Ideal Power Reports Fourth Quarter and Full Year 2020 Financial Results

March 17 2021 - 4:05PM

Ideal Power Inc. (“Ideal Power” or the “Company”) (Nasdaq:

IPWR), pioneering the development and commercialization of highly

efficient and broadly patented B-TRAN™ bi-directional power

switches, reported results for its fourth quarter and full year

ended December 31, 2020.

“Throughout 2020, we sustained our momentum

toward our commercialization goals and are moving into 2021 with

excitement about our prospects for B-TRAN™ as a differentiated

technology that can address a large and growing market, while armed

with a strong balance sheet to make our vision a reality,” stated

Dan Brdar, President and Chief Executive Officer of Ideal Power.

“Recently, we successfully completed the second major milestone

with United States Naval Sea Systems Command (NAVSEA) under our

partnership with Diversified Technologies, Inc. (DTI), and are in

receipt of the wafers from Teledyne’s second fabrication run. We

also completed the design for a dedicated B-TRAN™ driver as well as

a manufacturing-ready packaging design, key steps for our

engineering sampling with potential customers. In 2021, our focus

is on completing our wafer runs and device fabrication under the

NAVSEA program, engaging with customers under our engineering

sampling program, obtaining the customer feedback needed to develop

an intelligent power module and laying the groundwork for the

commercial agreements that we expect to result in commercial

revenue in 2022.”

Key Recent Operational

Highlights

- Completed the second major milestone

under the NAVSEA program in partnership with DTI to demonstrate

B-TRAN™ enabled high efficiency direct current circuit breakers as

we received wafers from Teledyne’s second fabrication run. These

wafers are being tested for selection and packaging into B-TRAN™

devices.

- In collaboration with The University

of Texas at Austin’s Semiconductor Power Electronics Center:

- Finalized the development and

fabrication of a new B-TRAN™ driver for use in the customer

sampling program; and

- Under the NAVSEA program, finalized

the development of a second packaging design to incorporate design

for manufacturing feedback received from a commercial packaging

firm.

- Hired a Vice President of Business

Development with a strong semiconductor background in both silicon

and silicon carbide devices and established customer relationships

in the electric vehicle and renewable energy market segments.

- B-TRAN™ Patent Estate: Currently

have 58 issued B-TRAN™ patents with 21 of those issued outside of

the United States and 26 pending B-TRAN™ patents. Current

geographic coverage now includes North America, China, Japan and

Europe, with potential to expand coverage into South Korea and

India.

- In February 2021, completed an

underwritten public offering of 1.4 million shares of common stock

for net proceeds of $21.2 million to fund B-TRAN™ commercialization

and development and general corporate and working capital

purposes.

- Subsequent to year-end and through

the end of February 2021, raised an additional $3.2 million from

the exercise of then-outstanding warrants.

Fourth Quarter and Full Year 2020

Financial Results

- Grant revenue was $0.3 million in

the fourth quarter of 2020 and $0.4 million for the full year

2020.

- Operating expenses in the fourth

quarter of 2020 were $1.1 million compared to $0.8 million in the

fourth quarter of 2019 on higher research and development

spending.

- Operating expenses in the full year

2020 were $4.1 million compared to $3.1 million in the full year

2019, primarily on higher research and development spending as well

as higher stock-based compensation expense.

- Net loss in the fourth quarter of

2020 was $1.1 million compared to $0.8 million in the fourth

quarter of 2019.

- Net loss in the full year 2020 was

$7.8 million, inclusive of non-cash warrant inducement expense of

$3.7 million, compared to $3.9 million in the full year 2019. The

full year 2019 included a $0.8 million loss from discontinued

operations.

- Cash used in operating activities

for the full year 2020 was $3.0 million compared to $3.2 million in

the full year 2019. The full year 2019 included $0.7 million of

cash used in operating activities related to discontinued

operations.

- In 2020, the Company raised net

cash proceeds of $2.5 million from an early warrant exercise

transaction.

- Cash and cash equivalents totaled

$3.2 million at December 31, 2020.

- Subsequent to year-end and through

February 2021, the company raised an additional $3.2 million from

the exercise of then-outstanding warrants. Additionally, in

February 2021, the Company raised $21.2 million in net proceeds

through an underwritten public offering of our common stock.

- Long-term debt outstanding at

December 31, 2020 was $0.1 million relating to a Payroll Protection

Program loan received in the second quarter of 2020 to temporarily

subsidize payroll and facilities costs in a business landscape

impacted by the COVID-19 pandemic. Ideal Power has applied for, and

currently expects, this loan to be forgiven.

Fourth Quarter 2020 Conference Call

Details

Ideal Power CEO and President Dan Brdar and CFO

Tim Burns will host the conference call, followed by a question and

answer period.

To access the call, please use the following

information:

| Date: |

|

Wednesday March 17, 2021 |

| Time: |

|

4:30 p.m. EST, 1:30 p.m. PST |

| Toll-free dial-in number: |

|

1- 800-430-8332 |

| International dial-in number: |

|

1- 323-289-6581 |

| Conference ID: |

|

1356868 |

Please call the conference telephone number 5-10

minutes prior to the start time. An operator will register your

name and organization. If you have any difficulty connecting with

the conference call, please contact LHA Investor Relations at

1-212-838-3777.

The conference call will be broadcast live and

available for replay

at http://public.viavid.com/index.php?id=142114 and via

the investor relations section of the Company’s website

at www.IdealPower.com.

A replay of the conference call will be

available after 7:30 p.m. Eastern time on Wednesday March 17, 2021,

through April 17, 2021.

| Toll Free Replay Number: |

|

1- 844-512-2921 |

| International Replay Number: |

|

1-412-317-6671 |

| Replay ID: |

|

1356868 |

| |

|

|

About Ideal Power Inc.

Ideal Power (NASDAQ: IPWR) is pioneering the

development of its broadly patented bi-directional power switches,

creating highly efficient and ecofriendly energy control solutions

for electric vehicle, electric vehicle charging, renewable energy,

energy storage, UPS / data center and other industrial and military

applications. The Company is focused on its patented

Bi-directional, Bi-polar Junction Transistor (B-TRAN™)

semiconductor technology. B-TRAN™ is a unique double-sided

bi-directional AC switch able to deliver substantial performance

improvements over today's conventional power semiconductors. Ideal

Power believes B-TRAN™ modules will reduce conduction and switching

losses, complexity of thermal management and operating cost in

medium voltage AC power switching and control circuitry. For more

information, visit www.IdealPower.com.

Safe Harbor StatementAll

statements in this release that are not based on historical fact

are "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and the provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. While Ideal

Power’s management has based any forward-looking statements

included in this release on its current expectations, the

information on which such expectations were based may change. These

forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of risks,

uncertainties and other factors, many of which are outside of our

control that could cause actual results to materially differ from

such statements. Such risks, uncertainties, and other factors

include, but are not limited to, the impact of COVID-19 on our

business, financial condition and results of operations, the

success of our B-TRAN™ technology, including the success of our

contract with DTI, whether the patents for our technology provide

adequate protection and whether we can be successful in

maintaining, enforcing and defending our patents and our inability

to predict with precision or certainty the pace and timing of

development and commercialization of our B-TRAN™ technology and

uncertainties set forth in our quarterly, annual and other reports

filed with the Securities and Exchange Commission. Furthermore, we

operate in a highly competitive and rapidly changing environment

where new and unanticipated risks may arise. Accordingly, investors

should not place any reliance on forward-looking statements as a

prediction of actual results. We disclaim any intention to, and

undertake no obligation to, update or revise forward-looking

statements.Ideal Power Investor Relations

Contact: LHA Investor RelationsCarolyn Capaccio, CFA;

Keith FetterT: 212-838-3777IdealPowerIR@lhai.com

IDEAL POWER

INC. Balance Sheets

| |

|

December 31, |

|

| |

|

2020 |

|

|

2019 |

|

| ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,157,256 |

|

|

$ |

3,057,682 |

|

|

Accounts receivable, net |

|

|

170,287 |

|

|

|

- |

|

|

Prepayments and other current assets |

|

|

118,883 |

|

|

|

248,148 |

|

|

Total current assets |

|

|

3,446,426 |

|

|

|

3,305,830 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

37,125 |

|

|

|

47,302 |

|

| Intangible assets, net |

|

|

1,568,903 |

|

|

|

1,634,378 |

|

| Right of use asset |

|

|

79,719 |

|

|

|

260,310 |

|

| Other assets |

|

|

- |

|

|

|

17,920 |

|

|

Total assets |

|

$ |

5,132,173 |

|

|

$ |

5,265,740 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

101,984 |

|

|

$ |

182,956 |

|

|

Accrued expenses |

|

|

475,487 |

|

|

|

319,135 |

|

|

Current portion of lease liability |

|

|

82,055 |

|

|

|

183,119 |

|

|

Total current liabilities |

|

|

659,526 |

|

|

|

685,210 |

|

| |

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

91,407 |

|

|

|

- |

|

| Long-term lease liability |

|

|

- |

|

|

|

82,055 |

|

| Other long-term

liabilities |

|

|

552,031 |

|

|

|

609,242 |

|

|

Total liabilities |

|

|

1,302,964 |

|

|

|

1,376,507 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; 0

shares issued and outstanding at December 31, 2020 and 2019 |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

3,265,740 shares issued and 3,264,419 shares outstanding at

December 31, 2020; 2,101,272 shares issued and 2,099,951 shares

outstanding at December 31, 2019 |

|

|

3,266 |

|

|

|

2,101 |

|

|

Additional paid-in capital |

|

|

78,974,964 |

|

|

|

71,242,256 |

|

|

Treasury stock, at cost; 1,321 shares at December 31, 2020 and

2019, respectively |

|

|

(13,210 |

) |

|

|

(13,210 |

) |

|

Accumulated deficit |

|

|

(75,135,811 |

) |

|

|

(67,341,914 |

) |

|

Total stockholders’ equity |

|

|

3,829,209 |

|

|

|

3,889,233 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

5,132,173 |

|

|

$ |

5,265,740 |

|

IDEAL POWER

INC.Statements of Operations

| |

|

Three Months EndedDecember

31, |

|

|

Year EndedDecember 31, |

|

| |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| Grant revenue |

|

$ |

273,827 |

|

|

$ |

– |

|

|

$ |

428,129 |

|

|

$ |

– |

|

| Cost of grant revenue |

|

|

273,827 |

|

|

|

– |

|

|

|

428,129 |

|

|

|

– |

|

|

Gross profit |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

559,356 |

|

|

|

245,410 |

|

|

|

1,720,893 |

|

|

|

1,050,151 |

|

|

General and administrative |

|

|

573,474 |

|

|

|

544,787 |

|

|

|

2,347,089 |

|

|

|

2,065,112 |

|

|

Total operating expenses |

|

|

1,132,830 |

|

|

|

790,197 |

|

|

|

4,067,982 |

|

|

|

3,115,263 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations before interest |

|

|

(1,132,830 |

) |

|

|

(790,197 |

) |

|

|

(4,067,982 |

) |

|

|

(3,115,263 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

2,569 |

|

|

|

1,195 |

|

|

|

5,049 |

|

|

|

4,267 |

|

|

Warrant inducement expense |

|

|

– |

|

|

|

– |

|

|

|

3,720,866 |

|

|

|

- |

|

|

Total other expenses |

|

|

2,569 |

|

|

|

1,195 |

|

|

|

3,725,915 |

|

|

|

4,267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations |

|

|

(1,135,399 |

) |

|

|

(791,392 |

) |

|

|

(7,793,897 |

) |

|

|

(3,119,530 |

) |

| Loss from discontinued

operations |

|

|

– |

|

|

|

(30,978 |

) |

|

|

- |

|

|

|

(799,025 |

) |

| Loss on sale of discontinued

operations |

|

|

– |

|

|

|

– |

|

|

|

- |

|

|

|

(9,107 |

) |

| Net loss |

|

$ |

(1,135,399 |

) |

|

$ |

(822,370 |

) |

|

$ |

(7,793,897 |

) |

|

$ |

(3,927,662 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations per share – basic and fully diluted |

|

$ |

(0.26 |

) |

|

$ |

(0.36 |

) |

|

$ |

(2.20 |

) |

|

$ |

(1.89 |

) |

| Loss from discontinued

operations per share – basic and fully diluted |

|

|

– |

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.49 |

) |

| Net loss per share – basic and

fully diluted |

|

$ |

(0.26 |

) |

|

$ |

(0.37 |

) |

|

$ |

(2.20 |

) |

|

$ |

(2.38 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

shares outstanding – basic and fully diluted |

|

|

4,356,324 |

|

|

|

2,228,152 |

|

|

|

3,539,217 |

|

|

|

1,653,996 |

|

IDEAL POWER

INC.Statements of Cash Flows

|

|

|

For the Year Ended December 31, |

|

|

|

|

2020 |

|

|

2019 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

$ |

(7,793,897 |

) |

|

$ |

(3,119,530 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

122,152 |

|

|

|

110,463 |

|

|

Write-off of capitalized patents |

|

|

20,660 |

|

|

|

14,707 |

|

|

Stock-based compensation |

|

|

868,648 |

|

|

|

184,339 |

|

|

Stock issued for services |

|

|

50,000 |

|

|

|

— |

|

|

Warrant inducement expense |

|

|

3,720,866 |

|

|

|

— |

|

|

Decrease (increase) in operating assets: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(170,287 |

) |

|

|

— |

|

|

Prepaid expenses and other assets |

|

|

147,185 |

|

|

|

85,729 |

|

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

(80,972 |

) |

|

|

88,753 |

|

|

Accrued expenses |

|

|

96,613 |

|

|

|

104,956 |

|

|

Net cash used in operating activities |

|

|

(3,019,032 |

) |

|

|

(2,530,583 |

) |

|

Net cash used in operating activities – discontinued

operations |

|

|

— |

|

|

|

(688,074 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(13,940 |

) |

|

|

(4,253 |

) |

|

Acquisition of intangible assets |

|

|

(53,220 |

) |

|

|

(99,845 |

) |

|

Net cash used in investing activities |

|

|

(67,160 |

) |

|

|

(104,098 |

) |

|

Net cash provided by (used in) investing activities – discontinued

operations |

|

|

— |

|

|

|

23,587 |

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

Proceeds from loans |

|

|

91,407 |

|

|

|

— |

|

|

Net proceeds from exercise of warrants |

|

|

3,094,359 |

|

|

|

— |

|

|

Net proceeds from issuance of common stock and pre-funded

warrants |

|

|

— |

|

|

|

3,098,773 |

|

|

Net cash provided by (used in) financing activities |

|

|

3,185,766 |

|

|

|

3,098,773 |

|

| Net increase in cash and cash

equivalents – continuing operations |

|

|

99,574 |

|

|

|

464,092 |

|

| Net decrease in cash and cash

equivalents – discontinued operations |

|

|

— |

|

|

|

(664,487 |

) |

| Cash and cash equivalents at

beginning of year |

|

|

3,057,682 |

|

|

|

3,258,077 |

|

| Cash and cash equivalents at

end of year |

|

$ |

3,157,256 |

|

|

$ |

3,057,682 |

|

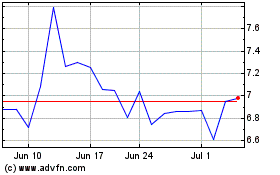

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

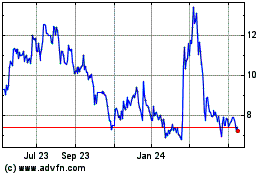

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024