Ideal Power Reports Third Quarter 2019 Financial Results

November 13 2019 - 4:01PM

Ideal Power Inc. (NASDAQ: IPWR), pioneering the development

and commercialization of highly efficient and broadly patented

B-TRAN™ bi-directional power switches, reported results for its

third quarter ended September 30, 2019.

Key Third Quarter 2019 and Subsequent B-TRAN™ Division

Highlights:

- Sold our Power Conversion Systems

(PCS) business and Power Packet Switching Architecture (PPSA™)

technology to CE+T Energy Solutions.

-

- Received a combination of cash,

CE+T Energy Solutions equity and the assumption of certain

liabilities; and

-

- Reduced cash burn to approximately

$700,000 per quarter, an approximately 60% reduction from our

average quarterly cash burn in 2018.

- Strengthened balance sheet through

the completion of a $3.5 million private placement subsequent to

the close of the third quarter 2019. We are now solely

focused on B-TRAN™ solid state switch commercialization.

- Completed testing of double-sided B-TRAN™ dies.

- Demonstrated bi-directional

operation with symmetrical performance in both directions;

- Measured forward voltage drop of

0.2V, consistent with our simulations. This value is substantially

lower than the corresponding junction voltage drop of approximately

1.75V for an IGBT switch;

and

- Measured breakdown voltages of up

to 1200V, a characteristic required for commercial, industrial and

military applications such as data centers, battery storage,

renewable energy and traction

drives.

- B-TRAN™ dies are being packaged for

use with a bi-directional driver to characterize switching

performance.

- Design basis and test results of

initial B-TRAN™ devices meet the criteria for our engineering

prototype sampling

program.

- B-TRAN™ Patent Estate: Currently

have 47 issued B-TRAN™ patents with 12 of those patents issued

outside North America. Significantly, our geographic coverage now

includes China, Japan and Europe. Our B-TRAN™ patent portfolio of

approximately 36 patent filings includes pending applications that

will enhance our coverage in the US, China, Japan and Europe and

potentially expand our coverage to include Korea and India.

Management Commentary

“The third quarter of 2019 was highlighted by

the completion of our PCS disposition allowing us to focus solely

on our proprietary B-TRAN™ power switch technology

commercialization,” said Dr. Lon Bell, Chief Executive Officer of

Ideal Power. “During the quarter we collaborated extensively with

semiconductor fabrication partners to manufacture B-TRAN™ wafers

for packaging and bench testing.

“Subsequent to the closing of the third quarter

and in conjunction with the recent B-TRAN progress, the Company was

able to fortify the balance sheet with $3.5 million in gross

proceeds from institutional investors and company management. I

personally contributed $500,000 to the offering, demonstrating my

confidence in the immense opportunity for our repositioned Company.

We look forward to sharing more on our commercial progress on our

year-end earnings call and upcoming investor conferences,”

concluded Bell.

Third Quarter 2019 Financial Results

- The company had no revenues from

continuing operations in the third quarter of 2019.

- Q3 2019 operating expenses were

$0.7 million compared to $1.2 million in Q3 2018. The decrease in

operating expense was primarily due to a decrease in our general

and administrative expenses impacted by our cost reduction plan,

inclusive of reduced headcount, and disposition of PCS

business.

- Q3 2019 net loss was $0.8 million,

compared to $2.2 million in Q3 2018.

- Q3 2019 cash used in operating

activities in Q3 2019 was $0.7 million compared to $1.4 million in

Q3 2018. Year-to-date Q3 2019 cash used in operating activities was

$2.4 million compared to $4.3 million in year-to-date Q3 2018.

- Cash and cash equivalents totaled

$0.8 million as of September 30, 2019, with no long-term debt

outstanding.

- Subsequent to the close of the

third quarter, the company entered into definitive agreements with

certain institutional and accredited investors, including Dr. Lon

E. Bell, Chief Executive Officer and Chairman of the Board of Ideal

Power, for a private placement of Ideal Power’s common stock (or

common stock equivalents) and warrants to purchase common stock for

aggregate gross proceeds of $3.5 million.

Conference Call Details

Ideal Power Chairman, CEO and President Dr. Lon

Bell, CFO Tim Burns and B-TRAN™ Chief Commercial Officer Dan Brdar

will host the conference call, which will be accompanied by a

presentation and followed by a question and answer period.

To access the call, please use the following

information:

|

Date: |

Wednesday, November 13, 2019 |

|

Time: |

4:30 p.m. ET, 1:30 p.m. PT |

|

Toll-free dial-in number: |

1-800-458-4148 |

|

International dial-in number:

|

1-323-794-2597 |

|

Conference ID: |

7385903 |

|

Presentation: |

Events Section of IR website here |

Please call the conference telephone number 5-10

minutes prior to the start time. An operator will register your

name and organization. If you have any difficulty connecting with

the conference call, please contact MZ Group at 1-949-491-8235.

The conference call will be broadcast live and

available for replay

at http://public.viavid.com/index.php?id=136767 and via

the investor relations section of the Company’s website

at www.IdealPower.com.

A replay of the conference call will be

available after 7:30 p.m. Eastern time through December 13,

2019.

|

Toll Free Replay Number: |

1-844-512-2921 |

|

International Replay Number: |

1-412-317-6671 |

|

Replay ID: |

7385903 |

About Ideal Power Inc. Ideal

Power (NASDAQ: IPWR) is pioneering the development of its broadly

patented bi-directional power switches, creating highly efficient

and ecofriendly energy control solutions for industrial,

alternative energy, military and automotive applications. The

company is focused on its patented Bi-directional, Bi-polar

Junction Transistor (B-TRAN™) semiconductor technology. B-TRAN™ is

a unique double-sided bi-directional AC switch able to deliver

substantial performance improvements over today's conventional

power semiconductors. Ideal Power believes B-TRAN™ modules will

reduce conduction and switching losses, complexity of thermal

management and operating cost in medium voltage AC power switching

and control circuitry. For more information,

visit www.IdealPower.com.

Safe Harbor Statement All

statements in this release that are not based on historical fact

are "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and the provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. While Ideal

Power’s management has based any forward-looking statements

included in this release on its current expectations, the

information on which such expectations were based may change. These

forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of risks,

uncertainties and other factors, many of which are outside of our

control that could cause actual results to materially differ from

such statements. Such risks, uncertainties, and other factors

include, but are not limited to, the success of our B-TRAN™

technology, whether the patents for our technology provide adequate

protection and whether we can be successful in maintaining,

enforcing and defending our patents, our inability to predict with

precision or certainty the pace of development and

commercialization of our B-TRAN™ technology and uncertainties set

forth in our quarterly, annual and other reports filed with the

Securities and Exchange Commission. Furthermore, we operate in a

highly competitive and rapidly changing environment where new and

unanticipated risks may arise. Accordingly, investors should not

place any reliance on forward-looking statements as a prediction of

actual results. We disclaim any intention to, and undertake no

obligation to, update or revise forward-looking

statements. Ideal Power Investor

Relations Contact: MZ North America Chris

Tyson 949-491-8235 IPWR@mzgroup.us www.mzgroup.us

IDEAL POWER INC. Balance

Sheets

| |

|

September 30, 2019 |

|

|

December 31, 2018 |

|

| |

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

769,833 |

|

|

$ |

3,258,077 |

|

|

Prepayments and other current assets |

|

|

129,347 |

|

|

|

333,877 |

|

|

Current assets of discontinued operations held for sale |

|

|

– |

|

|

|

1,096,323 |

|

|

Total current assets |

|

|

899,180 |

|

|

|

4,688,277 |

|

|

|

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

52,879 |

|

|

|

63,214 |

|

| Intangible assets, net |

|

|

1,645,555 |

|

|

|

1,396,409 |

|

| Right of use asset |

|

|

303,246 |

|

|

|

– |

|

| Other assets |

|

|

17,920 |

|

|

|

17,920 |

|

|

Total assets |

|

$ |

2,918,780 |

|

|

$ |

6,165,820 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

195,540 |

|

|

$ |

94,203 |

|

|

Accrued expenses |

|

|

178,720 |

|

|

|

167,755 |

|

|

Current portion of lease liability |

|

|

177,669 |

|

|

|

– |

|

|

Current liabilities of discontinued operations held for sale |

|

|

– |

|

|

|

877,755 |

|

|

Total current liabilities |

|

|

551,929 |

|

|

|

1,139,713 |

|

| |

|

|

|

|

|

|

|

|

| Long-term lease liability |

|

|

129,995 |

|

|

|

– |

|

| Other long-term

liabilities |

|

|

651,483 |

|

|

|

428,163 |

|

|

Total liabilities |

|

|

1,333,407 |

|

|

|

1,567,876 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares

authorized;810,000 shares issued and outstanding at September

30, 2019 and 1,518,430 shares issued and outstanding at December

31, 2018, respectively |

|

|

810 |

|

|

|

1,518 |

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

1,475,322 shares issued and 1,474,001 shares outstanding at

September 30 30, 2019 and 1,404,479 shares issued and 1,403,158

shares outstanding at December 31, 2018, respectively |

|

|

1,475 |

|

|

|

1,404 |

|

|

Additional paid-in capital |

|

|

68,115,842 |

|

|

|

68,022,484 |

|

|

Treasury stock, at cost, 1,321 shares at September 30, 2019 and

December 31, 2018, respectively |

|

|

(13,210 |

) |

|

|

(13,210 |

) |

|

Accumulated deficit |

|

|

(66,519,544 |

) |

|

|

(63,414,252 |

) |

|

Total stockholders’ equity |

|

|

1,585,373 |

|

|

|

4,597,944 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,918,780 |

|

|

$ |

6,165,820 |

|

IDEAL POWER INC.

Statements of Operations

(unaudited)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Product revenue |

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

| Cost of product revenue |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

Gross profit |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

250,773 |

|

|

|

326,733 |

|

|

|

804,741 |

|

|

|

743,495 |

|

|

General and administrative |

|

|

471,272 |

|

|

|

911,763 |

|

|

|

1,520,325 |

|

|

|

2,597,174 |

|

|

Total operating expenses |

|

|

722,045 |

|

|

|

1,238,496 |

|

|

|

2,325,066 |

|

|

|

3,340,669 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations before interest |

|

|

(722,045 |

) |

|

|

(1,238,496 |

) |

|

|

(2,325,066 |

) |

|

|

(3,340,669 |

) |

| Interest (income) expense,

net |

|

|

2,763 |

|

|

|

112 |

|

|

|

3,072 |

|

|

|

(36,817 |

) |

| Loss from continuing

operations |

|

|

(724,808 |

) |

|

|

(1,238,608 |

) |

|

|

(2,328,138 |

) |

|

|

(3,303,852 |

) |

| Loss from discontinued

operations |

|

|

(78,796 |

) |

|

|

(1,011,315 |

) |

|

|

(768,047 |

) |

|

|

(2,724,679 |

) |

| Loss on sale of discontinued

operations |

|

|

(9,107 |

) |

|

|

– |

|

|

|

(9,107 |

) |

|

|

– |

|

| Net loss |

|

$ |

(812,711 |

) |

|

$ |

(2,249,923 |

) |

|

$ |

(3,105,292 |

) |

|

$ |

(6,028,531 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations per share – basic and fully diluted |

|

$ |

(0.49 |

) |

|

$ |

(0.88 |

) |

|

$ |

(1.60 |

) |

|

$ |

(2.36 |

) |

| Loss from discontinued

operations per share – basic and fully diluted |

|

|

(0.06 |

) |

|

|

(0.73 |

) |

|

|

(0.53 |

) |

|

|

(1.94 |

) |

| Net loss per share – basic and

fully diluted |

|

$ |

(0.55 |

) |

|

$ |

(1.61 |

) |

|

$ |

(2.13 |

) |

|

$ |

(4.30 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

shares outstanding – basic and fully diluted |

|

|

1,474,001 |

|

|

|

1,401,348 |

|

|

|

1,460,507 |

|

|

|

1,401,060 |

|

IDEAL POWER INC. Statements of Cash Flows

(unaudited)

| |

|

Nine Months Ended September 30, |

|

| |

|

2019 |

|

|

2018 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

$ |

(2,328,138 |

) |

|

$ |

(3,303,852 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

82,913 |

|

|

|

109,845 |

|

|

Write-off of capitalized patents |

|

|

– |

|

|

|

10,873 |

|

|

Stock-based compensation |

|

|

156,882 |

|

|

|

645,349 |

|

|

Decrease in operating assets: |

|

|

|

|

|

|

|

|

|

Prepayments and other current assets |

|

|

204,530 |

|

|

|

186,764 |

|

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

1,337 |

|

|

|

192,352 |

|

|

Accrued expenses |

|

|

6,336 |

|

|

|

(108,489 |

) |

|

Net cash used in operating activities |

|

|

(1,876,140 |

) |

|

|

(2,267,158 |

) |

|

Net cash used in operating activities – discontinued

operations |

|

|

(557,096 |

) |

|

|

(2,076,842 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(4,253 |

) |

|

|

(1,088 |

) |

|

Acquisition of intangible assets |

|

|

(74,342 |

) |

|

|

(85,913 |

) |

|

Net cash used in investing activities |

|

|

(78,595 |

) |

|

|

(87,001 |

) |

|

Net cash provided by (used in) investing activities – discontinued

operations |

|

|

23,587 |

|

|

|

(49,865 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

Payment of taxes related to restricted stock vesting |

|

|

– |

|

|

|

(2,616 |

) |

|

Net cash used in financing activities |

|

|

– |

|

|

|

(2,616 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in cash and cash

equivalents – continuing operations |

|

|

(1,954,735 |

) |

|

|

(2,356,775 |

) |

| Net decrease in cash and cash

equivalents – discontinued operations |

|

|

(533,509 |

) |

|

|

(2,126,707 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

3,258,077 |

|

|

|

10,022,247 |

|

| Cash and cash equivalents at

end of period |

|

$ |

769,833 |

|

|

$ |

5,538,765 |

|

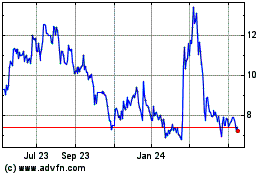

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024