Uber's Speed Could Limit Lyft -- Heard on the Street

May 05 2021 - 8:10PM

Dow Jones News

By Laura Forman

The great ride-share recovery is no freeway.

Shares of ride-hailing companies fell Wednesday following Lyft's

first-quarter report and went even lower after hours on Uber's

earnings release that came 24 hours later. Uber said its full

ride-share recovery in places like Australia and Hong Kong has been

offset to some degree by continued weakness in places like India

and Brazil, where Covid-19 case counts remain high. Meanwhile Lyft,

which operates the majority of its business in the U.S., says its

ride-share ride recovery peaked in March, at least temporarily,

with volumes declining month over month in April as demand

outstripped supply.

On an earnings call Wednesday, Uber chief executive Dara

Khosrowshahi said the two factors determining driver supply are

safety and earnings opportunities. The company's focus on the

latter, in particular, might have given it a leg up versus its U.S.

competitor recently.

Lyft continues to forecast that it will turn profitable in the

third quarter this year on the basis of adjusted earnings before

interest, taxes, depreciation and amortization. But that forecast

assumes a higher volume of rides and more rational pricing to the

rider.

To get there, Lyft has been offering incentives to drivers

through higher pay and bonuses in some cases, but it also seems to

think its supply problem will naturally sort itself out to some

degree. The company cites less government aid, more vaccines,

historically superior economics relative to food-delivery driving

and the desire for meaningful social interactions as several

factors that should attract gig-economy drivers back to its

platform.

Uber also stands to benefit from all of those factors and

already seems to be seeing some of their effects. On Wednesday, the

company said its own U.S. mobility bookings recovery picked up the

pace in April on a sequential monthly basis. Even though ride-share

drivers commonly "double app," incentives can lead drivers to pick

up rides from one platform more frequently than others. The

Rideshare Guy recently cited an Uber promotion offering an extra

$100 for a driver who completes three trips in a week. With both

Uber and Lyft saying this week that their drivers are making up to

$30 to $40 an hour in some U.S. cities, $100 is a significant

bonus.

AB Bernstein's Mark Shmulik suggests Uber's aggressive driver

incentives could be leading to shorter wait times and lower

consumer fares compared to Lyft. He also notes the popularity of

its membership program, Uber Pass, which includes Uber Eats, means

riders might be more likely to open Uber's app first and book

without even opening up Lyft to compare, assuming Uber's wait time

and pricing are acceptable.

New data from Edison Trends suggest Uber's more recent recovery

in the U.S. could be coming at Lyft's expense. Consumer spending on

Uber, for example, hit a new post-Covid high the week of April 26,

the data show, while Lyft's post-Covid consumer spending peaked

mid-March and has since fallen. According to Edison Trends, in the

week of April 27 last year, Lyft riders spent 57% as much as Uber

riders. In the corresponding week this year, that figure dropped to

44%.

That isn't to say all is good for Uber. Global rides revenue

missed Wall Street's forecast by a sizable margin, even excluding a

$600 million accrual related to driver classification in the U.K.

Still, thanks to continued strength in its Eats business, the

company also said April was its strongest month ever in terms of

overall gross bookings, while last week was its best week ever.

Lyft investors betting on recovery momentum might want to switch

lanes.

Write to Laura Forman at laura.forman@wsj.com

(END) Dow Jones Newswires

May 05, 2021 19:55 ET (23:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

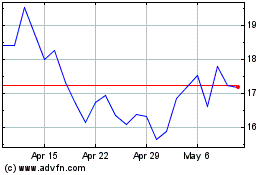

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024