Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-248466

PROSPECTUS

Ideal Power Inc.

705,688 Shares

Common Stock

This prospectus relates

to the offer, resale, transfer or other disposition, from time to time in one or more offerings, of up to 705,688 shares of our

common stock issuable upon exercise of the Series C Warrants (as defined herein), by the selling stockholders identified in this

prospectus or in supplements to this prospectus (together with any of such selling stockholders’ transferees, pledgees, donees

or successors, collectively, the “selling stockholders”).

We are registering

the resale of the common stock as required by the Letter Agreements (as defined herein) we entered into with the selling stockholders.

We will not receive any proceeds from the sale of our common stock by the selling stockholders pursuant to this prospectus, other

than any proceeds from the cash exercise of the Series C Warrants, but we will bear certain registration expenses, other than underwriting

discounts, selling commissions and brokerage fees.

The selling stockholders

from time to time may offer and resell the common stock covered by this prospectus and any prospectus supplement on any stock exchange,

market, or trading facility on which the shares are traded or in private transactions, to or through one or more underwriters,

broker-dealers and agents, or directly to purchasers, or through a combination of these methods, on terms to be determined at the

time of sale, such as at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market

price, at varying prices determined at the time of sale, or at negotiated prices, as described in more detail in this prospectus.

If any underwriters, dealers or agents are involved in the sale of any of the shares of our common stock, their names, and any

applicable purchase price, fee, commission or discount arrangement with, between or among them, will be set forth, or will be calculable

from the information set forth, in an accompanying prospectus supplement. See “About this Prospectus” and “Plan

of Distribution” for more information.

The registration of

the shares of common stock to which this prospectus relates does not require the selling stockholders to sell any of their shares

of our common stock. We cannot predict when or in what amounts the selling stockholders may sell any of the shares of our common

stock covered by this prospectus.

Our common stock is

listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IPWR.” On September 4, 2020, the last reported

sales price of our common stock, as reported on Nasdaq was $5.30 per share.

Investing in our

common stock involves certain risks. See “Risk Factors” on page 3 of this prospectus, any applicable prospectus

supplement, as well as the “Risk Factors” incorporated by reference herein from our most recent Annual Report on Form

10-K, our Quarterly Reports on Form 10-Q and other reports and information that we file with the Securities and Exchange Commission.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

September 8, 2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is

part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process.

Under this shelf registration

process, the selling stockholders named herein or to be named in a supplement to this prospectus may sell up to 705,688 shares

of our common stock issuable upon exercise of the Series C Warrants, from time to time in one or more offerings. This prospectus

provides you with a general description of the shares of common stock that the selling stockholders may offer. Each time that any

of the selling stockholders offer and sell shares of common stock using this prospectus, to the extent necessary, we may provide

you with a prospectus supplement to this prospectus that will contain specific information about the offering, the selling stockholders,

as well as specific amounts, prices and terms of the shares of common stock being offered. We may also authorize one or more free

writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement

or free writing prospectus may also add, update or change information contained in or incorporated by reference into this prospectus

with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable.

This prospectus does not contain all the information provided in the registration statement filed with the SEC. You should carefully

read both this prospectus and any applicable prospectus supplement (and any applicable free writing prospectuses), together with

the additional information described below under “Where You Can Find More Information” and “Information Incorporated

By Reference” before you make an investment decision.

Neither we, nor

the selling stockholders, have authorized anyone to provide you with any information or to make any representations other than

those contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any free writing prospectuses,

prepared by or on behalf of us or to which we have referred you. We and the selling stockholders take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders will

not make an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted.

You should assume

that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of

the date on its respective cover and that any information incorporated by reference is accurate only as of the date of the document

incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects

may have changed since those dates. Any statement made in this prospectus or in a document incorporated or deemed to be incorporated

by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that

a statement contained in a prospectus supplement or in any other subsequently filed document that is also incorporated or deemed

to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded

will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. See “Information Incorporated

By Reference.”

This prospectus and

any accompanying prospectus supplements may include trademarks, service marks and trade names owned by us or other companies. All

trademarks, service marks and trade names included in this prospectus or any accompanying prospectus supplement are the property

of their respective owners.

Unless the context

otherwise indicates, references in this prospectus to “we,” “us,” “our,” “Ideal Power”

and the “Company” are to Ideal Power Inc. The term “you” refers to a prospective investor.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

STATEMENTS

This prospectus, any

applicable prospectus supplement and the documents incorporated by reference herein and therein and the documents incorporated

by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995

and the provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements give our current

expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical

or current facts. You can find many (but not all) of these statements by looking for words such as “approximates,”

“believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,”

“intends,” “plans,” “would,” “should,” “could,” “may” or

other similar expressions in this prospectus, any applicable prospectus supplement and the documents incorporated by reference

herein and therein and the documents incorporated by reference herein. In particular, these include statements relating to future

actions, prospective products, applications, customers, technologies, future performance or results of anticipated products, expenses,

and financial results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from our historical experience and our present expectations or projections. Factors that could cause

actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

|

|

·

|

our ability to generate revenue;

|

|

|

·

|

our limited operating history;

|

|

|

·

|

the size and growth of markets for our technology;

|

|

|

·

|

regulatory developments that may affect our business;

|

|

|

·

|

our ability to successfully develop new technologies, particularly our bi-directional bipolar junction

transistor, or B-TRAN™;

|

|

|

·

|

our expectations regarding the timing of prototype and commercial fabrication of B-TRAN™

devices;

|

|

|

·

|

our expectations regarding the performance of our B-TRAN™ and the consistency of that performance

with both internal and third-party simulations;

|

|

|

·

|

the expected performance of future products incorporating our B-TRAN™;

|

|

|

·

|

the performance of third-party consultants and service providers whom we have and will continue

to rely on to assist us in development of our B-TRAN™ and related drive circuitry;

|

|

|

·

|

the rate and degree of market acceptance for our B-TRAN™;

|

|

|

·

|

the time required for third parties to redesign, test and certify their products incorporating

our B-TRAN™;

|

|

|

·

|

our ability to successfully commercialize our B-TRAN™ technology;

|

|

|

·

|

our ability to secure strategic partnerships with semiconductor fabricators and others related

to our B-TRAN™ technology;

|

|

|

·

|

our ability to obtain, maintain, defend and enforce intellectual property rights protecting our

technology;

|

|

|

·

|

the success of our efforts to manage cash spending, particularly prior to the commercialization

of our B-TRAN™ technology;

|

|

|

·

|

general economic conditions and events and the impact they may have on us and our potential partners

and licensees;

|

|

|

·

|

our ability to obtain adequate financing in the future, as and when we need it;

|

|

|

·

|

our ability to maintain listing of our common stock on the Nasdaq Capital Market;

|

|

|

·

|

the impact of the novel coronavirus (COVID-19) on our business, financial condition and results

of operations;

|

|

|

·

|

our success at managing the risks involved in the foregoing items; and

|

The forward-looking

statements are based upon management’s beliefs and assumptions and are made as of the date made. We undertake no obligation

to publicly update or revise any forward-looking statements included or incorporated by reference in this prospectus, any applicable

prospectus supplement and the documents incorporated by reference herein and therein. You should not place undue reliance on these

forward-looking statements.

PROSPECTUS SUMMARY

The following summary

highlights information contained in this prospectus and does not contain all of the information that you should consider in making

your investment decision. Before investing in our common stock, you should read this entire prospectus carefully, including the

documents incorporated by reference herein, including the section entitled “Risk Factors” included elsewhere in this

prospectus, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and the related notes thereto, which are incorporated

by reference herein, and any applicable prospectus supplement. Some of the statements in this prospectus, the documents incorporated

by reference herein and any applicable prospectus supplement may constitute forward-looking statements. See “Cautionary Statement

Regarding Forward-Looking Statements.”

Our Company

Ideal Power is located

in Austin, Texas. Until April 2018, we were primarily focused on the design, marketing and sale of electrical power conversion

products using our proprietary technology called Power Packet Switching Architecture™, or PPSA™. PPSA™ is a power

conversion technology that improves upon existing power conversion technologies in key product metrics, such as size and weight

while providing built-in isolation and bi-directional and multi-port capabilities. PPSA™ utilizes standardized hardware with

application specific embedded software. Our products were designed to be used in both on-grid and off-grid applications with a

focus on solar + storage, microgrid and stand-alone energy storage applications. The principal products of the Company were 30-kilowatt

power conversion systems, including 2-port and multi-port products.

In April 2018, we realigned

into two operating divisions: Power Conversion Systems, to continue the commercialization of our PPSA™ technology, and B-TRAN,

to develop our Bi-directional bi-polar junction TRANsistor (B-TRAN™) solid state switch technology.

In January 2019, our

Board of Directors (our “Board”) approved a strategic shift to focus on the commercialization of our B-TRAN™

technology and a plan to suspend further power converter system, or PPSA™, development and sales while we located a buyer

for our power conversion systems division and PPSA™ technology. On September 19, 2019, we closed on the sale of our power

conversion systems division and are now solely focused on the further development and commercialization of our B-TRAN™ technology.

Recent Developments

Early Warrant Exercise Transaction

On July 31, 2020,

we entered into letter agreements (the “Letter Agreements”) with certain of our Series A warrant holders (the

“Series A Warrant Holders”), who were previously issued warrants (the “Original Warrants”) to

purchase shares of our common stock pursuant to that certain Securities Purchase Agreement between us, the Series A Warrant

Holders and the other parties thereto, dated as of November 7, 2019. The Series A Warrant Holders agreed to the early

exercise of their Original Warrants pursuant to the Letter Agreements (the “Transaction”). We raised net

proceeds of approximately $2.5 million in the Transaction.

Pursuant to the Letter

Agreements, in consideration of the Series A Warrant Holders exercising Original Warrants to purchase an aggregate of 1,176,137

shares of common stock, we issued to the Series A Warrant Holders new Series C warrants (the “Series C Warrants”) to

purchase up to an aggregate of 705,688 shares of our common stock (the “Series C Warrant Shares”). The Series C Warrants

have an exercise price of $8.90 per share, with an expiration date of August 4, 2025.

The exercise price

of the Series C Warrants is subject to adjustment for stock splits, stock dividends, recapitalizations, and similar transactions

as provided for in the terms of the Series C Warrants. The holders may exercise the Series C Warrants in whole or in part.

The foregoing description

of the Letter Agreements and the Series C Warrants is a summary and is qualified in its entirety by reference to the form of Letter

Agreement and the form of Series C Warrants, copies of which are filed as exhibits to the registration statement of which this

prospectus forms a part.

Corporate Information

We were formed in Texas

on May 17, 2007 and converted to a Delaware corporation on July 15, 2013.

Our principal executive

offices are located at 4120 Freidrich Lane, Suite 100, Austin, Texas 78744 and our telephone number is (512) 264-1542. Our website

address is www.idealpower.com. The foregoing website address is provided as an inactive textual reference only. The information

provided on our website (or any other website referred to in this prospectus) is not part of this this prospectus and is not incorporated

by reference as part of this prospectus.

THE OFFERING

|

Shares of common stock that may be sold or otherwise disposed of by the selling stockholders

|

|

705,688 shares of our common stock issuable upon exercise of the Series C Warrants.

|

|

Shares of common stock to be outstanding after the offering by the selling stockholders

|

|

3,605,503 shares

|

|

Use of proceeds

|

|

We will not receive any of the proceeds from the sale or other disposition of the shares covered by this prospectus. We will receive proceeds from the cash exercise of the Series C Warrants held by the selling stockholders, and we intend to use any such proceeds to fund commercialization and development of our B-TRAN™ semiconductor technology and general corporate and working capital purposes. See “Use of Proceeds.”

|

|

Nasdaq Capital Market symbol

|

|

“IPWR”

|

|

Transfer Agent

|

|

EQ Shareowner Services

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this prospectus as well as those risk factors that are incorporated by reference in this prospectus and any applicable prospectus supplement for a discussion of factors to consider carefully before deciding to invest in our common stock.

|

Except as otherwise indicated, the number

of shares of common stock to be outstanding after the offering by the selling stockholders is based on 2,899,815 shares of common

stock outstanding as of August 17, 2020, and excludes in each case as of August 17, 2020:

|

|

·

|

316,182 shares of common stock issuable upon the exercise of stock options issued and outstanding under our Amended & Restated

2013 Equity Incentive Plan (as amended and restated, the “Plan”) at a weighted-average exercise price of $5.39 per

share, of which 251,038 of such stock options are vested;

|

|

|

·

|

1,932,316 shares of common stock issuable upon the exercise of outstanding warrants (other than the Series C Warrants) at a

weighted-average exercise price of $0.69 per share; and

|

|

|

·

|

226,461 shares of common stock reserved for issuance under the Plan.

|

RISK FACTORS

An investment in our

common stock involves risks. You should carefully consider the risk factors incorporated by reference from our most recent Annual

Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K that we file after the date

of this prospectus, and all other information contained, or incorporated by reference, in this prospectus, as updated by our subsequent

filings under the Exchange Act, and the risk factors and other information contained, or incorporated by reference, in any applicable

prospectus supplement or free writing prospectus that we provide you in connection with an offering of the shares of common stock

pursuant to this prospectus, before acquiring any shares of our common stock. Each of these risks could materially and adversely

affect our business, financial condition, results of operations and prospects, and could result in a loss of your investment. Additional

risks and uncertainties not known to us or that we deem immaterial may also adversely impact our business, financial condition,

results of operations and prospects. Please also refer to the section entitled “Cautionary Statement Regarding Forward-Looking

Statements” in this prospectus.

USE OF PROCEEDS

We will not receive

any of the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus.

We will receive proceeds

upon the cash exercise of the Series C Warrants for which underlying shares of common stock are being registered hereunder. Assuming

full cash exercise of the Series C Warrants at the exercise price of $8.90 per underlying share of common stock, we will receive

proceeds of $6,280,623.

We currently intend

to use the cash proceeds from any Series C Warrant exercise to fund commercialization and development of our B-TRAN™ semiconductor

technology and general corporate and working capital purposes. The amount and timing of our actual use of proceeds may vary significantly

depending upon numerous factors, including the actual amount of proceeds we receive and the timing of when we receive such proceeds.

In addition, the terms of the Series C Warrants provide that each Series C Warrant may be exercised on a cashless basis at any

time if, at the time of exercise thereof, there is no effective registration statement registering, or the prospectus contained

therein is not available for the resale of, the shares underlying such Series C Warrants by the holder thereof. We will not receive

any cash proceeds as a result of such Series C Warrants that are exercised on a cashless basis pursuant to such terms of such Series

C Warrants.

DESCRIPTION OF CAPITAL STOCK

The following description

of our capital stock is intended as a summary only. This description is based upon, and is qualified by reference to, our certificate

of incorporation, as amended to date (our “certificate of incorporation”), our certificate of designation of preferences,

rights and limitations of Series A convertible preferred stock (our “certificate of designation”), our bylaws, as amended

to date (our “bylaws”), and applicable provisions of the General Corporation Law of the State of Delaware (the “DGCL”).

This summary is not complete. You should read our certificate of incorporation (including the certificate of amendment thereto),

our certificate of designation and our bylaws, which are incorporated by reference as exhibits to the registration statement of

which this prospectus forms a part, for the provisions that are important to you.

Authorized and Outstanding Capital Stock

Our certificate

of incorporation provides that we may issue up to 50,000,000 shares of common stock, par value $0.001 per share, and

10,000,000 shares of preferred stock, par value $0.001 per share. 3,000,000 shares of our authorized preferred stock have

been designated as Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred

Stock”). As of August 17, 2020, we had 2,899,815 shares of common stock outstanding and no shares of preferred

stock outstanding.

Common Stock

Each holder of our

common stock is entitled to one vote for each such share outstanding in the holder’s name. No holder of common stock is entitled

to cumulate votes in voting for directors, which means that the holders of a majority of the outstanding shares of our common stock

will be entitled to elect all of the directors standing for election.

Holders of our common

stock are entitled to such dividends as may be declared by our Board out of funds legally available for such purpose, subject to

any preferential dividend rights of any then outstanding preferred stock.

In the event of our

liquidation, dissolution or winding up, the holders of our common stock are entitled to receive pro rata our assets, which are

legally available for distribution, after payments of all debts and other liabilities and subject to the prior rights of any holders

of preferred stock then outstanding.

The shares of common

stock are neither redeemable nor convertible. Holders of common stock have no preemptive or subscription rights to purchase any

of our securities. The shares of common stock are not subject to further calls or assessment by us. There are no redemption or

sinking fund provisions applicable to the common stock. All of the outstanding shares of our common stock are fully paid and non-assessable.

Preferred Stock

General

Our certificate of

incorporation provides that our Board has the authority, without any further action by our stockholders, to designate and issue

up to 10,000,000 shares of preferred stock in one or more classes or series and to fix the powers, rights, preferences, and privileges

of each class or series of preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation

preferences and the number of shares constituting any class or series, which may be greater than the rights of the holders of the

common stock.

The purpose of authorizing

our Board to issue preferred stock and determine its rights and preferences is to eliminate delays associated with a shareholder

vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions,

future financings and other corporate purposes, could have the effect of making it more difficult for a third party to acquire,

or could discourage a third party from seeking to acquire, a majority of our outstanding voting stock. Additionally, the issuance

of preferred stock may adversely affect the holders of our common stock by restricting dividends on our common stock, diluting

the voting power of our common stock or subordinating the liquidation rights of our common stock. As a result of these or other

factors, the issuance of preferred stock could have an adverse impact on the market price of our common stock.

Series A Preferred Stock

On February 23, 2017,

we filed our certificate of designation with the Secretary of State of the State of Delaware creating our Series A Preferred Stock

and establishing the designations, preferences, and other rights of the Series A Preferred Stock, which became effective upon filing.

Our Series A

Preferred Stock ranks senior to our common stock with respect to dividend rights and rights on liquidation, winding-up and

dissolution. Our Series A Preferred Stock has a stated value of $2.535. Holders of Series A Preferred Stock are entitled to

receive dividends declared or paid on our common stock. The holders of the Series A Preferred Stock do not have the right to

vote on any matter except to the extent required by Delaware law.

No shares of Series

A Preferred Stock are outstanding as of August 17, 2020.

Anti-Takeover Effects of Certain Provisions

of Delaware Law and Our Charter Documents

Provisions of Delaware

law and our charter documents could have the effect of delaying or preventing a third party from acquiring us, even if the acquisition

would benefit our stockholders. These provisions may delay, defer or prevent a tender offer or takeover attempt of our Company

that a stockholder might consider in his, her or its best interest, including those attempts that might result in a premium over

the market price for the shares held by our stockholders. These provisions are intended to enhance the likelihood of continuity

and stability in the composition of our Board and in the policies formulated by the Board and to discourage types of transactions

that may involve our actual or threatened change of control. These provisions are designed to reduce our vulnerability to an unsolicited

proposal for a takeover that does not contemplate the acquisition of all of our outstanding shares, or an unsolicited proposal

for the restructuring or sale of all or part of us.

Effect of Delaware

Anti-Takeover Statute. We are subject to Section 203 of the DGCL, an anti-takeover law. In general, Section 203 prohibits

a Delaware corporation from engaging in any business combination (as defined below) with any interested stockholder (as defined

below) for a period of three years following the date that the stockholder became an interested stockholder, unless:

|

|

·

|

prior to that date, the board of directors of the corporation approved either the business combination

or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

·

|

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced,

excluding for purposes of determining the number of shares of voting stock outstanding (but not the voting stock owned by the interested

stockholder) those shares owned by persons who are directors and officers and by excluding employee stock plans in which employee

participants do not have the right to determine whether shares held subject to the plan will be tendered in a tender or exchange

offer; or

|

|

|

·

|

on or subsequent to that date, the business combination is approved by the board of directors of

the corporation and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative

vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Section 203 defines

“business combination” to include the following:

|

|

·

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

·

|

any sale, lease, exchange, mortgage, transfer, pledge or other disposition of 10% or more of the

assets of the corporation involving the interested stockholder;

|

|

|

·

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the

corporation of any stock of the corporation to the interested stockholder;

|

|

|

·

|

subject to limited exceptions, any transaction involving the corporation that has the effect of

increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested

stockholder; or

|

|

|

·

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges

or other financial benefits provided by or through the corporation.

|

In general, Section

203 defines an “interested stockholder” as any entity or person beneficially owning 15% or more of the outstanding

voting stock of the corporation, or who beneficially owns 15% or more of the outstanding voting stock of the corporation at any

time within a three-year period immediately prior to the date of determining whether such person is an interested stockholder,

and any entity or person affiliated with or controlling or controlled by any of these entities or persons.

Our Charter Documents.

Effects of

authorized but unissued common stock and blank check preferred stock. One of the effects of the existence of authorized

but unissued common stock and undesignated preferred stock may be to enable our Board to make more difficult or to discourage

an attempt to obtain control of our Company by means of a merger, tender offer, proxy contest or otherwise, and thereby to

protect the continuity of management. If, in the due exercise of its fiduciary obligations, the Board were to determine that

a takeover proposal was not in our best interest, such shares could be issued by the Board without stockholder approval in

one or more transactions that might prevent or render more difficult or costly the completion of the takeover transaction by

diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial voting

block in institutional or other hands that might undertake to support the position of the incumbent Board, by effecting an

acquisition that might complicate or preclude the takeover, or otherwise.

In addition, our certificate

of incorporation grants our Board broad power to establish the rights and preferences of authorized and unissued shares of preferred

stock. The issuance of additional shares of preferred stock could decrease the amount of earnings and assets available for distribution

to holders of shares of common stock. The issuance also may adversely affect the rights and powers, including voting rights, of

those holders and may have the effect of delaying, deterring or preventing a change in control of our Company.

Cumulative Voting.

Our certificate of incorporation does not provide for cumulative voting in the election of directors, which would allow holders

of less than a majority of the stock to elect some directors.

No Stockholder Action

by Written Consent. Our certificate of incorporation expressly prohibits stockholders from acting by written consent. This

means that stockholders may only act at annual or special meetings.

Vacancies. Our

certificate of incorporation provides that all vacancies may be filled by the affirmative vote of a majority of directors then

in office, even if less than a quorum.

Special Meeting

of Stockholders. A special meeting of stockholders may only be called by the chairman of the Board, the chief executive officer,

or the Board at any time and for any purpose or purposes as shall be stated in the notice of the meeting, and shall be called by

the secretary upon the written request of the holders of record of at least 25% of the outstanding shares of common stock. This

provision could prevent stockholders from calling a special meeting because, unless certain significant stockholders were to join

with them, they might not obtain the percentage necessary to request the meeting. Therefore, stockholders holding less than 25%

of the issued and outstanding common stock, without the assistance of management, may be unable to propose a vote on any transaction

that would delay, defer or prevent a change of control, even if the transaction were in the best interests of our stockholders.

Requirements for

Advance Notification of Stockholder Nominations and Proposals. Our certificate of incorporation and bylaws have advance notice

procedures with respect to stockholder proposals and nominations of candidates for election as directors, other than nominations

made by or at the direction of our Board or a committee of our Board. The business to be conducted at a meeting will be limited

to business properly brought before the meeting, in accordance with our certificate of incorporation and bylaws. Failure to follow

the procedures set forth in our certificate of incorporation and bylaws will result in the chairman of the meeting disregarding

the nomination or declaring that the proposed business will not be transacted.

Transfer Agent and Registrar

Our transfer agent

and registrar for our common stock is EQ Shareowner Services.

Listing

Our common stock is

listed on The Nasdaq Capital Market under the symbol “IPWR.”

SELLING STOCKHOLDERS

The shares of

common stock being offered by the selling stockholders are those issuable to the selling stockholders upon exercise of the Series

C Warrants. For additional information regarding the issuances of those securities, please see “Prospectus Summary—Recent

Developments— Early Warrant Exercise Transaction.” We are registering the shares of common stock pursuant to the Letter

Agreements in order to permit the selling stockholders to offer the shares for resale from time to time. Except for (i) the ownership

of the shares of common stock and other warrants and (ii) Dr. Lon E. Bell’s service as our former Chief Executive Officer

and Chairman of the Board, the selling stockholders have not had any material relationship with us within the past three years.

Furthermore, except as set forth below, none of the selling stockholders is a broker-dealer registered under Section 15 of the

Exchange Act or an affiliate of a broker-dealer registered under Section 15 of the Exchange Act.

The table below lists

the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the

selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder,

based on its ownership of the shares of common stock and the Series C Warrants, as of the date of this prospectus, assuming exercise

of the Series C Warrants held by the selling stockholders on that date, without regard to any limitations on exercises.

The third column lists

the shares of common stock being offered by this prospectus by the selling stockholders, assuming exercise of the Series C Warrants

held by the selling stockholders as of the date of this prospectus, without regard to any limitations on exercises.

In accordance with

the terms of the Letter Agreements, this prospectus generally covers the resale of the shares of common stock issuable upon exercise

of the Series C Warrants, determined as if the outstanding Series C Warrants were exercised in full as of the trading day immediately

preceding the date the registration statement of which this prospectus forms as part was initially filed with the SEC, each as

of the trading day immediately preceding the applicable date of determination, without regard to any limitations on exercises.

The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus, assuming

exercise of the Series C Warrants held by the selling stockholders as of the date of this prospectus, without regard to any limitations

on exercises, and that the selling stockholders do not acquire any additional shares. Information in the table below, with respect

to beneficial ownership, has been furnished by the selling stockholders.

Under the terms of

the Series C Warrants, a selling stockholder may not exercise the Series C Warrants to the extent such exercise would cause such

selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock

which would exceed 4.99% or 9.99% of our then outstanding common stock following such exercise, excluding for purposes of such

determination shares of common stock issuable upon exercise of the Series C Warrants which have not been exercised. The number

of shares in the second column does not reflect this limitation.

Information concerning

the selling stockholders may change from time to time and any changed information will be set forth in supplements to this prospectus,

if and when necessary. The selling stockholders may sell all, some or none of their shares in this offering. We cannot advise you

as to whether the selling stockholders will in fact sell any or all of such shares. In addition, the selling stockholders listed

in the table below may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time

and from time to time, shares in transactions exempt from the registration requirements of the Securities Act, after the date on

which they provided the information set forth in the table below. See “Plan of Distribution.”

To our knowledge, each

person named in the table has sole voting and investment power with respect to all of the securities shown as beneficially owned

by such person, except as otherwise set forth in the notes to the table. The number of securities shown represents the number of

securities the person “beneficially owns,” as determined by the rules of the SEC. The SEC has defined “beneficial”

ownership of a security to mean the possession, directly or indirectly, of voting power and/or investment power. A security holder

is also deemed to be, as of any date, the beneficial owner of all securities that such security holder has the right to acquire

within 60 days after that date through (1) the exercise of any option, warrant or right, (2) the conversion of a security, (3)

the power to revoke a trust, discretionary account or similar arrangement, or (4) the automatic termination of a trust, discretionary

account or similar arrangement.

The percentages in

the table below reflect beneficial ownership immediately prior to the date of this prospectus and immediately after the resale

of all shares subject to resale pursuant to this prospectus as determined in accordance with Rule 13d-3 under the Exchange Act

and are based on 2,899,815 shares of our common stock outstanding as of August 17, 2020.

|

|

|

Shares of Common Stock

Beneficially Owned Immediately

Prior to this Prospectus

|

|

|

Maximum Number

of Shares of

Common Stock

that May be Offered

for Resale

|

|

|

Shares

of Common Stock

Beneficially Owned Immediately

After Resale of the Maximum

Number of Shares of Common

Stock

Subject to Resale Pursuant

to this Prospectus (1)

|

|

|

Name of Selling Stockholder

|

|

Number of

Shares

|

|

|

Percentage of Common Stock

|

|

|

Pursuant

to this

Prospectus

|

|

|

Number of Shares

|

|

|

Percentage of Common Stock

|

|

|

AIGH Investment Partners, L.P. (2)

|

|

|

1,594,958

|

|

|

|

37.8

|

%

|

|

|

424,023

|

|

|

|

1,170,935

|

|

|

|

26.0

|

%

|

|

AWM Investment Company, Inc. (3)

|

|

|

1,017,167

|

|

|

|

28.0

|

%

|

|

|

39,366

|

|

|

|

977,801

|

|

|

|

22.7

|

%

|

|

Lon E. Bell (4)

|

|

|

733,554

|

|

|

|

21.9

|

%

|

|

|

151,436

|

|

|

|

582,118

|

|

|

|

14.9

|

%

|

|

Peter A. Appel (5)

|

|

|

365,618

|

|

|

|

12.3

|

%

|

|

|

60,575

|

|

|

|

305,043

|

|

|

|

8.4

|

%

|

|

Laurence Lytton (6)

|

|

|

81,267

|

|

|

|

2.8

|

%

|

|

|

30,288

|

|

|

|

50,979

|

|

|

|

1.4

|

%

|

|

|

(1)

|

Assumes 3,605,503 shares of our common stock are outstanding after this offering, which reflects

2,899,815 shares of common stock presently outstanding as of August 17, 2020, and 705,688 shares of common stock issuable upon

exercise of the Series C Warrants.

|

|

|

(2)

|

Includes (i) (a) 183,834 shares of common stock, (b) 287,123 shares of common stock issuable upon

exercise of Series C Warrants and (c) 577,619 shares of common stock issuable upon exercise of other warrants, in each case, held

by AIGH Investment Partners, L.P. (“AIGH IP LP”), (ii) (a) 14,392 shares of common stock, (b) 60,575 shares of common

stock issuable upon exercise of Series C Warrants and (c) 167,330 shares of common stock issuable upon exercise of other warrants,

in each case, held by AIGH Investment Partners, L.L.C. (“AIGH IP L.L.C.”), (iii) (a) 62,758 shares of common stock,

(b) 53,427 shares of common stock issuable upon exercise of Series C Warrants and (c) 103,966 shares of common stock issuable upon

exercise of other warrants, in each case, held by WVP Emerging Manager Onshore Fund, LLC - AIGH Series (“WVP AIGH”),

and (iv) (a) 14,973 shares of common stock, (b) 22,898 shares of common stock issuable upon exercise of Series C Warrants and (c)

46,063 shares of common stock issuable upon exercise other warrants, in each case, held by WVP Emerging Manager Onshore Fund, LLC

- Optimized Equity Series (“WVP OES”). The Series C Warrants and other warrants held by AIGH IP LP, AIGH IP L.L.C.,

WVP AIGH, WVP OES, AIGH Capital Management, LLC, a Maryland limited liability company (“AIGH CM”) and Mr. Hirschman

may be exercised only to the extent that the total number of shares of common stock then beneficially owned by Mr. Hirschman does

not exceed 9.99% of the outstanding shares of our common stock. Mr. Orin Hirschman is the managing member of AIGH CM, who is an

advisor or sub-advisor with respect to the securities held by AIGH IP L.P., WVP AIGH and WVP OES, and president of AIGH IP L.L.C.,

with respect to securities indirectly held by AIGH CM, directly by AIGH IP and Mr. Hirschman and his family directly, and has voting

and investment control over the securities. The address for AIGH CM, AIGH IP and Mr. Hirschman is 6006 Berkeley Avenue, Baltimore,

Maryland 21209.

|

|

|

(3)

|

AWM Investment Company, Inc., a Delaware corporation (“AWM”), is the investment adviser

to Special Situations Cayman Fund, L.P., a Cayman Islands Limited Partnership (“Cayman”), Special Situations Fund III

QP, L.P., a Delaware limited partnership (“SSFQP”), Special Situations Technology Fund, L.P., a Delaware limited partnership

(“Tech”) and Special Situations Technology Fund II, L.P., a Delaware limited partnership (“Tech II” and,

together with Cayman, SSFQP and Tech, the “AWM Funds”). Austin W. Marxe, David M. Greenhouse and Adam C. Stettner are

the principal owners of AWM. Through their control of AWM, Messrs. Marxe, Greenhouse and Stettner share voting and investment control

over the portfolio securities of each of the AWM Funds. Includes (i) (a) 54,088 shares of common stock, (b) 5,763 shares of common

stock issuable upon exercise of Series C Warrants and (c) 101,458 shares of common stock issuable upon exercise of other warrants,

in each case, held by Cayman, (ii) (a) 134,331 shares of common stock, (b) 19,823 shares of common stock issuable upon exercise

of Series C Warrants and (c) 348,983 shares of common stock issuable upon exercise of other warrants, in each case, held by SSFQP,

(iii) (a) 14,327 shares of common stock, (b) 2,054 shares of common stock issuable upon exercise of Series C Warrants and (c) 36,141

shares of common stock issuable upon exercise of other warrants, in each case, held by Tech, and (iv) (a) 82,047 shares of common

stock, (b) 11,726 shares of common stock issuable upon exercise of Series C Warrants and (c) 206,426 shares of common stock issuable

upon exercise of other warrants, in each case, held by Tech II. The Series C Warrants and the other warrants held by AWM may be

exercised only to the extent that the total number of shares of common stock then beneficially owned by AWM does not exceed 9.99%

of the outstanding shares of our common stock. The address for AWM is 527 Madison Avenue, Suite 2600, New York, New York, 10022.

|

|

|

(4)

|

Includes (i) 24,182 shares of common stock held in Dr. Bell’s name, (ii) 263,606 shares of

common stock held by The Bell Family Life Insurance No 1 Trust dated 2/2/95 as amended (the “Bell Family Trust”), of

which Dr. Bell is the trustee and a beneficiary and has voting and investment control over the securities, (iii) 92,179 shares

of common stock subject to vested options to purchase common stock held in Dr. Bell’s name, (iv) 151,436 shares of common

stock issuable upon exercise of Series C Warrants held by the Bell Family Trust, and (v) 202,151 shares of common stock issuable

upon the exercise of other warrants held by the Bell Family Trust. The Series C Warrants held by Dr. Bell may be exercised only

to the extent that the total number of shares of common stock then beneficially owned by Dr. Bell does not exceed 9.99% of the

outstanding shares of our common stock. The address of each of Dr. Bell and the Bell Family Trust is 1819 Grand Oaks Ave, Altadena,

California 91001.

|

|

|

(5)

|

Includes (i) 284,607 shares of common stock, (ii) 60,575 shares of common stock issuable upon exercise

of Series C Warrants and (iii) 20,436 shares of common stock issuable upon exercise of other warrants, in each case, held by Mr.

Appel. The Series C Warrants held by Mr. Appel may be exercised only to the extent that the total number of shares of common stock

then beneficially owned by Mr. Appel does not exceed 9.99% of the outstanding shares of common stock. The address for Peter A.

Appel is 3505 Main Lodge Drive, Coconut Grove, Florida 33133.

|

|

|

(6)

|

Includes (i) 50,979 shares of common stock and (ii) 30,288 shares of common stock issuable upon

exercise of Series C Warrants, in each case, held by Mr. Lytton. The Series C Warrants held by Mr. Lytton may be exercised only

to the extent that the total number of shares of common stock then beneficially owned by Mr. Lytton does not exceed 4.99% of the

outstanding shares of common stock. The address for Mr. Lytton is 467 Central Park West, 17-A, New York, New York 10025.

|

PLAN OF DISTRIBUTION

Each selling stockholder

of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their

securities covered hereby on the principal Trading Market (as defined in the form of Series C Warrant, which is filed as an exhibit

to the registration statement of which this prospectus forms as part) or any other stock exchange, market or trading facility on

which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder

may use any one or more of the following methods when selling securities:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may

position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

settlement of short sales;

|

|

|

·

|

in transactions through broker-dealers that agree with the selling stockholders to sell a specified

number of such securities at a stipulated price per security;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an

options exchange or otherwise;

|

|

|

·

|

a combination of any such methods of sale; or

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholders

may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather

than under this prospectus.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities,

from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an

agency transaction not in excess of a customary brokerage commission in compliance with the Financial Industry Regulatory Authority,

Inc. (“FINRA”) Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA

IM-2440.

In connection with

the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions

they assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions,

or loan or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter

into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities

which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which

securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended

to reflect such transaction).

The selling stockholders

and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within

the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We will pay certain

fees and expenses incurred by us incident to the registration of the securities, other than underwriting discounts, selling commissions

and brokerage fees.

We agreed to keep the

registration statement of which this prospectus forms a part effective until no selling stockholder owns any Series C Warrants

or Series C Warrant Shares underlying the Series C Warrants issuable upon exercise thereof. The resale securities will be sold

only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain

states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules

and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation

M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions

of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and

sales of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to

the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior

to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity

of the shares of our common stock offered by this prospectus will be passed upon for us by Perkins Coie LLP. Additional legal matters

may be passed upon for us, the selling stockholders or any underwriters, dealers or agents, by counsel that we will name in the

applicable prospectus supplement.

EXPERTS

The audited financial

statements as of December 31, 2019 and 2018 and for each of the two years in the period ended December 31, 2019 incorporated by

reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon

the report of Gumbiner Savett Inc., an independent registered public accounting firm, upon the authority of said firm as experts

in accounting and auditing in giving said report.

WHERE YOU CAN FIND MORE INFORMATION

We file with, or furnish

to, the SEC reports including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and

amendments to those reports pursuant to Section 13(a) or 15(d) of the Exchange Act. These reports are available free of charge

on our corporate website, www.idealpower.com, as soon as reasonably practicable after they are electronically filed with or furnished

to the SEC. Copies of any materials we file with the SEC can be obtained at www.sec.gov. The foregoing website addresses are provided

as inactive textual references only. The information provided on our website (or any other website referred to in this prospectus

or any applicable prospectus supplement) is not part of this prospectus or any applicable prospectus supplement and is not incorporated

by reference as part of this prospectus or any applicable prospectus supplement.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to

“incorporate by reference” the information we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus

and any accompanying prospectus supplement, and later information filed with the SEC will automatically update and supersede this

information. We incorporate by reference the documents listed below and all documents subsequently filed with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering under this prospectus and any

prospectus supplement (other than information deemed furnished and not filed in accordance with SEC rules, including Items 2.02

and 7.01 of Form 8-K):

|

|

·

|

our Quarterly Reports on Form 10-Q for the quarterly periods ended

March 31, 2020 and June 30, 2020, filed with the SEC on May 14, 2020 and August 13, 2020,

respectively;

|

|

|

·

|

our Current Reports on Form 8-K filed with the SEC on April 2, 2020, April 14, 2020, April 29, 2020, May 8, 2020, June 18, 2020 and August 3, 2020.

|

You may request a copy

of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing)

at no cost, by writing to or telephoning us at the following address:

Ideal Power Inc.

4120 Freidrich Lane, Suite 100

Austin, Texas, 78744

(512) 264-1542

Attention: Chief Financial Officer

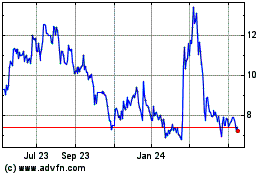

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024