Post-effective Amendment to an S-8 Filing (s-8 Pos)

July 01 2021 - 3:44PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 1, 2021

|

|

Registration No. 333-254891

Registration No. 333-257578

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 ON FORM S-8 TO FORM F-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ICON PUBLIC COMPANY LIMITED

(Exact name of registrant as specified in its charter)

|

Ireland

|

Not Applicable

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

South County Business Park

|

|

|

Leopardstown

|

|

|

Dublin 18, Ireland

|

Not Applicable

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

PRA Health Sciences, Inc. 2020 Stock Incentive Plan

PRA Health Sciences, Inc. 2018 Stock Incentive Plan

PRA Health Sciences, Inc. 2014 Omnibus Incentive Plan

2013 Stock Incentive Plan for Key Employees of PRA Health Sciences and its Subsidiaries

(Full title of the plans)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(Name and address of agent for service)

(302) 738-6680

(Telephone number, including area code, of agent for service)

Copies to:

|

William M. Hartnett

|

Diarmaid Cunningham

|

|

Kimberly Petillo-Décossard

|

General Counsel

|

|

Ross E. Sturman

|

ICON plc

|

|

Cahill Gordon & Reindel LLP

|

South County Business Park

|

|

32 Old Slip

|

Leopardstown

|

|

New York, NY 10005

|

Dublin 18, Ireland

|

|

(212) 701-3000

|

+353-1-291-2000

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company)

|

Smaller reporting company ☐

|

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered

|

Amount to be Registered (1)(2)

|

Proposed Maximum

Offering Price

per share (3)

|

Proposed Maximum

Aggregate Offering

Price (3)

|

Amount of Registration Fee (3)

|

|

Ordinary Shares, par value €0.06 per share

|

2,605,853 (2)(3)

|

N/A

|

N/A

|

N/A

|

|

|

(1)

|

Represents Ordinary Shares, par value €0.06 per share (“Ordinary Shares”), of ICON public limited company (the “Registrant”) that may be offered or issued pursuant to outstanding stock options and restricted stock units previously granted under

the PRA Health Sciences, Inc. 2020 Stock Incentive Plan, PRA Health Sciences, Inc. 2018 Stock Incentive Plan, PRA Health Sciences, Inc. 2014 Omnibus Incentive Plan or 2013 Stock Incentive Plan for Key Employees of PRA Health Sciences and its

Subsidiaries (the “PRA Plans”).

|

|

|

(2)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also registers such additional Ordinary Shares that may be offered or issued pursuant to the PRA Plans to prevent dilution

resulting from stock splits, stock dividends, or similar transactions resulting in an increase in the number of outstanding Ordinary Shares.

|

|

|

(3)

|

The filing fee payable in connection with the registration of the Ordinary Shares was previously paid in connection with the filing of the Registrant’s Registration Statement on Form F-4 (File No. 333-254891) filed with the Securities and

Exchange Commission (the “Commission”) on March 31, 2021, and amended by Amendment No. 1 on April 26, 2021, and Registration Statement on Form F-4 (File No. 333- 257578) filed with the Commission on June 30, 2021.

|

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 on Form S-8 (“Post-Effective Amendment”) amends the Registrant’s Registration Statement on Form F-4 (File No. 333-254891) filed

with the Commission on March 31, 2021, as previously amended by the Amendment No. 1 filed with the Commission on April 26, 2021, and which became effective on April 27, 2021, and Registration Statement on Form F-4 (File No. 333-257578), filed with the

Commission on June 30, 2021, which became effective on filing (the “Forms F-4” and, together with this Post-Effective Amendment, the “Registration Statement”). The Registrant filed the Forms F-4 in connection with the transactions contemplated by the

Agreement and Plan of Merger dated as of February 24, 2021 (the “Merger Agreement”), by and among the Registrant, ICON US Holdings Inc., a wholly owned subsidiary of the Registrant (“US Holdco”), Indigo Merger Sub, Inc., a wholly owned subsidiary of

the Registrant and US Holdco (“Merger Sub”) and PRA Health Sciences, Inc. (“PRA”).

Pursuant to the Merger Agreement, effective on July 1, 2021, Merger Sub merged with and into PRA, with PRA surviving the merger as a wholly owned subsidiary of the

Registrant and US Holdco (the “Merger”), and each outstanding share of PRA common stock (each, a “PRA Share”) converted into the right to receive (i) 0.4125 of one Ordinary Share and (ii) $80.00 in cash. Further, each outstanding stock option and

restricted stock unit under the PRA Plans was assumed by the Registrant and converted into a stock option or restricted stock unit exercisable for or payable in Ordinary Shares based on the ratio of the average trading price per Ordinary Share for the

ten days prior to July 1, 2021, and the corresponding value of the merger consideration for each PRA Share. This Post-Effective Amendment relates to 2,605,853 Ordinary Shares previously registered on the Forms F-4 for issuance under stock options and

restricted stock units assumed by the Registrant under the PRA Plans.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information required by Part I of Form S-8 is omitted from this filing in accordance with Rule 428 under the Securities Act and the introductory note to Part I of

Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

Item 3.

|

Incorporation of Documents by Reference.

|

The following documents filed by the Registrant with the Commission (File No. 000-29714) are incorporated by reference in this Registration Statement:

|

|

●

|

The Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2020, filed with the Commission on February 24, 2021 (the

“Annual Report”);

|

|

|

●

|

The Registrant’s Report on Form 6-K filed with the Commission on July 1, 2021; and

|

|

|

●

|

The description of Ordinary Shares contained in Exhibit 2.2 to the Annual Report, including any amendment or reports filed for the purpose of

updating such description.

|

In addition, all documents subsequently filed with the Commission by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of

1934 (the “Exchange Act”), prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be

incorporated by reference in this Registration Statement and to be part thereof from the filing date of such documents.

|

|

Item 4.

|

Description of Securities.

|

Not applicable.

|

|

Item 5.

|

Interests of Named Experts and Counsel.

|

Not applicable.

|

|

Item 6.

|

Indemnification of Directors and Officers.

|

The constitution of the Registrant provides that, so far as may be permitted by the Irish Companies Act, every director, managing director, secretary or other officer

of the Registrant shall be entitled to be indemnified by the Registrant against all costs, charges, losses, expenses, and liabilities incurred by them in the execution and discharge of their duties or in relation thereto including any liability

incurred by them in defending any proceedings, civil or criminal, which relate to anything done or omitted or alleged to have been done or omitted by them as an officer or employee of the Registrant and in which judgment is given in their favor (or the

proceedings are otherwise disposed of without any finding or admission of any material breach of duty on their part) or in which he is acquitted or in connection with any proceedings or any application under the Irish Companies Act or under any statute

for relief from liability in respect of any such act or omission in which relief is granted to them by the court.

However the Irish Companies Act only permits the Registrant to enter into an agreement to pay the costs or discharge the liability of a director or the secretary where

judgment is given in their favor in any civil or criminal action in respect of such costs or liability, or where an Irish court grants relief because the director or secretary acted honestly and reasonably and ought fairly to be excused. This

restriction does not apply to executives who are not directors or the secretary of the Registrant. Any obligation of an Irish company which purports to indemnify a director or secretary of an Irish company over and above this will be void under Irish

law, whether contained in its constitution or any contract between the director and the company.

The Irish company law restrictions outlined above do not prevent the Registrant from obtaining, and paying for, directors’ and officers’ liability insurance, as well

as other types of insurance, for its directors and officers.

|

|

Item 7.

|

Exemption from Registration Claimed.

|

Not applicable.

The following exhibits are filed or incorporated by reference as part of this Post-Effective Amendment:

|

Exhibit No.

|

Description

|

|

|

|

|

4.1

|

PRA Health Sciences, Inc. 2020 Stock Incentive Plan (as amended and restated and assumed by the Registrant effective as of July 1, 2021).

|

|

|

|

|

4.2

|

PRA Health Sciences, Inc. 2018 Stock Incentive Plan (as amended and restated and assumed by the Registrant effective as of July 1, 2021).

|

|

|

|

|

4.3

|

PRA Health Sciences, Inc. 2014 Omnibus Incentive Plan (as amended and restated and assumed by the Registrant effective as of July 1, 2021).

|

|

|

|

|

4.4

|

2013 Stock Incentive Plan for Key Employees of PRA Health Sciences and its Subsidiaries (as amended and restated and assumed by the Registrant effective as of July 1, 2021).

|

|

|

|

|

5.1

|

Opinion of A&L Goodbody LLP as to the validity of the Ordinary Shares being registered pursuant to this Registration Statement.

|

|

|

|

|

23.1

|

Consent of KPMG, Independent Registered Public Accounting Firm, relating to the financial statements of the Registrant.

|

|

|

|

|

23.3

|

Consent of A&L Goodbody LLP (included in Exhibit 5.1).

|

|

|

|

|

24.1

|

Power of Attorney of Officers and Directors (included on the signature page of the Registration Statement on Form F-4 (File No. 333-254891) filed with the Commission on March 31, 2021).

|

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in

the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any

deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than

20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

|

provided, however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post-effective amendment by those

paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each

filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is

incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant

to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid

by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act

and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Post-Effective Amendment to be signed on its behalf by the undersigned, thereunto duly authorized, in Dublin, Ireland, on July 1, 2021.

|

|

ICON PLC

|

|

|

|

|

|

|

/s/ Brendan Brennan

|

|

|

Name:

|

Brendan Brennan

|

|

|

Title:

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, this Post-Effective Amendment has been signed below by the following persons in the capacities and on the

date indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

|

|

Chairman of the Board and Director

|

|

July 1, 2021

|

|

Ciaran Murray

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Executive Officer and Director

|

|

July 1, 2021

|

|

Dr. Steve Cutler

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Brendan Brennan

|

|

Chief Financial Officer

|

|

July 1, 2021

|

|

Brendan Brennan

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Lead Independent Director

|

|

July 1, 2021

|

|

Rónán Murphy

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Professor Hugh Brady

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Dr. John Climax

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Joan Garahy

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Professor William Hall

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Eugene McCague

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Julie O’Neill

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 1, 2021

|

|

Mary Pendergast

|

|

|

|

|

|

*By:

|

/s/ Brendan Brennan

|

|

|

|

Brendan Brennan, Attorney-in-Fact

|

|

AUTHORIZED REPRESENTATIVE

|

Puglisi & Associates

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Donald J. Puglisi

|

Authorized Representative in the United States

|

July 1, 2021

|

|

Donald J. Puglisi

|

|

|

|

Managing Director, Puglisi & Associates

|

|

10

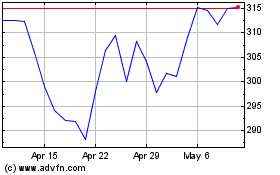

ICON (NASDAQ:ICLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ICON (NASDAQ:ICLR)

Historical Stock Chart

From Apr 2023 to Apr 2024