Current Report Filing (8-k)

April 17 2019 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April

11, 2019

IDEAL POWER INC.

(Exact name of registrant as specified in

charter)

|

Delaware

|

001-36216

|

14-1999058

|

|

(State or Other Jurisdiction of

Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification

Number)

|

4120 Freidrich Lane, Suite 100

Austin, Texas 78744

(Address of principal executive offices,

including zip code)

(512) 264-1542

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨

Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On April 11, 2019, Ideal Power Inc. (the “

Company

”)

entered into an asset purchase agreement (the “

Purchase Agreement

”) with Pathion Holdings, Inc., a Delaware

corporation (the “

Purchaser

”) and Pathion, Inc., a Delaware corporation (“

Subsidiary

”

and together with the Purchaser, the “

Purchaser Entities

”) to sell certain assets related to the Company’s

PPSA™ / Power Conversion Systems business (the “

PPSA Business

”). The purchase price consists

of $500,000 in cash and 150,000 shares of the common stock of the Purchaser. Pursuant to the Purchase Agreement, the Purchaser

will assume certain liabilities relating to the PPSA Business, and the Purchaser shall have a limited three (3) year exclusive

option to purchase the Company’s B-TRAN™ (Bi-directional bi-polar junction transistor), subject to certain minimum

purchase obligations. The option is limited to third parties and for use in commercial, industrial, microgrid and grid-scale standalone

energy storage systems using an integrated multi-port power conversion system. The Purchase Agreement contains customary provisions

for an asset sale including representations and warranties, indemnification for intellectual property-related matters and indemnification,

expiring after 6 months, for certain assumed liabilities in excess of $1 million. The closing of the transaction is contingent

upon the Company and the Purchaser entering into an agreement pursuant to which the Company will sublease to the Purchaser approximately

80% of the premises located at 4120 Freidrich Lane, Suite 100, Austin, Texas, and the satisfaction of customary closing conditions.

Subject to certain exceptions described in the Purchase Agreement, in the event that the Purchase Agreement is terminated by either

party prior to closing, a “break-up” fee of $200,000 shall be payable to the non-terminating party. The transaction

is expected to close in April 2019. The foregoing description of the Purchase Agreement does not purport to be complete and highlights

only those terms and conditions of the Purchase Agreement which are material to the Company.

On April 17, 2019, the Company issued a press release announcing

the signing of the Purchase Agreement. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated by reference

herein.

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

IDEAL POWER INC.

|

|

|

|

|

|

|

|

|

|

Date: April 17, 2019

|

By:

|

/s/ Timothy Burns

|

|

|

|

Timothy Burns

|

|

|

|

Chief Financial Officer

|

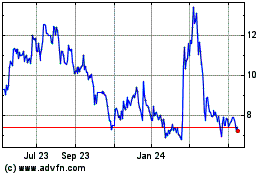

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024