Report of Foreign Issuer (6-k)

October 17 2019 - 9:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2019

Commission File Number 001-34837

Luokung Technology Corp.

(Translation of registrant's name into English)

B9-8, Block B, SOHO Phase II,

No. 9, Guanghua Road, Chaoyang District, Beijing

People’s

Republic of China, 100020

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form

40-F ☐

Indicate by check mark if the registrant is

submitting the Form 6'-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(6)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule l01(b)(7): ____

Note: Regulation S-T Rule 101(6)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign

private issuer must furnish and make public' under the laws of the jurisdiction in which the registrant is incorporated, domiciled

or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the

registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has

not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of

a Form 6-K submission or other Commission filing on EDGAR.

Luokung Technology Corp.

Entry into Supplemental Agreement

As reported in a Form 6-K filed on September

13, 2019, on August 28, 2019, Luokung Technology Corp., a corporation organized under the laws of the British Virgin Islands (the

“Company”), entered into a Share Purchase Agreement (the “Agreement”) pursuant to which the Company will

acquire 100% of the equity interests of eMapgo Technologies (Beijing) Col, Ltd. (“EMG) from EMG’s shareholders for

an aggregate purchase price of RMB 836 million (approximately equivalent to $119 million), which includes approximately RMB 709

million in cash and the remaining RMB 127 million will be paid by issuance of the Company’s common stock (the “Shares”)

at the conversion rate of $7 per share. The agreement to acquire EMG is

conditioned on, among other things, the Company's ability to raise the necessary financing to consummate the acquisition of EMG.

The Agreement contains customary representations and warranties, indemnification provisions, and pre- and post-closing conditions

and covenants of each party, including that the agreement is conditioned on the Company’s ability to raise the necessary

financing to consummate the acquisition of EMG. The description contained herein of the terms of the Agreement does not purport

to be complete and is qualified in its entirety by reference to the Agreement, a copy of which was attached hereto as Exhibit 99.1,

and incorporated by reference herein, to the Form 6-K filed by the Company on September 13, 2019. The Shares to be issued by the

Company pursuant to the Agreement shall be sold and issued pursuant to the exemption from registration provided by Regulation S

promulgated under the Securities Act of 1933, as amended.

On October 11, 2019, the

Company entered into a Supplemental Agreement (the “Supplemental Agreement”) by and among the Company, Beijing

Zhong Chuan Shi Xun Technology Limited, a company incorporated under the laws of the People’s Republic of China (“Beijing

Zhong”), Saleya Holdings Limited, a company incorporated under the laws of the British Virgin Islands (“Saleya”),

eMapgo Technologies (Beijing) Co., Ltd., a company incorporated under the laws of the PRC (the “eMapgo”); Beijing DMG

Infotech Co., Ltd., a company incorporated under the laws of the PRC (“Beijing DMG”); and the parties set forth on

Schedule A of the Supplemental Agreement, pursuant to which the parties to the Supplemental Agreement agreed to further clarify

and make amendments to the closing schedule and payment schedule as set forth in the Agreement. The parties to the Supplemental

Agreement have agreed that the closing contemplated in the Agreement shall occur on or prior to December 31, 2019, unless otherwise

further agreed in writing by the Company and all the parties set forth on Part I of Schedule A to the Supplemental Agreement.

Notwithstanding

anything to the contrary contained in the Agreement or any documents entered into in connection with the transactions contemplated

by the Agreement, including but not limited to Section 2.8 of the Agreement, and subject to the terms and conditions in the Supplemental

Agreement, the Company and Beijing Zhong shall, (i) deliver or cause to be delivered common stock with a restricted legend on or

prior to October 31, 2019 as set forth in the Agreement; and (ii) deliver or cause to be delivered to the parties set forth on

Schedule A of the Supplemental Agreement the remaining amount of the Aggregate Purchase Price in three installments, provided that

(a) the first installment (the “First Installment”) shall be delivered on or prior to October 31, 2019 (the

“First Payment Date”), (b) the second installment (the “Second Installment”) shall be delivered

on or prior to November 30, 2019 (the “Second Payment Date”), (c) the third installment (the “Third

Installment”, together with the First Installment and the Second Installment, collectively, the “Installments”,

and each a “Installment”) shall be delivered on or prior to December 31, 2019 (the “Third Payment Date”,

together with the First Installment Date and the Second Installment Date, collectively, the “Installment Dates”,

and each a “Installment Date”), (d) the aggregate amount of the First installment shall be no less than USD10,000,000,

and the aggregate amount of the First Installment and the Second installment shall be no less than the amount equal to eighty percent

(80%) of RMB709,567,913. The Parties further agree that the liquidated damages set forth in Section 9.4 of the Agreement shall

still apply mutatis mutandis to the obligations of the Company and Beijing Zhong to pay the First Installment, the Second

Installment and/or the Third Installment provided that the Company or Beijing Zhong fail(s) to pay the relative Installment within

5 Business Days after the relative Installment Date.

The description

contained herein of the terms of the Supplemental Agreement does not purport to be complete and is qualified in its entirety by

reference to the Supplemental Agreement, a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference herein.

In connection with the Supplemental Agreement,

the Company is hereby furnishing under the cover of Form 6-K:

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

Exhibit 99.1

|

|

Supplemental Agreement Agreement, dated October 11, 2019, by and among, Luokung Technology Corp.,, Beijing Zhong Chuan Shi Xun Technology Limited, Saleya Holdings Limited, EMapgo Technologies (Beijing) Col, Ltd., Beijing DMG Infotech Col Ltd. and the parties set forth on Schedule A therein

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Luokung Technology Corp.

|

|

|

|

|

|

|

|

Date: October 17,

2019

|

By:

|

/s/ Xuesong Song

|

|

|

Name:

|

Xuesong Song

|

|

|

Title:

|

Chief Executive Officer

(Principal Executive Officer) and

Duly Authorized Officer

|

Exhibit Index

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

Exhibit 99.1

|

|

Supplemental Agreement Agreement, dated October 11, 2019, by and among, Luokung Technology Corp.,, Beijing Zhong Chuan Shi Xun Technology Limited, Saleya Holdings Limited, EMapgo Technologies (Beijing) Col, Ltd., Beijing DMG Infotech Col Ltd. and the parties set forth on Schedule A therein

|

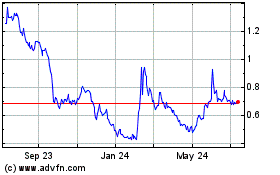

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

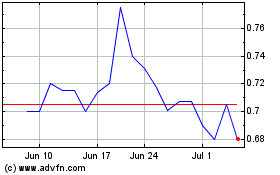

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Apr 2023 to Apr 2024