Lyft, Bumble, Walt Disney: Stocks That Defined the Week

February 12 2021 - 7:44PM

Dow Jones News

By Francesca Fontana

Lyft Inc.

Lyft took another turn toward profitability. The ride-hailing

company posted a narrower annual loss on Tuesday, even as the

pandemic decimated demand in the industry. Lyft President John

Zimmer aims to become profitable on an adjusted basis by the end of

this year. Rival Uber Technologies Inc. also reported a smaller

annual loss, on the back of its food-delivery business and

aggressive cost cuts. Lyft shares gained 4.8% Wednesday.

Oracle Corp.

TikTok's U.S. fate is in limbo again. The Biden administration

shelved a plan to force a sale of the popular video-sharing app's

American operations to a group including Oracle and Walmart Inc.

The deal was driven by former President Donald Trump, who last year

ordered a ban on TikTok aimed at forcing a sale of the app to a

majority-U.S.-ownership group. The TikTok deal has languished since

last fall in the midst of successful legal challenges to the U.S.

government's effort by the app's owner, Chinese tech company

ByteDance Ltd. Oracle shares slipped 0.6% Wednesday.

Bumble Inc.

Bumble is buzzing from its public market debut. Shares of the

online-dating company jumped 64% in their first day of trading and

closed at $70.31 Thursday. Its initial public offering was priced

at $43 a share, raising $2.2 billion for Bumble. Its namesake app,

on which women make the first move, was founded by Whitney Wolfe

Herd in 2014 to disrupt traditional dating dynamics. The app also

has an option for users seeking same-sex interactions. Ms. Wolfe

Herd had earlier co-founded Match Group Inc.'s Tinder, and Bumble

now joins rival Match on the public market.

Zillow Group Inc.

One of Zillow's hottest properties is the company itself. The

online real-estate company reported a sharp rise in traffic in the

latest quarter and better-than-expected earnings. In recent years,

Zillow has moved into iBuying, or automated home flipping. It also

recently acquired virtual home-touring company ShowingTime. Demand

for homes has jumped in the past year as buyers took advantage of

record-low interest rates and the pandemic prompted many households

to seek more space to better accommodate remote work. Zillow shares

jumped 17% Thursday.

Tesla Inc.

Elon Musk is backing up his tweeting about bitcoin. Tesla said

Monday that it bought $1.5 billion of the digital currency,

following Mr. Musk's promotion of the cryptocurrency on social

media. The electric-car maker's announcement in its latest annual

report caused bitcoin prices to jump more than 10% that morning,

according to cryptocurrency research and news site CoinDesk. The

electric-vehicle company also said it expects to start accepting

bitcoin as payment for its products soon. Tesla joins a handful of

other companies that have disclosed bitcoin holdings, such as

software developer MicroStrategy Inc. The purchase, likely among

the largest by a public company, comes after a rally in 2020 when

the price more than quadrupled. Tesla shares rose 1.3% Monday.

Walt Disney Co.

Disney still managed to deliver some magic last quarter. Despite

the blows Covid-19 has dealt to its film distribution and theme

park businesses, Disney beat pessimistic Wall Street estimates and

posted a quarterly profit of $17 million. With the traditional

movie business hurting from closed theaters, Chief Executive Bob

Chapek reiterated the shift toward a streaming-first model. Its

flagship streaming service, Disney+, added more than 21 million new

subscribers in its latest quarter, the entertainment giant said

Thursday. Disney+ is now a crucial arm of the company's franchise

planning, as shows and movies that play at home slot into the

narratives of the feature films. Disney shares lost 1.7%

Friday.

Kraft Heinz Co.

Mr. Peanut has a new owner. Kraft Heinz said Thursday that it

reached an agreement to sell its Planters nuts business to Skippy

peanut butter owner Foods Corp. The all-cash deal values the

century-old business at $3.35 billion. Kraft Heinz, the product of

a 2015 merger of the two well-known food companies, has been

divesting itself of brands after struggling to keep up with

shifting consumer tastes, and in September agreed to sell a chunk

of its cheese business to France's Groupe Lactalis SA for $3.2

billion. The food company also reported better-than-expected

quarterly earnings. Kraft shares added 4.9% Thursday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

February 12, 2021 19:29 ET (00:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

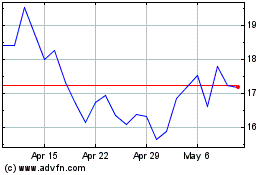

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024