As filed with the Securities and Exchange Commission on July 30, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

Lexaria Bioscience Corp.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

47-3812456

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

100 – 740 McCurdy Road

Kelowna, BC Canada V1X 2P7

|

|

10528

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

Equity Incentive Plan

|

|

|

(Full title of the plan)

|

|

|

Christopher Bunka

Chief Executive Officer

100 – 740 McCurdy Road

Kelowna, BC Canada V1X 2P7

1-250-765-6424

(Name, address and telephone number, including area code,

of agent for service)

|

|

Copy to:

Gregory Sichenzia, Esq.

Avital Perlman, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

(212) 930-970

|

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “small reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

CALCULATION OF REGISTRATION FEE

|

Title of Securities

to be Registered

|

|

Amount to be

Registered (1)

|

|

|

Proposed

Maximum Offering

Price Per Share

|

|

|

Proposed

Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee

|

|

|

Common Stock, $0.001 par value

|

|

|

157,902

|

(2)

|

|

$

|

6.45

|

(3)

|

|

$

|

1,018,467.90

|

|

|

$

|

111.11

|

|

|

Common Stock, $0.001 par value

|

|

|

249,143

|

(4)

|

|

$

|

6.65

|

(5)

|

|

$

|

1,656,800.95

|

|

|

$

|

180.76

|

|

|

TOTAL

|

|

|

407,045

|

|

|

|

|

|

|

$

|

2,675,268.85

|

|

|

$

|

291.87

|

|

______________

|

|

(1)

|

This Registration Statement also registers an indeterminable number of additional securities to be offered or issued upon adjustments or changes made to registered securities by reason of any stock splits, stock dividends or similar transactions as permitted by Rule 416(a) and Rule 416(b) under the Securities Act of 1933, as amended, or the Securities Act.

|

|

|

|

|

|

|

(2)

|

Represents shares of common stock issuable pursuant to stock option awards outstanding under the Equity Incentive Plan (the “Plan”).

|

|

|

|

|

|

|

(3)

|

Estimated pursuant to Rule 457(h) solely for purposes of calculating the aggregate offering price and the amount of the registration fee based upon a weighted average of the exercise prices of outstanding options previously granted.

|

|

|

|

|

|

|

(4)

|

Represents shares of common stock reserved for future issuance pursuant to the Plan.

|

|

|

|

|

|

|

(5)

|

Estimated pursuant to Rule 457(c) and (h) solely for purposes of calculating the aggregate offering price and the amount of the registration fee based upon the average of the high and low prices reported for the shares on the Nasdaq Capital Market on July 27, 2021.

|

EXPLANATORY NOTE

This registration statement on Form S-8 (the “Registration Statement”) relates to an additional 249,143 shares of common stock, par value $0.001 per share of Lexaria Bioscience Corp. (the “Registrant,” the “Company,” “we,” “us” or “our”), which are issuable pursuant to awards that may be granted under our Equity Incentive Plan (the “Plan”). Under the Plan, a total of 510,433 shares of common stock have been reserved for issuance upon the grant of awards and exercise of options to directors, officers, employees and consultants of the Company and of the Company’s affiliates, of which 261,290 shares (adjusted to reflect our 1 for 30 reverse stock split effective January 11, 2021) have been registered pursuant to the Registrant’s previously filed Registration Statement on Form S-8 (File No. 333-231585), filed on May 17, 2019. Pursuant to General Instruction E to Form S-8, Part I and Items 4-7 and 9 of Part II of the Registrant's Registration Statement on Form S-8 (File No. 333-231585) are incorporated herein by reference except to the extent supplemented, amended or superseded by the information set forth herein. Only those items of Form S-8 containing new information not contained in the earlier registration statement are presented herein.

This Registration Statement also includes a reoffer prospectus prepared in accordance with General Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3, to be used in connection with resales of securities registered hereunder by selling stockholders (the “Selling Stockholders”), some of whom may be considered affiliates of the Company, as defined in Rule 405 under the Securities Act of 1933, as amended. The Selling Stockholders may be selling up to an aggregate of 157,902 shares of common stock that constitute “restricted securities” and “control securities” which have been issued by the Registrant pursuant to the Plan, prior to the filing of this Registration Statement.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I, and the Note to Part I of Form S-8 will be delivered to each of the participants in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), but these documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a Prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Annual Information.

Upon written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) Prospectus) and other documents required to be delivered to eligible employers, non-employee directors and consultants pursuant to Rule 428(b) are available without charge by contacting: Vanessa Carle, Head of Legal Department, Lexaria Bioscience Corp., 100 – 740 McCurdy Road, Kelowna, BC Canada V1X 2P7 at vcarle@lexariabioscience.com or 250-765-6424.

REOFFER PROSPECTUS

157,902 Shares

Lexaria Bioscience Corp.

Common Stock

This reoffer prospectus relates to the public resale, from time to time, of an aggregate of 157,902 shares (the “Shares”) of our common stock, $0.001 par value per share, by certain security holders identified herein in the section entitled “Selling Stockholders”. The amount of Shares to be reoffered or resold by means of this prospectus by each Selling Stockholder, and any other person with whom such Selling Stockholder is acting in concert for the purpose of selling our securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) of the Securities Act of 1933, as amended (the “Securities Act”). Such Shares have been or may be acquired in connection with awards granted under the Equity Incentive Plan (the “Plan”) of Lexaria Bioscience Corp. (the “Company”). You should read this prospectus carefully before you invest in the common stock.

Such resales shall take place on the Nasdaq Capital Market, or such other stock market or exchange on which our common stock may be listed or quoted, in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan of Distribution” starting on page ___ of this prospectus). We will receive no part of the proceeds from sales made under this reoffer prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering and not borne by the Selling Stockholders will be borne by us.

This reoffer prospectus has been prepared for the purposes of registering the Shares under the Securities Act to allow for future sales by the Selling Stockholders on a continuous or delayed basis to the public without restriction. We have not entered into any underwriting arrangements in connection with the sale of the Shares covered by this reoffer prospectus. The Selling Stockholders identified in this reoffer prospectus, or their pledgees, donees, transferees or other successors-in-interest, may offer the Shares covered by this reoffer prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 4 of this reoffer prospectus. These are speculative securities.

Our common stock and tradable warrants are listed on the Nasdaq Capital Market under the symbols “LEXX” and “LEXXW,” respectively, and the last reported sale prices of our common stock and warrants on July 29, 2021 was $6.70 and $2.495, respectively.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is July 30, 2021

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) that involve risks and uncertainties. All statements other than statements of historical fact contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, including statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission, or the SEC. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this prospectus to conform our statements to actual results or changed expectations.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein. In particular, attention should be directed to our “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

Corporate Information

Lexaria Bioscience Corp. (“Lexaria,” the “Company,” “we,” “us” or “our”) was incorporated on December 9, 2004 under the laws of the State of Nevada. In March 2014, the Company began work in the fields of enhanced delivery of active ingredients and drugs. In May 2016, the Company commenced out-licensing its patented DehydraTECH™ technology (the “Technology”) for improved delivery of bioactive compounds that promotes healthy ingestion methods, lower overall dosing and higher effectiveness in active molecule delivery. We have our principal executive office in Kelowna, BC, Canada located at 100 – 740 McCurdy Road, and our telephone number is 1-250-765-6424. The Company’s website address is https://www.lexariabioscience.com/. Our website and the information contained on our website, or linked through our website, are not part of this prospectus, and you should not rely on our website or such information in making a decision to invest in our common stock.

Business Overview

We are a biotechnology research and development (“R&D”) company focused on developing and out licensing our patented DehydraTECH™ technology. DehydraTECH improves delivery orally and topically of active ingredients and drugs. The Company is focusing its capital and management time on its pursuit of intellectual property, the development of strategic partnerships with licensees for our patented DehydraTECH technology in exchange for up front and/or staged licensing fees and/or royalty payments over time, and an expanding portfolio of patent pending applications.

Our current patent portfolio includes patent family applications or grants pertaining to our method of improving bioavailability and taste, and the use of DehydraTECH as a delivery platform for a wide variety of Active Pharmaceutical Ingredients (“APIs”) including, but not limited to, fat soluble vitamins; nonsteroidal anti-inflammatory drugs (“NSAIDs”); anti-viral drugs; phosphodiesterase inhibitors; human hormones; regulated cannabinoids, and nicotine and its analogs.

The Company currently has over 50 patent applications pending worldwide and on April 30, 2021 the Company was granted its first patent in India for its third patent family titled “Stable ready-to-drink beverage compositions comprising lipophilic active agents” representing its 19th patent granted to date.

On July 13, 2021 and July 27, 2021, respectively, the Company announced its first patent issued in Japan for its third patent family titled “Stable ready-to-drink beverage compositions comprising lipophilic active agents” and its second patent issued in Japan for its first patent family titled “Food and Beverage Compositions Infused with Lipophilic Active Agents and Methods of Use Thereof” becoming the 20th and 21st patents granted to Lexaria.

The Company’s issued patents in the United States, Australia, Europe, India and Japan are as follows:

|

Issued Patent #

|

Patent Certificate Grant Date

|

Patent Family

|

|

US 9,474,725 B1

|

10/25/2016

|

Food and Beverage Compositions Infused With

Lipophilic Active Agents and Methods of Use Thereof

|

|

US 9,839,612 B2

|

12/12/2017

|

|

US 9,972,680 B2

|

05/15/2018

|

|

US 9,974,739 B2

|

05/22/2018

|

|

US 10,084,044 B2

|

09/25/2018

|

|

US 10,103,225 B2

|

10/16/2018

|

|

US 10,381,440

|

08/13/2019

|

|

US 10,374,036

|

08/06/2019

|

|

US 10,756,180

|

08/25/2020

|

|

AUS 2015274698

|

06/15/2017

|

|

AUS 2017203054

|

08/30/2018

|

|

AUS 2018202562

|

08/30/2018

|

|

AUS 2018202583

|

08/30/2018

|

|

AUS 2018202584

|

01/10/2019

|

|

AUS 2018220067

|

07/30/2019

|

|

EP 3164141

|

11/11/2020

|

|

JP 2017-517203

|

07/05/2021

|

|

AUS 2016367036

|

07/30/2019

|

Methods for Formulating Orally Ingestible Compositions Comprising Lipophilic Active Agents

|

|

AUS 2016367037

|

08/15/2019

|

Stable Ready-to-Drink Beverage Compositions Comprising Lipophilic Active Agents

|

|

IN 365854

|

04/30/2021

|

|

JP 2017-554607

|

06/30/2021

|

Due to the complexity of pursuing patent protection, the quantity of patent applications will vary continuously as each application advances or stalls. The Company is also filing new patent applications for new discoveries that arise from the Company’s R&D programs and, due to the inherent unpredictability of scientific discovery, it is not possible to predict if or how often such new applications might be filed.

Impact of COVID-19

The COVID-19 pandemic continues to present uncertainty and unforecastable new risks to the Company and its’ business plan. Restrictions on national and international travel and required business closures present challenges in carrying out normal business activities related to corporate finance efforts and the pursuit of new customers throughout North America who might otherwise access the retail products of our licensees. As a result, the pandemic has increased risk of lower revenues and higher losses. To date, we have not experienced a material impact on our financial statements, impairments of any of our assets or any major business disruptions, including with our vendors.

We have made modifications to our normal operations including requiring team members to work remotely on a staggered basis. To the extent possible, we are conducting business as usual, with necessary or advisable modifications to employee travel. At this time, these measures will continue in force for the near term.

We will continue to actively monitor the rapidly evolving situation related to COVID-19 and may take further actions that alter our operations, including those that may be required by federal, state, provincial, or local authorities, or that we determine are in the best interests of our employees and other third parties with whom we do business. We do not know when, or if, it will become practical to relax or eliminate some or all these measures entirely.

Research and Development

During the quarter ended May 31, 2021, Lexaria incurred $454,443 (May 2020 $24,577) in R&D expenditures. Specific R&D programs are in ongoing development and align to our financial ability to undertake each research phase for each API. Due to our expanding portfolio coverage, we continually examine accelerated timetable options for testing, research, and development of each API.

The Company continually focuses on new R&D programs to investigate the potential of additional commercial applications for its Technology. These include, but are not limited to, ongoing programs to explore methods to integrate nanoemulsification chemistry techniques together with its Technology and to further enhance intestinal bioabsorption rates with its Technology, as well as ongoing programs to expand the types and breadth of product form factors into which its Technology can be applied. Depending on how many of these tests are undertaken, R&D budgets are expected to vary significantly. It is in our best interests to remain flexible at this early stage of our R&D efforts in order to capitalize on potential novel findings from early-stage tests and thus re-direct research into specific avenues that offer the most rapid path to and/or highest likelihood of commercial revenue generation.

Historically the Company has conducted in vitro and in vivo absorption tests of our DehydraTECH technology of molecules such as: CBD, ibuprofen, and nicotine which supplied us with knowledge and understanding to perform subsequent testing on nicotine and CBD with generally positive results. Our work during 2018 wherein we conducted our first ever human clinical absorption tests on CBD also yielded positive results and we discovered that DehydraTECH-processed CBD was effective in lowering human blood pressure, leading to expanded plans to evaluate DehydraTECH-processed CBD during 2021 for potential blood pressure reduction outcomes. In our first tests of representative drugs from two classes of antiviral therapies we had positive results which we announced in December of 2020. During the second quarter ended May 31, 2021, the Company announced the positive results of its CBD DehydraTECH 2.0 enhanced formulations. Ongoing testing plans are proceeding to further define molecular compatibility, absorption rates, timing and viable formats of delivery. Our R&D is conducted with the goal of further defining DehydraTECH’s value with the goal of commercialization and revenue generation.

During the period ended May 31, 2021, the Company received results from certain of its animal studies which tested new formulations of DehydraTECH (“DehydraTECH 2.0”) enabled cannabidiol (“CBD”) for the purposes of future use in human clinical trial studies focusing on the efficacy of DehydraTECH 2.0 formulations for treating hypertension. The Company was also able to report generally positive results from pharmacokinetic testing in the R&D studies and most recent advancements with antiviral and hypertension drugs in our investigatory programs.

RISK FACTORS

An investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully all of the information contained or incorporated by reference in this prospectus, including any risks in the section entitled “Risk Factors” contained in any supplements to this prospectus and in our Annual Report on Form 10-K for the fiscal year ended August 31, 2020, as amended to date, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

USE OF PROCEEDS

The shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Stockholders listed herein (which includes our officers and directors). Accordingly, we will not realize any proceeds from the sale of the Shares. We will receive proceeds from the exercise of the options; however, no assurance can be given as to when or if any or all of the options will be exercised. If any options are exercised, the proceeds derived therefrom will be used for working capital and general corporate purposes. All expenses of the registration of the Shares will be paid by us. See “Selling Stockholders” and “Plan of Distribution.”

SELLING STOCKHOLDERS

We are registering for resale the Shares covered by this reoffer prospectus to permit the Selling Stockholders identified below and their pledgees, donees, transferees and other successors-in-interest that receive their securities from a Selling Stockholder as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to resell the Shares when and as they deem appropriate. The Selling Stockholders may acquire these Shares from us pursuant to the Plan. The Shares may not be sold or otherwise transferred by the Selling Stockholders unless and until the applicable awards vest and are exercised, as applicable, in accordance with the terms and conditions of the Plan.

The following table sets forth:

|

|

●

|

the name of each Selling Stockholder;

|

|

|

|

|

|

|

●

|

the number and percentage of shares of our common stock that each Selling Stockholder beneficially owned as of July _, 2021 prior to the offering for resale of the Shares under this prospectus;

|

|

|

|

|

|

|

●

|

the number of Shares that may be offered for resale for the account of each Selling Stockholder under this prospectus; and

|

|

|

|

|

|

|

●

|

the number and percentage of shares of our common stock to be beneficially owned by each Selling Stockholder after the offering of the resale Shares (assuming all of the offered resale Shares are sold by such Selling Stockholder).

|

Information with respect to beneficial ownership is based upon information obtained from the Selling Stockholders. Because the Selling Stockholders may offer all or part of the Shares, which they own pursuant to the offering contemplated by this reoffer prospectus, and because its offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of Shares that will be held upon termination of this offering. Except where indicated, all options and warrants held by the selling stockholders are exercisable within 60 days of July 28, 2021.

The number of shares in the column “Number of Shares Being Offered Hereby” represents all of the Shares of our common stock that each Selling Stockholder may offer under this prospectus. We do not know how long the Selling Stockholders will hold the Shares before selling them or how many Shares they will sell. The Shares of our common stock offered by this prospectus may be offered from time to time by the Selling Stockholders listed below. We cannot assure you that any of the Selling Stockholders will offer for sale or sell any or all of the Shares of common stock offered by them by this prospectus.

|

|

|

|

|

|

|

|

|

Number of

|

|

|

Percentage of

|

|

|

|

|

Number of Shares

|

|

|

|

|

|

Shares

|

|

|

Shares to be

|

|

|

|

|

Beneficially

|

|

|

Number of

|

|

|

Beneficially

|

|

|

Beneficially

|

|

|

|

|

Owned

|

|

|

Shares

|

|

|

Owned Upon

|

|

|

Owned Upon

|

|

|

Name of Selling

|

|

Prior to

|

|

|

Being Offered

|

|

|

Completion of

|

|

|

Completion of

|

|

|

Stockholder

|

|

the Offering(1)

|

|

|

Hereby (2)

|

|

|

the Offering

|

|

|

the Offering (3)

|

|

|

John Docherty

|

|

|

103,743

|

(4)

|

|

|

49,668

|

|

|

|

54,075

|

(4)

|

|

|

*

|

|

|

Christopher Bunkav

|

|

|

545,456

|

(5)

|

|

|

49,334

|

|

|

|

496,122

|

(5)

|

|

|

8.58

|

%

|

|

Gregory Downey

|

|

|

26,833

|

(6)

|

|

|

25,000

|

(6)

|

|

|

1,833

|

|

|

|

*

|

|

|

Albert Reese Jr.

|

|

|

4,317

|

|

|

|

3,400

|

|

|

|

917

|

|

|

|

*

|

|

|

William (Ted) McKechnie

|

|

|

19,691

|

|

|

|

6,500

|

|

|

|

13,191

|

|

|

|

*

|

|

|

Nicholas Baxter

|

|

|

17,500

|

|

|

|

6,500

|

|

|

|

11,000

|

|

|

|

*

|

|

|

Vanessa Carle

|

|

|

17,634

|

(7)

|

|

|

17,500

|

|

|

|

134

|

|

|

|

*

|

|

____________

|

|

(1)

|

Includes shares noted under “Number of Shares Being Offered Hereby”

|

|

|

(2)

|

Represents shares of stock issuable upon exercise of outstanding stock options.

|

|

|

(3)

|

Based on 5,726,699 shares issued and outstanding as of July 28, 2021.

|

|

|

(4)

|

Includes 54,075 shares held in the name of Docherty Management Ltd.

|

|

|

(5)

|

Includes 215,912 shares held in the name of C.A.B. Financial Services and 273,543 shares held directly by Christopher Bunka. Includes 6,667 warrants held in the name of C.A.B. Financial Services.

|

|

|

(6)

|

Includes 13,000 options that are not exercisable within 60 days of July 28, 2021.

|

|

|

(7)

|

Includes 67 warrants.

|

PLAN OF DISTRIBUTION

Our common stock is quoted on the Nasdaq Capital Market under the symbol “LEXX.”

The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each and any sale.

The Selling Stockholders may, from time to time, sell all or a portion of the Shares on any market where our common stock may be listed or quoted (currently the Nasdaq Capital Market), in privately negotiated transactions or otherwise. Such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices. The Shares being offered for resale by this Prospectus may be sold by the Selling Stockholders by one or more of the following methods:

|

|

●

|

block trades in which the broker or dealer so engaged will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

purchases by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this prospectus;

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

●

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

●

|

privately negotiated transactions;

|

|

|

●

|

market sales (both long and short to the extent permitted under the federal securities laws);

|

|

|

●

|

at the market to or through market makers or into an existing market for the Shares;

|

|

|

●

|

through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and

|

|

|

●

|

a combination of any of the aforementioned methods of sale.

|

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledge or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or any other applicable provision of the Securities Act amending the list of stockholders to include the pledge, transferee or other successors in interest as selling stockholders under this prospectus.

In effecting sales, brokers and dealers engaged by the Selling Stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from a Selling Stockholder or, if any of the broker-dealers act as an agent for the purchaser of such Shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with a Selling Stockholder to sell a specified number of the Shares at a stipulated price per Share. Such an agreement may also require the broker-dealer to purchase as principal any unsold Shares at the price required to fulfill the broker-dealer commitment to the Selling Stockholder if such broker-dealer is unable to sell the Shares on behalf of the Selling Stockholder. Broker-dealers who acquire Shares as principal may thereafter resell the Shares from time to time in transactions which may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above. Such sales by a broker-dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such resales, the broker-dealer may pay to or receive from the purchasers of the Shares commissions as described above.

The Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the sale of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

From time to time, any of the Selling Stockholders may pledge its Shares pursuant to the margin provisions of customer agreements with brokers. Upon a default by a Selling Stockholder, their broker may offer and sell the pledged Shares from time to time. Upon a sale of the Shares, the Selling Stockholders intend to comply with the Prospectus delivery requirements under the Securities Act by delivering a Prospectus to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities Act which may be required in the event any of the Selling Stockholders defaults under any customer agreement with brokers.

To the extent required under the Securities Act, a post-effective amendment to this Registration Statement will be filed disclosing the name of any broker-dealers, the number of Shares, the price at which the Shares are to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this Prospectus and other facts material to the transaction. We and the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a Selling Stockholder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M.

All of the foregoing may affect the marketability of the common stock.

Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the Shares will be borne by the Selling Stockholders, the purchasers participating in such transaction, or both.

Any Shares covered by this Prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this Prospectus.

LEGAL MATTERS

The validity of the issuance of the Shares described in this Prospectus will be passed upon for us by Sichenzia Ross Ference LLP at 1185 Avenue of the Americas, 31st Floor, New York, NY 10036.

EXPERTS

The consolidated financial statements of the Company and its subsidiaries, as of and for the years ended August 31, 2020 and 2019, have been incorporated by reference in this prospectus in reliance upon the report of Davidson & Company LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

INCORPORATION OF DOCUMENTS BY REFERENCE

We are “incorporating by reference” in this Prospectus certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this Prospectus will automatically update and supersede information contained in this Prospectus, including information in previously filed documents or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K):

|

|

●

|

Our Annual Report on Form 10-K for the fiscal year ended August 31, 2020, filed with the SEC on October 15, 2020;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended November 30, 2020, filed with the SEC on January 14, 2021;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended February 28, 2021, filed with the SEC on April 14, 2021;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended May 31, 2021, filed with the SEC on July 15, 2021;

|

|

|

●

|

Our Definitive Proxy Statement filed with the SEC on May 14, 2021;

|

|

|

●

|

Our Current Reports on Form 8-K filed with the SEC on November 19, 2020; December 10, 2020; December 31, 2020; January 14, 2021; April 16, 2021; June 30, 2021; July 6, 2021; July 27, 2021 and July 30, 2021; and

|

|

|

●

|

The description of certain capital stock contained in our Registration Statement 8-A filed on January 11, 2021, as it may further be amended from time to time.

|

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this Prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until we sell all of the securities offered by this Prospectus supplement. Information in such future filings updates and supplements the information provided in this Prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporate by reference), by contacting Vanessa Carle, c/o Lexaria Bioscience Corp., at 100 – 740 McCurdy Road, Kelowna, BC Canada V1X 2P7. Our telephone number is 1-250-765-6424. Information about us is also available at our website at https://www.lexariabioscience.com/. The information in our website is not a part of this prospectus and is not incorporated by reference.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant, the registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC under the Securities Act a Registration Statement on Form S-8, of which this Prospectus forms a part, with respect to the Shares being offered in this offering. This Prospectus does not contain all of the information set forth in the Registration Statement, certain items of which are omitted in accordance with the rules and regulations of the SEC. The omitted information may be inspected and copied at the Public Reference Room maintained by the SEC at 100 F. Street, N.E., Washington, D.C. 20549. You can obtain information about operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file with the SEC (including exhibits to such documents) at the SEC’s Public Reference Room at 100 F. Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain additional information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a site on the Internet at http://www.sec.gov/ that contains reports, proxy statements and other information that we file electronically with the SEC.

Statements contained in this Prospectus as to the contents of any contract or other document filed as an exhibit to the Registration Statement are not necessarily complete and in each instance reference is made to the copy of the document filed as an exhibit to the Registration Statement, each statement made in this Prospectus relating to such documents being qualified in all respect by such reference. For further information with respect to us and the securities being offered hereby, reference is hereby made to the Registration Statement, including the exhibits thereto.

REOFFER PROSPECTUS

Lexaria Bioscience Corp.

157,902 shares of

Common Stock

July 30, 2021

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

We are “incorporating by reference” in this Prospectus certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this Prospectus will automatically update and supersede information contained in this Prospectus, including information in previously filed documents or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K):

|

|

●

|

Our Annual Report on Form 10-K for the fiscal year ended August 31, 2020, filed with the SEC on October 15, 2020;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended November 30, 2020, filed with the SEC on January 14, 2021;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended February 28, 2021, filed with the SEC on April 14, 2021;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended May 31, 2021, filed with the SEC on July 15, 2021;

|

|

|

●

|

Our Definitive Proxy Statement filed with the SEC on May 14, 2021;

|

|

|

●

|

Our Current Reports on Form 8-K filed with the SEC on November 19, 2020; December 10, 2020; December 31, 2020; January 14, 2021; April 16, 2021; June 30, 2021; July 6, 2021; July 27, 2021 and July 30, 2021; and

|

|

|

●

|

The description of certain capital stock contained in our Registration Statement 8-A filed on January 11, 2021, as it may further be amended from time to time.

|

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this Prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until we sell all of the securities offered by this Prospectus supplement. Information in such future filings updates and supplements the information provided in this Prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporate by reference), by contacting Vanessa Carle, c/o Lexaria Bioscience, Corp., at 100 – 740 McCurdy Road, Kelowna, BC Canada V1X 2P7. Our telephone number is 1-250-765-6424. Information about us is also available at our website at https://www.lexariabioscience.com/. The information in our website is not a part of this prospectus and is not incorporated by reference.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The NRS empower us to indemnify our directors and officers against expenses relating to certain actions, suits or proceedings as provided for therein. In order for such indemnification to be available, the applicable director or officer must not have acted in a manner that constituted a breach of his or her fiduciary duties and involved intentional misconduct, fraud or a knowing violation of law, or must have acted in good faith and reasonably believed that his or her conduct was in, or not opposed to, our best interests. In the event of a criminal action, the applicable director or officer must not have had reasonable cause to believe his or her conduct was unlawful.

Pursuant to our articles, we may indemnify each of our present and future directors, officers, employees or agents who becomes a party or is threatened to be made a party to any suit or proceeding, whether pending, completed or merely threatened, and whether said suit or proceeding is civil, criminal, administrative, investigative, or otherwise, except an action by or in the right of the Company, by reason of the fact that he is or was a director, officer, employee, or agent of the Company, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses, including, but not limited to, attorneys' fees, judgments, fines, and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit, proceeding or settlement, provided such person acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interest of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

The expenses of directors, officers, employees or agents of the Company incurred in defending a civil or criminal action, suit, or proceeding may be paid by the Company as they are incurred and in advance of the final disposition of the action, suit, or proceeding, if and only if the director, officer, employee or agent undertakes to repay said expenses to the Company if it is ultimately determined by a court of competent jurisdiction, after exhaustion of all appeals therefrom, that he is not entitled to be indemnified by the corporation.

No indemnification shall be applied, and any advancement of expenses to or on behalf of any director, officer, employee or agent must be returned to the Company, if a final adjudication establishes that the person's acts or omissions involved a breach of any fiduciary duties, where applicable, intentional misconduct, fraud or a knowing violation of the law which was material to the cause of action.

The NRS further provides that a corporation may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising out of his status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses. We have secured a directors’ and officers’ liability insurance policy. We expect that we will continue to maintain such a policy.

Item 7. Exemption From Registration Claimed.

The grant of our securities were issued as compensation awards or as enticement or incentive awards. These grants were exempt from registration pursuant to Section 4(2) of the Securities Act.

Item 8. Exhibits.

______

* Filed herewith

Item 9. Undertakings.

(a) The undersigned Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Company pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Company hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in Kelowna, British Columbia, on the 30th of July, 2021.

|

LEXARIA BIOSCIENCE, CORP.

|

|

|

|

|

|

|

By:

|

/s/ Christopher Bunka

|

|

|

|

Christopher Bunka

|

|

|

|

Chief Executive Officer and

Chairman of the Board of Directors

|

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Christopher Bunka their true and lawful attorneys-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments, to this Registration Statement on Form S-8, and to file the same, with exhibits thereto and other documents in connection therewith, with the SEC granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that each of said attorney-in-fact and agent, or his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Name

|

|

Position

|

|

Date

|

|

|

|

|

|

|

|

/s/ Christopher Bunka

|

|

Chairman and Chief Executive Officer (Principal Executive Officer)

|

|

July 30, 2021

|

|

Christopher Bunka

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gregory Downey

|

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

|

July 30, 2021

|

|

Gregory Downey

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Docherty

|

|

President and Director

|

|

July 30, 2021

|

|

John Docherty

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Nicholas Baxter

|

|

Director

|

|

July 30, 2021

|

|

Nicholas Baxter

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ted McKechnie

|

|

Director

|

|

July 30, 2021

|

|

Ted McKechnie

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Al Reese Jr.

|

|

Director

|

|

July 30, 2021

|

|

Al Reese Jr.

|

|

|

|

|

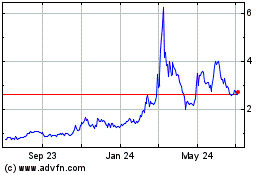

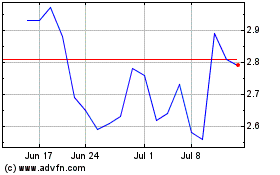

Lexaria Bioscience (NASDAQ:LEXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lexaria Bioscience (NASDAQ:LEXX)

Historical Stock Chart

From Apr 2023 to Apr 2024