Ideal Power Reports First Quarter 2021 Financial Results

May 13 2021 - 4:05PM

Ideal Power Inc. (“Ideal Power” or the “Company”) (Nasdaq:

IPWR), pioneering the development and commercialization of highly

efficient and broadly patented B-TRAN™ bi-directional power

switches, reported results for its first quarter ended March 31,

2021.

“We continue to make progress toward our B-TRAN™

commercialization objectives,” stated Dan Brdar, President and

Chief Executive Officer of Ideal Power. “Under our collaboration

with Diversified Technologies, Inc. (DTI), we recently began the

next wafer fabrication run with Teledyne, which, when completed

later this quarter, represents the next major milestone under the

United States Naval Sea Systems Command (NAVSEA) program. We have

signed initial sampling agreements and are working with potential

partners’ technical and procurement teams on additional sampling

agreements. We also submitted proposals for government funding with

both new and prospective partners in our customer sampling program.

Since the beginning of the year, we have strengthened our balance

sheet, added highly qualified business development and engineering

leaders to the team, developed new packaging and driver designs and

completed a major milestone under the NAVSEA program.”

Key First Quarter and Recent Operational

Highlights

- Completed the second major milestone

under the NAVSEA program in partnership with DTI to demonstrate

B-TRAN™ enabled high efficiency direct current circuit breakers as

we received wafers from Teledyne’s second fabrication run.

- In collaboration with The University

of Texas at Austin’s Semiconductor Power Electronics Center:

- Finalized the development and

fabrication of a new B-TRAN™ driver for use in the customer

sampling program; and

- Under the NAVSEA program, finalized

the development of a second packaging design for high volume

production and to incorporate design for manufacturing feedback

from a commercial packaging firm.

- Released a B-TRAN™ information sheet

that provides technical information on B-TRAN™, the new packaging

design and driver that serve as the core of Ideal Power’s customer

sampling program. The B-TRAN™ information sheet is available at

http://www.idealpower.com/wp-content/uploads/2021/05/BTRAN-Information-Sheet-V1.1.pdf.

- Actively engaged with automotive

companies, electric vehicle (EV) system suppliers and renewable

energy power converter manufacturers on evaluating B-TRAN™ for

their applications and participation in our customer sampling

program.

- Submitted multiple proposals in

collaboration with both new and prospective partners in our

customer sampling program under a new round of solicitations from

the Department of Energy for government funding, representing

diverse applications including EVs, power converters for renewable

energy and UPS systems for data centers.

- Hired a Vice President of Business

Development with a strong semiconductor background in both silicon

and silicon carbide devices and established customer relationships

in the electric vehicle and renewable energy market segments.

- Hired a Vice President of

Engineering with over 20 years of experience in leading power

semiconductor design devices teams, including for EV and hybrid

electric vehicle applications, and numerous publications and

patents, to further expand in-house expertise and lead B-TRAN™

technology development.

- B-TRAN™ Patent Estate: Currently

have 62 issued B-TRAN™ patents with 25 of those issued outside of

the United States and 22 pending B-TRAN™ patents. In late March, we

had our first patent issuance in South Korea. Current geographic

coverage now includes North America, China, Japan, South Korea and

Europe, with potential to expand coverage into India.

- Raised $21.2 million in net proceeds

through an underwritten public offering of common stock, and an

additional $3.3 million through the exercise of options and

warrants.

First Quarter Financial

Results

- Grant revenue was $0.2 million in the first quarter of

2021.

- Operating expenses in the first quarter of 2021 were $0.9

million, flat compared to $0.9 million in the first quarter of

2020.

- Net loss in the first quarter of 2021 was $0.9 million, flat

compared to $0.9 million in the first quarter of 2020.

- Cash used in operating activities in first quarter of 2021 was

$0.8 million compared to $0.8 million in the first quarter of 2020.

Including investing activities, cash burn in the first quarter of

2021 was $0.9 million.

- In the first quarter of 2021, the Company raised $21.2 million

in net proceeds through an underwritten public offering of our

common stock and net cash proceeds of $3.3 million from the

exercise of options and warrants.

- Cash and cash equivalents totaled $26.8 million at March 31,

2021.

- Long-term debt outstanding at March 31, 2021 was $0.1 million

relating to a Payroll Protection Program loan received in the

second quarter of 2020 to temporarily subsidize payroll and

facilities costs in a business landscape impacted by the COVID-19

pandemic. This loan was forgiven by the SBA earlier this

month.

First Quarter 2021 Conference Call

Details

Ideal Power CEO and President Dan Brdar and CFO

Tim Burns will host the conference call, followed by a question and

answer period.

To access the call, please use the following

information:

| Date: |

|

Thursday, May 13, 2021 |

| Time: |

|

4:30 p.m. EST, 1:30 p.m. PST |

| Toll-free dial-in number: |

|

1-866-248-8441 |

| International dial-in number: |

|

1-323-289-6581 |

| Conference ID: |

|

3477153 |

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact LHA Investor Relations at

1-212-838-3777.

The conference call will be broadcast live and available for

replay at http://public.viavid.com/player/index.php?id=144800 and

via the investor relations section of the Company’s website at

www.IdealPower.com.

A replay of the conference call will be available after 7:30

p.m. Eastern time on Thursday, May 13, 2021, through Saturday, June

12, 2021.

| Toll Free Replay Number: |

|

1- 844-512-2921 |

| International Replay Number: |

|

1-412-317-6671 |

| Replay ID: |

|

3477153 |

About Ideal Power Inc.Ideal

Power (NASDAQ: IPWR) is pioneering the development of its broadly

patented bi-directional power switches, creating highly efficient

and ecofriendly energy control solutions for electric vehicle,

electric vehicle charging, renewable energy, energy storage, UPS /

data center and other industrial and military applications. The

Company is focused on its patented Bi-directional, Bi-polar

Junction Transistor (B-TRAN™) semiconductor technology. B-TRAN™ is

a unique double-sided bi-directional AC switch able to deliver

substantial performance improvements over today's conventional

power semiconductors. Ideal Power believes B-TRAN™ modules will

reduce conduction and switching losses, complexity of thermal

management and operating cost in medium voltage AC power switching

and control circuitry. For more information, visit

www.IdealPower.com.

Safe Harbor StatementAll

statements in this release that are not based on historical fact

are "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and the provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. While Ideal

Power’s management has based any forward-looking statements

included in this release on its current expectations, the

information on which such expectations were based may change. These

forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of risks,

uncertainties and other factors, many of which are outside of our

control that could cause actual results to materially differ from

such statements. Such risks, uncertainties, and other factors

include, but are not limited to, the impact of COVID-19 on our

business, financial condition and results of operations, the

success of our B-TRAN™ technology, including the success of our

contract with DTI, whether the patents for our technology provide

adequate protection and whether we can be successful in

maintaining, enforcing and defending our patents and our inability

to predict with precision or certainty the pace and timing of

development and commercialization of our B-TRAN™ technology,

including the timing of the completion of our next wafer

fabrication run with Teledyne and our success engaging companies to

participate in our customer sampling program, and uncertainties set

forth in our quarterly, annual and other reports filed with the

Securities and Exchange Commission. Furthermore, we operate in a

highly competitive and rapidly changing environment where new and

unanticipated risks may arise. Accordingly, investors should not

place any reliance on forward-looking statements as a prediction of

actual results. We disclaim any intention to, and undertake no

obligation to, update or revise forward-looking

statements.Ideal Power Investor Relations

Contact: LHA Investor RelationsCarolyn Capaccio,

CFAT: 212-838-3777IdealPowerIR@lhai.com

IDEAL POWER

INC. Balance Sheets

| |

March 31, 2021 |

|

|

December 31,2020 |

|

| |

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

26,789,017 |

|

|

$ |

3,157,256 |

|

|

Accounts receivable, net |

|

125,887 |

|

|

|

170,287 |

|

|

Prepayments and other current assets |

|

172,913 |

|

|

|

118,883 |

|

|

Total current assets |

|

27,087,817 |

|

|

|

3,446,426 |

|

|

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

32,770 |

|

|

|

37,125 |

|

| Intangible assets, net |

|

2,001,417 |

|

|

|

1,568,903 |

|

| Right of use asset |

|

32,215 |

|

|

|

79,719 |

|

| Other assets |

|

11,189 |

|

|

|

– |

|

|

Total assets |

$ |

29,165,408 |

|

|

$ |

5,132,173 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

107,290 |

|

|

$ |

101,984 |

|

|

Accrued expenses |

|

448,029 |

|

|

|

475,487 |

|

|

Current portion of lease liability |

|

33,149 |

|

|

|

82,055 |

|

|

Total current liabilities |

|

588,468 |

|

|

|

659,526 |

|

| |

|

|

|

|

|

|

|

| Long-term debt |

|

91,407 |

|

|

|

91,407 |

|

| Other long-term

liabilities |

|

944,026 |

|

|

|

552,031 |

|

|

Total liabilities |

|

1,623,901 |

|

|

|

1,302,964 |

|

| |

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

5,873,367 shares issued and 5,872,046 shares outstanding at

March 31, 2021 and 3,265,740 shares issued and 3,264,419

shares outstanding at December 31, 2020 |

|

5,873 |

|

|

|

3,266 |

|

|

Additional paid-in capital |

|

103,608,805 |

|

|

|

78,974,964 |

|

|

Treasury stock, at cost, 1,321 shares at March 31, 2021 and

December 31, 2020 |

|

(13,210 |

) |

|

|

(13,210 |

) |

|

Accumulated deficit |

|

(76,059,961 |

) |

|

|

(75,135,811 |

) |

|

Total stockholders’ equity |

|

27,541,507 |

|

|

|

3,829,209 |

|

|

Total liabilities and stockholders’ equity |

$ |

29,165,408 |

|

|

$ |

5,132,173 |

|

IDEAL POWER

INC.Statements of Operations

| |

Three Months EndedMarch 31, |

|

| |

2021 |

|

|

2020 |

|

|

Grant revenue |

$ |

242,061 |

|

|

$ |

– |

|

| Cost of grant revenue |

|

242,061 |

|

|

|

– |

|

|

Gross profit |

|

– |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

260,880 |

|

|

|

350,664 |

|

|

General and administrative |

|

600,686 |

|

|

|

579,770 |

|

|

Sales and marketing |

|

62,578 |

|

|

|

– |

|

|

Total operating expenses |

|

924,144 |

|

|

|

930,434 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

|

(924,144 |

) |

|

|

(930,434 |

) |

| |

|

|

|

|

|

|

|

| Interest expense, net |

|

6 |

|

|

|

67 |

|

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(924,150 |

) |

|

$ |

(930,501 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share – basic and

fully diluted |

$ |

(0.17 |

) |

|

$ |

(0.31 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of

shares outstanding – basic and fully diluted |

|

5,344,025 |

|

|

|

2,968,394 |

|

IDEAL POWER

INC.Statements of Cash Flows

|

|

Three Months EndedMarch 31, |

|

|

|

2021 |

|

|

2020 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(924,150 |

) |

|

$ |

(930,501 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

29,515 |

|

|

|

28,113 |

|

|

Write-off of capitalized patents |

|

– |

|

|

|

17,344 |

|

|

Stock-based compensation |

|

61,933 |

|

|

|

116,497 |

|

|

Stock issued for services |

|

68,680 |

|

|

|

– |

|

|

Decrease (increase) in operating assets: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

44,400 |

|

|

|

– |

|

|

Prepaid expenses and other assets |

|

(17,715 |

) |

|

|

(5,754 |

) |

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

5,306 |

|

|

|

(44,036 |

) |

|

Accrued expenses |

|

(111,306 |

) |

|

|

4,710 |

|

|

Net cash used in operating activities |

|

(843,337 |

) |

|

|

(813,627 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

(1,462 |

) |

|

|

(10,678 |

) |

|

Acquisition of intangible assets |

|

(29,275 |

) |

|

|

(13,385 |

) |

|

Net cash used in investing activities |

|

(30,737 |

) |

|

|

(24,063 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

| Net proceeds from issuance of

common stock |

|

21,204,609 |

|

|

|

– |

|

| Exercise of options and

warrants |

|

3,301,226 |

|

|

|

– |

|

| Net cash provided by financing

activities |

|

24,505,835 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

| Net increase (decrease) in

cash and cash equivalents |

|

23,631,761 |

|

|

|

(837,690 |

) |

| Cash and cash equivalents at

beginning of period |

|

3,157,256 |

|

|

|

3,057,682 |

|

| Cash and cash equivalents at

end of period |

$ |

26,789,017 |

|

|

$ |

2,219,992 |

|

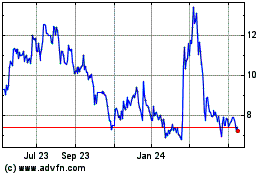

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024