Securities Registration: Employee Benefit Plan (s-8)

December 09 2021 - 9:18AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on December 9, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Iterum Therapeutics plc

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

Ireland

|

98-1283148

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

Fitzwilliam Court, 1st Floor,

Leeson Close,

Dublin 2, Ireland

(Address of Principal Executive Offices)

Not applicable

(Zip Code)

Iterum Therapeutics plc 2021 Inducement Equity Incentive Plan

(Full Title of the Plan)

Corey Fishman

President and Chief Executive Officer

200 South Wacker Dr., Suite 650

Chicago, IL 60606

(Name and Address of Agent For Service)

(312) 778-6070

(Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Brian A. Johnson, Esq.

Wilmer Cutler Pickering Hale and Dorr LLP

7 World Trade Center

250 Greenwich Street

New York, New York 10007

Telephone: (212) 230-8800

Fax: (212) 230-8888

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

|

|

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

Title of Securities to be Registered

|

Amount to be Registered(1)

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Ordinary Shares, par value $0.01 per share

|

5,000,000 (2)

|

$0.44 (3)

|

$2,200,000 (3)

|

$203.94

|

|

|

(1)

|

Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional ordinary shares of the Registrant (“Ordinary Shares”) that become issuable under the Registrant’s 2021 Inducement Equity Incentive Plan by reason of any share dividend, share split, recapitalization, or other similar transaction effected that results in an increase to the number of the Registrant’s outstanding Ordinary Shares.

|

|

|

(2)

|

Represents Ordinary Shares reserved for future issuance under the Registrant’s 2021 Inducement Equity Incentive Plan as of the date of this Registration Statement.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act. The price per share and aggregate offering price are calculated on the basis of $0.44, the average of the high and low sale prices of the Ordinary Shares as reported on the Nasdaq Capital Market on December 3, 2021, in accordance with Rule 457(c) under the Securities Act.

|

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

ITEM 1. PLAN INFORMATION.

The information required by Item 1 is included in documents sent or given to participants in the plan covered by this registration statement pursuant to Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”).

ITEM 2. REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION.

The written statement required by Item 2 is included in documents sent or given to participants in the plan covered by this registration statement pursuant to Rule 428(b)(1) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

Iterum Therapeutics plc (the “Registrant”) is subject to the informational and reporting requirements of Sections 13(a), 14, and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission”). The following documents, which are on file with the Commission, are incorporated in this Registration Statement by reference:

(a)The Registrant’s latest annual report filed pursuant to Section 13(a) or 15(d) of the Exchange Act or the latest prospectus filed pursuant to Rule 424(b) under the Securities Act that contains audited financial statements for the registrant’s latest fiscal year for which such statements have been filed.

(b)All other reports filed by the Registrant pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the document referred to in (a) above.

(c)The description of the Registrant’s ordinary shares which is contained in the Registrant’s prospectus filed on May 25, 2018 pursuant to Rule 424(b) under the Securities Act relating to the registration statement on Form S-1 (File No. 333-224582).

(d)All other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Any statement

contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM 4. DESCRIPTION OF SECURITIES.

Not applicable.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL.

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

To the fullest extent permitted by Irish law, the Registrant’s Articles of Association confer an indemnity on its directors and officers. However, this indemnity is limited by the Companies Act 2014 (the “Irish Companies Act”), which prescribes that an advance commitment to indemnify only permits a company to pay the costs or discharge the liability of a director or corporate secretary where judgment is given in favor of the director or corporate secretary in any civil or criminal action in respect of such costs or liability, or where an Irish court grants relief because the director or corporate secretary acted honestly and reasonably and ought fairly to be excused. Any provision whereby an Irish company seeks to commit in advance to indemnify its directors or corporate secretary over and above the limitations imposed by the Irish Companies Act will be void under Irish law, whether contained in its articles of association or any contract between the company and the director or corporate secretary. This restriction does not apply to the Registrant’s executives who are not directors, the corporate secretary or other persons who would be considered “officers” within the meaning of that term under the Irish Companies Act.

The Registrant’s Articles of Association also contain indemnification and expense advancement provisions for persons who are not directors or our corporate secretary.

The Registrant is permitted under its Articles of Association and the Irish Companies Act to purchase directors’ and officers’ liability insurance, as well as other types of insurance, for its directors, officers, employees and agents. The Registrant has purchased and maintains a directors’ and officers’ liability policy for such purpose for the benefit of its directors and officers and directors and officers of its subsidiaries.

The Registrant has also entered into indemnification agreements with each of its directors and executive officers. In addition, one of the Registrant’s Delaware subsidiaries has entered into indemnification agreements with each of the Registrant’s directors and executive officers. These agreements, among other things, require the Registrant to indemnify an indemnitee to the fullest extent permitted by applicable law, including indemnification of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by the indemnitee in any action or proceeding, including any action or proceeding by us or in our right, arising out of the person’s services as a director or executive officer.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED.

Not applicable.

ITEM 8. EXHIBITS

____________

1. Item 512(a) of Regulation S-K. The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i) and (ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

2. Item 512(b) of Regulation S-K. The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. Item 512(h) of Regulation S-K. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Chicago, State of Illinois, on this 9th day of December, 2021.

ITERUM THERAPEUTICS PLC

By:/s/ Corey N. Fishman

Corey N. Fishman

President and Chief Executive Officer

POWER OF ATTORNEY AND SIGNATURES

We, the undersigned officers and directors of Iterum Therapeutics plc, hereby severally constitute and appoint Corey N. Fishman and Judith M. Matthews, and each of them singly, our true and lawful attorneys with full power to them, and each of them singly, to sign for us and in our names in the capacities indicated below, the registration statement on Form S-8 filed herewith and any and all subsequent amendments to said registration statement, and generally to do all such things in our names and on our behalf in our capacities as officers and directors to enable Iterum Therapeutics plc to comply with the provisions of the Securities Act of 1933, as amended, and all requirements of the Securities and Exchange Commission, hereby ratifying and confirming our signatures as they may be signed by our said attorneys, or any of them, to said registration statement and any and all amendments thereto.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

Signature

|

Title

|

Date

|

|

/s/Corey N. Fishman

Corey N. Fishman

|

President, Chief Executive Officer and Director (Principal Executive Officer)

|

December 9, 2021

|

|

/s/Judith M. Matthews

Judith M. Matthews

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

December 9, 2021

|

|

/s/ Brenton K. Ahrens

Brenton K. Ahrens

|

Chairman of the Board of Directors

|

December 9, 2021

|

|

/s/ Mark Chin

Mark Chin

|

Director

|

December 9, 2021

|

|

/s/ Michael W. Dunne

Michael W. Dunne

|

Director

|

December 9, 2021

|

|

|

|

|

|

/s/ Beth P. Hecht

Beth P. Hecht

|

Director

|

December 9, 2021

|

|

/s/ Ronald M. Hunt

Ronald M. Hunt

|

Director

|

December 9, 2021

|

|

/s/ David G. Kelly

David G. Kelly

|

Director

|

December 9, 2021

|

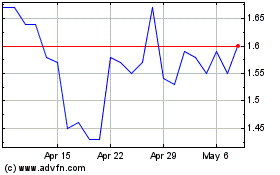

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

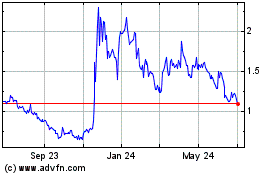

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2023 to Apr 2024