SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 13G

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Lyft, Inc.

(Name of

Issuer)

Class A Common Stock

(Title of

Class of Securities)

55087P104

(CUSIP Number)

December 31, 2020

(Date of

Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant

to which this Schedule is filed:

¨ Rule 13d-1(b)

¨ Rule 13d-1(c)

x Rule 13d-1(d)

*The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

(Continued on following pages)

Page 1 of 17 Pages

Exhibit Index Contained on Page 16

|

CUSIP

NO. 55087P104

|

13 G

|

Page 2 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Andreessen Horowitz Fund III, L.P. (“AH III”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

3,028,180 shares, except that AH Equity Partners III, L.L.C. (“AH Equity III”), the general partner of AH III, may be deemed to have sole power to vote these shares, and Marc Andreessen (“Andreessen”) and Ben Horowitz (“Horowitz”), the managing members of AH Equity III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

3,028,180 shares, except that AH Equity III, the general partner of AH III, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

3,028,180

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

1.0%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 3 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Andreessen Horowitz Fund III-A, L.P. (“AH III-A”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

24,620 shares, except that AH Equity III, the general partner of AH III-A, may be deemed to have sole power to vote these shares, and

Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

24,620 shares, except that AH Equity III, the general partner of AH III-A, may be deemed to have sole power to dispose of these shares,

and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

24,620

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.0%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 4 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Andreessen Horowitz Fund III-B, L.P. (“AH III-B”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

35,176 shares, except that AH Equity III, the general partner of AH III-B, may be deemed to have sole power to vote these shares, and

Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

35,176 shares, except that AH Equity III, the general partner of AH III-B, may be deemed to have sole power to dispose of these shares,

and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

35,176

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.0%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 5 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Andreessen Horowitz Fund III-Q, L.P. (“AH III-Q”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

234,031 shares, except that AH Equity III, the general partner of AH III-Q, may be deemed to have sole power to vote these shares, and

Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

234,031 shares, except that AH Equity III, the general partner of AH III-Q, may be deemed to have sole power to dispose of these shares,

and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

234,031

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.1%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 6 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Equity Partners III, L.L.C. (“AH Equity III”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

3,322,007 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned by AH III-B and 234,031 are directly owned by AH III-Q. AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

3,322,007 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned by AH III-B and 234,031 are directly owned by AH III-Q. AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

3,322,007

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

1.1%1

|

|

12

|

TYPE OF REPORTING PERSON

|

OO

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 7 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Parallel Fund III, L.P. (“AH Parallel III”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

4,512,575 shares, except that AH Equity Partners III (Parallel) L.L.C. (“AH Equity Parallel III”), the general partner of AH Parallel III, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

4,512,575 shares, except that AH Equity Parallel III, the general partner of AH Parallel III, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

4,512,575

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

1.5%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 8 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Parallel Fund III-A, L.P. (“AH Parallel III-A”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

36,694 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-A, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

36,694 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-A, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

36,694

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.0%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 9 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Parallel Fund III-B, L.P. (“AH Parallel III-B”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

52,428 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-B, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

52,428 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-B, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

52,428

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.0%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1

Based on 308,720,401 shares of the Issuer’s Class A Common Stock outstanding as of November 9, 2020,

as reported by the Issuer in its Form 10-Q filed with the Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 10 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Parallel Fund III-Q, L.P. (“AH Parallel III-Q”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

348,809 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-Q, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

348,809 shares, except that AH Equity Parallel III, the general partner of AH Parallel III-Q, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

348,809

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

0.1%1

|

|

12

|

TYPE OF REPORTING PERSON

|

PN

|

1 Based on 308,720,401 shares of the Issuer’s

Class A Common Stock outstanding as of November 9, 2020, as reported by the Issuer in its Form 10-Q filed with the

Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 11 of 17

|

|

1

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

AH Equity Partners III (Parallel), L.L.C. (“AH Equity Parallel III”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

4,950,506 shares, of which 4,512,575 are directly owned by AH Parallel III, 36,694 are directly owned by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly owned by AH Parallel III-Q. AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B and AH Parallel III-Q, may be deemed to have sole power to vote these shares, and Andreessen and Horowitz, the managing members of AH Equity Parallel III, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

4,950,506 shares, of which 4,512,575 are directly owned by AH

Parallel III, 36,694 are directly owned by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly

owned by AH Parallel III-Q. AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B

and AH Parallel III-Q, may be deemed to have sole power to dispose of these shares, and Andreessen and Horowitz, the managing members

of AH Equity Parallel III, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

4,950,506

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

1.6%1

|

|

12

|

TYPE OF REPORTING PERSON

|

OO

|

1 Based on 308,720,401 shares of the Issuer’s

Class A Common Stock outstanding as of November 9, 2020, as reported by the Issuer in its Form 10-Q filed with the

Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 12 of 17

|

|

1

|

NAME OF REPORTING PERSONS

|

Marc Andreessen (“Andreessen”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S. Citizen

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0 shares.

|

|

6

|

SHARED VOTING POWER

8,272,513 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned

by AH III-B, 234,031 are directly owned by AH III-Q, 4,512,575 are directly owned by AH Parallel III, 36,694 are directly owned

by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly owned by AH Parallel III-Q. Andreessen

is a managing member of AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, and a managing member of

AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B and AH Parallel III-Q, and

may be deemed to have shared power to vote these shares.

|

|

7

|

SOLE DISPOSITIVE POWER

0 shares.

|

|

8

|

SHARED DISPOSITIVE POWER

8,272,513 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned

by AH III-B, 234,031 are directly owned by AH III-Q, 4,512,575 are directly owned by AH Parallel III, 36,694 are directly owned

by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly owned by AH Parallel III-Q. Andreessen

is a managing member of AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, and a managing member of

AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B and AH Parallel III-Q, and

may be deemed to have shared power to dispose of these shares.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

8,272,513

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

2.7%1

|

|

12

|

TYPE OF REPORTING PERSON

|

IN

|

1 Based on 308,720,401 shares of the Issuer’s

Class A Common Stock outstanding as of November 9, 2020, as reported by the Issuer in its Form 10-Q filed with the

Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 13 of 17

|

|

1

|

NAME OF REPORTING PERSONS

|

Ben Horowitz (“Horowitz”)

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S. Citizen

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

74,210 shares1

|

|

6

|

SHARED VOTING POWER

8,272,513 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned by AH III-B, 234,031 are directly owned by AH III-Q, 4,512,575 are directly owned by AH Parallel III, 36,694 are directly owned by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly owned by AH Parallel III-Q. Horowitz is a managing member of AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, and a managing member of AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B and AH Parallel III-Q, and may be deemed to have shared power to vote these shares.

|

|

7

|

SOLE DISPOSITIVE POWER

74,210 shares1

|

|

8

|

SHARED DISPOSITIVE POWER

8,272,513 shares, of which 3,028,180 are directly owned by AH III, 24,620 are directly owned by AH III-A, 35,176 are directly owned by AH III-B, 234,031 are directly owned by AH III-Q, 4,512,575 are directly owned by AH Parallel III, 36,694 are directly owned by AH Parallel III-A, 52,428 are directly owned by AH Parallel III-B and 348,809 are directly owned by AH Parallel III-Q. Horowitz is a managing member of AH Equity III, the general partner of AH III, AH III-A, AH III-B and AH III-Q, and a managing member of AH Equity Parallel III, the general partner of AH Parallel III, AH Parallel III-A, AH Parallel III-B and AH Parallel III-Q, and may be deemed to have shared power to dispose of these shares.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

8,346,723

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

2.7%2

|

|

12

|

TYPE OF REPORTING PERSON

|

IN

|

1 Shares held by a family trust for which the Reporting

Person is a trustee.

2 Based on 308,720,401 shares of the Issuer’s

Class A Common Stock outstanding as of November 9, 2020, as reported by the Issuer in its Form 10-Q filed with the

Securities and Exchange Commission on November 12, 2020.

|

CUSIP

NO. 55087P104

|

13 G

|

Page 14

of 17

|

This

Amendment No. 1 amends the Schedule 13G previously filed by Andreessen Horowitz Fund III, L.P., a Delaware limited

partnership, Andreessen Horowitz Fund III-A, L.P., a Delaware limited partnership, Andreessen Horowitz Fund III-B, L.P., a Delaware

limited partnership, Andreessen Horowitz Fund III-Q, L.P., a Delaware limited partnership, AH Equity Partners III, L.L.C., a Delaware

limited liability company, AH Parallel Fund III, L.P., a Delaware limited partnership, AH Parallel Fund III-A, L.P., a Delaware

limited partnership, AH Parallel Fund III-B, L.P., a Delaware limited partnership, AH Parallel Fund III-Q, L.P., a Delaware limited

partnership, AH Equity Partners III (Parallel), L.L.C., a Delaware limited liability company, Marc Andreessen and Ben Horowitz.

The foregoing entities and individuals are collectively referred to as the “Reporting Persons.” Only those items as

to which there has been a change are included in this Amendment No. 1.

|

|

ITEM 4.

|

OWNERSHIP

|

|

|

|

|

|

|

|

The following information with respect

to the beneficial ownership of the Class A Common Stock of the Issuer by the Reporting Persons is provided as of December 31,

2020.

|

|

|

(a)

|

Amount beneficially owned:

|

|

|

|

|

|

|

|

See Row 9 of cover page for

each Reporting Person.

|

|

|

(b)

|

Percent of Class:

|

|

|

|

|

|

|

|

See Row 11 of cover page for

each Reporting Person.

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or to direct the vote:

|

See Row 5 of cover page for

each Reporting Person.

|

|

(ii)

|

Shared power to vote or to direct the vote:

|

See Row 6 of cover page for

each Reporting Person.

|

|

(iii)

|

Sole power to dispose or to direct the disposition of:

|

See Row 7 of cover page for

each Reporting Person.

|

|

(iv)

|

Shared power to dispose or to direct the disposition of:

|

See Row 8 of cover page for

each Reporting Person.

|

|

ITEM 5.

|

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS

|

|

|

|

|

|

|

|

If this statement is being filed to report the fact that as of the

date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities,

check the follow: x

Yes

|

|

|

ITEM 6.

|

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON.

|

|

|

|

|

|

|

|

Please see Item 5.

|

|

CUSIP

NO. 55087P104

|

13 G

|

Page 15

of 17

|

SIGNATURES

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Date: February 16, 2021

|

|

|

|

Andreessen Horowitz Fund III, L.P.

|

|

|

Andreessen Horowitz Fund III-A, L.P.

|

|

|

Andreessen Horowitz Fund III-B, L.P.

|

|

|

Andreessen Horowitz Fund III-Q, L.P.

|

|

|

|

|

|

By: AH Equity Partners III, L.L.C.

|

|

|

Its: General Partner

|

|

|

|

|

|

By:

|

/s/ Scott Kupor

|

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

|

|

|

|

AH Equity Partners III, L.L.C.

|

|

|

|

|

|

By:

|

/s/ Scott Kupor

|

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

|

|

|

AH Parallel Fund III, L.P.

|

|

|

AH Parallel Fund III-A, L.P.

|

|

|

AH Parallel Fund III-B, L.P.

|

|

|

AH Parallel Fund III-Q, L.P.

|

|

|

|

|

|

By: AH Equity Partners III (Parallel), L.L.C.

|

|

|

Its: General Partner

|

|

|

|

|

|

By:

|

/s/ Scott Kupor

|

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

|

|

|

AH Equity Partners III (Parallel), L.L.C.

|

|

|

|

|

|

By:

|

/s/ Scott Kupor

|

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

|

|

|

Marc Andreessen

|

|

|

|

|

|

/s/ Scott Kupor

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

Attorney-in-fact for Marc Andreessen*

|

|

|

|

|

|

Ben Horowitz

|

|

|

|

|

|

/s/ Scott Kupor

|

|

|

Scott Kupor, Chief Operating Officer

|

|

|

Attorney-in-fact for Ben Horowitz*

|

*The Power of Attorney set forth in Exhibit 24.1 to the

Initial Statement of Beneficial Ownership of Securities on Form 3, as amended, filed by such Reporting Person with the Securities

and Exchange Commission on April 25, 2019 is incorporated herein by reference.

|

CUSIP

NO. 55087P104

|

13

G

|

Page 16

of 17

|

EXHIBIT INDEX

|

|

Found on

Sequentially

|

|

Exhibit

|

Numbered Page

|

|

|

|

|

Exhibit A: Agreement of Joint Filing

|

17

|

|

CUSIP

NO. 55087P104

|

13

G

|

Page 17

of 17

|

exhibit

A

Agreement of Joint Filing

The Reporting Persons

agree that a single Schedule 13G (or any amendment thereto) relating to the Class A Common Stock of Lyft, Inc. shall

be filed on behalf of each of the Reporting Persons. Note that copies of the applicable Agreement of Joint Filing is already on

file with the appropriate agencies.

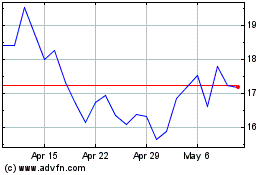

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024