Current Report Filing (8-k)

January 23 2020 - 8:00AM

Edgar (US Regulatory)

United

States

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): January 22, 2020

Merchants Bancorp

(Exact Name of Registrant as Specified

in its Charter)

|

Indiana

|

001-38258

|

20-5747400

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

410 Monon Boulevard

Carmel, Indiana

46032

(Address of Principal Executive Offices) (Zip Code)

(317) 569-7420

(Registrant’s Telephone Number, Including

Area Code)

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

Common Stock, without par value

Series A Preferred Stock, without par value

Depositary Shares, each representing a 1/40th interest in a share of Series B Preferred Stock, without par value

|

MBIN

MBINP

MBINO

|

NASDAQ

NASDAQ

NASDAQ

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 23, 2020, Merchants Bancorp (the “Company”)

issued a press release announcing that effective immediately Michael J. Dunlap has been promoted to Chief Executive Officer of

the Company’s subsidiary, Merchants Bank of Indiana (“Merchants Bank”), and Chairman of the Company’s subsidiary,

Merchants Capital Corp. (“Merchants Capital”), and Michael R. Dury has been promoted to Chief Executive Officer of

Merchants Capital. Mr. Dunlap and Mr. Dury will succeed Michael F. Petrie in such positions.

Mr. Petrie currently serves as and will remain Chairman and

Chief Executive Officer of the Company. Mr. Dunlap currently serves as and will remain a Director and the President and Chief Operating

Officer of the Company. Mr. Dury currently serves as and will remain President of Merchants Capital.

In consideration of the above promotions and changes in responsibilities,

on January 22, 2020 the Company’s Compensation Committee approved the following change to Mr. Petrie’s compensation

and the Compensation Committee recommended to and the Company’s Board of Directors approved the following changes to Messrs.

Dunlap and Dury’s compensation, in each case effective for 2020:

|

|

·

|

Mr. Petrie’s base salary will be $750,000 and he will be eligible

to receive an award of restricted stock units under the Company’s 2017 Equity Incentive Plan (the “Plan”) based

on the Company’s achievement of performance measures permissible under the Plan and established by the Compensation Committee

(the “Performance Measures”). Mr. Petrie’s target restricted stock units award is equal to 70% of base salary.

|

|

|

·

|

Mr. Dunlap’s base salary will be $600,000 and he will be eligible

to receive a cash bonus award and an award of restricted stock units under the Plan, with each award based on the Company’s

achievement of the Performance Measures. Mr. Dunlap’s target cash bonus award is equal to 20% of base salary and the target

restricted stock units award is equal to 70% of base salary.

|

|

|

·

|

Mr. Dury’s base salary will be $130,000 and he will be eligible

to receive an award of restricted stock units under the Plan based on the Company’s achievement of the Performance Measures.

Mr. Dury’s target restricted stock units award is equal to 70% of base salary. Additionally, Mr. Dury will continue to receive

commissions pursuant to that Employment Agreement dated December 29, 2010, as amended effective January 1, 2017.

|

For each fiscal year, in addition to establishing the Performance

Measures for each of Messrs. Petrie, Dunlap, and Dury, the Compensation Committee will establish the weighting and payout ranges

of each Performance Measure. Thus, the exact payout of Messrs. Petrie, Dunlap, and Dury’s aforementioned awards (i.e., for

Mr. Petrie his restricted stock units award, for Mr. Dunlap his cash bonus award and restricted stock units award, and for Mr.

Dury his restricted stock units award) will vary depending on the Company’s actual results with respect to the Performance

Measures, as determined by the Compensation Committee following the close of the Company’s fiscal year. However, if the Company

fails to meet the threshold for all Performance Measures none of Messrs. Petrie, Dunlap, or Dury will receive a payout. For 2020,

the Compensation Committee has established total revenue growth, earnings per common share, and return on average total equity

as the Performance Measures for each of Messrs. Petrie, Dunlap, and Dury, with each Performance Measure equally weighted and having

a payout range of 75% (threshold) to 125% (maximum).

Along with the above changes in compensation, on January 22,

2020 the Company’s Board of Directors approved of offering and each of Messrs. Dunlap and Dury and the Company’s Chief

Financial Officer, John F. Macke, entered into a change in control agreement with the Company. Each of the change in control agreements

contain identical terms and in particular (a) provide for payment of an amount equal to two times base salary plus two times the

target cash bonus award most recently approved by the Company in the event both (1) there is a change in control event and (2)

employment is terminated by (i) the Company for any reason other than cause or (ii) Messrs. Dunlap, Dury, or Macke, as applicable,

with good reason, within a period between 120 days prior to an announcement of the change in control event and 18 months after

the change in control event becomes effective; and (b) contains customary restrictive covenants regarding confidentiality, non-competition,

and non-solicitation of customers and employees of the Company and its affiliates as well as a clawback provision should any benefit

thereunder be subject to recapture under any policy of the Company or applicable law. A copy of the form of change in control agreement

entered into with each of Messrs. Dunlap, Dury, and Macke is filed as Exhibit 10.1 hereto and incorporated herein by reference.

The foregoing summary of each change in control agreement is qualified in its entirety by the full text thereof.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MERCHANTS BANCORP

|

|

|

|

|

|

Date: January 23, 2020

|

By:

|

/s/ Terry A. Oznick

|

|

|

|

Name:

|

Terry A. Oznick

|

|

|

|

Title:

|

General Counsel

|

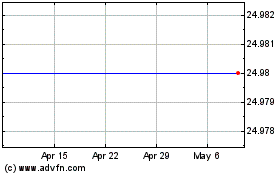

Merchants Bancorp (NASDAQ:MBINP)

Historical Stock Chart

From Mar 2024 to Apr 2024

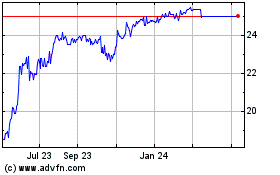

Merchants Bancorp (NASDAQ:MBINP)

Historical Stock Chart

From Apr 2023 to Apr 2024