Filed Pursuant to Rule 424(b)(5)

Registration No. 333-238162

575,001 American Depositary

Shares

Representing 11,500,020 Ordinary

Shares

2,758,333 Pre-Funded Warrants

each to purchase one American Depositary Share

Medigus

Ltd.

We are offering 575,001

American Depositary Shares, or ADSs, at a public offering price of $1.50 per ADS, pursuant to this prospectus supplement and

the accompanying prospectus. Each ADS represents 20 ordinary shares, par value NIS 1.00 per share. See “Description of American

Depositary Shares” and “Description of Ordinary Shares” in the accompanying prospectus for more information.

We

are also offering to those purchasers whose purchase of ADSs in this offering would result in the purchaser, together with its

affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our

outstanding ordinary shares immediately following the consummation of this offering, 2,758,333 Pre-Funded Warrants, in lieu of

the ADSs that would otherwise result in ownership in excess of 4.99% (or at the election of the purchaser, 9.99%) of our outstanding

ordinary shares. The purchase price of each Pre-Funded Warrant will equal the price per ADS being sold in this offering, minus

$0.001, and the exercise price of each Pre-Funded Warrant will be $0.001 per ADS. The Pre-Funded Warrants will be immediately exercisable

and may be exercised at any time until exercised in full. The Pre-Funded Warrants will not be certificated. We do not expect to

list the Pre-Funded Warrants on any national securities exchange or other trading market.

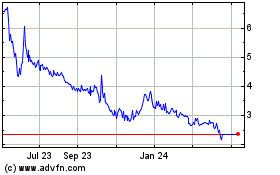

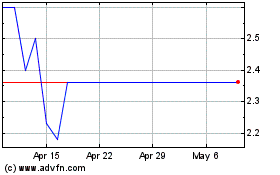

The ADSs trade on The Nasdaq Capital Market, or Nasdaq, under the

symbol “MDGS”. On May 18, 2020, the last reported price of the ADSs on Nasdaq was $2.92 per ADS. Our ordinary shares

currently trade on the Tel Aviv Stock Exchange Ltd., or TASE, under the symbol “MDGS”. On May 18, 2020, the last reported

sale price of our ordinary shares on the TASE was NIS 0.56, or $0.16 per share (based on the exchange rate reported by the Bank of

Israel on such date).

We are an emerging

growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act and, as such, we have

elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

On May 15, 2020, the

aggregate market value of our ordinary shares held by non-affiliates was approximately $15,146,712, based on 84,538,738 ordinary

shares outstanding, 77,675,444 of which are held by non-affiliates, and a per ordinary share price of $0.195 based on the closing

sale price of our ADSs on Nasdaq on May 12, 2020. We have not offered or sold any securities pursuant to General Instruction I.B.5

on Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

Under the registration

statement to which this prospectus supplement forms a part, we may not sell our securities in a primary offering with a value

exceeding one-third of our public float in any 12-month period unless our public float rises to $75 million or more.

You should carefully

read this prospectus supplement and the accompanying prospectus (including all of the information incorporated by reference therein)

before you invest. Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page

S-6 of this prospectus supplement and on page 4 of the accompanying prospectus for a discussion of certain factors you should

consider before investing in our securities.

|

|

|

Per ADS

|

|

|

Per Pre-Funded Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.500

|

|

|

$

|

1.499

|

|

|

$

|

4,997,243

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

0.105

|

|

|

$

|

0.105

|

|

|

$

|

349,807

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.395

|

|

|

$

|

1.394

|

|

|

$

|

4,647,436

|

|

|

|

(1)

|

The

underwriter will also be reimbursed for certain expenses incurred in this offering. See

“Underwriting” on page S-14 of this prospectus supplement for more information

regarding underwriting compensation.

|

We expect to deliver

the ADSs and Pre-Funded Warrants being offered pursuant to this prospectus supplement on or about May 22, 2020.

None

of the United States Securities and Exchange Commission, the Israeli Securities Authority, any state securities commission or

any other regulatory body, has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus supplement is

May 19, 2020.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT THIS PROSPECTUS

SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a “shelf” registration statement on Form F-3 (File No. 333-238162) utilizing

a shelf registration process relating to the securities described in this prospectus supplement that was initially filed with

the Securities and Exchange Commission, or the SEC, on May 11, 2020, and that was declared effective by the SEC on May 15, 2020.

This document comprises two parts. The first part is this prospectus supplement, which describes the specific terms of this offering

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

herein. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering.

Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is

a conflict between the information contained in this prospectus supplement and the accompanying prospectus, you should rely on

the information in this supplement.

This prospectus supplement

and the accompanying prospectus relate to the offering of our ordinary shares as represented by ADSs and the Pre-Funded Warrants.

Before buying any of the ordinary shares as represented by ADSs offered hereby, we urge you to read carefully this prospectus supplement

and the accompanying prospectus, together with the information incorporated herein by reference as described below under the heading

“Incorporation by Reference.” This prospectus supplement contains information about the ADSs and Pre-Funded Warrants

offered hereby and may add to, update or change information in the accompanying prospectus.

In this prospectus

supplement, as permitted by law, we “incorporate by reference” information from other documents that we file with

the SEC. This means that we can disclose important information to you by referring to those documents. The information incorporated

by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and should be read with

the same care. When we make future filings with the SEC to update the information contained in documents that have been incorporated

by reference, the information included or incorporated by reference in this prospectus supplement is considered to be automatically

updated and superseded. If the description of the offering varies between this prospectus supplement and the accompanying prospectus,

you should rely on the information contained in this prospectus supplement. However, if any statement in this prospectus supplement

or the accompanying prospectus is inconsistent with a statement in another document having a later date (including a document

incorporated by reference in the accompanying prospectus), the statement in the document having the later date modifies or supersedes

the earlier statement.

Neither we nor the

underwriter have authorized anyone to provide you with information different from that contained in this prospectus supplement,

the accompanying prospectus or any free writing prospectus we have authorized for use in connection with this offering. We and

the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. The information contained in, or incorporated by reference into, this prospectus supplement, the accompanying

prospectus, and any free writing prospectus we have authorized for use in connection with this offering is accurate only as of

the date of each such document. Our business, financial condition, results of operations and prospects may have changed since

those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference

in this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in

connection with this offering in their entirety before making an investment decision. You should also read and consider the information

in the documents to which we have referred you in the sections of the accompanying prospectus entitled “Where You Can Find

More Information” and “Incorporation of Certain Documents by Reference.” These documents contain important information

that you should consider when making your investment decision.

We are not making

offers to sell or solicitations to buy our ordinary shares as represented by ADSs in any jurisdiction in which an offer or solicitation

is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is

unlawful to make an offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying

prospectus is accurate only as of the date on the front of the respective document and that any information that we have incorporated

by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of

this prospectus supplement or the accompanying prospectus or the time of any sale of a security.

Throughout this prospectus,

unless otherwise designated, the terms “we”, “us”, “our”, “Medigus”, “the

Company” and “our Company” refer to Medigus Ltd. and its consolidated subsidiaries. References to “ordinary

shares”, “ADSs”, “warrants” and “share capital” refer to the ordinary shares, ADSs,

warrants and share capital, respectively, of Medigus.

This prospectus supplement

and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but

reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the

actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein

by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below under

the section entitled “Where You Can Find More Information.”

Market data and certain

industry data and forecasts used throughout this prospectus supplement were obtained from sources we believe to be reliable, including

market research databases, publicly available information, reports of governmental agencies and industry publications and surveys.

We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which

we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate,

especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth

were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently

available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates

involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading

“Risk Factors” in this prospectus. Our financial statements are prepared and presented in accordance with International

Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our historical results

do not necessarily indicate our expected results for any future periods.

Certain figures included

in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be

an arithmetic aggregation of the figures that precede them.

Unless derived from

our financial statements or otherwise noted, the terms “shekels,” “Israeli shekels” and “NIS”

refer to New Israeli Shekels, the lawful currency of the State of Israel, and the terms “dollar,” “U.S. dollar,”

“US$,” “USD” or “$” refer to U.S. dollars, the lawful currency of the United States.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary highlights

selected information about us, this offering and information contained in greater detail elsewhere in this prospectus supplement,

the accompanying prospectus, and in the documents incorporated by reference. This summary is not complete and does not contain

all of the information that you should consider before investing in our securities. You should carefully read and consider this

entire prospectus supplement, the accompanying prospectus and the documents, including financial statements and related notes,

and information incorporated by reference into this prospectus supplement, including the financial statements and “Risk

Factors” starting on pages S-6 of this prospectus supplement, before making an investment decision. If you invest in our

securities, you are assuming a high degree of risk.

Business Overview

We previously engaged

in the development, production and marketing of innovative miniaturized imaging equipment known as the micro ScoutCam™ portfolio

for use in medical procedures as well as various industrial applications, through our Israeli subsidiary, ScoutCam Ltd. ScoutCam

Ltd. was incorporated as part of a reorganization of the Company intended to distinguish the Company’s micro ScoutCam™

portfolio from the other operations of the Company and to enable the Company to form a separate business unit with dedicated resources,

focused on the promotion of our miniaturized imaging technology. After we completed the transfer of all of the Company’s

assets and intellectual property related to the Company’s miniature video cameras business into ScoutCam Ltd., we consummated

a securities exchange agreement with Intellisense Solutions Inc., under which we received 60% of the issued and outstanding stock

of Intellisense Solutions Inc. in consideration for 100% of our holdings in ScoutCam Ltd. Following the aforementioned transactions,

Intellisense Solutions Inc. changed its name to ScoutCam Inc. Since the securities exchange agreement, the commercialization efforts

relating to the ScoutCam™ portfolio are carried out exclusively by ScoutCam Inc.

ScoutCam Inc. is examining

and pursuing additional applications for the micro ScoutCam™ portfolio outside of the medical device industry, including,

among others, the defense, aerospace, automotive, and industrial non-destructing-testing industries, and plans to further expand

the activity in these non-medical spaces.

In addition, we have

been engaged in the development, production and marketing of innovative surgical devices with direct visualization capabilities

for the treatment of Gastroesophageal Reflux Disease, or GERD, a common ailment, which is predominantly treated by medical therapy

(e.g. proton pump inhibitors) or in chronic cases, conventional open or laparoscopic surgery. Our FDA-cleared and CE-marked endosurgical

system, known as the Medigus Ultrasonic Surgical Endostapler, or MUSE™ (Medigus Ultrasonic Surgical Endostapler) system,

enables minimally-invasive and incisionless procedures for the treatment of GERD by reconstruction of the esophageal valve via

the mouth and esophagus, eliminating the need for surgery in eligible patients. We believe that this procedure offers a safe,

effective and economical alternative to the current modes of GERD treatment for certain GERD patients, and has the ability to

provide results which are equivalent to those of standard surgical procedures while reducing pain and trauma, minimizing hospital

stays, and delivering economic value to hospitals and payors. The key elements of the MUSE™ system include a single-use

endostapler containing several sophisticated innovative technologies such as flexible stapling technology, a miniature camera

and ultrasound transducer, as well as a control console offering a video image transmitted from the tip of the endostapler. Our

board of directors has determined to examine potential opportunities to sell our MUSE™ technology, or alternatively grant

a license or licenses for the use of the MUSE™ technology.

Our MUSE™ System

Treatment of GERD

GERD, is a worldwide

disorder, with evidence suggesting an increase in GERD disease prevalence since 1995. Treatment of GERD involves a stepwise approach.

The goals are to control symptoms, to heal esophagitis and to prevent recurrent esophagitis. The treatment is based on lifestyle

modification and control of gastric acid through medical treatment (antacids, PPI’s, H2 blockers or other reflux inhibitors)

or antireflux surgery.

Drug Treatment - Proton pump inhibitors

(PPI)

For moderate to severe

GERD, physicians usually prescribe PPIs. This class of drugs reduces acid production by the stomach, and thereby relieves the

patients of their symptoms. Drugs of this class are among the most commonly prescribed medications in the world. There are several

brands on the market, best known are Prilosec (omeprazole), Prevacid (lansoprazole) and Nexium (esomeprazole). Certain PPI drugs

are available over the counter in the United States and in other countries, but the over the counter dosage may be inadequate

to control GERD symptoms, except in mild cases.

Interventional Treatment

The most common operation

for GERD is called a surgical fundoplication, a procedure that prevents reflux by wrapping or attaching the upper part of the

stomach around the lower esophagus and securing it with sutures. Due to the presence of the wrap or attachment, increasing pressure

in the stomach compresses the portion of the esophagus which is wrapped or attached by the stomach, and prevents acidic gastric

content from flowing up into the esophagus. Today, the operation is usually performed laparoscopically: instead of a single large

incision into the chest or abdomen, four or five smaller incisions are made in the abdomen, and the operator uses a number of

specially designed tools to operate under video control.

MUSE™ Solution

Our product, the MUSE™

system for transoral fundoplication is a single use innovate device for the treatment of GERD. The MUSE™ technology is based

on our proprietary platform technology, experience and know-how. Transoral means that procedure is perform through the mouth,

rather than through incisions in the abdomen. The MUSE™ system is used to perform a procedure as an alternative to a surgical

fundoplication. The MUSE™ system offers an endoscopic, incisionless alternative to surgery. A single surgeon or gastroenterologist

can perform the MUSE™ procedure in a transoral way, unlike in a laparoscopic fundoplication which requires incisions.

The MUSE™ system

consists of the MUSE™ console controller, the MUSE™ endostapler and several accessories, including an overtube, irrigation

bottle, tubing supplies and staple cartridges. The MUSE™ endostapler incorporates a video camera, a flexible surgical stapler

and an ultrasonic guidance system that is used to measure the distance between the anvil and the cartridge of the stapler, to

ensure their proper alignment and tissue thickness. The device also contains an alignment pin, which is used for initial positioning

of the anvil against the cartridge, two anvil screws, which are used to reduce the thickness of the tissue that needs to be stapled

and to fix the position of the anvil and the MUSE™ endostapler during stapling. The system allows the operator to staple

the fundus of the stomach to the esophagus, in two or more locations, typically around the circumference, thereby creating a fundoplication,

without any incisions.

Endoscopic procedures

generally involve less recovery time and patient discomfort than conventional open or laparoscopic surgery. These procedures are

also typically performed in the outpatient hospital setting as opposed to an inpatient setting. Typically, outpatient procedures

cost the hospital or the insurer less money since there is no overnight stay in the hospital.

The clearance by the

FDA, or ‘Indications for Use’, of the MUSE™ system is “for endoscopic placement of surgical staples in

the soft tissue of the esophagus and stomach in order to create anterior partial fundoplication for treatment of symptomatic chronic

Gastro-Esophageal Reflux Disease in patients who require and respond to pharmacological therapy”. As such, the FDA clearance

covers the use by an operator of the MUSE™ endostapler as described in the above paragraph. In addition, in the pivotal

study that was presented to the FDA in order to gain clearance, only patients who were currently taking GERD medications (i.e.

pharmacological therapy) were allowed in the study. In addition, all patients had to have a significant decrease in their symptoms

when they were taking medication compared to when they were off the medication. As such, the FDA clearance included the indication

that MUSE™ system is intended for patients who require and respond to pharmacological therapy. The MUSE™ system

indication does not restrict its use with respect to GERD severity from a regulatory point of view. However, clinicians typically

only consider interventional treatment options for moderate to severe GERD. Therefore, it is reasonable to expect the MUSE™

system would be primarily used to treat moderate and severe GERD in practice. The system has received 510(k) marketing clearance

from the FDA in the United States, as well as a CE mark in Europe.

On June 3, 2019, we

entered into a Licensing and Sale Agreement with Shanghai Golden Grand-Medical Instruments Ltd. (Golden Grand) for the know-how

licensing and sale of good relating to the Medigus Ultrasonic Surgical Endostapler (MUSE™) system in China, Hong Kong, Taiwan

and Macao. Under the agreement, we committed to provide a license, training services and goods to Golden Grand in consideration

for $3,000,000 to be paid to us in four milestone-based installments. To date, some of these milestones have been achieved and

the Company has received $1,800,000. The final milestone shall be completed, and the final installment paid upon completion of

a MUSE™ assembly line in China.

Other Activities

Algomizer Ltd.

We currently own a

minority stake in Algomizer and Linkury. Linkury operates in the field of software development, marketing and distribution to

internet users. Algomizer recently announced its intention to focus its efforts on Linkury Ltd., its subsidiary, which is the

main source of Algomizer’s revenues and operations, with a goal of expanding its product portfolio in the field of technological

solutions for advertising and media. In the coming year, Linkury plans to launch new products in the sector of advertising technologies

and mobile. Furthermore, Algomizer continues its efforts to seek opportunities of engaging in acquisitions of companies with significant

revenues and commercial potential.

Matomy Media Group Ltd.

In addition, we hold

approximately 24.99% of Matomy Media Group Ltd.’s, or Matomy, outstanding share capital. Matomy is dually listed on the

London and Tel Aviv Stock Exchanges.

Recent Developments

Polyrizon Ltd.

On April 23, 2020,

we entered into a binding letter of intent, or the LOI, with Polyrizon Ltd. or Polyrizon, a private company engaged in developing

biological gels for the purpose of protecting patients against biological threats, and preventing intrusion of allergens and viruses

through the upper airways and eye cavities. The LOI provides for an initial investment by us of $50,000 in consideration for ordinary

shares of Polyrizon constituting 10% of its issued and outstanding share capital on a fully diluted basis as of April 23, 2020.

We are entitled to increase the aforementioned investment up to a total of $100,000, in consideration for shares based on a price

per share calculated based on the initial investment. Furthermore, we were granted an option to invest an additional $1,000,000

in consideration for ordinary shares constituting 30% of Polyrizon’s share capital (excluding deferred shares) on a fully

diluted basis. The option is exercisable until the earlier of (i) the third year anniversary of the LOI, or (ii) consummation

of equity financing in Polyrizon of at least $500,000 at a pre money valuation of $10 million.

The LOI provides for

the Company and Polyrizon entering a joint marketing and distribution agreement, whereby we shall receive an exclusive right to

market, resell and distribute Polyrizon’s products for a period of four years commencing upon the date on which Polyrizon’s

products receive sufficient FDA approvals for its commercialization. In consideration for the rights, Polyrizon shall be entitled

to royalty payments based on the extent of actual sales.

L-1 Systems Ltd.

On April 27, 2020,

we entered into a collaboration agreement with L-1 Systems Ltd. or L-1 Systems, a private company, for the joint commercialization

of various COVID-19 related products such as serological test kits and face masks. The agreement provides that we shall have the

option to provide working capital /financing in connection with the distribution of COVID-19 related products and stipulates profit

share arrangements between the Company and L-1 Systems. Under the agreement, we shall be entitled to receive 5% of profits from

sale, 50% of profits in the event that we facilitated the transaction, and in the event that we provided working capital financing

in connection with a sale, a profit share proportionate to the extent of the financing.

On May 13, 2020, the

Company and L-1 Systems signed an amendment to the agreement, stipulating 50% profit share arrangements between the parties with

respect to sales deriving from the distribution of Life-Can Pandemic Response Ventilators in Mexico.

Elbit Systems Land Ltd.

On May 6, 2020, we

entered into a distribution agreement with Elbit Systems Land Ltd., or ESL, pursuant to which we received an exclusive license

for a period of one year to distribute Life-Can Pandemic Response Ventilators in Mexico. In consideration for the distribution

license, we are obligated to purchase the ventilators solely from ESL in accordance with ESL’s standard terms and conditions.

ScoutCam Inc, Investment

On

May 19, 2020, we announced that ScoutCam Inc. (OTC: SCTC), our subsidiary, entered into and consummated a securities purchase agreement

with M. Arkin (1999) Ltd. in connection with an investment of $2,000,000.

Corporate Information

We were incorporated

in the State of Israel on December 9, 1999, as a private company pursuant to the Israeli Companies Ordinance (New Version), 1983.

In February 2006, we completed our initial public offering in Israel, and our ordinary shares have since traded on TASE, under

the symbol “MDGS”. In May 2015, we listed the ADSs on Nasdaq, and since August 2015 the ADSs have been traded on Nasdaq

under the symbol “MDGS”. Our Series C Warrants have been trading on Nasdaq under the symbol “MDGSW” since

July 2018. Each Series C Warrant is exercisable into one ADS for an exercise price of $3.50 and will expire in July 2023. Each

ADS represents 20 ordinary shares.

We are a public limited

liability company and operate under the provisions of Israel’s Companies Law, 5759-1999, as amended, or the Companies Law.

Our registered office and principal place of business are located at Omer Industrial Park, No. 7A, P.O. Box 3030, Omer 8496500,

Israel and our telephone number in Israel is +972-72-260-2200. Our website address is www.medigus.com. The information contained

on our website or available through our website is not incorporated by reference into and should not be considered a part of this

prospectus.

THE OFFERING

|

ADSs offered by us

|

|

575,001 ADSs representing 11,500,020 ordinary shares.

|

|

|

|

|

|

Pre-Funded Warrants offered by us

|

|

2,758,333

Pre-funded Warrants to purchase up to 2,758,333 ADSs representing 55,166,660 ordinary shares. This prospectus also relates to the offering of ADSs issuable upon exercise of the Pre-funded Warrants.

|

|

|

|

|

|

Public offering price

|

|

$1.50 per ADS and $1.499 per Pre-Funded Warrant.

|

|

|

|

|

|

Ordinary shares to be outstanding after this offering

|

|

151,205,418 ordinary shares (assuming the full exercise of the Pre-Funded Warrants).

|

|

|

|

|

|

The ADSs

|

|

Each ADS represents 20 ordinary shares.

The ADSs will be evidenced by American Depositary Receipts, or ADRs, executed and delivered by The Bank of New York Mellon, as

Depositary.

The Depositary, as depositary, will be

the holder of the ordinary shares underlying your ADSs and you will have rights as provided in the Deposit Agreement, among us,

The Bank of New York Mellon, as Depositary, and all owners and holders from time to time of ADSs issued thereunder, or the Deposit

Agreement, a form of which has been filed as Exhibit 1 to the Registration Statement on Form F-6 filed by The Bank of New York

Mellon with the SEC on May 7, 2015.

Subject to compliance with the relevant

requirements set out in the prospectus, you may turn in your ADSs to the Depositary in exchange for ordinary shares underlying

your ADSs.

The Depositary will charge you fees for

such exchanges pursuant to the Deposit Agreement.

You should carefully read the “Description

of American Depositary Shares” section of the accompanying prospectus and the Deposit Agreement to better understand the

terms of the ADSs.

|

|

|

|

|

|

The Pre-Funded Warrants

|

|

We are offering 2,758,333 Pre-Funded Warrants to purchasers whose

purchase of ADSs in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties,

beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding ordinary shares immediately

following the consummation of this offering, in lieu of ADSs that would otherwise result in the purchaser’s beneficial ownership

exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding ordinary shares. The Pre-Funded Warrant will have

an exercise price of $0.001 per ADS, will be immediately exercisable and may be exercised at any time until all of the Pre-Funded

Warrants are exercised in full. The Pre-Funded Warrants will not be certificated.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate the net proceeds from this offering will be approximately $4.4 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-11 of this prospectus supplement.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement, on page 4 of the accompanying prospectus and in our Annual Report on Form 20-F filed with the SEC, on April 21, 2020, for a discussion of certain factors you should consider before investing in our securities.

|

|

|

|

|

|

Listings

|

|

The ADSs are traded on Nasdaq

under the symbol “MDGS” and our ordinary shares trade on the TASE in Israel under the symbol “MDGS”. The

Pre-Funded Warrants are not listed on any securities exchange and we do not expect to list the Pre-Funded Warrants on Nasdaq,

the Tel Aviv Stock Exchange, or TASE, or any other national securities exchange or any other recognized trading system, and we

do not expect a market to develop.

|

|

|

|

|

|

Depositary

|

|

The Bank of New York Mellon

|

Unless otherwise

indicated, the number of ordinary shares outstanding prior to and after this offering is based on 84,538,738 ordinary shares issued

and outstanding as of May 13, 2020, and excludes:

|

|

●

|

4,256,380 ordinary shares issuable upon the exercise of outstanding options at a weighted average exercise price of NIS 0.88 per share or $0.25 per share (based on the exchange rate reported by the Bank of Israel on such date), equivalent to 212,819 ADSs at a weighted average exercise price of $5.02 per ADS;

|

|

|

●

|

87,988,240 ordinary shares issuable upon the exercise of warrants to purchase up to an aggregate of 4,399,412 ADSs at a weighted average exercise price of $5.22 per ADS; and

|

|

|

●

|

810,500 ordinary shares held by us as dormant shares.

|

Unless otherwise indicated,

all information in this prospectus supplement assumes no exercise of the outstanding options or warrants described above.

RISK FACTORS

An investment in

our securities involves significant risks. Before making an investment in our securities, you should carefully read all of the

information contained in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference

herein, including the risk factors contained in our Annual Report on Form 20-F for the year ended December 31, 2019 filed with

the SEC on April 21, 2020. For a discussion of risk factors that you should carefully consider before deciding to purchase any

of our securities, please review the additional risk factors disclosed below and the information under the heading “Risk

Factors” in the accompanying prospectus. In addition, please read “About this Prospectus Supplement” and “Special

Note Regarding Forward-Looking Statements” in this prospectus supplement, where we describe additional uncertainties associated

with our business and the forward-looking statements included or incorporated by reference in this prospectus supplement and the

accompanying prospectus. Please note that additional risks not currently known to us or that we currently deem immaterial also

may adversely affect our business, results of operations, financial condition and prospects. Our business, financial condition,

results of operations and prospects could be materially and adversely affected by these risks, and you may lose all or part of

your original investment.

Risks Related to an Investment in Our Shares and the ADSs

The market price for

our securities may be volatile.

The stock market in

general and the market prices of our ordinary shares on TASE, and the ADSs on Nasdaq, in particular, are or will be subject to

fluctuation, and changes in these prices may be unrelated to our operating performance. We anticipate that the market prices of

our securities will continue to be subject to wide fluctuations. The market price of our securities is, and will be,

subject to a number of factors, including:

|

|

●

|

announcements of

technological innovations or new products by us or others;

|

|

|

|

|

|

|

●

|

announcements by

us of significant acquisitions, strategic partnerships, in-licensing, out-licensing, joint ventures or capital commitments;

|

|

|

|

|

|

|

●

|

expiration or terminations

of licenses, research contracts or other collaboration agreements;

|

|

|

|

|

|

|

●

|

public concern as

to the safety of the equipment we sell;

|

|

|

|

|

|

|

●

|

the volatility of

market prices for shares of medical devices companies generally;

|

|

|

|

|

|

|

●

|

developments concerning

intellectual property rights or regulatory approvals;

|

|

|

|

|

|

|

●

|

variations in our

and our competitors’ results of operations;

|

|

|

|

|

|

|

●

|

changes in revenues,

gross profits and earnings announced by the company;

|

|

|

|

|

|

|

●

|

changes in estimates

or recommendations by securities analysts, if our ordinary shares or the ADSs are covered by analysts;

|

|

|

|

|

|

|

●

|

fluctuations in

the share price of our publicly traded subsidiaries;

|

|

|

|

|

|

|

●

|

changes in government

regulations or patent decisions; and

|

|

|

|

|

|

|

●

|

general market conditions

and other factors, including factors unrelated to our operating performance.

|

These factors may materially and

adversely affect the market price of our securities s and result in substantial losses by our investors.

Our securities

are traded on different markets and this may result in price variations.

Our ordinary shares

have been traded on TASE since February 2006 and our ADSs have been traded on Nasdaq since August 5, 2015. Trading in our

securities on these markets takes place in different currencies (U.S. dollars on the Nasdaq and NIS on the TASE), and at different

times (resulting from different time zones, different trading days and different public holidays in the United States

and Israel). The trading prices of these securities on these two markets may differ due to these and other factors. Any decrease

in the price of our securities on one of these markets could cause a decrease in the trading price of our securities on the other

market.

Issuance of

additional equity securities may adversely affect the market price of the ADSs or ordinary shares.

We are currently authorized

to issue 250,000,000 ordinary shares, par value NIS 1.00. As of May 13, 2020, we had 84,538,738 ordinary shares issued and outstanding

(excluding 810,500 dormant shares), and 94,998,240 ordinary shares reserved for future issuance under outstanding options and warrants

and under our 2013 Share Option and Incentive Plan. Any equity financing necessary in order to fund our operations may require

us to increase our authorized share capital prior to initiating any such financing transaction.

To the extent that

we issue ADSs or ordinary shares, or options and warrants are exercised, holders of the ADSs and our ordinary shares will experience

dilution. In addition, in the event of any future issuances of equity securities or securities convertible into or exchangeable

for ADSs or ordinary shares, holders of the ADSs or our ordinary shares may experience dilution. We also consider from time to

time various strategic alternatives that could involve issuances of additional ADSs or ordinary shares, including but not limited

to acquisitions and business combinations, but do not currently have any definitive plans to enter into any of these transactions.

We do not know

whether a market for the ADSs and ordinary shares will be sustained or what the trading price of the ADSs and ordinary shares

will be and as a result it may be difficult for you to sell your ADSs or ordinary shares.

Although our ADSs

trade on Nasdaq and our ordinary shares trade on TASE, an active trading market for the ADSs or ordinary shares may not be sustained.

It may be difficult for you to sell your ADSs or ordinary shares without depressing the market price for the ADSs or ordinary

shares. As a result of these and other factors, you may not be able to sell your ADSs or ordinary shares. Further, an inactive

market may also impair our ability to raise capital by selling ADSs and ordinary shares and may impair our ability to enter into

strategic partnerships or acquire companies or products by using our ordinary shares as consideration.

Future sales

of our ordinary shares or the ADSs could reduce the market price of our ordinary shares and the ADSs.

Substantial

sales of our ordinary shares or the ADSs, either on the TASE or on Nasdaq, may cause the market price of our ordinary shares or

ADSs to decline. All of our outstanding ordinary shares are registered and available for sale in Israel. Sales by us or our security

holders of substantial amounts of our ordinary shares or ADSs, or the perception that these sales may occur in the future, could

cause a reduction in the market price of our ordinary shares or ADSs.

The

issuance of any additional ordinary shares, any additional ADSs, or any securities that are exercisable for or convertible into

our ordinary shares or ADSs, may have an adverse effect on the market price of our ordinary shares and the ADSs and will have

a dilutive effect on our existing shareholders and holders of ADSs.

We have no plans

to pay dividends on our ordinary shares, and you may not receive funds without selling the ADSs or ordinary shares.

We have not declared

or paid any cash dividends on our ordinary shares, nor do we expect to pay any cash dividends on our ordinary shares for the foreseeable

future. We currently intend to retain any additional future earnings to finance our operations and growth and, therefore, we have

no plans to pay cash dividends on our ordinary shares at this time. Any future determination to pay cash dividends on our ordinary

shares will be at the discretion of our board of directors and will be dependent on our earnings, financial condition, operating

results, capital requirements, any contractual restrictions, and other factors that our board of directors deems relevant. Accordingly,

you may have to sell some or all of the ADSs or ordinary shares in order to generate cash from your investment. You may not receive

a gain on your investment when you sell the ADSs or ordinary shares and may lose the entire amount of your investment.

As a foreign

private issuer, we are permitted to follow certain home country corporate governance practices instead of applicable SEC and Nasdaq

requirements, which may result in less protection than is accorded to investors under rules applicable to domestic issuers.

As a foreign private

issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise required under

the rules of the Nasdaq Stock Market for domestic issuers. For instance, we may follow home country practice in Israel with regard

to: distribution of annual and quarterly reports to shareholders, director independence requirements, director nomination

procedures, approval of compensation of officers, approval of related party transactions, shareholder approval requirements, equity

compensation plans and quorum requirements at shareholders’ meetings. In addition, we follow our home country law, instead

of the rules of the Nasdaq Stock Market, which require that we obtain shareholder approval for certain dilutive events, such as

for the establishment or amendment of certain equity based compensation plans, an issuance that will result in a change of control

of the company, certain transactions other than a public offering involving issuances of a 20% or more interest in the company

and certain acquisitions of the stock or assets of another company. Following our home country governance practices as opposed

to the requirements that would otherwise apply to a U.S. company listed on the Nasdaq Stock Market, may provide less protection

than is accorded to investors under the rules of the Nasdaq Stock Market applicable to domestic issuers. For more information,

see “Item 16G. Corporate Governance - Nasdaq Stock Market Listing Rules and Home Country Practices” in our Annual

Report on Form 20-F for the year ended December 31, 2019.

In addition, as a

foreign private issuer, we are exempt from the rules and regulations under the Securities Exchange Act of 1934, as amended, or

the Exchange Act, related to the furnishing and content of proxy statements, and our officers, directors and principal

shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange

Act. In addition, we are not required under the Exchange Act to file annual, quarterly and current reports and financial statements

with the SEC as frequently or as promptly as domestic companies whose securities are registered under the Exchange Act.

The COVID-19

pandemic, or any other pandemic, epidemic or outbreak of an infectious disease, may materially and adversely affect our business

and operations.

The

recent outbreak of COVID-19 originated in Wuhan, China, in December 2019 and has since spread to multiple countries, including

the United States, Israel and many European countries in which we operate. On March 11, 2020, the World Health Organization declared

the outbreak a pandemic. While COVID-19 is still spreading and the final implications of the pandemic are difficult to estimate

at this stage, it is clear that it has affected the lives of a large portion of the global population. At this time, the pandemic

has caused states of emergency to be declared in various countries, travel restrictions imposed globally, quarantines established

in certain jurisdictions and various institutions and companies being closed. We are actively monitoring the pandemic and we are

taking any necessary measures to respond to the situation in cooperation with the various stakeholders.

Due

to the uncertainty surrounding the COVID-19 pandemic, we will continue to assess the situation, including government-imposed restrictions,

market by market. It is not possible at this time to estimate the full impact that the COVID-19 pandemic could have on our

business, the continued spread of COVID-19, and any additional measures taken by governments, health officials or by us in response

to such spread, could have on our business, results of operations and financial condition. The COVID-19 pandemic and mitigation

measures have also negatively impacted global economic conditions, which, in turn, could adversely affect our business, results

of operations and financial condition. The extent to which the COVID-19 outbreak continues to impact our financial condition

will depend on future developments that are highly uncertain and cannot be predicted, including new government actions or restrictions,

new information that may emerge concerning the severity, longevity and impact of the COVID-19 pandemic on economic activity.

Risks Related

to this Offering

Since we have

broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

We have not allocated specific

amounts of the net proceeds from this offering for any specific purpose. Accordingly, our management will have significant flexibility

in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of

these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used in ways with which you would agree. It is possible that the net proceeds will be invested in a way that does not

yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse

effect on our business, financial condition, operating results and cash flow. See “Use of Proceeds.”

A substantial number

of ADSs may be sold in this offering, which could cause the price of our ADSs or ordinary shares to decline.

In this offering we will sell

66,666,680 ordinary shares represented by 3,333,334 ADSs which represent approximately 79% of our outstanding ordinary shares as

of May 14, 2020 after giving effect to the sale of the ordinary shares represented by ADSs and assuming the full exercise of the

Pre-Funded Warrants sold in this offering. This sale and any future sales of a substantial number of ADSs in the public market,

or the perception that such sales may occur, could adversely affect the price of the ADSs on Nasdaq. We cannot predict the effect,

if any, that market sales of ADSs or the availability of ADSs for sale will have on the market price of the ADSs.

There is no public market for the Pre-Funded

Warrants being offered by us in this offering.

We

do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized

trading system, including Nasdaq. Without an active market, the liquidity of the Pre-Funded Warrants will be limited.

The Pre-Funded Warrants are speculative

in nature.

Except

as otherwise provided therein, the Pre-Funded Warrants offered by us in this offering do not confer any rights of ownership

of ordinary shares or ADSs on their holders, such as voting rights, but only represent the right to acquire ADSs at a fixed price.

Commencing on the date of issuance, holders of the Pre-Funded Warrants may exercise their right to acquire ADSs and pay an

exercise price per ADS of $0.001, subject to adjustment upon certain events.

Holders of our Pre-Funded Warrants will

have not generally have rights as shareholders until such holders exercise their Pre-Funded Warrants and acquire our ADSs.

Until

holders of the Pre-Funded Warrants acquire our ADSs upon exercise of the Pre-Funded Warrants, holders of the Pre-Funded Warrants

will have no rights with respect to our ADSs or ordinary shares underlying such warrants, except as otherwise provided therein.

Upon exercise of the Pre-Funded Warrants, the holders thereof will be entitled to exercise the rights of a holder of ADSs

only as to matters for which the record date occurs after the exercise date.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement

and the information incorporated by reference herein may include forward looking statements. These statements involve known and

unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some

cases, you can identify forward-looking statements by terms including “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would,” and similar expressions

intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events

and are based on assumptions and subject to risks and uncertainties. In addition, certain sections of this prospectus and the

information incorporated by reference herein contain information obtained from independent industry and other sources that we

have not independently verified. You should not put undue reliance on any forward-looking statements. Unless we are required to

do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

Our ability to predict

our operating results or the effects of various events on our operating results is inherently uncertain. Therefore, we caution

you to consider carefully the matters described under the caption “Risk Factors” above, and certain other matters

discussed in this prospectus and the information incorporated by reference herein, and other publicly available sources. Such

factors and many other factors beyond our control could cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements.

Factors that could

cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but

are not limited to:

|

|

●

|

recent material

changes in our strategy;

|

|

|

●

|

our ability to sell

or license our MUSE™ technology;

|

|

|

●

|

ScoutCam Inc.’s

commercial success in commercializing the ScoutCam™ system;

|

|

|

●

|

projected capital

expenditures and liquidity;

|

|

|

●

|

the overall global

economic environment as well as the direct impact of the coronavirus strain COVID-19 on us;

|

|

|

●

|

the impact of competition

and new technologies;

|

|

|

●

|

general market,

political, reimbursement and economic conditions in the countries in which we operate;

|

|

|

●

|

government regulations

and approvals;

|

|

|

●

|

litigation and regulatory

proceedings; and

|

|

|

●

|

those factors referred

to in “Item 3. Key Information – D. Risk Factors,” “Item 4. Information on the Company,”

and “Item 5. Operating and Financial Review and Prospects”, in our Annual Report on Form 20-F for the year

ended December 31, 2019, which is incorporated by reference in this prospectus supplement.

|

We caution you to

carefully consider these risks and not to place undue reliance on our forward-looking statements. Except as required by law, we

assume no responsibility for updating any forward-looking statements.

USE OF PROCEEDS

We estimate the net

proceeds from this offering will be approximately $4.4 million, after deducting underwriter commissions and discounts, and estimated

offering expenses payable by us.

We currently intend

to use the net proceeds from this offering for working capital and general corporate purposes. As a result, our management will

retain broad discretion in the allocation and use of the net proceeds of this offering, and investors will be relying on the judgment

of our management with regard to the use of these net proceeds. Pending application of the net proceeds for the purposes as described

above, we expect to invest the net proceeds in short-term, interest-bearing securities, investment grade securities, certificates

of deposit or direct or guaranteed obligations of the U.S. government.

CAPITALIZATION

The following

table sets forth our capitalization:

|

|

●

|

on an actual basis

as of December 31, 2019; and

|

|

|

●

|

on an as adjusted basis to give effect to this offering based on a public offering price of $1.50 per ADS and $1.499 per Pre-Funded Warrant, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, including the immediate charge to profit or loss of $507 thousand related to those underwriting discounts and commissions and estimated offering expenses.

|

The information set

forth in the following table should be read in conjunction with, and is qualified in its entirety by, reference to our audited

and unaudited financial statements and the notes thereto incorporated by reference into this prospectus supplement and the accompanying

prospectus.

|

|

|

As of

December 31,

2019

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(U.S. Dollars, in thousands)

|

|

|

Cash and cash equivalents

|

|

$

|

7,036

|

|

|

$

|

11,421

|

|

|

Total liabilities

|

|

|

5,203

|

|

|

|

9,338

|

|

|

Equity:

|

|

|

|

|

|

|

|

|

|

Ordinary shares, par value NIS 1.00 per share: 250,000,000 ordinary shares authorized (actual and as adjusted); 82,598,738 ordinary shares outstanding (actual), 94,098,758 ordinary shares outstanding (as adjusted)

|

|

|

22,802

|

|

|

|

26,064

|

|

|

Share premium

|

|

|

47,873

|

|

|

|

45,368

|

|

|

Other capital reserves

|

|

|

12,492

|

|

|

|

12,492

|

|

|

Warrants

|

|

|

197

|

|

|

|

197

|

|

|

Accumulated deficit

|

|

|

(76,657

|

)

|

|

|

(77,164

|

)

|

|

Equity attributable to owners of Medigus Ltd.

|

|

|

6,707

|

|

|

|

6,957

|

|

|

Non-controlling interests

|

|

|

1,424

|

|

|

|

1,424

|

|

|

Total equity

|

|

|

8,131

|

|

|

|

8,381

|

|

|

Total capitalization and indebtedness

|

|

$

|

13,334

|

|

|

$

|

17,719

|

|

The preceding table

excludes as of December 31, 2019: (i) 4,276,380 ordinary shares issuable upon the exercise of outstanding options at a weighted

average exercise price of NIS 0.88 per share or $0.26 per share (based on the exchange rate reported by the Bank of Israel on

such date), equivalent to 213,819 ADSs at a weighted average exercise price of $5.12 per ADS and (ii) 89,928,240 ordinary shares

issuable upon the exercise of warrants to purchase up to an aggregate of 4,496,412 ADSs at a weighted average exercise price of

$4.97 per ADS.

Description

of Pre-funded Warrants

The

following summary of certain terms and provisions of Pre-funded Warrants that are being offered hereby is not complete and

is subject to, and qualified in its entirety by, the provisions of the Pre-funded Warrant, the form of which is filed as an

exhibit to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the

terms and provisions of the form of Pre-funded Warrant for a complete description of the terms and conditions of the Pre-funded Warrant.

The purpose of

the Pre-funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than

4.99% (or at the election of the investor, 9.99%) of our outstanding ordinary shares following the consummation of this offering

the opportunity to invest capital into the Company without triggering such ownership restrictions. By receiving Pre-funded Warrants

in lieu of the ADSs which would result in such holders’ ownership exceeding 4.99% (or at the election of the investor, 9.99%),

such holders will have the ability to exercise their options to purchase the ADSs underlying the Pre-funded Warrants for

nominal consideration of $0.001 per ADS at a later date. Pre-funded Warrants that expire unexercised will have no further

value and the holders of such warrants will lose the pre-funded amount.

Form

The Pre-funded Warrants

will be issued to the investors in physical form.

Exercisability

The Pre-funded Warrants are exercisable until fully exercised.

The Pre-funded Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly

executed exercise notice accompanied by payment in full for the number of ADSs purchased upon such exercise (except in the case

of a cashless exercise as discussed below). Unless otherwise specified in the Pre-funded Warrant, a holder (together with

its affiliates and any persons acting as a group together with the holder or any of the holder’s affiliates) may not exercise

any portion of the Pre-funded Warrants to the extent that the holder would own more than 4.99% (or, 9.99%, at the initial

election of the holder) of the outstanding ordinary shares after exercise, except that upon at least 61 days’ prior notice

from the holder to us, the holder may increase or decrease the amount of ownership of outstanding shares after exercising the holder’s

warrants, as applicable, up to 9.99% of the number of our ordinary shares outstanding immediately after giving effect to the exercise,

as such percentage ownership is determined in accordance with the terms of the warrants.

Cashless Exercise

The holder may, in

its sole discretion, exercise Pre-funded Warrants and, in lieu of making the cash payment otherwise contemplated to be made

to us upon such exercise in payment of the aggregate exercise price, elect instead to receive upon such exercise the net number

of ADSs determined according to the formula set forth in the Pre-funded Warrant.

Exercise Price

The initial exercise price

per ADS purchasable upon exercise of the Pre-funded Warrants is equal to $0.001.

Listing

We

do not plan on applying to list the Pre-funded Warrants on the Nasdaq Capital Market, any other national securities exchange

or any other nationally recognized trading system.

Fundamental Transaction

If,

at any time while the Pre-funded Warrants are outstanding, (1) we consolidate or merge with or into another corporation whether

or not the Company is the surviving corporation, (2) we sell, lease, license, assign, transfer, convey or otherwise dispose of

all or substantially all of our assets, or any of our significant subsidiaries, (3) any purchase offer, tender offer or exchange

offer (whether by us or another individual or entity) is completed pursuant to which holders of the ordinary shares are permitted

to sell, tender or exchange their ordinary shares for other securities, cash or property and has been accepted by the holders of

50% or more of the ordinary shares, (4) we consummate a securities purchase agreement or other business combination with another

person or entity whereby such other person or entity acquires more than 50% of the outstanding ordinary shares, or (5) we effect

any reclassification or recapitalization of the ordinary shares or any compulsory exchange pursuant to which the ordinary shares

are converted into or exchanged for other securities, cash or property, or each, a “Fundamental Transaction,” then

upon any subsequent exercise of Pre-funded Warrants, the holders thereof will have the right to receive the same amount and

kind of securities, cash or property as they would have been entitled to receive upon the occurrence of such Fundamental Transaction

if they had been, immediately prior to such Fundamental Transaction, the holder of the number of ordinary shares then issuable

upon exercise of those Pre-funded Warrants, and any additional consideration payable as part of the Fundamental Transaction.

Rights as a Shareholder

Except

as otherwise provided in the form of Pre-funded Warrant or by virtue of such holder’s ownership of ADSs, the holder

of Pre-funded Warrants does not have rights or privileges of a holder of ADSs, including any voting rights, until the holder

exercises the warrants.

UNDERWRITING

ThinkEquity, a division

of Fordham Financial Management, Inc., is acting as the representative of the underwriters of the offering. We have entered into

an underwriting agreement dated May 19, 2020 with the representative. Subject to the terms and conditions of the underwriting

agreement, we have agreed to sell to each underwriter named below, and each underwriter named below has severally agreed to purchase,

at the public offering price less the underwriting discount set forth on the cover page of this prospectus supplement, the number

of ADSs and Pre-Funded Warrants listed next to its name in the following table:

|

Underwriter

|

|

Number of

ADSs

|

|

|

Number of Pre-Funded Warrants

|

|

|

ThinkEquity, a division of Fordham Financial Management, Inc.

|

|

|

575,001

|

|

|

|

2,758,333

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

575,001

|

|

|

|

2,758,333

|

|

The underwriters are committed

to purchase all the ADSs and Pre-Funded Warrants offered by the Company. The obligations of the underwriters may be terminated

upon the occurrence of certain events specified in the underwriting agreement. Furthermore, the underwriting agreement provides

that the obligations of the underwriters to pay for and accept delivery of the ADSs and Pre-Funded Warrants offered by us in this

prospectus supplement are subject to various representations and warranties and other customary conditions specified in the underwriting

agreement, such as receipt by the underwriters of officers’ certificates and legal opinions.

We have agreed to indemnify

the underwriters against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the

underwriters may be required to make in respect thereof.

The underwriters are offering

the ADSs and Pre-Funded Warrants subject to prior sale, when, as and if issued to and accepted by them, subject to approval of

legal matters by their counsel and other conditions specified in the underwriting agreement. The underwriters reserve the right

to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Discounts, Commissions and Reimbursement

The representative has advised us that the underwriters propose to offer the ADSs and Pre-Funded Warrants to the public at

the initial public offering price per share set forth on the cover page of this prospectus. The underwriters may offer ADSs

and Pre-Funded Warrants to securities dealers at that price less a concession of not more than $0.06 per ADS or Pre-Funded

Warrant. After the initial offering to the public, the public offering price and other selling terms may be changed by the

representative.

The following table

summarizes the underwriting discounts and commissions and proceeds, before expenses, to us:

|

|

|

Per ADS

|

|

|

Per Pre-Funded Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.50

|

|

|

|

1.499

|

|

|

$

|

4,997,243

|

|

|

Underwriting discounts and commissions (7%)

|

|

$

|

0.105

|

|

|

|

0.105

|

|

|

$

|

349,807

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.395

|

|

|

|

1.394

|

|

|

$

|

4,647,436

|

|

We have paid an expense

deposit of $10,000 to the representative, which will be applied against the actual out-of-pocket accountable expenses that will

be paid by us to the underwriters in connection with this offering, and will be reimbursed to us to the extent not incurred.

In addition, we have also

agreed to pay up to an aggregate of $85,000 of the underwriters’ reasonable out-of-pocket expenses in connection with the

offering, including the following expenses: (a) all fees, expenses and disbursements relating to background checks of our officers

and directors in an amount not to exceed $15,000 in the aggregate; (b) all filing fees and communication expenses associated with

the review of this offering by FINRA; (c) (d) $5,000 for the underwriters’ use of Ipreo’s book-building, prospectus

tracking and compliance software for this offering; (e) the fees and expenses of the underwriters’ legal counsel incurred

in connection with this offering in an amount up to $60,000; (f) the $5,000 cost for data services and communications expenses;

(g) the underwriters’ actual accountable “road show” expenses for the offering; and (h) costs associated with

bound volumes of the public offering materials as well as commemorative mementos and lucite tombstones.

We estimate the expenses

of this offering payable by us, not including underwriting discounts and commissions, will be approximately $0.3 million.

Lock-Up Agreements

The Company and each

of its directors and officers have agreed for a period of one month after the date of this prospectus supplement, subject to certain

exceptions, without the prior written consent of the representative, not to directly or indirectly:

|

|

●

|

issue (in the case

of us), offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to

sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any ADSs, ordinary shares or

other capital stock or any securities convertible into or exercisable or exchangeable for our ordinary shares or other capital

stock;

|

|

|

●

|

in the case of us,

file or cause the filing of any registration statement under the Securities Act with respect to any ADSs, ordinary shares

or other capital stock or any securities convertible into or exercisable or exchangeable for our ordinary shares or other

capital stock;

|

|

|

●

|

complete any offering

of debt securities of the Company, other than entering into a line of credit, term loan arrangement or other debt instrument

with a traditional bank; and

|

|

|

●

|

enter into any swap

or other agreement, arrangement, hedge or transaction that transfers to another, in whole or in part, directly or indirectly,

any of the economic consequences of ownership of the ADSs, ordinary shares or other capital stock or any securities convertible

into or exercisable or exchangeable for ordinary shares or ADSs, or other capital stock, whether any transaction described

in any of the foregoing bullet points is to be settled by delivery of ADSs or other capital stock, other securities, in cash

or otherwise, or publicly announce an intention to do any of the foregoing.

|

Electronic Offer, Sale and Distribution

of Securities

A prospectus in electronic

format may be made available on the websites maintained by one or more of the underwriters or selling group members. The representative

may agree to allocate a number of securities to underwriters and selling group members for sale to its online brokerage account

holders. Internet distributions will be allocated by the underwriters and selling group members that will make internet distributions

on the same basis as other allocations. Other than the prospectus in electronic format, the information on these websites is not

part of, nor incorporated by reference into, this prospectus or the registration statement of which this prospectus forms a part,

has not been approved or endorsed by us, and should not be relied upon by investors.

Stabilization

In connection with

this offering, the underwriters may engage in stabilizing transactions, syndicate-covering transactions, penalty bids and purchases

to cover positions created by short sales.

Stabilizing transactions

permit bids to purchase ADSs so long as the stabilizing bids do not exceed a specified maximum, and are engaged in for the purpose

of preventing or retarding a decline in the market price of the ADSs while the offering is in progress.

Syndicate covering

transactions involve purchases of ADSs in the open market after the distribution has been completed in order to cover syndicate

short positions. In determining the source of ADSs to close out the short position, the underwriters will consider, among other

things, the price of ADSs available for purchase in the open market.

Penalty bids permit

the representative to reclaim a selling concession from a syndicate member when the ADSs originally sold by that syndicate member

are purchased in stabilizing or syndicate covering transactions to cover syndicate short positions.

These stabilizing

transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price

of our ADSs or preventing or retarding a decline in the market price of our ADSs. As a result, the price of our ADSs in the open

market may be higher than it would otherwise be in the absence of these transactions. Neither we nor the underwriters make any

representation or prediction as to the effect that the transactions described above may have on the price of our ADSs. These transactions

may be effected in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

Other Relationships

Certain of the underwriters

and their affiliates may in the future provide various investment banking, commercial banking and other financial services for

us and our affiliates for which they may in the future receive customary fees.

Offer restrictions outside the United

States

Other than in the

United States, no action has been taken by us or the underwriters that would permit a public offering of the securities offered

by this prospectus supplement in any jurisdiction where action for that purpose is required. The securities offered by this prospectus

supplement and the accompanying prospectus may not be offered or sold, directly or indirectly, nor may this prospectus supplement

or any other offering material or advertisements in connection with the offer and sale of any such securities be distributed or

published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations

of that jurisdiction. Persons into whose possession this prospectus supplement comes are advised to inform themselves about and