Current Report Filing (8-k)

December 16 2019 - 8:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2019

Kewaunee Scientific Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-5286

|

|

38-0715562

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

2700 West Front Street

Statesville, North Carolina

|

|

28677

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 704-873-7202

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $2.50 par value

|

|

KEQU

|

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

|

|

(a)

|

On December 13, 2019, Kewaunee Scientific Corporation (the “Company”) entered into an Eighth

Amendment to Credit and Security Agreement and Fourth Amendment to Revolving Line of Credit Note (the “Amendment”) with Wells Fargo Bank, National Association (the “Bank”). The Amendment made certain changes to the Credit and

Security Agreement, dated as of May 6, 2013, as amended (the “Credit Agreement”), between the Company and the Bank, and to the Revolving Line of Credit Note, dated May 6, 2013, made by the Company and payable to the order of the Bank,

as amended (the “Revolving Note”). The changes included (i) changing the total capacity under the Credit Agreement from $20,000,000 to $15,000,000, effective January 31, 2020; (ii) changing the facility to an asset based lending

structure with availability based on percentages of eligible accounts receivable and eligible inventory; (iii) providing an additional tier of pricing under the Senior Funded Debt to EBITDA ratio used to calculate the Applicable Margin on

advances, with the margin on LIBOR advances to be set at 3.5%, and the margin on prime rate advances set at 1.25%, if the ratio is over 4.25; (iv) eliminating covenants relating to the Fixed Charge Coverage ratio and the asset coverage ratio;

(v) adding a minimum EBITDA requirement, beginning with the quarter ending April 30, 2020; (vi) adding a minimum monthly liquidity covenant; (vii) adding a minimum EBITDA covenant; (viii) requiring a cash repatriation of at least $4,000,000 by

December 31, 2019; (ix) imposing certain limitations on the declaration and payment of dividends; and (x) certain other related and/or immaterial changes.

|

The foregoing description is qualified in its entirety by reference to the Amendment, a copy is filed as Exhibit 10.1 to this Current Report

on Form 8-K and is incorporated herein by reference.

On December 16, 2019, Kewaunee Scientific Corporation (the “Company”) announced that the Company’s Board of Directors has elected to

suspend the Company’s dividend, as the Company believes that at this time, investing in projects intended to improve the Company’s operating performance will provide a better long-term return to the Company’s shareholders. These

investments include upgrading and replacement of the underlying information technology supporting all aspects of the business as well as capital investments intended to improve the Company’s manufacturing productivity and cost structure.

|

Item 9.01

|

Financial Statements and Exhibits

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

(Registrant)

Kewaunee Scientific Corporation

|

|

|

|

|

Date: December 16, 2019

|

|

/s/ Donald T. Gardner III

|

|

|

|

Donald T. Gardner III

|

|

|

|

Vice President, Finance and Chief Financial Officer

|

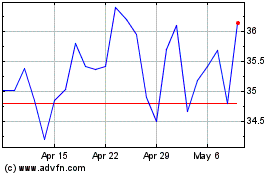

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From Mar 2024 to Apr 2024

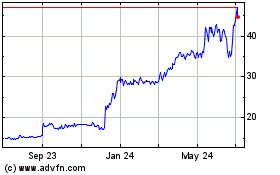

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From Apr 2023 to Apr 2024