|

|

OMB APPROVAL

|

|

|

|

|

|

OMB Number: 32350016

|

|

|

Expires: September 30, 2007

|

|

|

Estimated burden

|

|

|

hours per response ……5.43

|

|

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2019

Commission

File Number 001-34837

Luokung

Technology Corp.

(Translation

of registrant’s name into English)

B9-8,

Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District, Beijing, People’s Republic of China 710065

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F þ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6’-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note:

Regulation S-T Rule 101(6)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule l01(b)(7): ____

Note:

Regulation S-T Rule 101(6)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public’ under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a

press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material

event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Luokung

Technology Corp.

Departure

of Directors

Effective

December 13, 2019, Mr. Jiming Ha resigned from his position as a member of the Board of Directors of Luokung Technology Corp.

(the “Company”). Mr. Ha indicated that his resignation from the Board is not the result of any disagreement with the

Company.

Submission

of Matters to a Vote of Security Holders.

Shareholders

of the Company’s ordinary shares and preferred shares, voting together as a single class, holding a majority of the voting

rights of the Company have approved the following matters by written consent effective December 14, 2019:

Matter

1. Shareholders of the Company’s ordinary shares and preferred shares, voting together as a single class, elected Mr.

David Wei Tang and Mr. Bryan Yap to serve as directors on the Company’s Board of Directors effective immediately.

Messrs. Tang and Yap will each serve on the Company’s audit committee of the Board of Directors.

Mr.

David Wei Tang: Prior to joining our Company, Mr. Tang served as President of Huakang Financial Holdings, a Chinese multi-disciplinary

financial holdings group with subsidiaries in investments, insurance, wealth management and financial technology. From 2008 to

2010 and from 2012 to 2013, Mr. Tang served as Vice President, Chief Financial Officer and Chief Strategy Officer of Vimicro Corporation,

a NASDAQ-listed company (NASDAQ: VIMC). Prior to that, from 2006 to 2008 he served as the Chief Financial Officer of Fanhua Inc.,

formerly known as “CNinsure Inc.”, a NASDAQ-listed company (NASDAQ: FANH), from 2003 to 2004, he served as the Chief

Financial Officer of IRICO Group, a Hong Kong Stock Exchange-listed company (HKSE: 438) and in 2000, he served as the Chief Financial

Officer of Chinasoft International, a Hong Kong Stock Exchange-listed company (HKSE: 354). Prior to those positions, he worked

as an equity research analyst at Merrill Lynch & Co. in New York. Mr. Tang also serves as Chair of Audit Committee of HXD.

Mr. Tang received a master’s degree in business administration from the Stern School of Business, New York University.

Mr.

Jin Meng Bryan Yap: Mr. Yap has extensive experience in investment banking, financial and business consulting, financial structuring,

capital raising, portfolio optimization and balance sheet restructuring. He is currently the CEO and Managing Director of Daun

Consulting Singapore Pte Ltd, a single family office focusing on consulting and selective investments. He is also currently serving

as the Honorary Treasurer of the ACI (Financial Markets Association) – Singapore since 2001.

Mr.

Yap served as a Managing Director of Deutsche Bank from 1996 to 2008 where he was the Co-Head of Emerging Markets,Asia. Mr.Yap

also served as a director on the board of Deutsche Bank International Asia, a branch of Deutsche Bank Singapore. Mr.Yap also

represented Deutsche Bank on the MAS sponsored Singapore Foreign Exchange Market Committee (“SFEMC”) where he was an

active member of the Market Development Sub-Committee. Mr. Yap joined investment banking in 1988 at Citibank Singapore

where he rose to the position of Vice President. In 1988, Mr. Yap received a Bachelor of Science degree from the National

University of Singapore, majoring in Mathematics and Economics.

Matter

2. Shareholders of the Company’s ordinary shares and preferred shares, voting together as a single class, approved,

ratified and confirmed the adoption of the Luokung Technology Corp. 2018 Omnibus Equity Plan (the “Plan”). In connection

with the Plan, the Company is hereby furnishing under the cover of Form 6-K:

Exhibit

99.1 Luokung Technology Corp. 2018 Onmibus Equity Plan

Matter

3. Shareholders of the Company’s ordinary shares and preferred shares, voting together as a single class, approved, ratified

and confirmed the Company’s Securities Purchase Agreement (the “Securities Purchase Agreement”) with Acuitas

Capital, LLC (the “Purchaser”) and the Warrant to purchase the Company’s ordinary shares (the “Warrant”)

with the Purchaser. Each of the Securities Purchase Agreement and the Warrant were dated November 13, 2019 and the terms of the

Securities Purchase Agreement and the Warrant were as disclosed in the Form 6-k filed by the Company on December 3, 2019. Pursuant

to the Securities Purchase Agreement and the Warrant, the Purchaser subscribed to purchase up to $100,000,000 of units (the “Units”)

with up to a $10,000,000 subscription at each closing, with each Unit consisting of one ordinary share and one warrant, where

each whole warrant entitles the holder to purchase one ordinary share.

About

Luokung Technology Corp.

Luokung

Technology Corp. is one of the global leading spatial-temporal big-data processing technology companies and a leading interactive

location-based services company in China. The core business brands of the Company are “Luokuang” and “Superengine”

. The Company mainly provides spatial temporal big data PaaS, SaaS and DaaS intelligent services based on its self-developed patented

technology which can be applied in Mobile Internet LBS, Internet Travelling, Intelligent Transportation, Automatic Drive, Smart

City, Intelligent IoT, Natural Resources Exploration and Monitoring and so on. These services are integrated intelligent computing

and application services for spatial temporal data which including but not limited to Satellite and UAV Remote Sensing Image Data,

HD Map, 2D and 3D Internet Map, Real-time Trajectory, IoT Industrial Stream Data. For more information please go to http://www.luokung.com.

Safe

Harbor Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, including certain plans, expectations, goals, and projections, which are subject to numerous assumptions, risks,

and uncertainties. These forward-looking statements may include, but are not limited to, statements containing words such as “may,”

“could,” “would,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “expects,” “intends”, “future” and “guidance”

or similar expressions. These forward-looking statements speak only as of the date of this press release and are subject to change

at any time. These forward-looking statements are based upon management’s current expectations and are subject to a number

of risks, uncertainties and contingencies, many of which are beyond the Company’s control that may cause actual results,

levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance

or achievements expressed or implied by such forward-looking statements. The Company’s actual results could differ materially

from those contained in the forward-looking statements due to a number of factors, including those described under the heading

“Risk Factors” in the Company’s Annual Report for the fiscal year ended September 30, 2017 filed with the Securities

and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as required under applicable law.

For

investor and media inquiries, please contact:

Mr.

Jay Yu

Tel:

(+86) 10-6506 5217

Email:

yujie@luokung.com

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Luokung Technology Corp.

|

|

|

|

|

|

Date

December 30, 2019

|

By

|

/s/

Xuesong Song

|

|

|

|

Xuesong

Song

|

|

|

|

Chief

Executive Officer

|

|

|

|

(Principal

Executive Officer) and

|

|

|

|

Duly

Authorized Officer

|

3

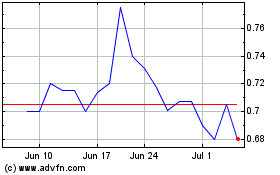

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

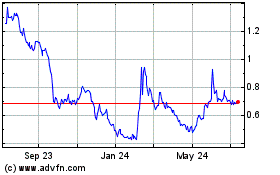

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Apr 2023 to Apr 2024