Current Report Filing (8-k)

October 28 2019 - 4:11PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

FORM 8‑K

CURRENT REPORT

|

|

|

|

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

|

October 22, 2019

|

|

|

(Date of Report (date of earliest event reported)

|

|

|

|

IRIDEX CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

0-27598

|

77-0210467

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer

Identification Number)

|

|

1212 Terra Bella Avenue

Mountain View, California 94043

|

|

(Address of principal executive offices, including zip code)

|

|

|

(650) 940-4700

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Class

|

|

Trading

Symbol

|

|

Name of Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

IRIX

|

|

Nasdaq Global Market

|

Item 1.01. Entry into a Material Definitive Agreement

On October 25, 2019, Iridex Corporation (the “Company”) entered into Change in Control Severance Agreements with David I. Bruce, the Company’s President and Chief Executive Officer, and Patrick Mercer, the Company’s Chief Operating Officer, that provide for certain severance benefits in the event that their employment with the Company is terminated in connection with a change in control.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

(b) Resignation of Director

On October 23, 2019 (the “Effective Date”) Ruediger Naumann-Etienne, Ph.D resigned from the board of directors (the “Board”) of the Company, the Nominating and Governance Committee of the Board, and as Lead Independent Director of the Board, in each case effective as of the Effective Date. Dr. Naumann-Etienne did not resign due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. In connection with Dr. Naumann-Etienne’s resignation from the Board the size of the Board was decreased from seven to six members as of the Effective Date.

Chairman of the Board

As announced in a press release dated October 28, 2019, the Board appointed Robert A. Gunst as Chairman of the Board effective October 23, 2019.

Nominating and Corporate Governance Committee

On October 25, 2019, the Board modified the composition of the Nominating and Governance Committee to consist of the following directors: Robert A. Gunst (Chair), Maria Sainz, and Kenneth E. Ludlum.

(e) Compensation of Executive Officers

Performance Restricted Stock Units

On October 22, 2019, the Compensation Committee of the Board approved an award of performance-based restricted stock units (“PRSUs”) to Romeo R. Dizon, the Company’s Vice President of Finance, and Mr. Mercer. Mr. Dizon’s and Mr. Mercer’s target numbers of PRSUs are 10,000 and 12,667, respectively.

Each PRSU represents the right to receive one share of the Company’s common stock and is subject to the terms of the Company’s 2008 Equity Incentive Plan (the “Plan”) and the applicable performance-based restricted stock unit award agreement under the Plan. The PRSUs will become eligible to vest if the Company’s Reported Gross Margin reaches one or more of five specified improvement goals, measured over a two-year period. The maximum number of PRSUs that can vest under each PRSU award is 120% of the target number of PRSUs.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRIDEX CORPORATION

|

|

|

|

|

By:

|

|

/s/ David I. Bruce

|

|

|

|

David I. Bruce

President and Chief Executive Officer

|

Date: October 28, 2019

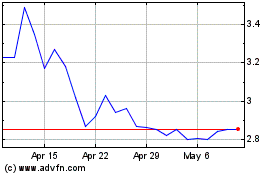

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

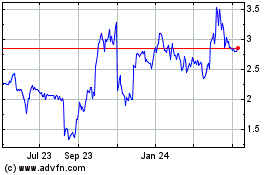

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Apr 2023 to Apr 2024