Current Report Filing (8-k)

October 26 2020 - 8:21AM

Edgar (US Regulatory)

0000837852

false

0000837852

2020-10-21

2020-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 21, 2020

IDEANOMICS, INC.

(Exact Name of Registrant as Specified in

Its Charter)

|

Nevada

|

001-35561

|

20-1778374

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1441 Broadway, Suite 5116, New York, NY 10018

(Address of principal executive offices)

(Zip Code)

212-206-1216

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001

|

|

IDEX

|

|

The NASDAQ Stock Market

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On October 21, 2020, Ideanomics, Inc. (“Ideanomics”)

entered into a stock purchase agreement (the “Agreement”) with Solectrac, Inc. (“Solectrac”) pursuant to

which Ideanomics acquired 14.7% of Solectrac through the purchase of common stock. Ideanomics received customary representations

and warranties from Solectrac in the Agreement. Solectrac develops, assembles and distributes 100% battery-powered electric tractors—an alternative

to diesel tractors—for agriculture and utility operations. Ideanomics will assume a seat on Solectrac’s board of directors.

Ideanomics and Solectrac also entered into a stockholders agreement (the “Stockholders’ Agreement”) pursuant

to which Ideanomics and the other stockholders of Solectrac received (i) preemptive rights to participate in a new sale of securities

by Solectrac; (ii) a right of first refusal if a stockholder proposes to transfer its capital stock of Solectrac; (iii) co-sale

rights if a stockholder proposes to transfer its capital stock of Solectrac; (iv) information rights which includes the right to

receive Solectrac’s financial statements within 45 days of the end of each quarter and 120 days within the end of each fiscal

year and (v) weighted average anti-dilution rights in the event Solectrac issues new securities for a per share consideration less

than Ideanomics paid at a time when Ideanomics owns greater than 5% of Solectrac.

On October 22, 2020, Ideanomics, Inc. (the “Company”)

issued a press release announcing the Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report

on Form 8-K and is hereby incorporated by reference herein.

The foregoing description of the Agreement and the Stockholders’

Agreement is not purported to be complete and is qualified in its entirety by reference to the complete text of such agreement

which will be filed as an exhibit to a Form 10-Q of the Company, as required.

|

|

Item 5.07.

|

Submission of Matters to a Vote by Security

Holders.

|

On

October 22, 2020, Ideanomics, Inc. (the “Company”) held its 2020 Annual Meeting of Shareholders (the “Annual

Meeting”). A brief description of the matters voted upon at the Annual Meeting and the results of the voting on such

matters is set forth below. On all matters (including the election of directors) submitted to a vote of the Company’s shareholders,

the Company’s Class A common stock and Series A preferred stock vote together as a single class, with each holder of Class

A common stock entitled to one vote per share of Class A common stock and each holder of Series A preferred stock entitled to ten

votes per share of Series A preferred stock. Broker non-votes and abstentions are not considered votes cast at the Annual Meeting

and are not counted for any purpose in determining whether a matter has been approved.

|

|

1.

|

Elect seven directors to serve for one-year terms

|

|

Nominee

|

Votes Cast For

|

Votes Withheld

|

Broker Non-Votes

|

Percentage of Votes Cast For

|

|

Bruno Wu

|

101,374,445

|

2,786,827

|

53,459,011

|

97.32%

|

|

Alfred Poor

|

98,491,803

|

5,669,469

|

53,459,011

|

94,55%

|

|

Shane McMahon

|

99,685,075

|

4,476,197

|

53,459,011

|

95,70%

|

|

James Cassano

|

95,375,040

|

8,786,232

|

53,459,011

|

91,56%

|

|

Jerry Fan

|

95,232,944

|

8,928,328

|

53,459,011

|

91.42%

|

|

Chao Yang

|

95,147,998

|

9,013,274

|

53,459,011

|

91.34%

|

|

Harry Edelson

|

95,281,874

|

8,879,398

|

53,459,011

|

91.47%

|

Each of the nominees

was re-elected by the Company’s shareholders to serve on the board of directors for a one-year term expiring at the Company’s

2021 Annual Meeting of Shareholders, and until their respective successors have been elected, or until their earlier resignation

or removal.

|

|

2.

|

Ratify the appointment of BF Borgers CPA PC as the independent registered accounting firm of the Company for the fiscal

year ending December 31, 2020

|

|

Votes Cast For

|

Votes Cast Against

|

Abstentions

|

Percentage of Votes Cast For

|

|

146,222,671

|

5,826,414

|

5,571,198

|

96.16%

|

Proposal No. 2

was approved by the Company’s shareholders.

|

|

3.

|

Approval of the amendment and restatement of the Company’s 2010 Equity Incentive Plan to increase the number of shares

authorized for issuance under the Plan to 56,800,000 and so that the term of the Plan shall be until August 31, 2030

|

|

Votes Cast For

|

Votes Cast Against

|

Abstentions

|

Broker Non-Votes

|

Percentage of Votes Cast For

|

|

88,775,426

|

14,680,618

|

705,228

|

53,459,011

|

85.80%

|

Proposal No. 3

was approved by the Company’s shareholders.

|

|

4.

|

Approval of the issuance of shares of common stock to Yorkville Advisors pursuant to the terms

of a standby equity distribution agreement in accordance with the stockholder approval requirements of NASDAQ listing rule 5635(d)

|

|

Votes Cast For

|

Votes Cast Against

|

Abstentions

|

Broker Non-Votes

|

Percentage of Votes Cast For

|

|

94,934,748

|

8,593,900

|

632,624

|

53,459,011

|

91.69%

|

Proposal No. 4

was approved by the Company’s shareholders.

|

|

Item 9.01

|

Financial Statements

and Exhibits

|

d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Ideanomics, Inc.

|

|

|

|

|

|

|

Date: October 26, 2020

|

By:

|

/s/ Alfred Poor

|

|

|

|

|

Alfred Poor

|

|

|

|

|

Chief Executive Officer

|

|

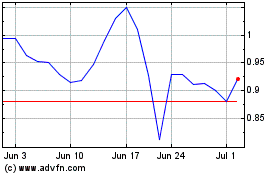

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024