Captive Insurance Seen as Covid-Era Remedy to Rising Premiums

September 27 2020 - 8:29AM

Dow Jones News

By Alice Uribe

Rising insurance premiums are costing businesses millions of

dollars they can ill afford as they navigate the coronavirus

pandemic. Many companies are responding by trying to manage risks

on their own.

A surge in demand for so-called captive insurance and the

increasing amount of capital being devoted to mitigating risks have

caught many in the industry by surprise, including brokers who sell

the idea of setting up a captive insurer.

A captive is owned and controlled by the business that

establishes it, which could be a restaurant, drugmaker or retailer.

It writes coverage for its owners and pays out claims when the

business runs into unexpected trouble. Before the coronavirus had

even appeared, some U.S. businesses had ensured their captives

wrote policies covering a potential pandemic, allowing them to

avoid disputes with mainstream insurers. Some mainstream insurers

have largely refused to pay out business-interruption claims made

by companies hurt by shutdowns.

Setting up one's own insurance company can be a risky strategy.

A captive insurer without sufficient capital -- particularly early

in its existence -- can become insolvent if it is hit with large

claims, leaving the parent company exposed at a time of need.

Captives also need to make underwriting and claims decisions at

arm's length from their owners. A failure to do so risks their

falling afoul of regulators in some countries.

But if a company can't find suitable cover on the open market,

setting up a captive could be an alternative. Going without

insurance might not be an option -- for regulatory reasons, a

company might need to show it has an insurance policy.

U.S.-based insurance broker Marsh said at least 25 of the

captives that it manages globally have been writing coverage for

pandemic risks. Many other businesses have set up captives to

counter premiums that have risen every quarter since late 2017. The

pandemic could fuel even higher premiums as insurers seek to price

risk more aggressively.

Marsh said the number of new captives it helped to form tripled

between January and July compared with a year earlier, coinciding

with a period when global insurance prices logged double-digit

increases in the midst of the coronavirus crisis. Aon, another

insurance broker, said it had also seen higher demand for the

units.

Investment group Blackstone Group Inc. is one company relying

more on captives as insurance premiums balloon.

In late July, its Gryphon Mutual Insurance Co. went live, the

culmination of months of preparatory work that began before the

pandemic. The captive is focused on property in North America, but

could be expanded to other regions in future.

"Ultimately, it will provide us with greater control over our

property insurance program and reduce premiums and brokerage costs

for our limited partners," a Blackstone spokesperson said.

Captives aren't a new tactic for companies to mitigate risk.

Credit-rating company A.M. Best Co. says the world's first captive

was formed in Bermuda in the 1960s in response to a hardening

insurance market, which describes when premiums get more expensive

and insurers' capacity for cover decreases. The use of captives

often coincides with a hardening insurance market, or during crises

such as the 9/11 terrorist attacks, or the hurricanes that ravaged

the Gulf of Mexico coast in 2004-05.

Many of the biggest U.S. companies have used captives, including

in the oil and gas sector. In recent years, ride-hailing companies

Uber Technologies Inc. and Lyft Inc. have formed insurance

subsidiaries. Insurance can be a challenge for companies engaging

in new business models: Mainstream insurers often don't have enough

information to price coverage in a way that would make these new

businesses economically viable.

Increased use of captives doesn't pose an immediate risk to the

insurance sector, brokers say. Aon said it reflects a reordering of

the industry, with insurers willing to give up business lines that

had become uneconomic. Still, companies with captives could look to

broaden their use in the future.

According to A.M. Best, the number of U.S. domestic captives

more than doubled to 3,133 between 2007 and 2019.

The pandemic has highlighted the attractiveness of being able to

tailor insurance using a captive, rather than relying on cover from

the open market through mainstream insurers. Many businesses

thought they were covered for unexpected shocks, only to be told by

their mainstream insurers that pandemic exclusions in the fine

print of policies made their claims invalid.

Around the world, courts are debating whether

business-interruption insurance policies held by millions of

companies cover a pandemic. In the U.S., property insurers have won

a flurry of judicial rulings backing up their rejections of claims

for businesses' lost income during government-ordered shutdowns,

dimming policyholders' hopes of payments to help them rebound. On

Sept. 15, a U.K. court ruled mostly in favor of policyholders in a

test case that examined different policy wordings.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

September 27, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

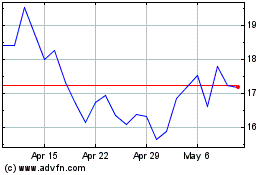

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024