SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934 (Amendment No. 13)*

ISRAMCO, INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

465141406

(CUSIP Number)

Noa Lendner

8, Granit Street, Kiryat Arie, Box 10188

Petach-Tikva, Israel 49222

Telephone: +972-3-922-9225

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 20, 2019

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits.

See

Rule 13d-7 for other parties to whom copies are to be sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

|

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “

Exchange Act

”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Exchange Act (however,

see

the

Notes

).

Introduction

This Amendment No. 13 to Schedule 13D (this “

Amendment-13

”) relates to the shares of common stock, par value $0.01 (“

Common Stock

”), of Isramco Inc., a Delaware corporation (the “

Issuer

”), and amends Amendment No. 12 to the Schedule 13D filed on January 8, 2019 (“

Amendment-12

”). The prior Amendment-12 amended the original Schedule 13D filed on September 20, 1995, as the same has been previously amended, supplemented and restated by each of Amendment No. 1 thereto filed on January 22, 1996, Amendment No. 2 thereto filed on March 27, 1996, Amendment No. 3 thereto filed on November 29, 1996, Amendment No. 4 thereto filed on February 12, 1997, Amendment No. 5 thereto filed on May 14, 1997, Amendment No. 6 thereto filed on October 21, 1997, Amendment No. 7 thereto filed on January 22, 1998, Amendment No. 8 thereto filed on September 18, 1998, Amendment No. 9 thereto filed on December 30, 1998, Amendment No. 10 thereto filed on April 3, 2014, and Amendment No. 11 thereto filed on March 21, 2018.

Capitalized terms used but not defined in this Amendment-13 have the meanings given to them in Amendment-12.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 is hereby amended by adding the following:

Pursuant to an Agreement and Plan of Merger, dated as of May 20, 2019 (the “

Merger Agreement

”), by and among the Issuer, Naphtha, Holding, IOC, and Naphtha US Oil, Inc., a Delaware corporation and wholly owned subsidiary of IOC (“

Merger Sub

” and, together with Naphtha, Holding and IOC, the “

Purchaser Parties

”), Merger Sub will be merged with and into the Issuer, with the Issuer continuing as the surviving corporation governed by the laws of the State of Delaware (the “

Merger

”).

The Board of Directors of the Issuer, acting on the unanimous recommendation of a special committee of independent directors, approved the Merger Agreement and the transactions contemplated by the Merger Agreement, and recommended that the Issuer’s stockholders adopt the Merger Agreement.

It is anticipated that, at a price of $121.40 in cash per share of Common Stock, approximately $96.5 million will be expended for purchasing all of the outstanding Common Stock that is not beneficially owned by the Purchaser Parties.

The financing for the Merger and other transactions contemplated by the Merger Agreement will be provided by cash contributions from the Purchaser Parties.

Concurrently with the execution of the Merger Agreement, Holding, IOC, Mr. Tsuff and the Issuer entered into a Voting and Support Agreement (the “

Support Agreement

”). Per the terms and conditions set forth in the Support Agreement, Holding, IOC and Haim Tsuff have agreed to vote, or cause to be voted, all shares of Common Stock beneficially owned by them for the adoption of the Merger Agreement.

The descriptions of the Merger, the Merger Agreement and the Support Agreement in this Item 3 are qualified in their entirety by reference to the complete texts of such documents, as applicable, which have been filed as Exhibits 99.10 and 99.11 to this statement, respectively, and which are incorporated herein by reference in their entirety.

Item 4.

Purpose of Transaction.

Item 4 is hereby amended and restated as follows:

The purpose of the transactions contemplated under the Merger Agreement, including the Merger, is to acquire all of the outstanding shares of Common Stock not already beneficially owned by the Purchaser Parties. If the proposed transaction is completed, the Issuer’s Common Stock would become eligible for termination of registration pursuant to Section 12(g)(4) of the Act and would be delisted from the NASDAQ Capital Market.

Pursuant to the Merger Agreement, at the effective time of the Merger, each issued and outstanding share of Common Stock, other than shares owned by the Issuer as treasury stock, shares beneficially owned by the Purchaser Parties, and shares owned by holders of Common Stock who shall neither have voted in favor of the Merger nor consented thereto in writing and who shall have properly and validly perfected, and not effectively withdrawn or lost, their statutory appraisal rights under Delaware law, will be converted into the right to receive $121.40 in cash per share, without interest and subject to any withholding taxes.

The consummation of the Merger is subject to the satisfaction or waiver of a number of conditions set forth in the Merger Agreement, including the adoption of the Merger Agreement by the affirmative vote of not less than 75% of the issued and outstanding shares of Common Stock entitled to vote in the election of directors. In addition, the consummation of the Merger is subject to a non-waivable condition that the holders of a majority of outstanding shares of Common Stock not beneficially owned by any member of the Purchaser Parties or any of their affiliates or any officer of the Issuer as determined in accordance with Rule 16a-1(f) promulgated under the Exchange Act shall have voted in favor of the adoption of the Merger Agreement. The Merger Agreement may be terminated by the Issuer or IOC under certain circumstances.

The descriptions of the Merger Agreement in this Item 4 are qualified in their entirety by reference to the complete text of such document, which has been filed as Exhibit 99.10 hereto and which is incorporated herein by reference in its entirety.

The information set forth in or incorporated by reference in Item 3 of this statement is incorporated herein by reference in its entirety.

Item 5.

Interest in Securities of the Issuer.

Item 5(c) is hereby amended and restated as follows:

|

|

(c)

|

No transactions in the Common Stock of the Issuer have been effected by the Reporting Persons during the sixty days preceding the date of this Amendment-13.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 is hereby amended by adding the following:

The information set forth in or incorporated by reference in Items 3 and 4 is incorporated herein by reference in its entirety.

Item 7. Material to be Filed as Exhibits.

Item 7 is hereby amended by adding the following:

|

99.10

|

Agreement and Plan of Merger, dated as of May 20, 2019, by and among Naphtha Israel Petroleum Corporation Ltd., Naphtha Holding Ltd., I.O.C. - Israel Oil Company, Ltd., Naphtha US Oil, Inc. and Isramco, Inc. (incorporated herein by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by the Issuer on May 20, 2019).

|

|

99.11

|

Voting and Support Agreement, dated as of May 20, 2019, by and among Naphtha Holding Ltd., I.O.C. - Israel Oil Company, Ltd., Haim Tsuff, an individual, and Isramco, Inc. (incorporated herein by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Issuer on May 20, 2019).

|

|

|

|

SIGNATURES

After reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned, severally and not jointly, certifies that the information set forth in this statement is true, complete and correct. Each of the undersigned also hereby agrees to file this statement jointly pursuant to the Joint Filing Agreement listed on Exhibit 99.1 to Amendment-10.

Dated: May 20, 2019

/s/ Haim Tsuff

Haim Tsuff, on behalf of himself, and as attorney-in-fact for:

NAPHTHA HOLDING LTD.*

NAPHTHA ISRAEL PETROLEUM CORPORATION LTD.*

I.O.C. - ISRAEL OIL COMPANY, LTD.*

ISRAMCO OIL & GAS LTD.*

ISRAMCO NEGEV 2 LP*

J.O.E.L. JERUSALEM OIL EXPLORATION LTD.*

EQUITAL LTD.*

YHK INVESTMENT LP*

YHK GENERAL MANAGER LTD.*

UNITED KINGSWAY LTD.*

* The power of attorney authorizing the above named individual to act on behalf of each of the foregoing Reporting Persons is attached as Exhibit 99.2 to Amendment-10.

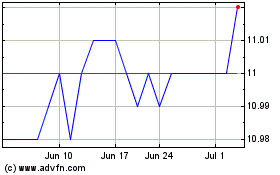

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Apr 2023 to Apr 2024