Growing interest in connected car technology and autonomous driving

in the United States, the most advanced market for these offerings,

is driving strong demand for engineering services, according to a

new report published today by Information Services Group (ISG)

(Nasdaq: III), a leading global technology research and advisory

firm.

The 2019-2020 ISG Provider Lens™ Engineering – Service

Partners Report for the U.S. finds the advanced autonomous vehicle

industry in the U.S. being driven by new partnerships between

automotive original equipment manufacturers (OEMs) and engineering

outsourcing providers.

Vehicle OEMs and product engineering services providers are

entering into long-term, outcome-based alliances focused on shared

risk and reward, with the goal of delivering greater innovation in

such areas as telematics, powertrain and autonomous driving.

As part of smart city infrastructure, providers also are focused

on electric mobility solutions, including battery systems and

charging stations for the personal and public transit markets, the

report says. OEMs are also embracing engineering R&D providers

to develop advanced driver assistance systems.

IT services providers are focused on leveraging their in-house

software capabilities to address customer needs in connected and

autonomous vehicle development, the report adds. Providers are also

partnering with academia to develop new sensor technologies, 3D

mapping and software integration capabilities.

“Engineering and R&D services are one of the fastest growing

segments in the outsourcing market,” said Jan Erik Aase, director

and global leader, ISG Provider Lens Research. “This is especially

true in the U.S. where automotive OEMs are partnering with

technology suppliers, telcos, cloud providers and IT services firms

to create a new generation of autonomous driving technologies.”

Meanwhile, the U.S. aerospace OEM industry is focused on the

so-called “more electric aircraft” (MEA) movement, which is working

to replace mechanical and hydraulic systems with electrical ones,

the report says. OEMs are working with product engineering

providers to find replacements for heavy power electronics boxes.

They are also focused on “light-weighting” aircraft by using

composite materials for airframes and other components.

Aerospace OEMs are looking for end-to-end transformational

outsourcing partners and are moving away from typical

labor-arbitrage-driven outsourcing models, the report adds. OEMs

are seeking outcome-based pricing models that encourage innovation

and reduce time to market.

In the aerospace manufacturing engineering space, OEMs are

leaning on service providers to bolster their manufacturing

capabilities, the report says. OEMs have been focused on component

sourcing for cost advantage, but component manufacturers have been

increasing prices.

As a result, service providers are in a good position to cater

to OEMs, the report adds. To increase their in-house manufacturing

capabilities, many OEMs would have to build up their workforces and

integrate new divisions into their organizations.

The 2019-2020 ISG Provider Lens™ Engineering – Service

Partners Report for the U.S. evaluates the capabilities of 34

providers across four quadrants: Automotive – Product (Design,

Development and Pilot) Engineering, Automotive – Manufacturing

Engineering, Aerospace – Product Engineering and Aerospace –

Manufacturing Engineering.

The report names Capgemini, HCL, Infosys, L&T Technology

Services (LTTS) and TCS as leaders in all four quadrants, and QuEST

Global as a leader in three. Altran, Cyient and Wipro are named as

leaders in two quadrants, and KPIT and Tech Mahindra are named

leaders in one.

The 2019-2020 ISG Provider Lens™ Engineering – Service

Partners Report for the U.S. is available to ISG Insights™

subscribers or for one-time purchase on this webpage.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only

service provider evaluation of its kind to combine empirical,

data-driven research and market analysis with the real-world

experience and observations of ISG's global advisory team.

Enterprises will find a wealth of detailed data and market analysis

to help guide their selection of appropriate sourcing partners,

while ISG advisors use the reports to validate their own market

knowledge and make recommendations to ISG's enterprise clients. The

research currently covers providers offering their services

globally, across Europe and Latin America, as well as in the

U.S., Germany, the U.K., the Nordics and Brazil, with

additional markets to be added in the future. For more information

about ISG Provider Lens research, please visit

this webpage.

The series is a complement to the ISG Provider Lens Archetype

reports, which offer a first-of-its-kind evaluation of providers

from the perspective of specific buyer types.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 700 clients, including more than 70 of the top

100 enterprises in the world, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including automation, cloud and data analytics; sourcing advisory;

managed governance and risk services; network carrier services;

strategy and operations design; change management; market

intelligence and technology research and analysis. Founded in 2006,

and based in Stamford, Conn., ISG employs more than 1,300

digital-ready professionals operating in more than 20 countries—a

global team known for its innovative thinking, market influence,

deep industry and technology expertise, and world-class research

and analytical capabilities based on the industry’s most

comprehensive marketplace data. For more information, visit

www.isg-one.com.

# # #

Will Thoretz

Information Services Group, Inc.

+1 203 517 3119

Will.Thoretz@isg-one.com

Jim Baptiste

Matter Communications for ISG

+1 978 518 4527

jbaptiste@matternow.com

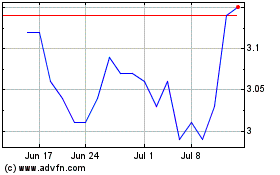

Information Services (NASDAQ:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

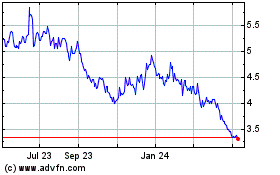

Information Services (NASDAQ:III)

Historical Stock Chart

From Apr 2023 to Apr 2024