Revenue increased 2% to $903 million

Diluted EPS of $0.66, Adjusted EPS of $0.74

lululemon athletica inc. (NASDAQ:LULU) today announced financial

results for the second quarter of fiscal 2020.

The summary below provides both GAAP and adjusted non-GAAP

financial measures. The adjusted financial measures exclude certain

costs incurred in connection with the acquisition of MIRROR, and

the related tax effects.

As a result of the COVID-19 pandemic, all of the Company's

stores in North America, Europe, and certain countries in Asia

Pacific were temporarily closed during the first quarter of fiscal

2020. The Company began reopening its retail locations in these

markets during the second quarter of fiscal 2020. As of August 2,

2020, 492 of its 506 company-operated stores were open.

For the second quarter ended August 2, 2020:

- Net revenue was $902.9 million, an increase of 2% compared to

the second quarter of fiscal 2019. On a constant dollar basis, net

revenue increased 3%.

- Company-operated stores net revenue was $287.2 million, a

decrease of 51% compared to the second quarter of fiscal 2019.

- Direct to consumer net revenue was $554.3 million, an increase

of 155% compared to the second quarter of fiscal 2019. On constant

dollar basis, direct to consumer net revenue increased 157%.

- Direct to consumer net revenue represented 61.4% of total net

revenue compared to 24.6% for the second quarter of fiscal

2019.

- Gross profit was $489.5 million, an increase of 1% compared to

the second quarter of fiscal 2019.

- Gross margin was 54.2%, a decrease of 80 basis points compared

to the second quarter of fiscal 2019.

- Income from operations was $124.4 million, a decrease of 26%

compared to the second quarter of fiscal 2019. Adjusted income from

operations decreased by 19% to $135.9 million.

- Operating margin was 13.8%, a decrease of 520 basis points

compared to the second quarter of fiscal 2019. Adjusted operating

margin was 15.0%, a decrease of 400 basis points.

- Income tax expense was $37.3 million compared to $44.8 million

in the second quarter of fiscal 2019 and the effective tax rate was

30.0% compared to 26.4% for the second quarter of fiscal 2019. The

adjusted effective tax rate was 28.9% for the second quarter of

fiscal 2020.

- Diluted earnings per share were $0.66 compared to $0.96 in the

second quarter of fiscal 2019. Adjusted diluted earnings per share

were $0.74 for the second quarter of fiscal 2020.

The Company ended the second quarter of fiscal 2020 with $523.0

million in cash and cash equivalents and the capacity under its

committed revolving credit facilities was $697.7 million. The

Company had $623.7 million in cash and cash equivalents at the end

of the second quarter of fiscal 2019. Inventories at the end of the

second quarter of fiscal 2020 increased 36% to $672.8 million

compared to $494.3 million at the end of the second quarter of

fiscal 2019. The Company ended the quarter with 506 stores.

Calvin McDonald, CEO of lululemon stated: "We're pleased with

our overall business results for the second quarter, as lululemon

increasingly lives into its Omni potential. As trends around the

world are shifting to working and sweating from home with an

increased focus on health and wellness, we believe 2020 is likely

an inflection point for retail and for lululemon." McDonald

continued: "We are cautiously optimistic with regard to the second

half of the year as we continue to navigate the uncertain

environment."

Fiscal 2020 Outlook

Due to the impact that COVID-19 is having across the globe, and

the rapid and continuous developments, the Company is not providing

detailed financial guidance for fiscal 2020 at this time.

Conference Call Information

A conference call to discuss second quarter results is scheduled

for today, September 8, 2020, at 4:30 p.m. Eastern time. Those

interested in participating in the call are invited to dial

1-800-319-4610 or 1-604-638-5340, if calling internationally,

approximately 10 minutes prior to the start of the call. A live

webcast of the conference call will be available online at:

http://investor.lululemon.com/events.cfm. A replay will be made

available online approximately two hours following the live call

for a period of 30 days.

About lululemon athletica inc.

lululemon athletica inc. (NASDAQ:LULU) is a healthy lifestyle

inspired athletic apparel company for yoga, running, training, and

most other sweaty pursuits, creating transformational products and

experiences which enable people to live a life they love. Setting

the bar in technical fabrics and functional designs, lululemon

works with yogis and athletes in local communities for continuous

research and product feedback. For more information, visit

www.lululemon.com.

Comparable Store Sales and Total Comparable Sales

The Company typically believes that investors would find

comparable store sales and total comparable sales useful in

assessing the performance of its business. As the temporary store

closures from COVID-19 have resulted in a significant number of

stores being removed from its comparable store base, the Company

believes total comparable sales and comparable store sales are not

currently representative of the underlying trends of its business.

The Company does not believe these metrics are currently useful to

investors in understanding performance, therefore it has not

included these metrics in this press release.

Non-GAAP Financial Measures

Constant dollar changes and adjusted financial results are

non-GAAP financial measures. A constant dollar basis assumes the

average foreign exchange rates for the period remained constant

with the average foreign exchange rates for the same period of the

prior year. The Company provides constant dollar changes in its

results to help investors understand the underlying growth rate of

net revenue excluding the impact of changes in foreign exchange

rates.

Adjusted income from operations, operating margin, income tax

expense, effective tax rates, net income, and diluted earnings per

share exclude items related to the MIRROR acquisition. We exclude

transaction, integration costs, the gain on lululemon's previous

investment in MIRROR, certain acquisition-related compensation

costs, and the related income tax effects of these items. The

acquisition-related compensation costs primarily relate to the

acceleration of vesting of certain stock options upon acquisition,

and to deferred consideration of $57.1 million in which is due to

certain MIRROR employees subject to their continued employment

through various vesting dates up to three years from the

acquisition date. These individuals also receive employment

compensation separate from the deferred amounts that is

commensurate with the services they provide and which we consider

to be normal operating expenses within selling, general and

administrative expenses. We believe these adjusted financial

measures are useful to investors as they provide supplemental

information that enable evaluation of the underlying trend in our

operating performance, and enable a more consistent comparison to

our historical financial information. Further, due to the finite

and discrete nature of these costs, we do not consider them to be

normal operating expenses that are necessary to operate the MIRROR

business and we do not expect them to recur beyond the expiry of

the related vesting periods. Management uses these adjusted

financial measures and constant currency metrics internally when

reviewing and assessing financial performance.

The presentation of this financial information is not intended

to be considered in isolation or as a substitute for, or with

greater prominence to, the financial information prepared and

presented in accordance with GAAP. For more information on these

non-GAAP financial measures, please see the section captioned

"Reconciliation of Non-GAAP Financial Measures" included in the

accompanying financial tables, which includes more detail on the

GAAP financial measure that is most directly comparable to each

non-GAAP financial measure, and the related reconciliations between

these financial measures.

Forward-Looking Statements:

This press release includes estimates, projections, statements

relating to the Company's business plans, objectives, and expected

operating results that are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. In many cases, you can identify

forward-looking statements by terms such as "may," "will,"

"should," "expects," "plans," "anticipates," "outlook," "believes,"

"intends," "estimates," "predicts," "potential" or the negative of

these terms or other comparable terminology. These forward-looking

statements also include the Company's guidance and outlook

statements. These statements are based on management's current

expectations but they involve a number of risks and uncertainties.

Actual results and the timing of events could differ materially

from those anticipated in the forward-looking statements as a

result of risks and uncertainties, which include, without

limitation: its ability to maintain the value and reputation of its

brand; the current COVID-19 coronavirus pandemic and related

government, private sector, and individual consumer responsive

actions; the acceptability of its products to its guests; its

highly competitive market and increasing competition; its reliance

on and limited control over third-party suppliers to provide

fabrics for and to produce its products; suppliers or manufacturers

not complying with its Vendor Code of Ethics or applicable laws;

the operations of many of its suppliers are subject to

international and other risks; an economic recession, depression,

or downturn or economic uncertainty in its key markets; increasing

product costs and decreasing selling prices; its ability to

anticipate consumer preferences and successfully develop and

introduce new, innovative and updated products; its ability to

accurately forecast guest demand for its products; its ability to

safeguard against security breaches with respect to its information

technology systems; any material disruption of its information

systems; its ability to have technology-based systems function

effectively and grow its e-commerce business globally; changes in

consumer shopping preferences and shifts in distribution channels;

the fluctuating costs of raw materials; its ability to expand

internationally in light of its limited operating experience and

limited brand recognition in new international markets; global

economic and political conditions and global events such as health

pandemics; its ability to deliver its products to the market and to

meet guest expectations if it has problems with its distribution

system; imitation by its competitors; its ability to protect its

intellectual property rights; its ability to source and sell its

merchandise profitably or at all if new trade restrictions are

imposed or existing trade restrictions become more burdensome; its

ability to realize the potential benefits and synergies sought with

the acquisition of MIRROR, its operating flexibility given the

significant costs incurred in connection with the acquisition of

MIRROR, its ability to grow the MIRROR business and have it achieve

profitability; changes in tax laws or unanticipated tax

liabilities; its ability to manage its growth and the increased

complexity of its business effectively; its ability to cancel store

leases if an existing or new store is not profitable; increasing

labor costs and other factors associated with the production of its

products in South and South East Asia; its ability to successfully

open new store locations in a timely manner; its ability to comply

with trade and other regulations; the service of its senior

management; seasonality; fluctuations in foreign currency exchange

rates; conflicting trademarks and the prevention of sale of certain

products; its exposure to various types of litigation; actions of

activist stockholders; anti-takeover provisions in its certificate

of incorporation and bylaws; and other risks and uncertainties set

out in filings made from time to time with the United States

Securities and Exchange Commission and available at www.sec.gov,

including, without limitation, its most recent reports on Form 10-K

and Form 10-Q. You are urged to consider these factors carefully in

evaluating the forward-looking statements contained herein and are

cautioned not to place undue reliance on such forward-looking

statements, which are qualified in their entirety by these

cautionary statements. The forward-looking statements made herein

speak only as of the date of this press release and the Company

undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances, except as

may be required by law.

lululemon athletica inc.

Condensed Consolidated Statements of

Operations

Unaudited; Expressed in thousands, except

per share amounts

Quarter Ended

Two Quarters Ended

August 2, 2020

August 4, 2019

August 2, 2020

August 4, 2019

Net revenue

$

902,942

$

883,352

$

1,554,904

$

1,665,667

Costs of goods sold

413,441

397,556

731,001

758,151

Gross profit

489,501

485,796

823,903

907,516

As a percent of net revenue

54.2

%

55.0

%

53.0

%

54.5

%

Selling, general and administrative

expenses

352,904

317,814

652,510

610,722

As a percent of net revenue

39.1

%

36.0

%

42.0

%

36.7

%

Amortization of intangible assets

724

—

724

—

Acquisition-related expenses

11,464

—

13,509

—

Income from operations

124,409

167,982

157,160

296,794

As a percent of net revenue

13.8

%

19.0

%

10.1

%

17.8

%

Other income (expense), net

(344)

1,850

830

4,229

Income before income tax expense

124,065

169,832

157,990

301,023

Income tax expense

37,264

44,842

42,557

79,430

Net income

$

86,801

$

124,990

$

115,433

$

221,593

Basic earnings per share

$

0.67

$

0.96

$

0.89

$

1.70

Diluted earnings per share

$

0.66

$

0.96

$

0.88

$

1.69

Basic weighted-average shares

outstanding

130,245

130,285

130,248

130,489

Diluted weighted-average shares

outstanding

130,799

130,783

130,802

131,060

lululemon athletica inc.

Condensed Consolidated Balance Sheets

Unaudited; Expressed in thousands

August 2, 2020

February 2,

2020

August 4, 2019

ASSETS

Current assets

Cash and cash equivalents

$

522,998

$

1,093,505

$

623,738

Inventories

672,773

518,513

494,294

Prepaid and receivable income taxes

125,019

85,159

112,572

Other current assets

168,965

110,761

102,409

Total current assets

1,489,755

1,807,938

1,333,013

Property and equipment, net

698,514

671,693

617,090

Right-of-use lease assets

725,805

689,664

657,044

Goodwill and intangible assets, net

471,064

24,423

24,184

Deferred income taxes and other

non-current assets

108,889

87,636

63,413

Total assets

$

3,494,027

$

3,281,354

$

2,694,744

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

122,767

$

79,997

$

110,513

Accrued inventory liabilities

31,675

6,344

8,778

Other accrued liabilities

177,436

112,641

108,695

Accrued compensation and related

expenses

84,102

133,688

100,735

Current lease liabilities

147,941

128,497

130,182

Current income taxes payable

75,153

26,436

5,090

Unredeemed gift card liability

106,425

120,413

79,629

Other current liabilities

17,810

12,402

8,987

Total current liabilities

763,309

620,418

552,609

Non-current lease liabilities

632,646

611,464

568,311

Non-current income taxes payable

43,150

48,226

48,226

Deferred income tax liability

46,901

43,432

14,114

Other non-current liabilities

6,919

5,596

4,105

Stockholders' equity

2,001,102

1,952,218

1,507,379

Total liabilities and stockholders'

equity

$

3,494,027

$

3,281,354

$

2,694,744

lululemon athletica inc.

Condensed Consolidated Statements of Cash

Flows

Unaudited; Expressed in thousands

Two Quarters Ended

August 2, 2020

August 4, 2019

Cash flows from operating activities

Net income

$

115,433

$

221,593

Adjustments to reconcile net income to net

cash provided by operating activities

(55,371

)

(171,551

)

Net cash provided by operating

activities

60,062

50,042

Net cash used in investing activities

(545,323

)

(131,969

)

Net cash used in financing activities

(82,157

)

(170,985

)

Effect of exchange rate changes on

cash

(3,089

)

(4,670

)

Decrease in cash and cash equivalents

(570,507

)

(257,582

)

Cash and cash equivalents, beginning of

period

1,093,505

881,320

Cash and cash equivalents, end of

period

$

522,998

$

623,738

lululemon athletica inc.

Reconciliation of Non-GAAP Financial Measures Unaudited;

Expressed in thousands, except per share amounts

Constant dollar changes in net revenue, direct to consumer net

revenue, and direct to consumer excluding the online warehouse

sale

The below changes in net revenue show the change compared to the

corresponding period in the prior year.

Quarter Ended August 2,

2020

Net Revenue

Direct to Consumer Net

Revenue

Direct to Consumer Net Revenue

Excluding the Online Warehouse Sale

Change

2

%

155

%

135

%

Adjustments due to foreign exchange rate

changes

1

2

2

Change in constant dollars

3

%

157

%

137

%

Adjusted financial measures

The following tables reconcile adjusted financial measures with

the most directly comparable measures calculated in accordance with

GAAP. The adjustments relate to the acquisition of MIRROR and its

related tax effects. Please refer to Note 3 to the unaudited

consolidated financial statements included in Item 1 of Part I of

our Report on Form 10-Q to be filed with the SEC on or about

September 8, 2020 for further information on these adjustments.

Quarter Ended August 2,

2020

Income from Operations

Operating Margin

Income Tax Expense

Effective Tax Rate

Net Income

Diluted Earnings Per

Share

GAAP results

$

124,409

13.8

%

$

37,264

30.0

%

$

86,801

$

0.66

Transaction and integration costs

7,201

0.8

7,201

0.06

Gain on existing investment

(782

)

(0.1

)

(782

)

(0.01

)

Acquisition-related compensation

5,045

0.5

5,045

0.04

Tax effect of the above

1,967

(1.1

)

(1,967

)

(0.01

)

Adjusted results (non-GAAP)

$

135,873

15.0

%

$

39,231

28.9

%

$

96,298

$

0.74

Two Quarters Ended August 2,

2020

Income from

Operations

Operating Margin

Income Tax Expense

Effective Tax Rate

Net Income

Diluted Earnings Per

Share

GAAP results

$

157,160

10.1

%

$

42,557

26.9

%

$

115,433

$

0.88

Transaction and integration costs

9,246

0.6

9,246

0.07

Gain on existing investment

(782

)

(0.1

)

(782

)

(0.01

)

Acquisition-related compensation

5,045

0.4

5,045

0.04

Tax effect of the above

1,967

(0.9

)

(1,967

)

(0.01

)

Adjusted results (non-GAAP)

$

170,669

11.0

%

$

44,524

26.0

%

$

126,975

$

0.97

lululemon athletica inc.

Company-operated Store Count and Square

Footage1

Square Footage Expressed in Thousands

Number of Stores Open at

the Beginning of the Quarter

Number of Stores Opened

During the Quarter

Number of Stores Closed During

the Quarter

Number of

Stores Open at the End of the Quarter

3rd Quarter 2019

460

21

2

479

4th Quarter 2019

479

16

4

491

1st Quarter 2020

491

4

6

489

2nd Quarter 2020

489

17

—

506

Total Gross Square Feet at the

Beginning of the Quarter

Gross Square Feet Added

During the Quarter2

Gross Square Feet Lost

During the Quarter2

Total Gross Square Feet at the

End of the Quarter

3rd Quarter 2019

1,522

87

5

1,604

4th Quarter 2019

1,604

87

11

1,680

1st Quarter 2020

1,680

24

12

1,692

2nd Quarter 2020

1,692

65

—

1,757

__________

1Company-operated store count and square

footage summary excludes retail locations operated by third parties

under license and supply arrangements.

2Gross square feet added/lost during the

quarter includes net square foot additions for company-operated

stores which have been renovated or relocated in the quarter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200908005913/en/

Investors: lululemon athletica inc. Howard Tubin

1-604-732-6124 or ICR, Inc. Joseph Teklits/Caitlin Churchill

1-203-682-8200

Media: lululemon athletica inc. Erin Hankinson

1-604-732-6124 or Brunswick Group Eleanor French 1-415-671-7676

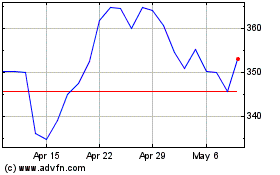

Lululemon Athletica (NASDAQ:LULU)

Historical Stock Chart

From Mar 2024 to Apr 2024

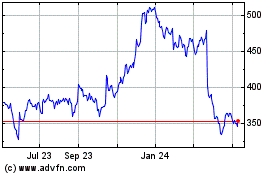

Lululemon Athletica (NASDAQ:LULU)

Historical Stock Chart

From Apr 2023 to Apr 2024