, or 2.0%

of the total portfolio, as of December 31, 2019, compared to $16.7

million or 9.4% of the total portfolio at the end of 2018. Total

medallion loan delinquencies 30 days or more past due were $17.2

million as of December 31, 2019, or 13.6% of the total portfolio,

compared to $28.1 million, or 15.9% of the total portfolio, at

December 31, 2018. Medallion loans comprised 10% of the Company’s

net loans receivable as of December 31, 2019, compared to 16% at

the end of 2018.

* * *

Conference Call Information

The Company will be hosting a conference call to discuss the

2019 fourth quarter and full year financial results on Friday,

February 21, 2020 at 9:00 a.m. Eastern time.

The dial-in number for the conference call is (877) 407-0789

(toll-free) or (201) 689-8562 (direct). Please dial the number 10

minutes prior to the scheduled start time. A live webcast of the

conference call will also be available on our website at

http://www.medallion.com/investors.html.

A replay will be available following the end of the call through

Friday, February 28, 2020, by telephone at (844) 512-2921

(toll-free) or (412) 317-6671 (direct), passcode 13699052. A

webcast replay of the call will be available at

http://www.medallion.com/investors.html until the next quarter’s

results are announced.

* * *

About Medallion Financial Corp.

Medallion Financial Corp. is a finance company that originates

and services loans in various industries, and its wholly-owned

subsidiary, Medallion Bank, also originates and services consumer

loans. Medallion Financial Corp. has lent more than $8.8 billion

since its initial public offering in 1996.

Please note that this press release contains forward-looking

statements that involve risks and uncertainties relating to

business performance, cash flow, costs, sales, net investment

income, earnings, and growth. Medallion’s actual results may differ

significantly from the results discussed in such forward-looking

statements. Factors that might cause such a difference include, but

are not limited to, those factors discussed under the heading “Risk

Factors,” in Medallion’s 2018 Annual Report on Form 10-K and its

other filings with the SEC.

MEDALLION FINANCIAL

CORP.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Bank Holding Company Accounting Combined(1)

For the Three Months Ended December 31 For the Year Ended

December 31 (Dollars in thousands, except shares and per share

data)

2019

2018

2019

2018

Total interest income/total investment income

$

35,864

$

31,007

$

132,562

$

100,836

Total interest expense

9,277

8,004

35,045

28,367

Net interest income/net investment income

26,587

23,003

97,517

72,469

Provision for loan losses

6,162

10,227

43,013

59,008

Net interest income after provision for loan losses

20,425

12,776

54,504

13,461

Other income (loss) Gain on deconsolidation of Trust

III

-

25,325

-

25,325

Sponsorship and race winnings

2,734

3,769

18,742

14,368

Gain on sale of loans

-

(542

)

-

4,946

Writedown of loan collateral in process of foreclosure

(177

)

(827

)

(4,381

)

(2,188

)

Other income

410

(98

)

6,026

(445

)

Total other income

2,967

27,627

20,387

42,006

Other expenses Salaries and employee benefits

6,514

7,719

24,971

21,706

Collection costs

2,049

2,989

6,638

5,207

Race team related expenses

1,785

1,705

8,996

7,121

Professional fees

1,441

2,412

7,402

9,332

Loan servicing fees

1,402

1,157

5,253

3,470

Intangible asset impairment

-

5,615

-

5,615

Other expenses

3,752

4,094

14,921

13,738

Total other expenses

16,943

25,691

68,181

66,189

Income before income taxes/net investment loss before

taxes

6,449

14,712

6,710

(10,722

)

Income tax provision

(3,412

)

(4,847

)

(1,486

)

(373

)

Net income after income taxes/net investment loss after

taxes

3,037

9,865

5,224

(11,095

)

Net realized losses on investments, net of taxes

-

-

-

(26,319

)

Net unrealized appreciation on investments, net of taxes

-

-

-

14,675

Net realized/unrealized losses on investments

-

-

-

(11,644

)

Net income after income taxes/net decrease on net assets

resulting from operations

3,037

9,865

5,224

(22,739

)

Less: income attributable to non-controlling interests

274

693

3,758

2,307

Total net income (loss) attributable to Medallion Financial

Corp.

$

2,763

$

9,172

$

1,466

$

(25,046

)

Basic net income (loss) per share

$

0.11

$

0.38

$

0.06

$

(1.03

)

Diluted net income (loss) per share

0.11

0.38

0.06

(1.03

)

Weighted average common shares outstanding Basic

24,361,680

24,237,841

24,342,979

24,214,978

Diluted

24,541,166

24,404,010

24,557,925

24,214,978

(1) Balance includes the nine months ended December 31, 2018 under

Bank Holding Company Accounting and the three months ended March

31, 2018 under Investment Company Accounting.

MEDALLION FINANCIAL

CORP.

CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except shares and per share

data)

December 31, 2019 December 31, 2018

Assets

Cash and federal funds sold

$

67,821

$

57,713

Equity investments and investment securities

59,077

54,521

Loans

1,160,855

1,017,882

Allowance for loan losses

(41,720

)

(36,395

)

Net loans receivable

1,119,135

981,487

Loan collateral in process of foreclosure

52,711

49,495

Goodwill and intangible assets

203,339

204,785

Other assets

43,957

33,845

Total assets

$

1,546,040

$

1,381,846

Liabilities Accounts payable, accrued

expenses, and accrued interest payable

$

20,632

$

22,641

Deposits

951,651

848,040

Short-term borrowings

38,223

55,178

Deferred tax liabilities and other tax payables

10,486

6,973

Operating lease liabilities

12,738

—

Long-term debt

174,614

158,810

Total liabilities

1,208,344

1,091,642

Commitments and contingencies.

Total

stockholders’ equity

266,376

262,608

Non-controlling interests in consolidated

subsidiaries

71,320

27,596

Total equity

337,696

290,204

Total liabilities and equity

$

1,546,040

$

1,381,846

Number of shares outstanding

24,646,559

24,434,357

Book value per share

$

10.81

$

10.75

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200220005834/en/

Company: Alex E. Arzeno

Investor Relations 212-328-2176 InvestorRelations@medallion.com

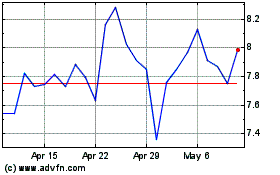

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

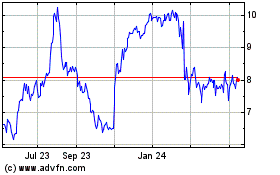

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024