By Robert Wall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 8, 2020).

Uber Technologies Inc. chief Dara Khosrowshahi mapped a revised

path to profitability after the coronavirus pandemic undermined

ridership for the company resulting in a larger first-quarter

loss.

Mr. Khosrowshahi said Thursday that Uber plans $1 billion in

fixed-cost cuts, including lowering marketing expenses, deferring

capital expenditures and a recently announced 14% reduction of

staff. "Reaching profitability as soon as possible remains a

strategic priority for us. We believe the disruption caused by

Covid-19 will impact our time line by a matter of quarters and not

years," the CEO told analysts on a conference call.

Those measures could put the ride-hailing company in a position

to be profitable in 2021, Chief Financial Officer Nelson Chai said

on the call. Uber had targeted this year for reaching that

milestone on an adjusted basis before interest, taxes, depreciation

and amortization, but withdrew the forecast in April because of the

sharp drop in demand caused by the health crisis.

Uber shares, up more than 11% on the day, were ahead 8% in

aftermarket trading.

Smaller rival Lyft Inc. also has shelved its profitability

target and embarked on a cost-cutting effort that it says will make

it easier to turn profitable once ridership recovers. "The actual

timing will depend on the speed of the recovery. It could be

earlier or later." Chief Financial Officer Brian Roberts said

Wednesday.

Uber and Lyft both said they have seen a slight pickup in

ridership in recent weeks after demand plummeted mid-March as

shelter-in-place restrictions were imposed across much of the U.S.

to stem the coronavirus outbreak. Overall for the first quarter,

Uber said the number of trips was up 7% from a year earlier, but

down 13% from 2019's final quarter.

Uber on Thursday reported a net loss of $2.94 billion on sales

of $3.54 billion in the three months ended March 31, compared with

a net loss of $1.09 billion and sales of $3.1 billion a year

earlier. The larger loss includes $2.1 billion in pretax

write-downs on some of Uber's investments that have lost value

because of the coronavirus crisis. Analysts surveyed by FactSet had

expected a $1.38 billion net loss on sales of $3.53 billion for the

quarter just ended.

Uber posted a $612 million first-quarter loss on an adjusted

basis before interest, taxes, depreciation and amortization, which

excludes costs linked to its Covid-19 response. The company said

its response, which included measures such as offering health-care

workers free rides and providing protective gear to drivers, took

$19 million from its top line and added $5 million in costs.

One bright spot was Eats, Uber's food-delivery business. It has

thrived as people stuck at home have relied on such services to get

meals from some of their favorite restaurants. Eats gross bookings

surged 52% from last year's first quarter to $4.68 billion.

"While our rides business has been hit hard by the ongoing

pandemic, we have taken quick action to preserve the strength of

our balance sheet, focus additional resources on Uber Eats, and

prepare us for any recovery scenario," Mr. Khosrowshahi said in a

statement.

He said there were signs of ridership recovering after plunging

80% year-on-year in April, though "the recovery is uneven." In

Georgia and Texas, where shelter-in-place rules have eased, gross

bookings are up 43% and 50%, respectively, from their recent lows.

Hong Kong, he said, is back to 70% of pre-crisis gross bookings

levels.

And growth at Uber Eats, Mr. Khosrowshah said, was poised to

remain strong, with millions of new customers having tried the

service. Uber has shifted some of its rideshare drivers idled by

falling trip demand to satisfy the strong food-delivery demand.

Lyft, which reported earnings on Wednesday, said ridership fell

75% in April and will likely take time to fully recover.

"Even as shelter-in-place orders and travel restrictions are

modified or lifted, we anticipate that continued social distancing,

altered consumer behavior and expected corporate cost cutting will

be significant headwinds for Lyft," Chief Executive Logan Green

told analysts. The company plans to trim about 17% of its staff as

part of an effort to cut expenses by $300 million this year.

Uber on Wednesday said it was cutting about 3,700 workers and

that Mr. Khosrowshahi agreed to waive his base salary for the rest

of the year. "We are continuing to look at all levers to ensure our

core rides and Eats businesses emerge from this crisis stronger

than ever," Mr. Chai, the finance chief, said in the statement

Thursday.

He said that as growth returns, Uber would add staff but

probably at a slower pace than precrisis as it focuses on

efficiency in a post-pandemic environment.

Beyond the current economic slowdown, Uber and Lyft also face

pressure from regulators and lawmakers for classifying their

drivers as contract workers rather than employees. On Tuesday,

California sued the companies, citing the state's gig-economy law

that took effect Jan. 1, saying their treatment of drivers deprives

them of rights such as paid sick leave and unemployment insurance

-- issues made more visible during the pandemic.

Despite the difficult period, Uber is continuing to invest in

ride-sharing activities. The company led a $170 million funding

round in electric-scooter rental startup Lime, which had its own

round of job cuts last month. Lime, in a statement Thursday, said

that as part of the transaction it was buying Uber's

electric-scooter unit Jump.

Uber contributed $85 million to the round as part of a deal that

includes an ability to acquire 100% of Lime in two years, according

to a person familiar with the terms. The Lime service will be

integrated into the Uber app. It also allows Uber to cut its own

bike and service operations, which make up much of the company's

other bets segment. In the first quarter, that segment reported a

$63 million adjusted operating loss, compared with a $42 million

loss a year earlier.

--Tim Higgins contributed to this article.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

May 08, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

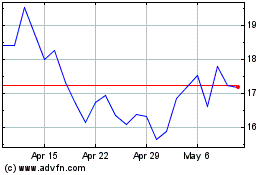

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024