Business intelligence from Akerna (Nasdaq: KERN), a leading

compliance technology provider and developer of the cannabis

industry’s first seed-to-sale enterprise resource planning (ERP)

software technology (MJ Platform®) shows in the wake of many states

reopening, online cannabis orders and pickup as a fulfillment

method have started to decline.

“The number of delivery orders skyrocketed in March

and April, but in May we’re seeing a shift back towards in person

transactions. The average number of daily deliveries kept climbing

through April but appears to be trending downward in the last two

weeks, so we may have hit a peak,” said Aryeh Primus, vice

president of analytics, Akerna. “We continue to see that the

in-store interaction between consumer and budtender is key for

people purchasing cannabis, and delivery takes away that.”

Looking at the numbers relative to January 2020,

before anything was affected by COVID-19, March saw a 220% increase

in daily deliveries and that ballooned to 710% in April.

Beginning March 14, the number of in store purchases declined

steadily, in some cases dropping by over half, presumably due to

stay at home orders. Now that states are reopening, more people are

going back to dispensaries.

“When we saw the increase in alternate modes of fulfillment,

like delivery and curbside pickup, our initial thought was that

this might be a sustainable trend because of increased consumer

convenience,” said Primus. “There will likely be a long-term

increase, but the April bump doesn’t seem sustainable; at least

some of the shoppers want to return to in person

transactions. May deliveries are about five times what we saw

in January, but that’s a 50% reduction compared to the highs in

April.”

Business intelligence from Akerna also shows, year-over-year,

May 2019 to May 2020, recreational order sales are up 157% with an

average ticket size of $77.73. The 30 – 40 age group had the

strongest order sales growth at 103%. As the industry evolves to

meet customer needs, product pickup as a fulfillment method

increased 141% year-over-year, accounting for 16% of order sales

for 2020.

**The Numbers, Year-over-Year, April 2020 compared to April

2019:

Total cannabis sales increased 68%, with an average ticket size

of $123. Top categories:

- Concentrates increased 22%, accounting for 11% of total product

sales

- Cartridges / Pens increased 3%, accounting for 35% of total

product sales

- Infused Edibles decreased 18%, accounting for 9% of total

product sales

- Flower maintained, accounting for 43% of total product

sales

MJ Freeway is more than software as a service. Its flagship

solution, MJ Platform now includes Platform Insights. Now

operators, investors, and regulators can access the industry’s

largest, and most statistically-relevant database to drive

data-driven business decisions.

Platform Insights provides:

- The greatest statistical relevance across countries

- Normalized data (not farmed from various disparate POS

platforms)

- Full cannabis supply chain data

- Business insights founded in category management

methodology

Platform Insights can eliminate the guesswork and

provide answers to questions like:

- What is the gross margin return on inventory?

- What SKUs should be carried?

- How do basket adjacencies influence discounting and retention

strategies?

- What does a medical market look like a year or five years after

decriminalizing cannabis?

Click here for more information about Platform

Insights.

About Akerna

Akerna is a global regulatory compliance technology company.

Akerna’s service offerings include MJ Platform®, Leaf Data

Systems®, and solo sciences tech platform. Since its establishment

in 2010, Akerna has tracked more than $18 billion in cannabis

sales. Akerna is based in Denver. For more information, please

visit www.akerna.com and follow us on Twitter @AkernaCorp.

About The Akerna Flash Report

Flash Report is a look at buying trends in the cannabis market

as captured by Akerna’s MJ Freeway subsidiary. MJ Freeway provides

operators with MJ Platform, the industry-leading solution for

regulatory compliance technology, from seed-to-sale-to-self. Some

instances of the flash report may include business intelligence

derived from Akerna’s family of companies, including Ample

Organics, Leaf Data Systems, solo sciences, and Trellis.

**Data is derived from MJ Platform, the leading provider of

cannabis compliance software for the marijuana industry. Reporting

data is obtained from operators using Akerna’s MJ Platform

solutions. Increases are relative to the prior period. Additional

business intelligence data sources may include proprietary tools

used by Akerna’s family of companies.

Forward-Looking Statements

Certain statements made in this release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

Such forward-looking statements include but are not limited to

statements regarding sustained increases in demand for cannabis and

the ability of the MJ Platform team to help operators make

decisions through analytics and reporting. These forward-looking

statements are not guarantees of future performance, conditions or

results, and involve a number of significant known and unknown

risks, uncertainties, assumptions, and other important factors,

many of which are outside Akerna’s control, that could cause actual

results or outcomes to differ materially from those discussed in

the forward-looking statements. Important factors, among others

that may affect actual results or outcomes, include (i) Akerna’s

ability to maintain relationships with customers and suppliers and

retain its management and key employees, (ii) changes in applicable

laws or regulations, (iii) changes in the market place due to the

coronavirus pandemic or other market factors, (iv) and other risks

and uncertainties disclosed from time to time in Akerna’s filings

with the U.S. Securities and Exchange Commission, including those

under “Risk Factors” therein. You are cautioned not to place

undue reliance on forward-looking statements. All information

herein speaks only as of the date hereof, in the case of

information about Akerna, or the date of such information, in the

case of information from persons other than Akerna. Akerna

undertakes no duty to update or revise the information contained

herein. Forecasts and estimates regarding Akerna’s industry and end

markets are based on sources believed to be reliable; however,

there can be no assurance these forecasts and estimates will prove

accurate in whole or in part.

| Akerna Media

RelationsD. Nikki Wheeler Nikki.Wheeler@Akerna.com

303-514-2012 |

Akerna Investor

Relations Jason Assad JAssad@akerna.com 678-570-6791 |

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c8174b8-c788-4206-bbc3-58c901316895

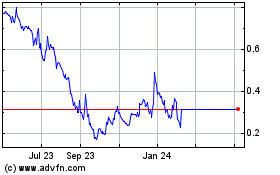

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

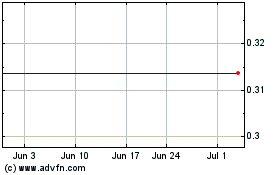

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Apr 2023 to Apr 2024