As filed with the Securities and Exchange Commission on December 23, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

JANONE INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

5700

|

|

41-1454591

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

325 E. Warm Springs Road, Suite 102

Las Vegas, Nevada 89119

(702) 997-5968

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Tony Isaac

President and Chief Executive Officer

JanOne Inc.

325 E. Warm Springs Road, Suite 102

Las Vegas, Nevada 89119

(702) 997-5968

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copy to:

Randolf W. Katz, Esq.

Clark Hill LLP

1055 West Seventh Street, Suite 2400

Los Angeles, California 90017

213-891-9100

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement is declared effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☒

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

Calculation of Registration Fee:

|

|

|

|

|

|

|

Title of each class of securities to be registered(1)

|

Amount to be

registered(2)(3)

|

Proposed maximum

offering price per

security(2)(3)(4)(5)

|

Aggregate

maximum offering

price(2)(3)(4)(5)

|

Amount of

registration fee(6)

|

|

Common Stock, par value $0.001 per share

|

|

|

|

|

|

Preferred Stock, par value $0.001 per share

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

Rights

|

|

|

|

|

|

Units(7)

|

|

|

|

|

|

Total

|

|

|

$100,000,000

|

$ 10,910

|

|

(1)

|

Securities registered hereunder may be sold separately, together, or as units with other securities registered hereunder.

|

|

(2)

|

The proposed maximum aggregate offering price per class of security will be determined from time to time by the registrant in connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class of securities pursuant to Form S-3 General Instruction II.D.

|

|

(3)

|

The registrant is registering an indeterminate aggregate principal amount and number of securities of each identified class of securities up to a proposed aggregate offering price of $100,000,000, which may be offered from time to time in unspecified numbers and at indeterminate prices, and as may be issuable upon exercise of any securities registered hereunder, including under any applicable anti-dilution provisions. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder includes such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions. In no event will the aggregate offering price of all securities issued by the registrant from time to time pursuant to this registration statement exceed $100,000,000, excluding accrued interest, if any, on any debt securities issued under this registration statement.

|

|

(4)

|

Pursuant to General Instruction II.D. of Form S-3, the table lists each of the classes of securities being registered and the aggregate proceeds to be raised, but does not specify by each class information as to the amount to be registered, proposed maximum offering price per unit, and proposed maximum aggregate offering price.

|

|

(5)

|

Includes consideration to be received by us, if applicable, for registered securities that are issuable upon exercise, conversion, or exchange of other registered securities.

|

|

(6)

|

The proposed maximum aggregate offering price has been estimated solely to calculate the registration fee in accordance with Rule 457(o) under the Securities Act. The Registrant previously paid this amount in connection with the filing of the Registration Statement on Form S-3 (File No. 333-248914), which has subsequently been withdrawn, and under Rule 457(p) applies such amount to this registration statement.

|

|

(7)

|

Each Unit consists of any combination of two or more of the securities being registered hereby.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not a solicitation of an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

Preliminary Prospectus Subject to completion, Dated December 23, 2020

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell from time to time shares of our common stock, par value $0.001 per share (our “Common Stock”), shares of our preferred stock, par value $0.001 per share (our “Preferred Stock”), debt securities, warrants, rights, and units that include any of these securities. The Preferred Stock or warrants may be convertible into or exercisable for shares of our Common Stock or shares of our Preferred Stock or other of our securities registered hereunder. The debt securities may be convertible into or exchangeable for shares of our Common Stock or shares of our Preferred Stock. Our Common Stock is listed on The Nasdaq Capital Market and trades under the symbol “JAN.”

We may offer and sell these securities to or through one or more underwriters, dealers, and agents, or directly to purchasers, on a continuous or delayed basis.

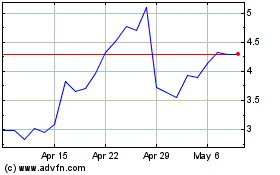

The aggregate market value of our outstanding Common Stock held by non-affiliates was approximately $2,186,586, based on 1,829,982 shares of outstanding Common Stock as of December 15, 2020, of which approximately 410,121 shares were held by affiliates, and based on the closing sale price of our Common Stock of $4.62 on November 25, 2020. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to this prospectus with a value of more than one-third of the aggregate market value of our Common Stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our Common Stock held by non-affiliates is less than $75,000,000. In the event that, subsequent to the date of this prospectus, the aggregate market value of our outstanding Common Stock held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation on sales shall not apply to additional sales made pursuant to this prospectus. During the prior 12 calendar months prior to, and including, the date of this prospectus, we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest.

See the “Risk Factors” section of this prospectus on page 4, our filings with the SEC, and the applicable prospectus supplement for certain risks that you should consider before investing in our securities.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities nor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a Registration Statement on Form S-3 that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings in amounts that we will determine from time to time, up to a total dollar amount of $100,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities described in this prospectus we will provide a prospectus supplement, incorporate information or document by reference into this prospectus or a related free writing prospectus or use other offering materials, as applicable, containing more specific information about the terms of the securities that are then being offered. We may also authorize one or more related free writing prospectuses to be provided to you that may contain material information relating to these offerings and securities. This prospectus, together with applicable prospectus supplements, any information or document incorporated by reference, and any related free writing prospectus or other offering materials, as applicable, we file with the SEC, includes all material information relating to these offerings and securities. We may also add, update, or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we incorporate by reference into this prospectus, including, without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution. If there is any inconsistency between the information in this prospectus and a prospectus supplement or information or document incorporated by reference having a later date, you should rely on the information in that prospectus supplement or incorporated information having a later date. We urge you to read carefully this prospectus, any applicable prospectus supplement, and any related free writing prospectus or other offering materials, as applicable, together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information by Reference,” before buying any of the securities being offered.

You should rely only on the information we have provided in, or incorporated by reference into, this prospectus, any applicable prospectus supplement, and any related free writing prospectus or other offering materials, as applicable. We have not authorized anyone to provide you with different information. No dealer, salesperson, or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable.

Neither the delivery of this prospectus nor any sale made under it implies that there has not been any change in our business or affairs or that the information in this prospectus is correct as of any date after the date of this prospectus. You should assume that the information in this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, or any sale of a security.

The Registration Statement containing this prospectus, including exhibits to the Registration Statement, provides additional information about us and the securities offered under this prospectus and any prospectus supplement. We have filed and plan to continue to file other documents with the SEC that contain information about us and our business. Also, we will file legal documents that control the terms of the securities offered by this prospectus as exhibits to the reports that we file with the SEC. The Registration Statement and other reports can be read at the SEC Internet site or at the SEC offices mentioned under the heading “Available Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein; but, reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the Registration Statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Available Information.”

1

AVAILABLE INFORMATION

We have filed with the SEC a Registration Statement on Form S-3 under the Securities Act with respect to the securities covered by this prospectus. This prospectus, which is a part of that Registration Statement, does not contain all of the information set forth in the Registration Statement or the exhibits and schedules filed therewith. For further information with respect to us and the securities covered by this prospectus, please see the Registration Statement and the exhibits filed with the Registration Statement. A copy of the Registration Statement and the exhibits filed with the Registration Statement may be inspected without charge at the Public Reference Room maintained by the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. The address of the website is http://www.sec.gov.

We are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, we file periodic reports, proxy statements, and other information with the SEC. Such periodic reports, proxy statements, and other information are available for inspection and copying at the Public Reference Room and website of the SEC referred to above. We maintain a website at http://www.janone.com. You may access our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus.

2

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to incorporate by reference information into this prospectus. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of the securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus.

We incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules):

|

•

|

Our Annual Report on Form 10-K for the year ended December 28, 2019, filed with the SEC on April 6, 2020;

|

|

•

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 28, 2020, filed with the SEC on May 12, 2020, June 27, 2020, filed with the SEC on August 10, 2020, and September 26, 2020, filed with the SEC on November 10, 2020;

|

|

•

|

Our Current Reports on Form 8-K, filed with the SEC on January 10, 2020, April 22, 2020 (as amended on April 23, 2020), May 4, 2020, June 18, 2020, June 25, 2020, June 30, 2020, July 8, 2020, July 21, 2020, July 30, 2020, August 6, 2020, August 12, 2020, September 3, 2020, September 16, 2020, September 24, 2020, and October 2, 2020 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of such Current Reports on Form 8-K); and

|

|

•

|

The description of our Common Stock contained filed as Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 28, 2019, filed with the SEC on April 6, 2020.

|

Additionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, after (i) the date of the initial Registration Statement and prior to effectiveness of the Registration Statement and (ii) the date of this prospectus and before the termination or completion of this offering, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.” Any information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part of this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above that have been or may be incorporated by reference into this prospectus, excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. Written or telephone requests should be directed to JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, Attention: Corporate Secretary; telephone: (702) 997-5968.

3

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents we incorporate by reference into it, contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the SEC. Such statements include, without limitation, statements regarding our expectations, hopes, or intentions regarding the future. Statements that are not historical fact are forward-looking statements. These forward looking statements can often be identified by their use of words such as “expect,” “believe,” “anticipate,” “outlook,” “could,” “target,” “project,” “intend,” “plan,” “seek,” “estimate,” “should,” “will,” “may,” and “assume,” as well as variations of such words and similar expressions referring to the future. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act, and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws.

The forward-looking statements contained in or incorporated by reference into this prospectus are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve certain risks and uncertainties, many of which are beyond our control. If any of those risks and uncertainties materialize, actual results could differ materially from those discussed in any such forward-looking statement. Among the factors that could cause actual results to differ materially from those discussed in forward-looking statements are those discussed under the heading “Risk Factors” below, those discussed under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 28, 2019, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. See “Available Information” and “Incorporation of Certain Information by Reference” for information about how to obtain copies of those documents.

All readers are cautioned that the forward-looking statements contained in this prospectus and in the documents incorporated by reference into this prospectus are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements. All forward-looking statements in this prospectus and the documents incorporated by reference into it are made only as of the date of the document in which they are contained, based on information available to us as of the date of that document, and we caution you not to place undue reliance on forward-looking statements in light of the risks and uncertainties associated with them. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTORS

Investing in our securities involves significant risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in, or incorporated into, the applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, and under similar headings in the other documents that are incorporated by reference herein or therein. Each of the referenced risks and uncertainties could adversely affect our business, operating results, and financial condition, as well as adversely affect the value of an investment in our securities. When we offer and sell any securities pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

4

BUSINESS

General

As of September 10, 2019, JanOne Inc. (formerly known as Appliance Recycling Centers of America, Inc.) and subsidiaries (collectively, “we,” the “Company,” or “JanOne”) broadened its business perspectives to being a pharmaceutical company focused on finding treatments for conditions that cause severe pain and bringing to market drugs with non-addictive pain-relieving properties. The Company aims to reduce prescriptions for dangerous opioid drugs by treating underlying diseases that cause severe pain. Our first drug candidate is a treatment for Peripheral Arterial Disease (“PAD”), a condition that can cause severe pain and affects over 8.5 million people in the U.S. alone. In addition, we continue to operate our legacy businesses, ARCA Recycling, Inc. (“ARCA Recycling”), in our Recycling segment, and GeoTraq Inc. (“GeoTraq”), in our Technology segment. ARCA Recycling recycles major household appliances in North America by providing turnkey appliance recycling and replacement services for utilities and other sponsors of energy efficiency programs. GeoTraq is engaged in the development, design, and, ultimately, we expect, the sale of cellular transceiver modules and associated wireless services.

On September 10, 2019, the Company changed its name from Appliance Recycling Centers of America, Inc. to JanOne Inc. and announced that it intended to broaden its business perspectives to include developing new and highly innovative solutions for ending the opioid epidemic. From digital technologies to educational advocacy to revolutionary painkilling drugs that address a multibillion dollar a year market, the Company intends to champion new initiatives to combat the opioid crisis, which claims tens of thousands of lives each year. The new name, JanOne, was strategically chosen to express the start of a “new day” in the fight against the opioid epidemic. January First is the first day of a New Year—a day of optimism, resolution, and hope. JanOne affirms the Company’s new strategic commitment to fresh thinking and innovative means to assist in ending the worst drug crisis in our nation’s history. The Company also adopted a new Nasdaq ticker symbol, NASDAQ: JAN, a new CUSIP number, 03814F403, and a new website address – www.janone.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

On December 28, 2019, we had 208 employees, of which 199 were full-time employees.

We were incorporated in Minnesota in 1983, although, through our predecessors, we began operating our legacy recycling business in 1976. On March 12, 2018, we reincorporated in the State of Nevada. Our principal office is located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

Biotechnology

Overview

We are a clinical-stage biopharmaceutical company focused on becoming the leader in identifying, acquiring, licensing, developing, partnering and commercializing novel, non-opioid and non-addictive therapies to address the large unmet medical need for the treatment of pain. Our initial product candidate, JAN101 (formerly known as TV1001SR) is a potential treatment for Periphery Artery Disease (“PAD”), a vascular disease that affects more than 60 million people worldwide. We are also researching the potential impact our compound JAN101 could have in patients with COVID-19 as many doctors around the world and our company believes COVID-19 is a respiratory disease that directly affects the vascular system. We expect to commence Phase 2b clinical trials for the treatment of PAD in early 2021. It is expected that the investigational new drug application (“IND”) for JAN101 as a COVID-19 vascular complication treatment will be submitted to the U.S. Food and Drug Administration (the “FDA”) in the coming weeks.

5

JAN101

Generally

JAN101, formerly known as TV1001SR and/or TV1001, our advanced product candidate, is a patented oral, sustained release pharmaceutical composition of sodium nitrite and targets poor blood flow to the extremities, such as those with vascular complications of diabetes or PAD and treats pain. A conclusion from a round of human studies found JAN101 sustained release sodium nitrite prevents the prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study of patients with PAD, 40 mg BID treatment with immediate release sodium nitrite led to a statistically significant reduction in reported pain while a 80 mg BID treatment had the more pronounced effect on bioactivity and Flow Mediated Dilation, a measure of vascular function. However, a number of subjects on both treatment groups reported headaches and dizziness following treatment. Although this did not result in subjects discontinuing treatment, JAN101 was developed to overcome this side effect. JAN101 was tested in a bridging study of diabetic neuropathy subjects and during that bridging study, the subjects did not report headaches or dizziness. Subjects in this bridge study also reported less pain following treatment and improvements in bioactivity (quantitative sensory testing, a measure of nerve function) were similar to the PAD study, where the 80 mg dose group had the greatest improvement in Flow Mediated Dilation. The ability to alleviate pain with BID treatment of JAN101 offers promise for a new non-addictive, non-sedating treatment of chronic pain.

Clinical studies in humans JAN101 Attributes

|

|

•

|

Well established safety profile

|

|

|

•

|

Excellent bioavailability

|

|

|

•

|

Lack of induced tolerance

|

JAN1010 does not mask pain, but instead treats the cause of pain by improving tissue and vascular dysfunction.

Benefits of Sodium Nitrite on Vascular Health

In initial research studies, sodium nitrite effectively restored ischemic tissue blood flow and was effective in a wide range of pathologies involving alterations of angiogenesis - development of new blood vessels - including diabetes, wound healing and tissue necrosis. Beneficial effects included enhancing angiogenesis, endothelial cell proliferation, and arteriogenesis. There is also a strong association between reduced circulating nitrite levels and cardiovascular diseases in humans. We describe some of the associations and beneficial effects of sodium nitrite/nitrite below.

Plasma nitrite levels are negatively correlated to cardiovascular disease

6

Plasma nitrite levels were inversely related to number of cardiovascular risk factors a subject had and decreased plasma nitrite was associated with decreased flow mediated vasodilation (FMD) and increased intimal medial thickness (IMT) (both indicators of vascular pathology). -Kleinbongard, et al. (2006) Free Radic Biol and Medicine 40:295-302

Plasma nitrite levels are reduced in diabetic and PAD patients

Exercise is a well-known stimulator of endothelial nitric oxide synthase activity, NO production that leads to increased plasma nitrite. In the study by Allen et al, these authors revealed that baseline plasma levels of nitrite were less in patients with diabetes mellitus (DM) or DM + PAD. Importantly, increases in plasma nitrite levels were not observed in either DM, PAD or DM + PAD patients after supervised exercise. These data reveal that baseline nitrite availability is compromised in DM patients and that supervised exercise is unable to increase plasma nitrite levels but actually results in a decrease in nitrite highlighting a physiological efficiency of this molecule. -Allen et al Nitric Oxide 2009 20:231-237

Skeletal Muscle Nitrite and Metabolite Levels are Reduced in Critical Limb Ischemia Patients

7

Skeletal muscle nitrite, nitrosothiol, nitric oxide-heme and cGMP are all significantly reduced in CLI patients. Diabetic patients with CLI show even further nitrite reductions.

In summary, nitrite levels in various cardiovascular and vascular diseases appear to be inversely related to the severity of the disease in humans:

|

|

•

|

Lower nitrite levels are associated with higher level of heart failure;

|

|

|

•

|

Lower nitrite levels are observed in diabetic patients with PAD and are not compensated by exercise; and

|

|

|

•

|

Nitrite levels are lower in the muscles of patients with critical limb ischemia and are further reduced in diabetic subjects with critical limb ischemia.

|

Given the association between low levels of circulating nitrite and human diseases, supplementation with sodium nitrite has been studied preclinically in animals. Below are summaries of some of the more important findings:

|

|

•

|

Stimulates wound healing

|

|

|

•

|

Prevents tissue necrosis

|

8

From Arya et al

Nitrite Therapy Selectively Increases Ischemic Tissue Vascular Density in a NO-dependent Manner

Chronic sodium nitrite therapy increases ischemic tissue vascular density in a NO-dependent manner. A and B show representative images of CD31 (red) and DAPI nuclear (blue) staining from sodium nitrite and sodium nitrate ischemic gastrocnemius muscle tissue at day 7. C and D report the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 for 165 μg/kg sodium nitrite and nitrate treatments, respectively. E and F demonstrate the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 from 165 μg/kg sodium nitrite plus carboxy PTIO. (Scale bar, 150 μm.) n = 10 mice per treatment group. Kumar D. et al. PNAS; 2008; 105:7540-7545.

9

Nitrite Therapy Augments Arterial Perfusion of Ischemic Tissue

Chronic sodium nitrite therapy acutely increases ischemic tissue blood flow and stimulates arteriogenesis. A and B report 165 μg/kg sodium nitrite-induced acute changes in blood flow of chronically ischemic tissues at various time points with or without cPTIO, respectively. C reports the number of arterial branches between PBS and nitrite therapies. D and E illustrate vascular casting of the arterial vasculature in ischemic hind limbs of day 7 nitrite or PBS-treated mice, respectively. *, P < 0.01 vs. sodium nitrate. n = 10 mice per treatment group. Kumar D. et.al. PNAS;2008; 105:7540-7545

10

Nitrite Therapy Restores Diabetic Ischemic Hind-Limb Blood Flow and Promotes Wound Heal

Unilateral femoral artery ligation was performed on 18-20 week old male Db/Db mice. Mice were randomized to PBS or sodium nitrite (165 μg/kg) therapy twice daily via I.P. injection. Laser doppler flowmetry was performed at the indicated time points. Increased wound dehiscence was noted in the PBS treated animals at day 7 but not in nitrite treated animals. (Bir et al Diabetes 2014, 63(1):270-81)

Nitrite Therapy Increases Diabetic Ischemia Induced Angiogenesis

11

Nitrite therapy prevented ischemia mediated endothelial cell density loss in normal C57BL/6J ischemic limbs. Nitrite therapy significantly restored endothelial cell density in ischemic limbs of diabetic mice to normal C57BL/6J levels compared to PBS therapy of non-ischemic and ischemic conditions. These data suggest that nitrite therapy may be useful in attenuating microvascular rarefaction due to loss of nitric oxide that is observed during metabolic dysfunction (Frisbee JC AJP Integr Comp Physiol 2005 289(2):R307-16; Stepp et al Microcirculation 2007 14(4-5): 311-6)

Delayed Nitrite Therapy Restores Ischemic Hind-Limb Blood Flow

Studies were performed to determine whether nitrite mediated therapy would be effective in tissue that had been left ischemic for 5 days after femoral artery ligation. Femoral artery ligation was performed in C57BL/6J mice and the animals randomized to either PBS or sodium nitrite therapy 5 days after artery ligation. Treatments were given b.i.d. via I.P. injection. Ischemic limb blood flow was measured using laser doppler flowmetry. (Bir et al Diabetes 2014, 63(1):270-81)

12

Delayed nitrite therapy increases SPY angiogram arteriogenesis

Delayed nitrite therapy increases SPY angiogram arteriogenesis. Representative temporal SPY angiogram image stills (3–6s) are shown at 11 days following ligation and 6 days after beginning therapy (either

PBS or sodium nitrite). Left: PBS control angiogram. Right: sodium nitrite angiogram following injection of ICG. n = 5 animals per cohort. Circles identify limb anatomical regions of vascular blush, whereas arrows indicate perfused vessels that progressively occur over time.

Bir S C et al. Am J Physiol Heart Circ Physiol 2012;303:H178-H188

13

Nitrite Therapy Prevents Tissue Necrosis in Aged Db/Db Mice

Delayed sodium nitrite (165 ug/kg) or control PBS therapy was stated 5 days post femoral artery ligation in 9 month old Db/Db mice. Nitrite therapy significantly prevented tissue necrosis (panel B) compared to control PBS therapy (panel A). Panel D reports tissue necrosis severity as a function of degree of limb and digit involvement. Nitrite therapy but not PBS control or sodium nitrate significantly prevented tissue necrosis. (Bir et al Diabetes 2014, 63(1):270-81)

Nitrite and Hind Limb Ischemia Summary

Sodium nitrite has long been known to be a potent vasodilator (transiently increasing blood vessel diameter) that can lead to a drop in blood pressure when given acutely. The above studies indicate that chronic administration at low doses, promotes angiogenesis, unlike single one-time nitrite therapy which does not stimulate angiogenesis. In addition, these studies and a large number of other studies not reviewed above, show:

|

|

•

|

Nitrite therapy is very specific, acting only in damaged, ischemic tissue;

|

|

|

•

|

Delayed nitrite therapy effectively restores ischemic tissue blood flow;

|

|

|

•

|

Nitrite therapy is effective in a wide range of pathologies involving alterations of angiogenesis including critical limb ischemia, heart failure, and tissue necrosis;

|

|

|

•

|

Nitrite supplementation has had positive effects in various diabetes models, including diabetic nephropathy and diabetic wound healing;

|

|

|

•

|

Beneficial effects center on enhancing angiogenesis, endothelial cell proliferation, and arteriogenesis; and

|

|

|

•

|

Sustained release nitrite therapy, unlike immediate release therapy, does not lead to vasodilation or a drop in blood pressure.

|

14

Our Product Candidate JAN101

Our product candidate is designed to treat diseases associated with poor vascular function. The following table summarizes our current product candidate pipeline:

Therapeutic Area Peripheral Artery Disease Pain COVID-19 Drug JAN101 Pre-IND Phase 1 Phase 2a Phase 2b Phase 3

The Company intends to file an Investigational IND with the FDA for COVID-19 in the coming weeks and a protocol amendment to carry out a large Phase 2 trial in Peripheral Artery Disease patients early next year.

Pain

Pain is a protective reaction that alerts the body to the presence of actual or potential tissue damage so that necessary corrective responses can be mounted. The National Institutes of Health (the “NIH”) defines chronic pain as pain that persists beyond the normal healing time of an injury or that persists longer than three months. It is estimated that chronic pain affects 100 million individuals in the US and over 1.5 billion people worldwide, thus more people suffer from chronic pain than diabetes, heart disease and cancer combined (Cowen Therapeutic Categories Outlook March 2019). Chronic pain exacts a tremendous cost in terms of direct treatment and rehabilitation expenditures, lost worker productivity, prevalent addiction to opioid-based drugs, and emotional and financial burden for patients and their families. According to an Institute of Medicine of the National Academies report, pain is a significant public health problem in the United States that costs society between $560 and $635 billion annually. Despite the magnitude of the pain problem, innovation in the development of therapeutic solutions has been largely absent. Since 2010, there have been 20 approvals by the FDA for the treatment of pain, of which 12 were opioid variants, one was an extended release generic corticosteroid, five were variants of aspirin, and two were variants of other existing drugs. We are developing a novel product candidate designed to overcome the limitations of current treatment options for patients with PAD who suffer from chronic pain. According to a research study by Stanford University more than 24% of patients with PAD are at risk of high opioid use. By treating pain at the source and present patients and physicians with better and safer treatment alternatives we expect to minimize opioids at the prescription pad. Given the properties of JAN101, we have made the strategic decision to initially focus on pain associated with PAD by treating the underlying cause of PAD.

Peripheral artery disease

Peripheral artery disease is a general term for conditions in which arterial blood flow to the limbs are partially blocked. When there is less blood present in the extremities relative to demand, muscle pain and fatigue result, especially in the calf, which is also known as intermittent claudication. In many patients, pain and fatigue are relieved through rest. Roughly half of patients with PAD are asymptomatic. The most common cause of PAD / intermittent claudication is atherosclerosis. Diabetes, chronic kidney disease, hypertension, and smoking are all risk factors which can increase the likelihood of PAD. In atherosclerosis, fat deposits (plaques) build up along arterial walls, resulting in a reduction in blood flow in the legs. This same process can cause strokes if the arteries leading up to the brain are affected.

15

Because of the high rate of asymptomatic patients, prevalence figures vary widely. Some estimate that up to 200 million worldwide have PAD, ranging from asymptomatic disease to severe. Prevalence increases as a function of patient age, rising sharply after the age of 60. Thus, in countries with an aging population, it is expected that the prevalence of PAD will only increase. There is also a strong ethnic and racial component to PAD prevalence, which may be due to cultural differences in diet and exercise, along with genetic differences. Some suggest a prevalence of 8-12 million in the US alone, with roughly a third experiencing pain when walking, which improves upon resting. The diagnosis of PAD usually begins with patient complaints of pain in the extremities. If the patient is already being treated or monitored for diabetes or other risk factors, then the physician will check for a weak or absent pulse in the extremity. Decreased blood pressure, poor wound healing, and whooshing sounds in the legs (via stethoscope) are also tell-tale signs of PAD / intermittent claudication. Angiograms, electrocardiograms, and ultrasounds can also be used to image and confirm the diagnosis.

The non-drug treatment of PAD / intermittent claudication may be divided into four general categories:

|

|

•

|

Lifestyle – Primarily changes in diet and smoking cessation.

|

|

|

•

|

Exercise – Patients who walk, cycle, stretch, or swim can experience marked improvement. Formal programs involving treadmills and track walking (usually 3-5 times per week) are frequently provided to patients. However, if the pain is triggered by exercise (claudication) and is significant, it can discourage the patient from exercise.

|

|

|

•

|

Angioplasty – A procedure by which the affected artery is stretched with a balloon-like device. This procedure has limited effectiveness and is reserved for severely blocked arteries.

|

|

|

•

|

Bypass Surgery – Arteries which are beyond angioplasty can be bypassed entirely. This procedure is typically reserved for cases where the blockage is considered very long (~10 centimeters) and nearly complete.

|

The underlying condition, however, is not addressed by surgery. Surgical approaches will not, in the long run, improve exercise capacity and walking distance. Only exercise itself, coupled with lifestyle changes and drug approaches, has this benefit.

16

Prescription drugs for the treatment of the underlying PAD may be divided into multiple categories, depending on the underlying condition and severity:

|

|

•

|

Cholesterol-Lowering Agents - Statins and bile acid sequestrants.

|

|

|

•

|

Antiplatelet Medica1ons – Aspirin and related drugs, such as clopidogrel. Cilostazol also has antiplatelet properties.

|

|

|

•

|

Antihypertensives – Patients with underlying high blood pressure can and will receive any number of medications to reduce blood pressure, such as ACE inhibitors and diuretics.

|

|

|

•

|

Diabetes Therapies – While a substantial portion of PAD patients may have pre-diabetes or fulminant diabetes, it is unknown of aggressive treatment of diabetes has a positive effect on PAD.

|

|

|

•

|

Pain – To our knowledge, no drugs are specifically indicated for PAD-associated pain. Pentoxifylline, for example, is indicated “…for the treatment of patients with intermittent claudication on the basis of chronic occlusive arterial disease of the limbs.” (Sanofi-Aventis U.S. LLC, 2010) However, the evidence supporting the effectiveness of pentoxifylline is mixed. Short-term courses of NSAIDs, such as ibuprofen may be used, provided the patient is not on another anticoagulant like aspirin. Non-drug pain relievers, such as TENS and massage, may also be used in these patients. Opioids may also be used which creates a risk for addiction and potential misuse at the medicine cabinet by family members.

|

The lack of any truly effective treatment of PAD, along with encouraging early trial results using JAN101 on both improving vascular function and reducing pain in PAD patients, has created an opportunity to potentially treat this large unmet medical need. By improving vascular function, JAN101 has the potential to reduce associated pain and improve PAD patients’ quality of life.

17

COVID-19

Coronavirus disease (COVID-19) is an infectious disease caused by a newly discovered coronavirus.

Most people infected with the COVID-19 virus will experience mild to moderate respiratory illness and recover without requiring special treatment. Older people, and those with underlying medical problems like cardiovascular disease, diabetes, chronic respiratory disease, and cancer are more likely to develop serious illness. The COVID-19 virus spreads primarily through droplets of saliva or discharge from the nose when an infected person coughs or sneezes. At the time of filing this Form 10-K, there are no specific vaccines or treatments for COVID-19. However, there are many ongoing clinical trials evaluating potential treatments and vaccines.

One of the hallmarks of severe cases of COVID-19 is acute respiratory distress syndrome (“ARDS”), a rapid, widespread inflammation of the lungs that can lead to respiratory failure and death. In addition to the widely reported lung injuries associated with COVID-19, clinicians around the world are reporting that the disease also could be causing cardiac injuries in patients that sometimes lead to cardiac arrest. Kidney damage also is becoming a commonly reported issue among COVID-19 patients.

Alan Kliger, a nephrologist at the Yale School of Medicine, found early data showed 14% to 30% of ICU COVID-19 patients in New York and Wuhan, China, lost kidney function and later required dialysis. Similarly, a study published in the journal Kidney International found that nine of 26 people who died of COVID-19 in Wuhan had acute kidney injuries, and seven had units of the new coronavirus in their kidneys.

A study in May, 28 2020 in the New England Journal published research detailing the post-mortem features of seven patients who died of COVID-19 provides critical insights, including evidence of extensive damage to the lining of the blood vessels, abnormal blood vessel growth in the lungs and widespread blood clotting. The study led by Steven Mentzer, HMS professor of surgery at Brigham and Women’s Hospital, and done in collaboration with a team of international researchers tissue analysis showed that infection with SARS-CoV-2, the virus that causes COVID-19, caused severe damage to the endothelial cells that line blood vessels and triggered widespread blood clotting. The team also identified signs of a distinctive pattern of vascular disease progression in some cases of COVID-19 compared with patterns seen in equally severe influenza virus infection. The findings highlight these key takeaways:

|

|

•

|

While caused by a respiratory virus, COVID-19 manifests as a vascular disease that leads to severe injuries to blood vessels throughout the lungs. The damage to vascular cells may help explain why serious blood clotting has been observed in many patients.

|

|

|

•

|

The substantial new blood vessel growth seen in the lungs of COVID-19 patients occurs primarily through a mechanism known as intussusceptive angiogenesis—the splitting of existing blood vessels to form new ones—perhaps as a repair response to blood clotting and blood vessel damage, according to the authors.

|

Damaged blood vessels may also underlie other problems, such as COVID toe, multisystem inflammatory syndrome in children (MIS-C), stroke and other seemingly unrelated problems seen with COVID-19.

Our Team

Tony Giordano PhD, our Chief Scientific Officer, joined the company in December 2019. Dr. Giordano joined JanOne from the Cleveland Clinic, the No.2 rated hospital in the country, where he served as Senior Director of Special Projects in the Business Development group. Dr. Giordano has extensive experience in commercialization and drug development, having served as Vice President or President of seven different biotechnology companies he co-founded, including companies developing platform technologies, a cancer vaccine, and Alzheimer’s Disease and cardiovascular therapies. He has managed numerous clinical trials and the launch of a medical food product. Dr. Giordano has also served as an Associate Professor and Assistant Dean of Research and Business Development at LSU Health Sciences Center in Shreveport, where he led the licensing efforts at the campus and at Abbott Labs, where in addition to serving as a Senior Research Scientist, he was involved in technology assessment activities. Dr. Giordano has a PhD focused in Molecular Genetics from Ohio State University and completed Fellowships at the NCI and NIA.

18

Dr. Amol Soin, our Chief Medical Officer, joined the Company in January 2020. Dr. Soin is considered one of the nation's top pain experts and is the Founder and Chairman of the Ohio Pain Clinic. Dr. Soin brings significant expertise for treating neuropathic and chronic pain and extensive research experience for non-opioid, nonaddictive pain solutions to the JanOne management team. In his role as Chief Medical Officer, Dr. Soin will guide JanOne's drug development activities, manage clinical research, set patient safety standards, and ensure regulatory compliance. In addition, Dr. Soin will play an integral role in establishing partnerships and drug candidate selection as the company expands its pipeline. Dr. Soin received his undergraduate degree from University of Akron, his MBA from University of Tennessee, his MD from Northeastern Ohio Universities College of Medicine, his master's in science from Brown University and also has studied at Dartmouth College. He is board certified in anesthesiology and pain medicine and a fellow of interventional pain management at the World Institute of Pain, and he served as a pain management fellow at the Cleveland Clinic, the oldest and largest academic pain management department in the United States. The founder and chairman of the Ohio Pain Clinic, Dr. Soin has also held several prestigious positions including President of the Ohio Society of Interventional Pain Physicians, president of the American Society of Interventional Pain Physicians Foundation, President of the Society of Interventional Pain Management Surgery Centers and president – elect of TriState Pain Society. He was appointed by Governor Kasich to the Ohio Medical Board in 2012 to two 5 year terms and has served as the Ohio Medical Board's president where he was instrumental in passing statewide rules and guidelines to help the opioid crisis.

In November 2019, we formed a Scientific Board of Advisors (the “SBA”) and the following doctors and scientist currently sit on the SBA:

Chris Kevil, Ph.D., Chair of the Scientific Advisory Board -- Dr. Kevil, an internationally known expert in vascular pathophysiology, PAD, and nitric oxide biology, discovered the role of sodium nitrite in promoting angiogenesis that led to the development of TV1001 now known as Jan101. Dr. Kevil earned his Ph.D. degree from LSU Health Shreveport in Molecular and Cellular Physiology followed by a fellowship at the University of Alabama at Birmingham (UAB) with an emphasis on redox pathophysiology. Returning to LSU Health Shreveport in the Department of Pathology, he established cutting edge research programs regarding redox biology regulation of peripheral vascular diseases. This led to ground-breaking insights on how glutathione, nitrite/nitric oxide, and hydrogen sulfide regulate vascular health during ischemia.

Edgar Ross, MD -- Dr. Ross is the current Director of the Pain Management Center at Brigham and Women's Hospital and a professor of anesthesia at Harvard Medical School. Dr. Ross is recognized as Castle Connolly's America's top doctors for the fifth year in a row. In addition to serving as chairman of Pfizer's partnership on pain, Dr. Ross also has served as a member of the Blue Cross and Blue Shield Opioid Prescribing Policy Committee.

Rakesh Patel, Ph.D. -- Dr. Patel is currently Vice Chair for Research, Department of Pathology, and Director of the Center for Free Radical Biology at the University of Alabama at Birmingham (UAB). Most noted is his research to understand the molecular basis of nitric oxide, and nitrite interactions with organs and red blood cells. Patel is also known for his work to understand the impacts on the biological process associated with blood flow regulation and pulmonary function.

Timothy Ness, MD, Ph.D. -- Dr. Ness is Professor Emeritus and former Pain Treatment Division Chief, Director of Pain Research and Vice Chair for Clinical Research in the Department of Anesthesiology and Perioperative Medicine at the University of Alabama at Birmingham (UAB) He has served as a clinical research expert on pain for the National Institutes of Health (NIH), Food and Drug Administration (FDA) advisory panels, the Veterans Administration (VA), and various international research institutes. He has served on the American Pain Society and the American Society of Regional Anesthesia and Pain Medicine Board of Directors. He is currently funded by the NIH.

Alan Kaye, MD, PhD, DABA, DABPM, DABIPP -- Dr Kaye is the Professor and Chairman of the Department of Anesthesiology at LSU Health Sciences Center in New Orleans since January 2005. Before LSU, he was Professor and Chairman of the Texas Tech University Health Sciences Center Department of Anesthesiology in Lubbock, Texas. Prior, he was the Medical Director of the Greater New Orleans Surgical Center, the Director of Resident Recruitment, Acting Program Director and an Attending Staff of the Department of Anesthesiology at Tulane University Medical Center in New Orleans. He received two BS degrees and a MD degree from the University of Arizona. He also completed a pain management fellowship at Texas Tech Health Sciences Center. He is Board

19

Certified as a Consultant in Anesthesiology and has a special certificate in Pain Management for the American Board of Anesthesiology. He is also a Diplomate of the American Board of Pain Medicine and the American Board of Interventional Pain Physicians. Dr. Kaye completed his PhD in pharmacology in May 1997. His thesis title was "Pharmacology of Angiotensin Peptides and Nonpeptide Agonists in the Pulmonary Vascular Bed of the Cat and of the Rat." He was awarded first place in the National Student Research Forum as a resident and has authored or co-authored over 150 abstracts and 200 manuscripts and book chapters in the fields of pulmonary vascular pharmacology and anesthesiology. He has had a lifelong interest in education and teaching medical students and residents. He serves on a number of national committees including as a National Board of Directors of ASIPP and ABIPP. He is editor-in-chief of the journal Pain Physicians and is on the FDA Advisory Board on Anesthetics and Analgesics. He was an Associate National Board Examiner in Anesthesiology

John Cooke, MD, Ph.D. -- is the Chair of the Department of Cardiovascular Sciences at the Houston Methodist Research Institute, Director of the Center for Cardiovascular Regeneration, and Medical Director of the RNA Therapeutics Program in the Houston Methodist DeBakey Heart and Vascular Center in Houston, Texas. He trained in cardiovascular medicine and obtained a Ph.D. in physiology at the Mayo Clinic. He was recruited to Harvard Medical School as an assistant professor of medicine. In 1990, he was recruited to Stanford University to spearhead the program in vascular biology and medicine, and was appointed professor in the Division of Cardiovascular Medicine at Stanford University School of Medicine, and associate director of the Stanford Cardiovascular Institute until his recruitment to Houston Methodist in 2013. Dr. Cooke has published over 500 research papers, position papers, reviews, book chapters and patents in the arena of vascular medicine and biology with over 30,000 citations. He has served on national and international committees that deal with cardiovascular diseases, including the American Heart Association, American College of Cardiology, Society for Vascular Medicine, and the National Heart, Lung and Blood Institute. He has served as president of the Society for Vascular Medicine, as a director of the American Board of Vascular Medicine, and as an associate editor of Vascular Medicine.

Our Strategy

Our mission is to develop and commercialize novel, non-opioid, and non-addictive therapies to safely and effectively address the significant unmet medical need of chronic pain or treat conditions that cause pain. The principal elements of our strategy to achieve this mission are the following:

|

|

•

|

License, acquire, develop, and create novel, non-opioid and non-addictive therapies by leveraging our understanding of pain biology to address the large and growing problem of pain. While innovation in medical sciences has led to exciting new treatment options in many disease areas, pain has seen limited innovation in recent years. We have a deep understanding of the pathophysiology of pain and diseases that cause pain. We intend to leverage this understanding to bring innovation in the pain treatment paradigm through targeted acquisitions of companies or assets in development. Our advisors and doctors have years of collective experience in leadership positions at institutions and substantial scientific experience, and understand the complexity of designing and executing clinical trials for and developing therapies.

|

|

|

•

|

Advance the development of our lead product candidate, JAN101, designed for the treatment of patients with PAD and pain associated with the disease. There are limited therapeutic options available for patients with PAD and we believe that JAN101 has the potential to transform the standard of care to a twice a day pill to substantially improve moderate to severe PAD. The company plans to engage a contract research organization (“CRO”) in early 2021 and begin enrolling subjects for the first Phase 2b trials for JAN101, and we expect to report topline results promptly following receipt of the data from the CRO.

|

|

|

•

|

Leverage clinical activity of JAN101 to expand into new indications, including complications associated with COVID-19. We believe that JAN101 may have utility in treating vascular complications in patients with COVID-19 as we believe COVID-19 is an endothelial cell disease which manifests its complications in the vascular system and major organ causing complications in recovered patients. In November 2020, we filed an IND for our COVID-19 indication (which was subsequently converted to a pre-IND) and begin our study if and when we receive approval from the FDA. We plan to release more information regarding our COVID-19 study once the FDA has cleared the IND.

|

20

|

|

•

|

Advance our product candidates through clinical development and pursue development of additional product candidates through acquisitions. Our objective is to build a well-balanced, multi-asset portfolio targeting the large population of patients with chronic and acute pain. To achieve this, in addition to JAN101, we intend to pursue partnerships, licensing agreements, and potential acquisitions of other pharma companies. We continue our search for assets with indications where we believe they could have meaningful impact and address the large unmet medical need. In addition, we may choose to selectively in-license or acquire complementary product candidates by leveraging the insights, network, and experience of our team.

|

|

|

•

|

Maximize the commercial potential of all our product candidates. We currently intend to retain all commercial rights to JAN101 in the United States and selectively partner outside of the United States. Because we believe that PAD is an attractive market for many major pharmaceutical companies, we may sub-license or partner certain indications if we believe it may enhance stockholder value. As we continue to build and develop our product portfolio, we may opportunistically pursue strategic partnerships that maximize the value of our pipeline while seeking to develop other indications.

|

|

|

•

|

Leverage our management team background and expertise. We have assembled a team with extensive experience described above.

|

Chronic Pain

The NIH defines chronic pain as pain that persists either beyond the normal healing time of an injury or longer than three months. We believe that chronic pain represents a significant public health crisis. In the United States, chronic pain affects approximately 40 million adults annually, which is greater than the annual prevalence of each of heart disease, cancer and diabetes. It is also estimated that pain leads to between $560 and $635 billion in healthcare and lost productivity costs each year. Chronic pain is the leading cause of long-term disability in the United States, and approximately 23 million adults in the United States experience severe pain over a three-month period. Globally the prevalence of chronic pain is even larger, with over 1 billion people worldwide affected each year. Common types of chronic pain include those of neuropathic and inflammatory origin and may involve the skin, muscles, joints, bones, tendons, ligaments, and other soft tissues. Chronic pain is associated with a variety of clinical conditions including, but not limited to, arthritis, spinal conditions, cancer, fibromyalgia, diabetes, surgical recovery, visceral injury and general trauma.

Pain is a necessary protective reaction that alerts the body to the presence of actual or potential tissue damage so that necessary corrective responses can be mounted. Pain is signaled by specialized cells in the peripheral nervous system called nociceptors, or pain-sensing fibers. These pain-sensing fibers normally transmit information about stimuli that approach or exceed harmful intensity from different locations in the body to the brain, which registers this information as a sensation of pain. In the case of tissue injury due to trauma or infection, pain accompanies the associated inflammation, persists for the duration of the inflammatory response, and aids healing by inhibiting use of the affected body part.

Pain also can modify the central nervous system such that the brain becomes sensitized and registers more pain with less provocation. This is called central sensitization. When central sensitization occurs, the nervous system goes through a process called wind-up and gets regulated in a persistent state of high reactivity. This persistent, or up-regulated, state of reactivity lowers the threshold for what triggers the sensation of pain and can result in the sensation of pain even after the initial injury might have healed.

When there is dysfunction in pain signaling, injury to the nervous system, or an unhealed injury, pain becomes no longer just a symptom, but a disease in itself.

Current Therapeutic Approaches to Treating Chronic Pain and Their Limitations

NSAIDs

Some of the most widely used therapies to treat chronic inflammatory pain are non-steroidal anti-inflammatory drugs, or NSAIDs. NSAIDs can have significant side effects that include gastrointestinal bleeding, gastritis, high blood pressure, fluid retention, kidney problems, heart problems and rashes. On April 7, 2005, the FDA announced a decision to require boxed warnings of potential cardiovascular risk for all NSAIDs.

21

Corticosteroids

Corticosteroids, or steroids, also possess anti-inflammatory properties and are commonly used in the practice of pain management, either systemically or locally, depending on the condition. Steroids work by decreasing inflammation and reducing the activity of the immune system. While steroids are commonly used, they may have numerous and serious side effects. These side effects may include allergic or hypersensitivity reactions, increased risk for infection, adrenal insufficiency, diabetes or decreased glucose tolerance, hypertension, loss of bone density, and loss of joint cartilage volume. In addition, steroids should not be administered when there is an infection present because steroids can inhibit the body’s natural infection-fighting immune response. Also, if a joint is already damaged or is subject to chronic deterioration, IA steroid injections are not likely to provide any long-term restorative benefit. For the above reasons, IA steroid injections are generally recommended to be administered no more often than every six weeks and not more than three to four times per year.

Opioids

Opioids are some of the most widely prescribed therapeutics for chronic and acute pain, and sales of these drugs have quadrupled between 1999 and 2010. According to a National Survey on Drug Use and Health report, in 2016 more than one third of adult Americans were prescribed opioids and 230 million opioid prescriptions were written that year in the United States. Opioids act by binding to specific receptors located on neurons in both the central and peripheral nervous system throughout the body including in the brain, spinal cord and other nervous tissue. Although they can be effective in providing pain relief, the increased medical use of opioids has been accompanied by an increase in the abuse and misuse of prescription opioids. In addition, for most patients, chronic opioid use is a poor option due to an intolerance to the many side effects, including nausea, vomiting, drowsiness and constipation, and the propensity for opioids to become less effective with long-term use. According to the Centers for Disease Control and Prevention, or CDC, almost two million individuals abused or were dependent on prescription opioids in 2014. CDC figures show that the number of opioid-related overdose deaths has quadrupled between 1999 and 2010, and currently approximately 40% of opioid overdose deaths in the United States involve a prescription opioid. This increase in prescription opioid-related deaths in the United States prompted President Trump to declare the opioid crisis a national Public Health Emergency in October 2017. Opioid abuse has become an epidemic in the United States, ranking as the nation’s second most prevalent illegal drug problem. These major issues create the need to find new approaches to treating chronic pain.

Our Approach to Treating PAD and Chronic Pain

The unmet medical need for treating PAD and chronic pain reflects the historic failure to develop novel classes of analgesics with comparable or greater efficacy, an acceptable level of adverse effects and a lower abuse liability than those currently available. Some of the reasons for this include the heterogeneity of chronic pain and its related conditions, and the complexity and diversity of the underlying pathophysiological mechanisms for pain. However, recent advances in the understanding of the neurobiology of pain are beginning to offer opportunities to identify new drug targets and develop new therapeutic strategies.

We have taken an innovative and targeted approach to identifying treatments for chronic pain that leverages our understanding of the pathophysiology of pain. Pain is variable—for example, it can be inflammatory or neuropathic in nature, and it may be localized to a specific area of the body or it may be generalized throughout. We believe that the most effective way to treat chronic pain is through therapies that specifically target the origin of the pain signal. We strive to maximize each of our product candidate’s potential based on its unique mechanism of action related to the origin of the pain signal.

A Randomized, Double-Blind Study of the Effects of a Sustained Release Formulation of Sodium Nitrite (SR-nitrite) on Patients with Diabetic Neuropathy

Background: Background: Sodium nitrite has been reported to be effective in reducing chronic peripheral pain.

Objectives: To evaluate the safety and efficacy of 40 and 80 mg, BID, of an oral sustained release formulation of sodium nitrite (SR-nitrite) in patients suffering from diabetic neuropathy, and to determine whether SR-nitrite would reduce the frequency of headaches reported previously by subjects receiving the same doses of an immediate release formulation. Study Design: Phase II, single-center, randomized, double-blind, placebo controlled clinical trial. Setting: The Ohio Pain Clinic and Kettering Medical Center.

22

Methods: Twenty-four patients were randomized to 40 mg or 80 mg SR-nitrite or placebo twice daily for 12 weeks. The primary objective was to determine whether headaches would be reduced using SR-nitrite. The primary efficacy endpoint was the mean difference in the change of the Neuropathic Pain Symptom Inventory (NPSI) pain score from baseline to that reported after 12 weeks of treatment. Secondary endpoints included changes from baseline for the Brief Pain Inventory (BPI) Scale, the RAND 36 questionnaire, Short Form McGill Questionnaire, daily patient reported score for neuropathic pain, changes in HbA1c, PulseOx and quantitative sensory testing. Results: The number of subjects reporting adverse events and the number of adverse events did not change with dose. There were no reports of treatment-related headaches. Although no significant differences were identified in patient responses to the questionnaires, a trend was observed. In the NPSI assessment, patients in the 40 mg and 80 mg dose group reported a 12.7% and 22.0% reduction in pain, respectively, compared to an 8.4% reduction by patients in the placebo group. A trend was also observed with the BPI total severity score. However, the 40 mg dosing group reported the greatest reduction in pain using the McGill Pain index and via patient logs of daily pain scores, where the mean of pain scores reported by subjects in the 40 mg group dropped by day 41 and generally stayed lower than the mean of scores reported by subjects in either of the other two groups. Patients in the 80 mg SR-nitrite group had an improvement in both Nerve Sensory Conductance and Nerve Sensory Velocity. No changes were observed in HbA1c levels or PulseOx.

Limitations: Small sample size.

Conclusion: Sustained release sodium nitrite prevents the prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study of patients with peripheral arterial disease (PAD), 40 mg BID treatment led to a statistically significant reduction in reported pain, similar trends were observed at the end of the trial period for most of the pain questionnaires used in the study. The 80 mg BID treatment had the more pronounced affect on bioactivity (quantitative sensory testing), which was similar to the PAD study, where this dose group had the greatest improvement in FMD {AU: spell out FMD}. The ability to alleviate pain with BID treatment of SR-nitrite offers promise for a new non-addictive, non-sedating treatment of chronic pain and warrants further study.

Microcirculatory injury, which is common in diabetic patients, can lead to a number of problems. Prominent among these is diabetic peripheral neuropathy (DPN) (1,2). About 10% of patients will have evidence of DPN at the time they are initially evaluated, and almost 50% of diabetic patients will ultimately develop DPN. Of diabetic patients with DPN, 40% to 50% suffer from chronic pain as well as paresthesias, sensory loss, and weakness, and have at least an 8-fold increased risk of undergoing a distal lower extremity amputation compared to similar non-diabetics. Endothelial cells play an important part in the regulation of microcirculation, as they maintain vascular tone by secreting both vasodilators and vasoconstrictors. A central feature of diabetic microvascular disease (MVD) is endothelial dysfunction, which, in turn, plays an important role in the development and progression of DPN. The pathophysiological factors leading to endothelial dysfunction in diabetes include chronic hyperglycemia and protein glycolation, insulin resistance, inflammation, and increased oxidative stress. Studies have now shown a close relationship between endothelial dysfunction and diminished nitric oxide (NO) bioavailability. Endogenously produced NO has a half life measured in seconds, and is rapidly oxidized to nitrite (NO2–) and nitrate (NO3––) end products, the latter of which is biologically inert. In the presence of microcirculatory ischemia and endothelial cell dysfunction, however, endogenous NO production by eNOS is much more limited. In such circumstances, circulating NO2– can be non-enzymatically reduced to increase NO availability. In addition to serving as a circulating NO reservoir, nitrite itself has also been shown to have direct and potent vasodilatory effects in vitro and in vivo. The findings that NO2– mediates vasodilatation, both directly and through NO generation, has led to growing interest in the potential effectiveness of nitrite as a therapeutic agent in conditions associated with DPN and endothelial dysfunction. Such conditions include diabetic microvascular disease, DPN, and retinopathy, in which low levels of NO and NO2–, as well as elevated levels of nitrate (NO3), suggest that the complete oxidation of NO occurs during diabetes with insufficient NO2– reserves to restore NO bioavailability. Previous human studies with an oral formulation of NaNO2 have shown that administration twice daily improves vascular function. In the peripheral arterial disease study, subjects who received the lower dose of NaNO2 reported a significant reduction in pain. Although side effects were minimal, headaches and dizziness were reported by a large number of subjects, likely due to the rapid release of NaNO2 leading to vasodilation. An oral sustained-release formulation of NaNO2 (SR-nitrite) was developed in an attempt to overcome these problems and was tested in a porcine model of metabolic syndrome with critical limb ischemia. SR-nitrite-treated animals showed increased myocardial NO

23