Ligand Pharmaceuticals Incorporated (NASDAQ: LGND)

provides a general corporate update, as follows:

“As the business environment has evolved in response to the

pandemic, Ligand has remained sharp with our operations and our

partners have been highly productive over the past few weeks,” said

John Higgins, Chief Executive Officer of Ligand Pharmaceuticals.

“Last week we completed an acquisition, we just signed a deal for a

novel FAAH inhibitor out of our Vernalis unit, two partners

recently closed important financings and over the past month

partners have begun additional COVID-19 initiatives. Our OmniAb®

business is advancing with a recent NDA filing in China and

positive Phase 2a data just announced. Notably, we are working to

ensure our Captisol® production meets the needs of our global

partners. Finally, despite the volatile capital markets, we have

used cash during the first quarter to buy back nearly a third of

our outstanding convertible bonds at what we believe were

attractive valuations.”

Follow Ligand on Twitter @Ligand_LGND.

OmniAb® Business Update

Ligand’s partners are actively progressing two OmniAb antibody

discovery programs for the potential treatment of COVID-19. One

multinational big pharma partner has initiated a program using

OmniChicken® and another partner is focused on antibodies derived

from OmniRat®.

Gloria Biosciences submitted an application for marketing

approval to the Chinese National Medicines Products Administration

for OmniAb-derived zimberelimab for the treatment of classical

Hodgkin lymphoma.

Immunovant announced positive results from its ongoing Phase 2a

proof-of-concept study of OmniAb-derived IMVT-1401 in thyroid eye

disease. IMVT-1401 is a novel investigational anti-FcRn antibody

delivered by subcutaneous injection. The results showed a 65% mean

reduction in total IgG observed from baseline to end of treatment,

with a pharmacodynamic response nearly identical to modeled

predictions for the dosing regimen tested in the trial. IMVT-1401

was generally well-tolerated.

Ligand’s partner Pandion Therapeutics closed an $80 million

financing on March 31, 2020 and announced that proceeds will

support the advancement of their pipeline of modular proteins and

bi-functional antibodies for the treatment of autoimmune diseases.

Ligand entered into an OmniAb Platform agreement with Pandion in

January 2020.

Captisol® Business Update

During the first quarter Ligand announced it is supplying

Captisol to partners evaluating remdesivir in clinical trials as a

potential treatment for COVID-19. Ligand continues to meet Captisol

requirements to support remdesivir clinical trials and

manufacturing scale-up. Our partner Gilead Sciences announced that

it has accelerated manufacturing timelines to increase the supply

of the drug before knowing whether remdesivir is safe and effective

in patients with COVID-19. Multiple clinical trials for remdesivir

are underway, involving thousands of patients with COVID-19 across

the world. Public information indicates initial clinical trial data

will be available over the next several weeks.

Ligand’s Captisol technology has applicability in a broad array

of therapeutic indications. Captisol is used in approved treatments

such as Amgen’s Kyprolis and Acrotech/CASI’s Evomela to treat

patients with multiple myeloma, a life-threatening cancer, and is

utilized in Sage Therapeutics’ Zulresso, which was recently

approved by the FDA for mothers suffering from post-partum

depression.

Ligand’s Captisol network is served by manufacturing plants in

two European countries and five distribution facilities around the

globe, all of which remain fully operational. Ligand has

substantial capacity to supply Captisol manufactured according to

cGMP and our focus is to ensure sufficient supply to meet all

existing and future partner needs, and to supply Gilead should

remdesivir be demonstrated to be safe and effective to treat

COVID-19. Ligand is also evaluating plans with its supply partner

to further increase capacity by bringing additional sites online if

needed.

Vernalis Business Update

Ligand recently entered into an exclusive worldwide license

agreement with Neuritek Therapeutics to develop and commercialize

V158866, a novel, oral, selective fatty acid amide hydrolase (FAAH)

inhibitor that was discovered using the Vernalis Design Platform

(VDP). Neuritek plans to develop V158866 for post-traumatic stress

disorder and other CNS diseases. Under the terms of the agreement,

Ligand will receive an upfront license fee and is eligible to

receive a financing-related milestone, development and

commercialization milestones and tiered royalties on net sales in

the mid-to-high single digits. On March 31, 2020, Neuritek

announced it had secured approximately $27 million in a capital

commitment from the GEM group, GEM Global Yield LLC SCS.

Recent third-party academic drug analyses suggest a potential

role for heat shock protein 90 (Hsp90) inhibitors in treating

COVID-19 infection. Based on these studies, we are evaluating

potential collaborations or partnerships relating to intravenous

luminespib (AUY-922) as a potential treatment for patients with

COVID-19. Luminespib is a Phase 2-ready Hsp90 inhibitor, previously

investigated in clinical trials for cancer.

Acquisition Update

On April 1, 2020 Ligand closed its acquisition of the core

assets of Icagen’s North Carolina operations, including two

significant partnered programs, proprietary ion channel screening

and assay platforms, x-ray fluorescence capabilities, custom

screening technologies and six preclinical-stage internal programs

applicable to a range of indications including diabetes,

Parkinson’s disease, pain and others. The two partnered programs

are a collaboration with Roche to develop and commercialize

therapies for neurological diseases, which includes research

funding, up to $274 million in potential milestone payments and

tiered royalties on net sales, and a collaboration with the Cystic

Fibrosis Foundation (CFF) Collaboration to discover therapeutics to

treat patients with cystic fibrosis caused by specific genetic

mutations. The CFF collaboration allows for up to $11 million in

research funding, up to $59 million in milestone payments and

tiered royalties on net sales.

Capital Deployment and Strategy Update

Ligand estimates that, as of March 31, 2020, its cash and cash

equivalents were approximately $735 million and outstanding

convertible debt was approximately $516 million. First quarter

estimated cash and cash equivalents is lower compared to the end of

2019, primarily because over the past several weeks Ligand

repurchased $234 million in principal amount of its convertibles

notes at a price of $203 million, and repurchased 473,000 common

shares for $37 million. These estimated amounts are preliminary and

are subject to completion of financial and quarterly closing

procedures.

We have a successful track record of acquiring innovative

companies and subsequently growing revenue, increasing our

partnered portfolio, and leveraging technology and customer

synergies. Given our significant financial resources and talented

operating team, we believe we are well positioned to pursue

acquisitions and new opportunities to expand our business.

First Quarter 2020 Earnings Conference Call

Ligand announced plans to report first quarter 2020 financial

results and hold an earnings conference call on May 6, 2020 after

market close. Details about the conference call will be announced

approximately two weeks in advance.

About Ligand Pharmaceuticals

Ligand is a biopharmaceutical company focused on developing or

acquiring technologies that help pharmaceutical companies discover

and develop medicines. Our business model creates value for

stockholders by providing a diversified portfolio of biotech and

pharmaceutical product revenue streams that are supported by an

efficient and low corporate cost structure. Our goal is to offer

investors an opportunity to participate in the promise of the

biotech industry in a profitable, diversified and lower-risk

business than a typical biotech company. Our business model is

based on doing what we do best: drug discovery, early-stage drug

development, product reformulation and partnering. We partner with

other pharmaceutical companies to leverage what they do best

(late-stage development, regulatory management and

commercialization) to ultimately generate our revenue. Ligand’s

OmniAb technology platform is a patent-protected transgenic animal

platform used in the discovery of fully human mono- and bispecific

therapeutic antibodies. The Captisol platform technology is a

patent-protected, chemically modified cyclodextrin with a structure

designed to optimize the solubility and stability of drugs. The

Vernalis Design Platform (VDP) integrates protein structure

determination and engineering, fragment screening and molecular

modeling, with medicinal chemistry, to help enable success in novel

drug discovery programs against highly-challenging targets. Ab

Initio™ technology and services for the design and preparation of

customized antigens enable the successful discovery of therapeutic

antibodies against difficult-to-access cellular targets. Ligand has

established multiple alliances, licenses and other business

relationships with the world’s leading pharmaceutical companies

including Amgen, Merck, Pfizer, Sanofi, Janssen, Takeda, Gilead

Sciences and Baxter International. For more information, please

visit www.ligand.com.

Forward-Looking Statements

This news release contains forward-looking statements by Ligand

that involve risks and uncertainties and reflect Ligand’s judgment

as of the date of this release. These include statements regarding:

Ligand’s estimated cash and debt amounts as of March 31, 2020; the

timeline for manufacturing remdesivir and timing of initial data

from ongoing clinical trials of remdesivir to treat patients with

COVID-19; the expected use of proceeds from Pandion’s financing;

Ligand’s expectation that it will have sufficient supply of

Captisol to meet all existing and future partner needs; Ligand’s

plans to pursue collaborations relating to intravenous Luminespib

(AUY-922) as a potential treatment for patients with COVID-19; and

anticipated benefits of the Neuritek license agreement and Icagen

asset acquisition. Actual events or results may differ from

Ligand's expectations due to risks and uncertainties inherent in

Ligand’s business, including, without limitation; Ligand’s partners

may not order as much Captisol as Ligand expects; remdesivir is not

yet licensed or approved anywhere globally and has not been

demonstrated to be safe or effective for any use, including

treatment of COVID-19; Ligand may not be able to provide sufficient

supply of Captisol to meet all existing and future partner needs,

including Gilead; the recent outbreak of the COVID-19 coronavirus

may disrupt Ligand's and its partners' business, including delaying

manufacturing, preclinical studies and clinical trials and product

sales, and impairing global economic activity, all of which could

materially and adversely affect our results of operations and

financial condition; Ligand may not receive expected revenue from

royalties, Captisol material sales and license fees and milestone

revenue; results of any clinical study may not be timely, favorable

or confirmed by later studies; products under development by Ligand

or its partners may not receive regulatory approval; there may not

be a market for the product(s) even if successfully developed and

approved; Ligand and its partners may experience delays in the

commencement, enrollment, completion or analysis of clinical

testing for its product candidates, or significant issues regarding

the adequacy of its clinical trial designs or the execution of its

clinical trials, which could result in increased costs and delays,

or limit Ligand's ability to obtain regulatory approval; Ligand may

not be able to successfully implement its strategic growth plan and

continue the development of its proprietary programs; Ligand may

not be successful in securing collaborations for Luminespib;

estimated cash and debt amounts may change following completion of

its financial statements and quarterly review, such estimated

amounts do not present all information necessary for an

understanding of Ligand’s financial condition as of March 31, 2020;

and the anticipated benefits of the Neuritek license agreement or

Icagen acquisition may not be realized or may be affected by

competition or other external events. The failure to meet

expectations with respect to any of the foregoing matters may

reduce Ligand’s stock price. Additional information concerning

these and other important risk factors affecting Ligand can be

found in Ligand’s prior press releases available at www.ligand.com

as well as in Ligand’s public periodic filings with the Securities

and Exchange Commission, available at www.sec.gov. Ligand disclaims

any intent or obligation to update these forward-looking statements

beyond the date of this press release, except as required by law.

This caution is made under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200406005284/en/

Ligand Pharmaceuticals Incorporated Patrick O’Brien

investors@ligand.com (858) 550-7768 @Ligand_LGND

LHA Investor Relations Bruce Voss bvoss@lhai.com (310)

691-7100

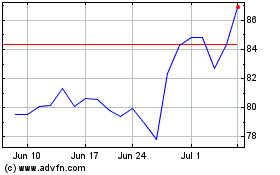

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Mar 2024 to Apr 2024

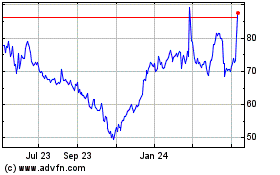

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Apr 2023 to Apr 2024