iMedia Announces Reverse Stock Split to Remain in Compliance with NASDAQ

November 25 2019 - 4:10PM

iMedia Brands, Inc. (NASDAQ: IMBI) is announcing that effective at

5:00 p.m. Central time on December 11, 2019 it will implement a

ten-for-one reverse stock split of its outstanding common stock.

The reverse stock split is primarily intended to bring the

company into compliance with the minimum bid price requirement for

maintaining its listing on the Nasdaq Capital Market. iMedia’s

common stock will continue to trade under the symbol “IMBI.”

Upon the effectiveness of the reverse stock split, every ten

shares of issued and outstanding common stock before the close of

business on December 11, 2019 will be combined into one

issued and outstanding share of common stock, with no change in par

value per share. The company’s common stock will open for trading

on NASDAQ on December 12, 2019 on a post-split basis.

No fractional shares will be issued as a result of the reverse

stock split. Any fractional shares that would result from the

reverse stock split will be cancelled in exchange for the payment

of cash consideration.

The reverse stock split will affect all issued and outstanding

shares of the company’s common stock, as well as the number of

shares of common stock available for issuance under the company’s

outstanding stock options and warrants. The reverse stock split

will reduce the number of shares of common stock issuable upon the

exercise of stock options or warrants outstanding immediately prior

to the reverse split and correspondingly increase the respective

exercise prices. The reverse stock split will affect all

shareholders uniformly and will not alter any shareholder’s

percentage interest in the company’s equity, except to the extent

that the reverse stock split results in some shareholders

experiencing an adjustment of a fractional share as described

above.

Shareholders holding share certificates will receive information

from EQ Shareowner Services, iMedia’s transfer agent, regarding the

process for exchanging their shares of common stock. Shareholders

with questions may contact EQ Shareowner Services by calling (800)

401-1957.

About iMedia Brands, Inc.

iMedia Brands, Inc. (NASDAQ: IMBI) is a global

interactive media company that manages a growing portfolio of

niche, lifestyle television networks and web service businesses,

primarily in North America, for both English speaking and, soon,

Spanish speaking audiences and customers. Its brand portfolio

spans multiple business models and product categories and includes

ShopHQ, Bulldog Shopping Network, iMedia Web Services and

soon-to-be-launched LaVenta Shopping Network. Please visit

www.imediabrands.com for more investor information.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

This release contains statements, estimates,

projections, guidance or outlooks that constitute “forward-looking”

statements as defined under U.S. federal securities laws.

Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “plan,” “project,” “should” and similar expressions

identify forward-looking statements, which generally are not

historical in nature. These statements may contain information

about our prospects, including anticipated show, event, or product

line launches, and involve risks and uncertainties. We caution that

actual results could differ materially from those that management

expects, depending on the outcome of certain factors.

Contacts:

Investors:Gateway Investor RelationsCody

SlachIMBI@gatewayir.com(949) 574-3860

Media:press@imediabrands.com (800) 938-9707

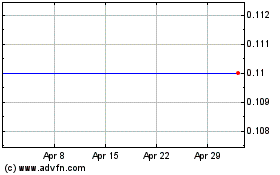

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

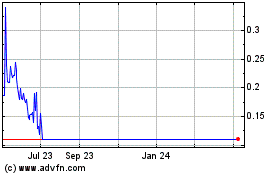

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Apr 2023 to Apr 2024