Kelly Services (Nasdaq: KELYA) (Nasdaq: KELYB), a global leader in

providing workforce solutions, today announced results for the

third quarter of 2019.

Peter W. Quigley, President and Chief Executive Officer,

announced revenue for the third quarter of 2019 totaled $1.3

billion, a 5.6% decrease, or 4.8% in constant currency, compared to

the corresponding quarter of 2018. Third quarter 2019 results

include the impact of the January 2019 acquisitions of NextGen and

Global Technology Associates, providers of specialty engineering

talent to the U.S. telecommunications industry. Excluding the

recent acquisitions, adjusted revenue declined 8.2% in the third

quarter, or 7.5% in constant

currency.

Earnings from operations for the third quarter of 2019 totaled

$17.1 million, compared to the $21.9 million reported for the third

quarter of 2018.

Diluted loss per share in the third quarter of 2019 was $0.27

compared to earnings per share of $0.84 in the third quarter of

2018. Included in the loss per share in the third quarter of 2019

is the unfavorable impact of $0.70 due to the non-cash after-tax

loss on our investment in Persol Holdings common stock compared to

a gain of $0.28 in the third quarter of 2018.

"It was a challenging quarter as our newly restructured U.S.

branch operations sought to capture high-value growth amidst a

sluggish manufacturing sector and a tight labor market,” noted

Quigley. “Despite pressure on the top line, we delivered

improvements in GP rate, saw strong performance in our specialty

acquisitions, and effectively contained costs. Our forward focus is

on balancing the value-and-volume equation in our portfolio;

managing expenses to align with revenue; and advancing our

specialty talent solutions strategy.”

Kelly also reported that on November 5, 2019 its board of

directors declared a dividend of $0.075 per share. The dividend is

payable December 5, 2019 to shareholders of record as of the close

of business on November 20, 2019.

In conjunction with its third quarter earnings release, Kelly

Services has published a financial presentation on the Investor

Relations page of our public website and will host a conference

call at 9:00 a.m. (ET) on November 6 to review the results and

answer questions. The call may be accessed in one of the following

ways:

Via the Internet:Kellyservices.com

| Via the

Telephone: |

|

|

| U.S. |

|

1 800 288-9626 |

| International |

|

1 651 291-5254 |

The pass code is Kelly Services

This release contains statements that are forward looking in

nature and, accordingly, are subject to risks and

uncertainties. These factors include, but are not limited to,

competitive market pressures including pricing and technology

introductions and disruptions, changing market and economic

conditions, our ability to achieve our business strategy, the risk

of damage to our brand, the risk our intellectual property assets

could be infringed upon or compromised, our ability to successfully

develop new service offerings, our exposure to risks associated

with services outside traditional staffing, including business

process outsourcing, our increasing dependency on third parties for

the execution of critical functions, the risks associated with past

and future acquisitions, exposure to risks associated with

investments in equity affiliates including PersolKelly Asia

Pacific, material changes in demand from or loss of large corporate

customers as well as changes in their buying practices, risks

particular to doing business with the government or government

contractors, risks associated with conducting business in foreign

countries, including foreign currency fluctuations, the exposure to

potential market and currency exchange risks relating to our

investment in Persol Holdings, risks associated with violations of

anti-corruption, trade protection and other laws and regulations,

availability of qualified full-time employees, availability of

temporary workers with appropriate skills required by customers,

liabilities for employment-related claims and losses, including

class action lawsuits and collective actions, risks arising from

failure to preserve the privacy of information entrusted to us or

to meet our obligations under global privacy laws, the risk of

cyber attacks or other breaches of network or information

technology security, our ability to sustain critical business

applications through our key data centers, our ability to

effectively implement and manage our information technology

projects, our ability to maintain adequate financial and management

processes and controls, risk of potential impairment charges

triggered by adverse industry developments or operational

circumstances, unexpected changes in claim trends on workers’

compensation, unemployment, disability and medical benefit plans,

the impact of changes in laws and regulations (including federal,

state and international tax laws), competition law risks, the risk

of additional tax or unclaimed property liabilities in excess of

our estimates, our ability to realize value from our tax credit and

net operating loss carryforwards, our ability to maintain specified

financial covenants in our bank facilities to continue to access

credit markets, and other risks, uncertainties and factors

discussed in this release and in the Company’s filings with the

Securities and Exchange Commission. Actual results may differ

materially from any forward-looking statements contained herein,

and we have no intention to update these statements.

About Kelly Services®Kelly Services,

Inc. (Nasdaq: KELYA, KELYB) connects talented people to

companies in need of their skills in areas including Science,

Engineering, Education, Office, Contact Center, Light Industrial,

and more. We’re always thinking about what’s next in the evolving

world of work, and we help people ditch the script on old ways of

thinking and embrace the value of all workstyles in the workplace.

We directly employ more than 500,000 people around the world, and

we connect thousands more with work through our global network of

talent suppliers and partners in our outsourcing and consulting

practice. Revenue in 2018 was $5.5 billion. Visit

kellyservices.com and let us help with what’s next for you.

KLYA-FIN

ANALYST & MEDIA

CONTACT:

James

Polehna

(248)

244-4586

james_polehna@kellyservices.com

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF EARNINGS |

|

FOR THE 13 WEEKS ENDED SEPTEMBER 29, 2019 AND SEPTEMBER 30,

2018 |

|

(UNAUDITED) |

|

(In millions of dollars except per share data) |

| |

|

|

|

|

|

|

|

% |

|

CC % |

|

| |

|

2019 |

|

2018 |

|

Change |

|

Change |

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

1,267.7 |

|

$ |

1,342.4 |

|

$ |

(74.7 |

) |

|

(5.6 |

) |

% |

(4.8 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of services |

|

1,040.0 |

|

|

1,103.3 |

|

|

(63.3 |

) |

|

(5.7 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

227.7 |

|

|

239.1 |

|

|

(11.4 |

) |

|

(4.8 |

) |

|

(4.1 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

210.6 |

|

|

217.2 |

|

|

(6.6 |

) |

|

(3.0 |

) |

|

(2.4 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings from operations |

|

17.1 |

|

|

21.9 |

|

|

(4.8 |

) |

|

(22.2 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gain (loss) on investment in Persol Holdings |

|

(39.3 |

) |

|

15.8 |

|

|

(55.1 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense), net |

|

(0.2 |

) |

|

(0.7 |

) |

|

0.5 |

|

|

75.5 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) before

taxes and equity in net earnings (loss) of affiliate |

|

(22.4 |

) |

|

37.0 |

|

|

(59.4 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense (benefit) |

|

(12.8 |

) |

|

5.9 |

|

|

(18.7 |

) |

|

(314.8 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss)

before equity in net earnings (loss) of affiliate |

|

(9.6 |

) |

|

31.1 |

|

|

(40.7 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net earnings (loss) of affiliate |

|

(0.9 |

) |

|

2.0 |

|

|

(2.9 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) |

$ |

(10.5 |

) |

$ |

33.1 |

|

$ |

(43.6 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share |

$ |

(0.27 |

) |

$ |

0.84 |

|

$ |

(1.11 |

) |

|

NM |

|

|

|

|

| Diluted earnings (loss) per share |

$ |

(0.27 |

) |

$ |

0.84 |

|

$ |

(1.11 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| STATISTICS: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Permanent placement income

(included in revenue from services) |

$ |

15.1 |

|

$ |

18.4 |

|

$ |

(3.3 |

) |

|

(18.3 |

) |

% |

(17.3 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit rate |

|

18.0 |

|

% |

17.8 |

|

% |

0.2 |

|

pts. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Conversion rate |

|

7.5 |

|

|

9.2 |

|

|

(1.7 |

) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| % Return: |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from operations |

|

1.3 |

|

|

1.6 |

|

|

(0.3 |

) |

|

|

|

|

|

|

Net earnings (loss) |

|

(0.8 |

) |

|

2.5 |

|

|

(3.3 |

) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Effective income tax rate |

|

57.3 |

|

% |

16.1 |

|

% |

41.2 |

|

pts. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average number of shares

outstanding (millions): |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39.1 |

|

|

38.8 |

|

|

|

|

|

|

|

|

|

Diluted |

|

39.1 |

|

|

38.9 |

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF EARNINGS |

|

FOR THE 39 WEEKS ENDED SEPTEMBER 29, 2019 AND SEPTEMBER 30,

2018 |

|

(UNAUDITED) |

|

(In millions of dollars except per share data) |

| |

|

|

|

|

|

|

|

% |

|

CC % |

|

| |

|

2019 |

|

2018 |

|

Change |

|

Change |

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

4,017.8 |

|

$ |

4,099.2 |

|

$ |

(81.4 |

) |

|

(2.0 |

) |

% |

(0.7 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of services |

|

3,294.5 |

|

|

3,381.4 |

|

|

(86.9 |

) |

|

(2.6 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

723.3 |

|

|

717.8 |

|

|

5.5 |

|

|

0.8 |

|

|

1.9 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

666.9 |

|

|

663.5 |

|

|

3.4 |

|

|

0.5 |

|

|

1.6 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of assets |

|

12.3 |

|

|

— |

|

|

12.3 |

|

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings from operations |

|

68.7 |

|

|

54.3 |

|

|

14.4 |

|

|

26.3 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gain (loss) on investment in Persol Holdings |

|

35.1 |

|

|

(13.0 |

) |

|

48.1 |

|

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense), net |

|

(1.1 |

) |

|

(1.8 |

) |

|

0.7 |

|

|

38.2 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) before

taxes and equity in net earnings (loss) of affiliate |

|

102.7 |

|

|

39.5 |

|

|

63.2 |

|

|

159.2 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense (benefit) |

|

6.3 |

|

|

(3.3 |

) |

|

9.6 |

|

|

293.3 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss)

before equity in net earnings (loss) of affiliate |

|

96.4 |

|

|

42.8 |

|

|

53.6 |

|

|

125.0 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Equity in net earnings (loss) of affiliate |

|

(1.0 |

) |

|

4.0 |

|

|

(5.0 |

) |

|

NM |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

$ |

95.4 |

|

$ |

46.8 |

|

$ |

48.6 |

|

|

103.6 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

2.42 |

|

$ |

1.20 |

|

$ |

1.22 |

|

|

101.7 |

|

|

|

|

| Diluted earnings per share |

$ |

2.41 |

|

$ |

1.19 |

|

$ |

1.22 |

|

|

102.5 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| STATISTICS: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Permanent placement income

(included in revenue from services) |

$ |

46.7 |

|

$ |

52.3 |

|

$ |

(5.6 |

) |

|

(10.9 |

) |

% |

(8.6 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit rate |

|

18.0 |

|

% |

17.5 |

|

% |

0.5 |

|

pts. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Conversion rate |

|

9.5 |

|

|

7.6 |

|

|

1.9 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| % Return: |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from operations |

|

1.7 |

|

|

1.3 |

|

|

0.4 |

|

|

|

|

|

|

|

Net earnings |

|

2.4 |

|

|

1.1 |

|

|

1.3 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Effective income tax rate |

|

6.1 |

|

% |

(8.2 |

) |

% |

14.3 |

|

pts. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average number of shares

outstanding (millions): |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39.0 |

|

|

38.7 |

|

|

|

|

|

|

|

|

|

Diluted |

|

39.2 |

|

|

38.8 |

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

RESULTS OF OPERATIONS BY SEGMENT |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Third Quarter |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

% |

|

CC

% |

|

| |

|

2019 |

|

|

2018 |

|

Change |

|

Change |

|

| Americas Staffing |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

516.0 |

|

|

$ |

561.8 |

|

|

(8.1 |

) |

% |

(8.0 |

) |

% |

|

Gross profit |

|

93.9 |

|

|

|

106.0 |

|

|

(11.3 |

) |

|

(11.2 |

) |

|

|

SG&A expenses excluding restructuring charges |

|

89.9 |

|

|

|

91.2 |

|

|

(1.3 |

) |

|

(1.2 |

) |

|

|

Restructuring charges |

|

(0.1 |

) |

|

|

— |

|

|

NM |

|

|

NM |

|

|

|

Total SG&A expenses |

|

89.8 |

|

|

|

91.2 |

|

|

(1.4 |

) |

|

(1.3 |

) |

|

|

Earnings from operations |

|

4.1 |

|

|

|

14.8 |

|

|

(72.6 |

) |

|

|

|

|

Earnings from operations excluding restructuring charges |

|

4.0 |

|

|

|

14.8 |

|

|

(73.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

18.2 |

|

% |

|

18.9 |

|

% |

(0.7 |

) |

pts. |

|

|

|

Conversion rate |

|

4.3 |

|

|

|

14.0 |

|

|

(9.7 |

) |

|

|

|

|

Conversion rate excluding restructuring charges |

|

4.2 |

|

|

|

14.0 |

|

|

(9.8 |

) |

|

|

|

|

Return on sales |

|

0.8 |

|

|

|

2.6 |

|

|

(1.8 |

) |

|

|

|

|

Return on sales excluding restructuring charges |

|

0.8 |

|

|

|

2.6 |

|

|

(1.8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global Talent Solutions |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

502.5 |

|

|

$ |

507.6 |

|

|

(1.0 |

) |

% |

(0.8 |

) |

% |

|

Gross profit |

|

99.6 |

|

|

|

97.3 |

|

|

2.3 |

|

|

2.8 |

|

|

|

Total SG&A expenses |

|

71.2 |

|

|

|

73.2 |

|

|

(2.8 |

) |

|

(2.4 |

) |

|

|

Earnings from operations |

|

28.4 |

|

|

|

24.1 |

|

|

18.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

19.8 |

|

% |

|

19.2 |

|

% |

0.6 |

|

pts. |

|

|

|

Conversion rate |

|

28.5 |

|

|

|

24.7 |

|

|

3.8 |

|

|

|

|

|

Return on sales |

|

5.6 |

|

|

|

4.7 |

|

|

0.9 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| International Staffing |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

252.9 |

|

|

$ |

277.2 |

|

|

(8.8 |

) |

% |

(5.8 |

) |

% |

|

Gross profit |

|

34.7 |

|

|

|

36.4 |

|

|

(4.8 |

) |

|

(1.8 |

) |

|

|

Total SG&A expenses |

|

31.2 |

|

|

|

31.6 |

|

|

(0.9 |

) |

|

2.1 |

|

|

|

Earnings from operations |

|

3.5 |

|

|

|

4.8 |

|

|

(29.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

13.7 |

|

% |

|

13.2 |

|

% |

0.5 |

|

pts. |

|

|

|

Conversion rate |

|

9.9 |

|

|

|

13.5 |

|

|

(3.6 |

) |

|

|

|

|

Return on sales |

|

1.4 |

|

|

|

1.8 |

|

|

(0.4 |

) |

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

RESULTS OF OPERATIONS BY SEGMENT |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

September Year to Date |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

% |

|

CC % |

|

| |

|

2019 |

|

|

2018 |

|

Change |

|

Change |

|

| Americas Staffing |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

1,740.1 |

|

|

$ |

1,770.1 |

|

|

(1.7 |

) |

% |

(1.4 |

) |

% |

|

Gross profit |

|

319.9 |

|

|

|

322.5 |

|

|

(0.8 |

) |

|

(0.6 |

) |

|

|

SG&A expenses excluding restructuring charges |

|

278.6 |

|

|

|

273.8 |

|

|

1.7 |

|

|

2.0 |

|

|

|

Restructuring charges |

|

5.6 |

|

|

|

— |

|

|

NM |

|

|

NM |

|

|

|

Total SG&A expenses |

|

284.2 |

|

|

|

273.8 |

|

|

3.8 |

|

|

4.1 |

|

|

|

Earnings from operations |

|

35.7 |

|

|

|

48.7 |

|

|

(26.7 |

) |

|

|

|

|

Earnings from operations excluding restructuring charges |

|

41.3 |

|

|

|

48.7 |

|

|

(15.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

18.4 |

|

% |

|

18.2 |

|

% |

0.2 |

|

pts. |

|

|

|

Conversion rate |

|

11.2 |

|

|

|

15.1 |

|

|

(3.9 |

) |

|

|

|

|

Conversion rate excluding restructuring charges |

|

12.9 |

|

|

|

15.1 |

|

|

(2.2 |

) |

|

|

|

|

Return on sales |

|

2.1 |

|

|

|

2.8 |

|

|

(0.7 |

) |

|

|

|

|

Return on sales excluding restructuring charges |

|

2.4 |

|

|

|

2.8 |

|

|

(0.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global Talent Solutions |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

1,509.4 |

|

|

$ |

1,494.1 |

|

|

1.0 |

|

% |

1.4 |

|

% |

|

Gross profit |

|

299.7 |

|

|

|

281.8 |

|

|

6.3 |

|

|

7.0 |

|

|

|

Total SG&A expenses |

|

220.2 |

|

|

|

224.0 |

|

|

(1.7 |

) |

|

(1.0 |

) |

|

|

Earnings from operations |

|

79.5 |

|

|

|

57.8 |

|

|

37.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

19.9 |

|

% |

|

18.9 |

|

% |

1.0 |

|

pts. |

|

|

|

Conversion rate |

|

26.5 |

|

|

|

20.5 |

|

|

6.0 |

|

|

|

|

|

Return on sales |

|

5.3 |

|

|

|

3.9 |

|

|

1.4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| International Staffing |

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

779.9 |

|

|

$ |

848.5 |

|

|

(8.1 |

) |

% |

(3.0 |

) |

% |

|

Gross profit |

|

105.4 |

|

|

|

115.4 |

|

|

(8.7 |

) |

|

(3.6 |

) |

|

|

Total SG&A expenses |

|

95.1 |

|

|

|

99.2 |

|

|

(4.0 |

) |

|

1.0 |

|

|

|

Earnings from operations |

|

10.3 |

|

|

|

16.2 |

|

|

(36.9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit rate |

|

13.5 |

|

% |

|

13.6 |

|

% |

(0.1 |

) |

pts. |

|

|

|

Conversion rate |

|

9.7 |

|

|

|

14.1 |

|

|

(4.4 |

) |

|

|

|

|

Return on sales |

|

1.3 |

|

|

|

1.9 |

|

|

(0.6 |

) |

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

| |

|

September 29, 2019 |

|

December 30, 2018 |

|

September 30, 2018 |

| Current Assets |

|

|

|

|

|

|

|

Cash and equivalents |

$ |

22.8 |

|

$ |

35.3 |

|

$ |

20.8 |

|

|

Trade accounts receivable, less allowances of |

|

|

|

|

|

|

|

$12.2, $13.2, and $12.4, respectively |

|

1,262.3 |

|

|

1,293.3 |

|

|

1,294.0 |

|

|

Prepaid expenses and other current assets |

|

80.7 |

|

|

71.9 |

|

|

68.0 |

|

| Total current assets |

|

1,365.8 |

|

|

1,400.5 |

|

|

1,382.8 |

|

| |

|

|

|

|

|

|

| Noncurrent Assets |

|

|

|

|

|

|

|

Property and equipment, net |

|

82.7 |

|

|

86.3 |

|

|

85.0 |

|

|

Operating lease right-of-use assets |

|

62.2 |

|

|

— |

|

|

— |

|

|

Deferred taxes |

|

221.0 |

|

|

198.7 |

|

|

196.5 |

|

|

Goodwill |

|

127.8 |

|

|

107.3 |

|

|

107.3 |

|

|

Investment in Persol Holdings |

|

174.9 |

|

|

135.1 |

|

|

213.6 |

|

|

Investment in equity affiliate |

|

120.4 |

|

|

121.3 |

|

|

120.3 |

|

|

Other assets |

|

321.5 |

|

|

265.2 |

|

|

287.6 |

|

| Total noncurrent assets |

|

1,110.5 |

|

|

913.9 |

|

|

1,010.3 |

|

| |

|

|

|

|

|

|

| Total

Assets |

$ |

2,476.3 |

|

$ |

2,314.4 |

|

$ |

2,393.1 |

|

| |

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

Short-term borrowings |

$ |

17.5 |

|

$ |

2.2 |

|

$ |

8.1 |

|

|

Accounts payable and accrued liabilities |

|

484.6 |

|

|

540.6 |

|

|

497.0 |

|

|

Operating lease liabilities |

|

19.8 |

|

|

— |

|

|

— |

|

|

Accrued payroll and related taxes |

|

285.3 |

|

|

266.0 |

|

|

304.7 |

|

|

Accrued workers' compensation and other claims |

|

25.1 |

|

|

26.0 |

|

|

25.9 |

|

|

Income and other taxes |

|

67.7 |

|

|

62.7 |

|

|

66.5 |

|

| Total current liabilities |

|

900.0 |

|

|

897.5 |

|

|

902.2 |

|

| |

|

|

|

|

|

|

| Noncurrent Liabilities |

|

|

|

|

|

|

|

Operating lease liabilities |

|

45.3 |

|

|

— |

|

|

— |

|

|

Accrued workers' compensation and other claims |

|

48.7 |

|

|

50.5 |

|

|

50.2 |

|

|

Accrued retirement benefits |

|

179.0 |

|

|

162.9 |

|

|

186.9 |

|

|

Other long-term liabilities |

|

55.5 |

|

|

44.0 |

|

|

68.0 |

|

| Total noncurrent liabilities |

|

328.5 |

|

|

257.4 |

|

|

305.1 |

|

| |

|

|

|

|

|

|

| Stockholders' Equity |

|

|

|

|

|

|

|

Common stock |

|

40.1 |

|

|

40.1 |

|

|

40.1 |

|

|

Treasury stock |

|

(21.3 |

) |

|

(26.0 |

) |

|

(27.3 |

) |

|

Paid-in capital |

|

22.3 |

|

|

24.4 |

|

|

25.0 |

|

|

Earnings invested in the business |

|

1,224.6 |

|

|

1,138.1 |

|

|

1,165.0 |

|

|

Accumulated other comprehensive income (loss) |

|

(17.9 |

) |

|

(17.1 |

) |

|

(17.0 |

) |

| Total stockholders' equity |

|

1,247.8 |

|

|

1,159.5 |

|

|

1,185.8 |

|

| |

|

|

|

|

|

|

| Total Liabilities and Stockholders'

Equity |

$ |

2,476.3 |

|

$ |

2,314.4 |

|

$ |

2,393.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STATISTICS: |

|

|

|

|

|

|

|

Working Capital |

$ |

465.8 |

|

$ |

503.0 |

|

$ |

480.6 |

|

|

Current Ratio |

|

1.5 |

|

|

1.6 |

|

|

1.5 |

|

|

Debt-to-capital % |

|

1.4 |

% |

|

0.2 |

% |

|

0.7 |

% |

|

Global Days Sales Outstanding |

|

59 |

|

|

55 |

|

|

58 |

|

|

Year-to-Date Free Cash Flow |

$ |

60.4 |

|

$ |

35.8 |

|

$ |

15.4 |

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

FOR THE 39 WEEKS ENDED SEPTEMBER 29, 2019 AND SEPTEMBER 30,

2018 |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

| |

|

2019 |

|

2018 |

| Cash flows from

operating activities: |

|

|

|

|

|

Net earnings |

$ |

95.4 |

|

$ |

46.8 |

|

|

Adjustments to reconcile net earnings to net cash from operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

23.8 |

|

|

19.5 |

|

|

Operating lease asset amortization |

|

16.9 |

|

|

— |

|

|

Provision for bad debts |

|

3.2 |

|

|

1.3 |

|

|

Stock-based compensation |

|

4.7 |

|

|

6.7 |

|

|

(Gain) loss on investment in Persol Holdings |

|

(35.1 |

) |

|

13.0 |

|

|

(Gain) loss on sale of assets |

|

(12.3 |

) |

|

— |

|

|

Equity in net (earnings) loss of PersolKelly Asia Pacific |

|

1.0 |

|

|

(4.0 |

) |

|

Other, net |

|

(1.0 |

) |

|

(1.0 |

) |

|

Changes in operating assets and liabilities, net of

acquisitions |

|

(22.4 |

) |

|

(49.0 |

) |

| |

|

|

|

|

|

Net cash from operating activities |

|

74.2 |

|

|

33.3 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

Capital expenditures |

|

(13.8 |

) |

|

(17.9 |

) |

|

Acquisition of companies, net of cash received |

|

(86.4 |

) |

|

— |

|

|

Investment in equity securities |

|

(1.0 |

) |

|

(5.0 |

) |

|

Loans to equity affiliate |

|

(4.4 |

) |

|

(2.9 |

) |

|

Proceeds from sale of assets |

|

13.8 |

|

|

— |

|

|

Proceeds from company-owned life insurance |

|

3.0 |

|

|

— |

|

|

Other investing activities |

|

— |

|

|

(0.8 |

) |

| |

|

|

|

|

|

Net cash used in investing activities |

|

(88.8 |

) |

|

(26.6 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

Net change in short-term borrowings |

|

15.2 |

|

|

(1.9 |

) |

|

Financing lease payments |

|

(0.4 |

) |

|

— |

|

|

Dividend payments |

|

(8.9 |

) |

|

(8.8 |

) |

|

Payments of tax withholding for stock awards |

|

(2.3 |

) |

|

(6.3 |

) |

| |

|

|

|

|

|

Net cash from (used in) financing activities |

|

3.6 |

|

|

(17.0 |

) |

| |

|

|

|

|

| Effect of exchange

rates on cash, cash equivalents and restricted cash |

|

(0.5 |

) |

|

(0.7 |

) |

| |

|

|

|

|

| Net change in cash,

cash equivalents and restricted cash |

|

(11.5 |

) |

|

(11.0 |

) |

| Cash, cash equivalents

and restricted cash at beginning of period |

|

40.1 |

|

|

36.9 |

|

| |

|

|

|

|

| Cash, cash equivalents

and restricted cash at end of period |

$ |

28.6 |

|

$ |

25.9 |

|

| |

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

REVENUE FROM SERVICES |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

|

|

|

| |

|

Third Quarter (Americas, International and

GTS) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

% |

|

CC % |

|

| |

|

2019 |

|

2018 |

|

Change |

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

| Americas |

|

|

|

|

|

|

|

|

|

|

United States |

$ |

903.2 |

|

$ |

942.5 |

|

|

(4.2 |

) |

% |

(4.2 |

) |

% |

|

Canada |

|

34.6 |

|

|

37.0 |

|

|

(6.5 |

) |

|

(5.5 |

) |

|

|

Mexico |

|

32.4 |

|

|

32.3 |

|

|

0.6 |

|

|

3.1 |

|

|

|

Puerto Rico |

|

18.8 |

|

|

28.2 |

|

|

(33.2 |

) |

|

(33.2 |

) |

|

|

Brazil |

|

8.4 |

|

|

8.1 |

|

|

3.1 |

|

|

4.3 |

|

|

| Total

Americas |

|

997.4 |

|

|

1,048.1 |

|

|

(4.8 |

) |

|

(4.7 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| EMEA |

|

|

|

|

|

|

|

|

|

|

France |

|

59.7 |

|

|

68.8 |

|

|

(13.4 |

) |

|

(9.4 |

) |

|

|

Switzerland |

|

50.6 |

|

|

53.8 |

|

|

(6.0 |

) |

|

(5.8 |

) |

|

|

Portugal |

|

44.0 |

|

|

48.2 |

|

|

(8.5 |

) |

|

(4.2 |

) |

|

|

Russia |

|

29.9 |

|

|

24.0 |

|

|

24.2 |

|

|

22.4 |

|

|

|

United Kingdom |

|

24.9 |

|

|

28.1 |

|

|

(11.3 |

) |

|

(6.2 |

) |

|

|

Italy |

|

18.5 |

|

|

18.3 |

|

|

0.9 |

|

|

5.6 |

|

|

|

Germany |

|

11.5 |

|

|

13.8 |

|

|

(16.4 |

) |

|

(12.5 |

) |

|

|

Ireland |

|

7.1 |

|

|

11.3 |

|

|

(36.7 |

) |

|

(33.9 |

) |

|

|

Other |

|

16.6 |

|

|

21.8 |

|

|

(24.0 |

) |

|

(19.5 |

) |

|

| Total

EMEA |

|

262.8 |

|

|

288.1 |

|

|

(8.8 |

) |

|

(5.8 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Total

APAC |

|

7.5 |

|

|

6.2 |

|

|

19.8 |

|

|

25.9 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Total Kelly Services,

Inc. |

$ |

1,267.7 |

|

$ |

1,342.4 |

|

|

(5.6 |

) |

% |

(4.8 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

REVENUE FROM SERVICES |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

|

|

|

| |

|

September Year to Date (Americas, International and

GTS) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

% |

|

CC % |

|

| |

|

2019 |

|

2018 |

|

Change |

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

| Americas |

|

|

|

|

|

|

|

|

|

|

United States |

$ |

2,913.4 |

|

$ |

2,898.4 |

|

|

0.5 |

|

% |

0.5 |

|

% |

|

Canada |

|

100.8 |

|

|

107.6 |

|

|

(6.3 |

) |

|

(3.3 |

) |

|

|

Mexico |

|

89.6 |

|

|

92.7 |

|

|

(3.3 |

) |

|

(2.2 |

) |

|

|

Puerto Rico |

|

57.6 |

|

|

74.2 |

|

|

(22.3 |

) |

|

(22.3 |

) |

|

|

Brazil |

|

25.1 |

|

|

26.6 |

|

|

(5.9 |

) |

|

3.9 |

|

|

| Total

Americas |

|

3,186.5 |

|

|

3,199.5 |

|

|

(0.4 |

) |

|

(0.2 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| EMEA |

|

|

|

|

|

|

|

|

|

|

France |

|

188.6 |

|

|

212.7 |

|

|

(11.4 |

) |

|

(5.8 |

) |

|

|

Switzerland |

|

150.0 |

|

|

156.3 |

|

|

(4.1 |

) |

|

(1.8 |

) |

|

|

Portugal |

|

135.5 |

|

|

150.5 |

|

|

(9.9 |

) |

|

(4.3 |

) |

|

|

Russia |

|

84.1 |

|

|

75.7 |

|

|

11.1 |

|

|

17.3 |

|

|

|

United Kingdom |

|

81.6 |

|

|

85.6 |

|

|

(4.6 |

) |

|

1.2 |

|

|

|

Italy |

|

59.8 |

|

|

58.1 |

|

|

2.9 |

|

|

9.4 |

|

|

|

Germany |

|

32.5 |

|

|

45.0 |

|

|

(27.8 |

) |

|

(23.2 |

) |

|

|

Ireland |

|

28.1 |

|

|

34.3 |

|

|

(17.9 |

) |

|

(12.7 |

) |

|

|

Other |

|

51.5 |

|

|

64.6 |

|

|

(20.3 |

) |

|

(14.5 |

) |

|

| Total

EMEA |

|

811.7 |

|

|

882.8 |

|

|

(8.1 |

) |

|

(3.0 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Total

APAC |

|

19.6 |

|

|

16.9 |

|

|

16.0 |

|

|

23.9 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Total Kelly Services,

Inc. |

$ |

4,017.8 |

|

$ |

4,099.2 |

|

|

(2.0 |

) |

% |

(0.7 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

THIRD QUARTER |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

| |

2019 |

|

2018 |

| Revenue from

Services: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

|

Americas Staffing |

$ |

516.0 |

|

|

$ |

— |

|

|

$ |

(20.0 |

) |

|

$ |

496.0 |

|

|

$ |

561.8 |

|

| Global Talent Solutions |

502.5 |

|

|

— |

|

|

(15.8 |

) |

|

486.7 |

|

|

507.6 |

|

| International Staffing |

252.9 |

|

|

— |

|

|

— |

|

|

252.9 |

|

|

277.2 |

|

| Intersegment |

(3.7 |

) |

|

— |

|

|

— |

|

|

(3.7 |

) |

|

(4.2 |

) |

| Total Company |

$ |

1,267.7 |

|

|

$ |

— |

|

|

$ |

(35.8 |

) |

|

$ |

1,231.9 |

|

|

$ |

1,342.4 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| Gross

Profit: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

| Americas Staffing |

$ |

93.9 |

|

|

$ |

— |

|

|

$ |

(6.6 |

) |

|

$ |

87.3 |

|

|

$ |

106.0 |

|

| Global Talent Solutions |

99.6 |

|

|

— |

|

|

(3.3 |

) |

|

96.3 |

|

|

97.3 |

|

| International Staffing |

34.7 |

|

|

— |

|

|

— |

|

|

34.7 |

|

|

36.4 |

|

| Intersegment |

(0.5 |

) |

|

— |

|

|

— |

|

|

(0.5 |

) |

|

(0.6 |

) |

| Total Company |

$ |

227.7 |

|

|

$ |

— |

|

|

$ |

(9.9 |

) |

|

$ |

217.8 |

|

|

$ |

239.1 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| SG&A

Expenses: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

| Americas Staffing |

$ |

89.8 |

|

|

$ |

0.1 |

|

|

$ |

(4.9 |

) |

|

$ |

85.0 |

|

|

$ |

91.2 |

|

| Global Talent Solutions |

71.2 |

|

|

— |

|

|

(2.0 |

) |

|

69.2 |

|

|

73.2 |

|

| International Staffing |

31.2 |

|

|

— |

|

|

— |

|

|

31.2 |

|

|

31.6 |

|

| Corporate |

18.9 |

|

|

— |

|

|

— |

|

|

18.9 |

|

|

21.8 |

|

| Intersegment |

(0.5 |

) |

|

— |

|

|

— |

|

|

(0.5 |

) |

|

(0.6 |

) |

| Total Company |

$ |

210.6 |

|

|

$ |

0.1 |

|

|

$ |

(6.9 |

) |

|

$ |

203.8 |

|

|

$ |

217.2 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| Earnings from

Operations: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Gain on sale of assets(4) |

|

Adjusted |

|

As Reported |

|

Americas Staffing |

$ |

4.1 |

|

|

$ |

(0.1 |

) |

|

$ |

(1.7 |

) |

|

$ |

— |

|

|

$ |

2.3 |

|

|

$ |

14.8 |

|

| Global Talent Solutions |

28.4 |

|

|

— |

|

|

(1.3 |

) |

|

— |

|

|

27.1 |

|

|

24.1 |

|

| International Staffing |

3.5 |

|

|

— |

|

|

— |

|

|

— |

|

|

3.5 |

|

|

4.8 |

|

| Corporate |

(18.9 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(18.9 |

) |

|

(21.8 |

) |

| Total Company |

$ |

17.1 |

|

|

$ |

(0.1 |

) |

|

$ |

(3.0 |

) |

|

$ |

— |

|

|

$ |

14.0 |

|

|

$ |

21.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP MEASURES |

|

SEPTEMBER YEAR TO DATE |

|

(UNAUDITED) |

|

(In millions of dollars) |

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| Revenue from

Services: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

|

Americas Staffing |

$ |

1,740.1 |

|

|

$ |

— |

|

|

$ |

(62.9 |

) |

|

$ |

1,677.2 |

|

|

$ |

1,770.1 |

|

| Global Talent Solutions |

1,509.4 |

|

|

— |

|

|

(48.2 |

) |

|

1,461.2 |

|

|

1,494.1 |

|

| International Staffing |

779.9 |

|

|

— |

|

|

— |

|

|

779.9 |

|

|

848.5 |

|

| Intersegment |

(11.6 |

) |

|

— |

|

|

— |

|

|

(11.6 |

) |

|

(13.5 |

) |

| Total Company |

$ |

4,017.8 |

|

|

$ |

— |

|

|

$ |

(111.1 |

) |

|

$ |

3,906.7 |

|

|

$ |

4,099.2 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| Gross

Profit: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

| Americas Staffing |

$ |

319.9 |

|

|

$ |

— |

|

|

$ |

(19.8 |

) |

|

$ |

300.1 |

|

|

$ |

322.5 |

|

| Global Talent Solutions |

299.7 |

|

|

— |

|

|

(10.3 |

) |

|

289.4 |

|

|

281.8 |

|

| International Staffing |

105.4 |

|

|

— |

|

|

— |

|

|

105.4 |

|

|

115.4 |

|

| Intersegment |

(1.7 |

) |

|

— |

|

|

— |

|

|

(1.7 |

) |

|

(1.9 |

) |

| Total Company |

$ |

723.3 |

|

|

$ |

— |

|

|

$ |

(30.1 |

) |

|

$ |

693.2 |

|

|

$ |

717.8 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| SG&A

Expenses: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Adjusted |

|

As Reported |

| Americas Staffing |

$ |

284.2 |

|

|

$ |

(5.6 |

) |

|

$ |

(14.9 |

) |

|

$ |

263.7 |

|

|

$ |

273.8 |

|

| Global Talent Solutions |

220.2 |

|

|

— |

|

|

(5.7 |

) |

|

214.5 |

|

|

224.0 |

|

| International Staffing |

95.1 |

|

|

— |

|

|

— |

|

|

95.1 |

|

|

99.2 |

|

| Corporate |

69.1 |

|

|

— |

|

|

— |

|

|

69.1 |

|

|

68.4 |

|

| Intersegment |

(1.7 |

) |

|

— |

|

|

— |

|

|

(1.7 |

) |

|

(1.9 |

) |

| Total Company |

$ |

666.9 |

|

|

$ |

(5.6 |

) |

|

$ |

(20.6 |

) |

|

$ |

640.7 |

|

|

$ |

663.5 |

|

| |

|

|

|

|

|

|

|

|

|

| |

2019 |

|

2018 |

| Earnings from

Operations: |

As Reported |

|

Restructuring(2) |

|

Acquisitions(3) |

|

Gain on sale of assets(4) |

|

Adjusted |

|

As Reported |

|

Americas Staffing |

$ |

35.7 |

|

|

$ |

5.6 |

|

|

$ |

(4.9 |

) |

|

$ |

— |

|

|

$ |

36.4 |

|

|

$ |

48.7 |

|

| Global Talent Solutions |

79.5 |

|

|

— |

|

|

(4.6 |

) |

|

— |

|

|

74.9 |

|

|

57.8 |

|

| International Staffing |

10.3 |

|

|

— |

|

|

— |

|

|

— |

|

|

10.3 |

|

|

16.2 |

|

| Corporate |

(56.8 |

) |

|

— |

|

|

— |

|

|

(12.3 |

) |

|

(69.1 |

) |

|

(68.4 |

) |

| Total Company |

$ |

68.7 |

|

|

$ |

5.6 |

|

|

$ |

(9.5 |

) |

|

$ |

(12.3 |

) |

|

$ |

52.5 |

|

|

$ |

54.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KELLY SERVICES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP MEASURES

(continued) |

|

(UNAUDITED) |

|

(In millions of dollars except per share data) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Third Quarter |

|

September Year to Date |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Income tax expense (benefit) |

|

$ |

(12.8 |

) |

|

$ |

5.9 |

|

|

$ |

6.3 |

|

|

$ |

(3.3 |

) |

| Taxes on investment in Persol

Holdings(1) |

|

12.1 |

|

|

(4.9 |

) |

|

(10.7 |

) |

|

4.0 |

|

| Taxes on restructuring

charges(2) |

|

— |

|

|

— |

|

|

1.5 |

|

|

— |

|

| Taxes on acquisitions(3) |

|

(0.8 |

) |

|

— |

|

|

(2.4 |

) |

|

— |

|

| Taxes on gain on sale of

assets(4) |

|

— |

|

|

— |

|

|

(3.3 |

) |

|

— |

|

| Adjusted income tax expense

(benefit) |

|

$ |

(1.5 |

) |

|

$ |

1.0 |

|

|

$ |

(8.6 |

) |

|

$ |

0.7 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Third Quarter |

|

September Year to Date |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Net earnings (loss) |

|

$ |

(10.5 |

) |

|

$ |

33.1 |

|

|

$ |

95.4 |

|

|

$ |

46.8 |

|

| (Gain) loss on investment in

Persol Holdings, net of taxes(1) |

|

27.2 |

|

|

(10.9 |

) |

|

(24.4 |

) |

|

9.0 |

|

| Restructuring charges, net of

taxes(2) |

|

(0.1 |

) |

|

— |

|

|

4.1 |

|

|

— |

|

| Net earnings from

acquisitions(3) |

|

(2.2 |

) |

|

— |

|

|

(7.1 |

) |

|

— |

|

| Gain on sale of assets, net of

taxes(4) |

|

— |

|

|

— |

|

|

(9.0 |

) |

|

— |

|

| Adjusted net earnings |

|

$ |

14.4 |

|

|

$ |

22.2 |

|

|

$ |

59.0 |

|

|

$ |

55.8 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Third Quarter |

|

September Year to Date |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

| |

|

Per Share |

|

Per Share |

| Net earnings (loss) |

|

$ |

(0.27 |

) |

|

$ |

0.84 |

|

|

$ |

2.41 |

|

|

$ |

1.19 |

|

| (Gain) loss on investment in

Persol Holdings, net of taxes(1) |

|

0.70 |

|

|

(0.28 |

) |

|

(0.62 |

) |

|

0.23 |

|

| Restructuring charges, net of

taxes(2) |

|

— |

|

|

— |

|

|

0.11 |

|

|

— |

|

| Acquisitions, net of

taxes(3) |

|

(0.05 |

) |

|

— |

|

|

(0.18 |

) |

|

— |

|

| Gain on sale of assets, net of

taxes(4) |

|

— |

|

|

— |

|

|

(0.23 |

) |

|

— |

|

| Adjusted net earnings |

|

$ |

0.37 |

|

|

$ |

0.56 |

|

|

$ |

1.50 |

|

|

$ |

1.42 |

|

Note: Earnings per share amounts for each quarter are required

to be computed independently and may not equal the amounts computed

for the total year.

KELLY SERVICES, INC. AND

SUBSIDIARIESRECONCILIATION OF NON-GAAP

MEASURES(UNAUDITED)

Management believes that the non-GAAP (Generally Accepted

Accounting Principles) information excluding the 2019 and 2018

gains and losses on the investment in Persol Holdings, the 2019

restructuring charges, the 2019 acquisitions, and the 2019 gain on

sale of assets are useful to understand the Company's fiscal 2019

financial performance and increases comparability.

Specifically, Management believes that removing the impact of these

items allows for a meaningful comparison of current period

operating performance with the operating results of prior

periods. Additionally, the Company does not acquire

businesses on a predictable cycle and the terms of each acquisition

are unique and may vary significantly. Management also

believes that such measures are used by those analyzing performance

of companies in the staffing industry to compare current

performance to prior periods and to assess future performance.

These non-GAAP measures may have limitations as analytical tools

because they exclude items which can have a material impact on cash

flow and earnings per share. As a result, Management

considers these measures, along with reported results, when it

reviews and evaluates the Company's financial performance.

Management believes that these measures provide greater

transparency to investors and provide insight into how Management

is evaluating the Company's financial performance. Non-GAAP

measures should not be considered a substitute for, or superior to,

measures of financial performance prepared in accordance with

GAAP.

(1) The gains and losses on the investment in Persol

Holdings represent the change in fair value of the investment

during the period presented and the related tax expense and

benefit.

(2) Restructuring charges in 2019 represent severance

costs primarily related to U.S. branch-based staffing

operations.

(3) NextGen and GTA were acquired on January 2, 2019, and

were included in the reported results of operations of Americas

Staffing and GTS segments, respectively, from the date of

acquisition.

(4) Gain on sale of assets primarily represents the excess of

the proceeds over the cost of an unused parcel of land located near

the Company headquarters sold during the second quarter of

2019.

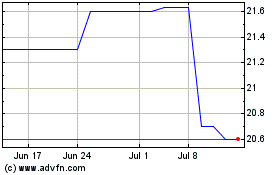

Kelly Services (NASDAQ:KELYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kelly Services (NASDAQ:KELYB)

Historical Stock Chart

From Apr 2023 to Apr 2024