J & J Snack Foods Corp. (NASDAQ-JJSF) today announced sales and

earnings for its fourth quarter and year ended September 28, 2019.

Sales for the fourth quarter this year increased

4% to $311.9 million from $300.7 million in last year’s fourth

quarter. For the year ended September 28, 2019, sales increased 4%

to $1.186 billion from $1.138 billion last year. Net earnings

increased 11% to $26.1 million ($1.36 per diluted share) in this

year’s fourth quarter compared to $23.4 million ($1.24 per diluted

share) last year and for the year earnings decreased 8% to $94.8

million ($5.00 per diluted share) from $103.6 million ($5.51 per

diluted share).

Operating income was $31.1 million in both

year’s fourth quarter. For the year, operating income

increased 6% to $117.0 million from $110.8 million last year.

Net earnings for last year’s quarter were

negatively impacted by a $1.4 million, or $0.07 per diluted

share, increase in income taxes because of changes to New Jersey

tax regulations enacted in July 2018 requiring the re-measurement

of deferred tax liabilities.

Net earnings for last year benefited from

a $20.9 million, or $1.11 per diluted share, gain on the

re-measurement of deferred tax liabilities and were impacted by a

$1.2 million, or $.06 per diluted share, provision for the one-time

repatriation tax both of which resulted from the Tax Cuts and

Jobs Act enacted in December 2017 and were also impacted by a

$1.4 million, or $0.07 per diluted share, increase in income

taxes because of the changes to New Jersey tax

regulations.

Gerald B. Shreiber, J & J’s President and

Chief Executive Officer, commented, “We are pleased that all of our

business segments had increased operating income for the

year. We will continue to work diligently toward improving

revenues, margins and operating income going forward.”

J&J Snack Foods Corp. (NASDAQ: JJSF) is a

leader and innovator in the snack food industry, providing

innovative, niche and affordable branded snack foods and beverages

to foodservice and retail supermarket outlets. Manufactured and

distributed nationwide, our principal products include

SUPERPRETZEL, the #1 soft pretzel brand in the world, as well as

internationally known ICEE and SLUSH PUPPIE frozen beverages,

LUIGI’S Real Italian Ice, MINUTE MAID* frozen ices, WHOLE FRUIT

sorbet and frozen fruit bars, SOUR PATCH KIDS** Flavored Ice Pops,

Tio Pepe’s & CALIFORNIA CHURROS, and THE FUNNEL CAKE FACTORY

funnel cakes and several bakery brands within DADDY RAY’S, COUNTRY

HOME BAKERS and HILL & VALLEY. With nearly twenty manufacturing

facilities, and more than $1 billion in annual revenue, J&J

Snack Foods Corp. has continued to see steady growth as a company,

reaching record sales for 48 consecutive years. The company

consistently seeks out opportunities to expand its unique niche

market product offering while bringing smiles to families

worldwide. For more information, please visit

http://www.jjsnack.com.

*MINUTE MAID is a registered trademark of The

Coca-Cola Company

**SOUR

PATCH KIDS is a registered trademark of Mondelēz International

group, used under license.

| |

|

|

| J

& J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF EARNINGS |

| (in

thousands, except per share information) |

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Year Ended |

|

|

|

|

|

|

|

|

|

|

|

September

28, |

|

September

29, |

|

September

28, |

|

September

29, |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

(13 weeks) |

|

(13 weeks) |

|

(52 weeks) |

|

(52 weeks) |

| |

|

|

|

|

|

|

|

| Net

Sales |

$ |

311,872 |

|

|

$ |

300,715 |

|

$ |

1,186,487 |

|

$ |

1,138,265 |

| Cost of

goods sold |

|

218,931 |

|

|

|

209,461 |

|

|

836,086 |

|

|

801,979 |

| Gross

Profit |

|

92,941 |

|

|

|

91,254 |

|

|

350,401 |

|

|

336,286 |

| |

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Marketing |

$ |

26,636 |

|

|

|

25,733 |

|

|

96,428 |

|

|

95,405 |

|

Distribution |

|

24,367 |

|

|

|

24,380 |

|

|

94,888 |

|

|

92,281 |

|

Administrative |

|

10,812 |

|

|

|

9,743 |

|

|

40,721 |

|

|

37,757 |

| Other

expense (income) |

|

65 |

|

|

|

261 |

|

|

1,408 |

|

|

68 |

|

Total operating expenses |

|

61,880 |

|

|

|

60,117 |

|

|

233,445 |

|

|

225,511 |

| Operating

Income |

|

31,061 |

|

|

|

31,137 |

|

|

116,956 |

|

|

110,775 |

| |

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

|

Investment income |

|

1,966 |

|

|

|

1,580 |

|

|

7,741 |

|

|

6,267 |

|

Interest expense & other |

|

(40 |

) |

|

|

843 |

|

|

1,880 |

|

|

1,110 |

| |

|

|

|

|

|

|

|

| Earnings

before |

|

|

|

|

|

|

|

|

income taxes |

|

32,987 |

|

|

|

33,560 |

|

|

126,577 |

|

|

118,152 |

| |

|

|

|

|

|

|

|

| Income

taxes |

|

6,920 |

|

|

|

10,175 |

|

|

31,758 |

|

|

14,556 |

| |

|

|

|

|

|

|

|

| NET

EARNINGS |

$ |

26,067 |

|

|

$ |

23,385 |

|

$ |

94,819 |

|

$ |

103,596 |

| |

|

|

|

|

|

|

|

| Earnings per

diluted share |

$ |

1.36 |

|

|

$ |

1.24 |

|

$ |

5.00 |

|

$ |

5.51 |

| |

|

|

|

|

|

|

|

| Weighted

average number |

|

|

|

|

|

|

|

| of

diluted shares |

|

19,101 |

|

|

|

18,867 |

|

|

18,959 |

|

|

18,817 |

| |

|

|

|

|

|

|

|

| Earnings per

basic share |

$ |

1.38 |

|

|

$ |

1.25 |

|

$ |

5.04 |

|

$ |

5.54 |

| |

|

|

|

|

|

|

|

| Weighted

average number of |

|

|

|

|

|

|

|

| basic

shares |

|

18,867 |

|

|

|

18,726 |

|

|

18,812 |

|

|

18,694 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| J

& J SNACK FOODS CORP. AND SUBSIDIARIES |

|

|

CONSOLIDATED BALANCE SHEETS |

|

| (in

thousands, except share amounts) |

|

|

|

|

|

|

|

|

|

September

28, |

|

September

29, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

Assets |

|

|

|

|

| Current

assets |

|

|

|

|

| Cash

and cash equivalents |

$ |

192,395 |

|

|

$ |

111,479 |

|

|

|

Marketable securities held to maturity |

|

51,091 |

|

|

|

21,048 |

|

|

|

Accounts receivable, net |

|

140,938 |

|

|

|

132,342 |

|

|

|

Inventories |

|

116,165 |

|

|

|

112,884 |

|

|

|

Prepaid expenses and other |

|

5,768 |

|

|

|

5,044 |

|

|

|

Total current assets |

|

506,357 |

|

|

|

382,797 |

|

|

| |

|

|

|

|

| Property,

plant and equipment, at cost |

|

749,532 |

|

|

|

697,517 |

|

|

| Less

accumulated depreciation |

|

|

|

|

| and

amortization |

|

496,084 |

|

|

|

454,844 |

|

|

|

Property, plant and equipment, net |

|

253,448 |

|

|

|

242,673 |

|

|

| |

|

|

|

|

| Other

assets |

|

|

|

|

|

Goodwill |

|

102,511 |

|

|

|

102,511 |

|

|

| Other

intangible assets, net |

|

54,922 |

|

|

|

57,762 |

|

|

|

Marketable securities held to maturity |

|

79,360 |

|

|

|

118,765 |

|

|

|

Marketable securities available for sale |

|

19,903 |

|

|

|

24,743 |

|

|

|

Other |

|

2,838 |

|

|

|

2,762 |

|

|

|

Total other assets |

|

259,534 |

|

|

|

306,543 |

|

|

|

Total Assets |

$ |

1,019,339 |

|

|

$ |

932,013 |

|

|

| |

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

Current obligations under capital leases |

$ |

339 |

|

|

$ |

324 |

|

|

|

Accounts payable |

|

72,029 |

|

|

|

69,592 |

|

|

|

Accrued insurance liability |

|

10,457 |

|

|

|

11,217 |

|

|

|

Accrued liabilities |

|

7,808 |

|

|

|

8,031 |

|

|

|

Accrued compensation expense |

|

21,154 |

|

|

|

20,297 |

|

|

|

Dividends payable |

|

9,447 |

|

|

|

8,438 |

|

|

|

Total current liabilities |

|

121,234 |

|

|

|

117,899 |

|

|

| |

|

|

|

|

| Long-term

obligations under capital leases |

|

718 |

|

|

|

753 |

|

|

| Deferred

income taxes |

|

61,920 |

|

|

|

52,322 |

|

|

| Other

long-term liabilities |

|

1,716 |

|

|

|

1,948 |

|

|

| |

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

| Preferred

stock, $1 par value; authorized |

|

|

|

|

|

10,000,000 shares; none issued |

|

- |

|

|

|

- |

|

|

| Common

stock, no par value; authorized, |

|

|

|

|

|

50,000,000 shares; issued and outstanding |

|

|

|

|

|

18,895,000 and 18,754,000 respectively |

|

45,744 |

|

|

|

27,340 |

|

|

| Accumulated

other comprehensive loss |

|

(12,988 |

) |

|

|

(11,994 |

) |

|

| Retained

Earnings |

|

800,995 |

|

|

|

743,745 |

|

|

|

Total stockholders' equity |

|

833,751 |

|

|

|

759,091 |

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

1,019,339 |

|

|

$ |

932,013 |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

| J

& J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in

thousands) |

|

|

|

|

|

|

|

|

|

Fiscal Year

Ended |

|

|

|

|

|

|

|

|

|

September

28, |

September

29, |

September

30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

(52 weeks) |

|

(52 weeks) |

|

(53 weeks) |

| |

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

| Net

earnings |

$ |

94,819 |

|

|

$ |

103,596 |

|

|

$ |

79,174 |

|

|

Adjustments to reconcile net earnings to net cash provided

by |

|

|

|

|

|

|

operating activities: |

|

|

|

|

|

|

Depreciation of fixed assets |

|

45,225 |

|

|

|

42,939 |

|

|

|

38,211 |

|

|

Amortization of intangibles and deferred costs |

|

3,385 |

|

|

|

3,538 |

|

|

|

4,234 |

|

|

Gains from disposals of property & equipment |

|

(347 |

) |

|

|

(912 |

) |

|

|

(346 |

) |

|

Amortization of bond premiums |

|

730 |

|

|

|

1,012 |

|

|

|

1,189 |

|

|

Share-based compensation |

|

4,230 |

|

|

|

3,858 |

|

|

|

3,048 |

|

|

Deferred income taxes |

|

9,637 |

|

|

|

(10,392 |

) |

|

|

7,847 |

|

|

Loss (gain) on sale of marketable securities |

|

404 |

|

|

|

140 |

|

|

|

(14 |

) |

|

Changes in assets and liabilities, net of effects from

purchase |

|

|

|

|

|

|

of companies: |

|

|

|

|

|

|

Increase in accounts receivable, net |

|

(8,759 |

) |

|

|

(7,917 |

) |

|

|

(20,370 |

) |

|

Increase in inventories |

|

(3,231 |

) |

|

|

(9,639 |

) |

|

|

(7,410 |

) |

|

(Increase) decrease in prepaid expenses and

other |

|

(744 |

) |

|

|

(1,120 |

) |

|

|

10,265 |

|

|

Increase (decrease) in accounts payable and

accrued liabilities |

|

2,150 |

|

|

|

(1,736 |

) |

|

|

9,521 |

|

| Net

cash provided by operating activities |

|

147,499 |

|

|

|

123,367 |

|

|

|

125,349 |

|

|

Investing activities: |

|

|

|

|

|

|

Payments for purchases of companies, net of cash

acquired |

|

(1,156 |

) |

|

|

- |

|

|

|

(47,698 |

) |

|

Purchases of property, plant and equipment |

|

(57,128 |

) |

|

|

(60,022 |

) |

|

|

(72,180 |

) |

|

Purchases of marketable securities |

|

(26,091 |

) |

|

|

(91,112 |

) |

|

|

(39,923 |

) |

|

Proceeds from redemption and sales of marketable

securities |

|

39,158 |

|

|

|

75,302 |

|

|

|

22,997 |

|

|

Proceeds from disposal of property, plant and

equipment |

|

2,050 |

|

|

|

2,639 |

|

|

|

1,935 |

|

|

Other |

|

(196 |

) |

|

|

54 |

|

|

|

(450 |

) |

| Net

cash used in investing activities |

|

(43,363 |

) |

|

|

(73,139 |

) |

|

|

(135,319 |

) |

|

Financing activities: |

|

|

|

|

|

|

Payments to repurchase common stock |

|

- |

|

|

|

(2,794 |

) |

|

|

(18,229 |

) |

|

Proceeds from issuance of common stock |

|

14,174 |

|

|

|

8,894 |

|

|

|

7,231 |

|

|

Payments on capitalized lease obligations |

|

(356 |

) |

|

|

(370 |

) |

|

|

(356 |

) |

|

Payment of cash dividend |

|

(36,644 |

) |

|

|

(33,066 |

) |

|

|

(30,859 |

) |

| Net

cash used in financing activities |

|

(22,826 |

) |

|

|

(27,336 |

) |

|

|

(42,213 |

) |

|

Effect of exchange rates on cash and cash

equivalents |

|

(394 |

) |

|

|

(2,375 |

) |

|

|

2,493 |

|

| Net

increase (decrease) in cash and cash equivalents |

|

80,916 |

|

|

|

20,517 |

|

|

|

(49,690 |

) |

| Cash and

cash equivalents at beginning of year |

|

111,479 |

|

|

|

90,962 |

|

|

|

140,652 |

|

| Cash and

cash equivalents at end of year |

$ |

192,395 |

|

|

$ |

111,479 |

|

|

$ |

90,962 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| J

& J SNACK FOODS CORP. AND SUBSIDIARIES |

|

| NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September

28, |

September

29, |

September

30, |

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

(52 weeks) |

|

(52 weeks) |

|

(53 weeks) |

|

| |

|

|

| Sales to

External Customers: |

|

|

|

|

|

|

|

| Food

Service |

|

|

|

|

|

|

|

|

Soft pretzels |

|

$ |

209,227 |

|

|

$ |

208,544 |

|

|

$ |

180,138 |

|

|

|

Frozen juices and ices |

|

|

43,672 |

|

|

|

42,364 |

|

|

|

49,469 |

|

|

|

Churros |

|

|

65,976 |

|

|

|

61,726 |

|

|

|

62,809 |

|

|

|

Handhelds |

|

|

31,685 |

|

|

|

38,928 |

|

|

|

36,913 |

|

|

|

Bakery |

|

|

384,636 |

|

|

|

371,391 |

|

|

|

351,357 |

|

|

|

Other |

|

|

26,407 |

|

|

|

22,991 |

|

|

|

21,108 |

|

|

| Total

Food Service |

|

$ |

761,603 |

|

|

$ |

745,944 |

|

|

$ |

701,794 |

|

|

| |

|

|

|

|

|

|

|

|

Retail Supermarket |

|

|

|

|

|

|

|

|

Soft pretzels |

|

$ |

36,264 |

|

|

$ |

36,438 |

|

|

$ |

35,081 |

|

|

|

Frozen juices and ices |

|

|

73,751 |

|

|

|

74,435 |

|

|

|

71,325 |

|

|

|

Handhelds |

|

|

10,902 |

|

|

|

12,419 |

|

|

|

14,892 |

|

|

|

Coupon redemption |

|

|

(3,596 |

) |

|

|

(4,439 |

) |

|

|

(4,898 |

) |

|

|

Other |

|

|

1,955 |

|

|

|

2,086 |

|

|

|

2,847 |

|

|

| Total

Retail Supermarket |

|

$ |

119,276 |

|

|

$ |

120,939 |

|

|

$ |

119,247 |

|

|

| |

|

|

|

|

|

|

|

|

Frozen Beverages |

|

|

|

|

|

|

|

|

Beverages |

|

$ |

171,820 |

|

|

$ |

160,937 |

|

|

$ |

154,157 |

|

|

|

Repair and |

|

|

|

|

|

|

|

|

maintenance service |

|

|

85,103 |

|

|

|

78,805 |

|

|

|

74,594 |

|

|

|

Machines revenue |

|

|

45,811 |

|

|

|

28,652 |

|

|

|

31,497 |

|

|

|

Other |

|

|

2,874 |

|

|

|

2,988 |

|

|

|

2,935 |

|

|

| Total

Frozen Beverages |

|

$ |

305,608 |

|

|

$ |

271,382 |

|

|

$ |

263,183 |

|

|

| |

|

|

|

|

|

|

|

| Consolidated

Sales |

|

$ |

1,186,487 |

|

|

$ |

1,138,265 |

|

|

$ |

1,084,224 |

|

|

| |

|

|

|

|

|

|

|

| Depreciation

and Amortization: |

|

|

|

|

|

|

|

| Food

Service |

|

$ |

26,978 |

|

|

$ |

25,983 |

|

|

$ |

24,629 |

|

|

|

Retail Supermarket |

|

|

1,418 |

|

|

|

1,313 |

|

|

|

949 |

|

|

|

Frozen Beverages |

|

|

20,214 |

|

|

|

19,181 |

|

|

|

16,867 |

|

|

|

Total Depreciation and Amortization |

$ |

48,610 |

|

|

$ |

46,477 |

|

|

$ |

42,445 |

|

|

| |

|

|

|

|

|

|

|

| Operating

Income: |

|

|

|

|

|

|

|

| Food

Service |

|

$ |

78,130 |

|

|

$ |

74,056 |

|

|

$ |

81,208 |

|

|

|

Retail Supermarket |

|

|

8,876 |

|

|

|

8,304 |

|

|

|

10,627 |

|

|

|

Frozen Beverages |

|

|

29,950 |

|

|

|

28,415 |

|

|

|

26,272 |

|

|

| Total

Operating Income |

|

$ |

116,956 |

|

|

$ |

110,775 |

|

|

$ |

118,107 |

|

|

| |

|

|

|

|

|

|

|

| Capital

Expenditures: |

|

|

|

|

|

|

|

| Food

Service |

|

$ |

29,197 |

|

|

$ |

36,325 |

|

|

$ |

44,067 |

|

|

|

Retail Supermarket |

|

|

1,979 |

|

|

|

928 |

|

|

|

239 |

|

|

|

Frozen Beverages |

|

|

25,952 |

|

|

|

22,769 |

|

|

|

27,874 |

|

|

| Total

Capital Expenditures |

|

$ |

57,128 |

|

|

$ |

60,022 |

|

|

$ |

72,180 |

|

|

| |

|

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

| Food

Service |

|

$ |

772,777 |

|

|

$ |

693,098 |

|

|

$ |

635,709 |

|

|

|

Retail Supermarket |

|

|

22,673 |

|

|

|

21,366 |

|

|

|

21,129 |

|

|

|

Frozen Beverages |

|

|

223,889 |

|

|

|

217,549 |

|

|

|

210,390 |

|

|

| Total

Assets |

|

$ |

1,019,339 |

|

|

$ |

932,013 |

|

|

$ |

867,228 |

|

|

| |

|

|

|

|

|

|

|

RESULTS OF OPERATIONS:

Fiscal 2019 (52 weeks) Compared to

Fiscal Year 2018 (52 weeks)

Net sales increased $48,222,000, or 4%, to

$1,186,487,000 in fiscal 2019 from $1,138,265,000 in fiscal

2018.

We have three reportable segments, as disclosed

in the accompanying notes to the consolidated financial statements:

Food Service, Retail Supermarkets and Frozen Beverages.

The Chief Operating Decision Maker for Food

Service and Retail Supermarkets and the Chief Operating Decision

Maker for Frozen Beverages monthly review detailed operating income

statements and sales reports in order to assess performance and

allocate resources to each individual segment. Sales and operating

income are the key variables monitored by the Chief Operating

Decision Makers and management when determining each segment’s and

the Company’s financial condition and operating performance.

In addition, the Chief Operating Decision Makers review and

evaluate depreciation, capital spending and assets of each segment

on a quarterly basis to monitor cash flow and asset needs of each

segment.

FOOD SERVICE

Sales to food service customers increased

$15,659,000, or 2 percent, to $761,603,000 in fiscal 2019.

Soft pretzel sales to the food service market increased about 1/3

of 1 percent to $209,227,000 for the year with higher sales to

convenience store chains offset by lower sales to restaurant chains

and with sales increases and decreases throughout our customer

base. Our line of BRAUHAUS pretzels contributed to the

increased sales. Frozen juice bar and ices sales increased

$1,308,000, or 3%, to $43,672,000 for the year due primarily to

higher sales to warehouse club stores. Churro sales to food

service customers were up 7% to $65,976,000 for the year with sales

increases and decreases across our customer base but with

particularly strong sales to warehouse club stores. Sales of

bakery products increased $13,245,000, or 4%, to $384,636,000 for

the year with increased sales to one customer accounting for all of

the increase. Handheld sales to food service customers were

down 19% to $31,685,000 in 2019 with sales decreases to three

customers accounting for all of the decrease. Sales of funnel

cake increased $3,223,000, or 15% to $24,793,000 due primarily to

increased sales to a quick service restaurant under a limited time

offer in our second quarter. Overall food service sales to

restaurant chains were down about 2% for the year. Sales of

new products in the first twelve months since their introduction

were approximately $13.5 million for the year. Price increases

accounted for approximately $15 million of sales for the year and

net volume including new product sales were essentially flat.

Operating income in our Food Service segment increased from

$74,056,000 in 2018 to $78,130,000 in 2019 resulting from benefits

of improved operations at several of our manufacturing facilities

and increased pricing.

RETAIL SUPERMARKETS

Sales of products to retail supermarkets

decreased $1,663,000 or 1% to $119,276,000 in fiscal year 2019.

Soft pretzel sales to retail supermarkets were $36,264,000

compared to $36,438,000 in 2018. Strong pretzel sales

increases from sales of AUNTIE ANNE’S products were offset by lower

sales of our SUPER PRETZEL products. Sales of frozen juices

and ices decreased $684,000 or 1% to $73,751,000 as we lost some

volume and placements due to price increases. Coupon

redemption costs, a reduction of sales, decreased 19% to $3,596,000

for the year. Handheld sales to retail supermarket customers

decreased 12% to $10,902,000 for the year as sales of this product

line in retail supermarkets continues its long-term

decline.

Sales of new products in the first twelve months

since their introduction were approximately $1 million in

fiscal year 2019. Price increases provided about $4 million

of sales for the year and net volume decreased about $5.5 million

for the year. Operating income in our Retail Supermarkets segment

increased from $8,304,000 to $8,876,000 for the year. The primary

contribution to the higher operating income this year was increased

pricing.

FROZEN BEVERAGES

Frozen beverage and related product sales

increased 13% to $305,608,000 in fiscal 2019. Beverage sales alone

increased 7% or $10,883,000 for the year with increases and

decreases throughout our customer base. About one third of

the beverage sales increase was from increased flow through sales

to one distributor which did not benefit operating income. Gallon

sales were up 3% in our base ICEE business, with sales increases

spread throughout our customer base. Service revenue

increased 8% to $85,103,000 for the year with sales increases and

decreases spread throughout our customer base. Machines

revenue, primarily sales of machines, increased from $28,652,000 in

2018 to $45,811,000 in 2019. The estimated number of Company

owned frozen beverage dispensers was 26,000 and 25,000 at September

28, 2019 and September 29, 2018, respectively. Operating

income in our Frozen Beverage segment increased from $28,415,000 in

2018 to $29,950,000 in 2019 as a result of higher sales.

CONSOLIDATED

Other than as commented upon above by segment,

there are no material specific reasons for the reported sales

increases or decreases. Sales levels can be impacted by the

appeal of our products to our customers and consumers and their

changing tastes, competitive and pricing pressures, sales

execution, marketing programs, seasonal weather, customer stability

and general economic conditions.

Gross profit as a percentage of sales was

essentially unchanged at 29.53% in 2019 and 29.54% in 2018 as the

benefits of improved operations at several of our manufacturing

facilities and increased pricing were offset by increases in lower

margin sales of machines in our frozen beverages segment and

increases in lower margin sales of bakery products in our food

service segment.

Total operating expenses increased $7,934,000 to

$233,445,000 in fiscal 2019 and as a percentage of sales decreased

to 19.68% of sales from 19.81% in 2018. Marketing expenses

decreased to 8.13% this year from 8.38% of sales in 2018 because of

modest spending increases in all of our businesses. Distribution

expenses as a percent of sales decreased to 8.00% from 8.11% in

2018 because freight rates have dropped from last year.

Administrative expenses were 3.43% and 3.32% of sales in 2019 and

2018, respectively.

Operating income increased $6,181,000 or 6% to

$116,956,000 in fiscal year 2019 as a result of the aforementioned

items.

Our investments generated before tax income of

$7.7 million this year, up from $6.3 million last year due to

increases in the amount of investments and higher interest

rates. Other income in 2019 includes

a $2.0 million payment received from a customer due to cancellation

of production under a co-manufacturing

agreement. Other income in 2018 includes

$520,000 gain on a sale of property and $869,000 reimbursement of

business interruption losses due to the MARY B’s biscuits recall in

January 2018.

Net earnings for the year ended September 29,

2018 benefited from a $20.9 million gain, or $1.11 per diluted

share, on the remeasurement of deferred tax liabilities and a $8.8

million, or $0.47 per diluted share, reduction in income taxes

related primarily to the lower corporate tax rate enacted under the

Tax Cuts and Jobs Act in December 2017 which was partially offset

by a $1.2 million, or $.06 per diluted share, provision for the one

time repatriation tax, both of which resulted from the Tax Cuts and

Jobs Act enacted in December 2017. Net earnings for the year

were also impacted by a $1.4 million, or $.07 per diluted share,

expense on the remeasurement of deferred tax liabilities due to

changes in New Jersey tax regulations effective July 2018.

Excluding the deferred tax gain, the deferred tax expense and the

one-time repatriation tax, our effective tax rate was 27.8% in the

year ended September 29, 2018. Net earnings this year benefitted by

a reduction of approximately $900,000 in tax as the provision for

the one-time repatriation tax was reduced as the amount recorded

last year was an estimate. Excluding the reduction in

the provision for the one-time repatriation tax, our effective tax

rate was 25.8% for this year.

Net earnings decreased $8,777,000 or 8%, in

fiscal 2019 to $94,819,000, or $5.00 per diluted share, from

$103,596,000, or $5.51 per diluted share, in fiscal 2018 as a

result of the aforementioned items.

There are many factors which can impact our net

earnings from year to year and in the long run, among which are the

supply and cost of raw materials and labor, insurance costs,

factors impacting sales as noted above, the continuing

consolidation of our customers, our ability to manage our

manufacturing, marketing and distribution activities, our ability

to make and integrate acquisitions and changes in tax laws and

interest rates.

Contact: Dennis G.

MooreSenior Vice PresidentChief

Financial Officer(856) 532-6603

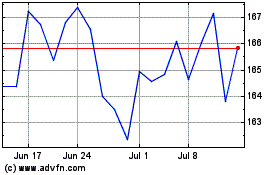

J and J Snack Foods (NASDAQ:JJSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

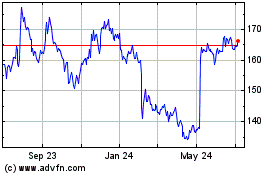

J and J Snack Foods (NASDAQ:JJSF)

Historical Stock Chart

From Apr 2023 to Apr 2024