Current Report Filing (8-k)

June 16 2022 - 8:16AM

Edgar (US Regulatory)

false000165932300016593232022-06-152022-06-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 15, 2022

|

|

|

Iterum Therapeutics plc |

(Exact name of registrant as specified in its charter) |

Ireland |

001-38503 |

98-1283148 |

(State or other jurisdiction |

(Commission File Number) |

(IRS Employer Identification No.) |

of incorporation) |

|

|

|

|

|

|

Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland |

Not applicable |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +353 1 903 8920 |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12 (b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Ordinary Shares, par value $0.01 per share |

ITRM |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 15, 2022, the Company held its annual general meeting of shareholders, at which the Company’s shareholders voted on the following proposals, each of which is described in the Company’s definitive proxy statement, filed with the Securities and Exchange Commission on April 25, 2022.

Proposal No. 1: Election of Directors. The shareholders re-elected, by separate resolutions, David G. Kelly and Mark Chin to the Company’s board of directors as Class I directors, each to serve for a three-year term expiring at the 2025 annual general meeting of shareholders. The results of the shareholders’ vote for the re-election of such Class I directors were as follows:

|

|

|

|

|

Nominee |

For |

Against |

Abstain |

Broker Non-Votes |

David G. Kelly |

24,413,823 |

11,880,131 |

3,225,927 |

44,436,623 |

Mark Chin |

24,600,500 |

11,832,841 |

3,086,540 |

44,436,623 |

Proposal No. 2: Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm for 2022 and Authorization of the Board of Directors to Approve the Remuneration of the Independent Registered Public Accounting Firm. The shareholders ratified, in a non-binding vote, the appointment of KPMG as the Company’s independent registered public accounting firm for its fiscal year ended December 31, 2022 and authorized the Company’s board of directors, acting through its audit committee, to set the independent registered public accounting firm’s remuneration. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For |

Against |

Abstain |

63,742,528 |

13,697,524 |

6,516,452 |

Proposal No. 3: Approval of Reverse Share Split. The shareholders approved, subject to and conditional upon the board of directors determining, in its sole discretion, that a reverse share split is necessary for the Company to comply with the minimum $1.00 per share requirement pursuant to Nasdaq Listing Rule 5550(a)(2), a reverse share split (i.e., a consolidation of share capital under Irish law), or the Reverse Share Split, whereby every 15 ordinary shares of $0.01 (nominal value) each in the authorized and unissued and authorized and issued share capital of the Company be consolidated into 1 ordinary share of $0.15 (nominal value) each, and the subsequent (i) reduction in the nominal value of the ordinary shares in the authorized and unissued and authorized and issued share capital of the Company from $0.15 each to $0.01 each and (ii) increase in the authorized ordinary share capital of the Company in order to round up the authorized share capital to an even number following the Reverse Share Split, with our board of directors able to elect to abandon such proposed amendments and not effect the Reverse Share Split authorized by shareholders, in its sole discretion. The results of the shareholders’ vote were as follows:

|

|

|

For |

Against |

Abstain |

46,105,926 |

37,370,038 |

480,540 |

Proposal No. 4: Approval of Share Option Exchange Program. The shareholders did not approve a share option exchange program whereby certain share options granted to eligible employees are exchanged on a one-for-one basis for new share options granted with an exercise price equal to the fair market value of our ordinary shares on the date of grant. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

|

|

For |

Against |

Abstain |

Broker Non-Votes |

16,893,747 |

20,607,671 |

2,018,463 |

44,436,623 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Iterum Therapeutics plc |

|

|

|

Dated: June 16, 2022 |

|

|

|

|

By: |

/s/ Corey N. Fishman |

|

|

|

|

Corey N. Fishman |

|

|

|

Chief Executive Officer |

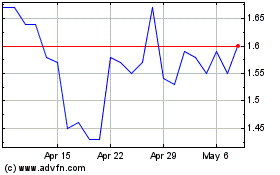

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

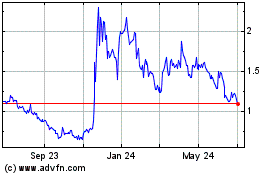

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2023 to Apr 2024