Current Report Filing (8-k)

October 07 2020 - 4:28PM

Edgar (US Regulatory)

0001800227

false

0001800227

2020-10-07

2020-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 7, 2020

IAC/InterActiveCorp

(Exact name of registrant as specified

in charter)

|

Delaware

|

|

001-39356

|

|

84-3727412

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

|

555

West 18th Street, New

York, NY

|

|

10011

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s telephone number, including

area code: (212) 314-7300

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

IAC

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

On October 7, 2020, the Registrant announced

that it had posted a shareholder letter on the investor relations section of its website (https://www.iac.com/investor-relations/overview/),

which letter contains preliminary monthly trends for its various financial reporting segments through September 30, 2020, as set

forth immediately below.

|

|

|

Year Over Year Growth (1)

|

|

|

|

|

1/2020

|

|

|

2/2020

|

|

|

3/2020

|

|

|

4/2020

|

|

|

5/2020

|

|

|

6/2020

|

|

|

7/2020

|

|

|

8/2020

|

|

|

9/2020

|

|

|

ANGI

Homeservices

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketplace

Revenue

|

|

25

|

%

|

|

27

|

%

|

|

3

|

%

|

|

-2

|

%

|

|

20

|

%

|

|

18

|

%

|

|

10

|

%

|

|

15

|

%

|

|

12

|

%

|

|

Advertising

& Other Revenue

|

|

7

|

%

|

|

8

|

%

|

|

4

|

%

|

|

4

|

%

|

|

1

|

%

|

|

0

|

%

|

|

-2

|

%

|

|

-1

|

%

|

|

2

|

%

|

|

Total North America

Revenue

|

|

21

|

%

|

|

23

|

%

|

|

3

|

%

|

|

-1

|

%

|

|

16

|

%

|

|

15

|

%

|

|

7

|

%

|

|

12

|

%

|

|

10

|

%

|

|

Europe

Revenue

|

|

3

|

%

|

|

-3

|

%

|

|

-27

|

%

|

|

-28

|

%

|

|

-7

|

%

|

|

8

|

%

|

|

-5

|

%

|

|

2

|

%

|

|

-5

|

%

|

|

Total

ANGI Homeservices Revenue

|

|

19

|

%

|

|

21

|

%

|

|

1

|

%

|

|

-2

|

%

|

|

15

|

%

|

|

14

|

%

|

|

7

|

%

|

|

12

|

%

|

|

9

|

%

|

|

Other ANGI Homeservices

Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketplace Service

Requests

|

|

11

|

%

|

|

13

|

%

|

|

-12

|

%

|

|

-8

|

%

|

|

27

|

%

|

|

34

|

%

|

|

24

|

%

|

|

33

|

%

|

|

30

|

%

|

|

Marketplace Monetized

Transactions

|

|

4

|

%

|

|

11

|

%

|

|

-11

|

%

|

|

-11

|

%

|

|

8

|

%

|

|

10

|

%

|

|

5

|

%

|

|

10

|

%

|

|

10

|

%

|

|

Marketplace Transacting

Service Professionals

|

|

8

|

%

|

|

8

|

%

|

|

5

|

%

|

|

4

|

%

|

|

4

|

%

|

|

3

|

%

|

|

7

|

%

|

|

9

|

%

|

|

9

|

%

|

|

Advertising Service

Professionals

|

|

4

|

%

|

|

7

|

%

|

|

4

|

%

|

|

4

|

%

|

|

3

|

%

|

|

4

|

%

|

|

5

|

%

|

|

6

|

%

|

|

5

|

%

|

|

Vimeo

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Revenue

|

|

30

|

%

|

|

34

|

%

|

|

29

|

%

|

|

46

|

%

|

|

52

|

%

|

|

43

|

%

|

|

40

|

%

|

|

43

|

%

|

|

48

|

%

|

|

Ending Subscribers

|

|

29

|

%

|

|

29

|

%

|

|

31

|

%

|

|

35

|

%

|

|

39

|

%

|

|

16

|

%

|

|

17

|

%

|

|

19

|

%

|

|

20

|

%

|

|

Dotdash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Display Advertising

Revenue

|

|

17

|

%

|

|

17

|

%

|

|

12

|

%

|

|

-5

|

%

|

|

-13

|

%

|

|

-6

|

%

|

|

3

|

%

|

|

9

|

%

|

|

15

|

%

|

|

Performance

Marketing Revenue

|

|

70

|

%

|

|

65

|

%

|

|

96

|

%

|

|

114

|

%

|

|

121

|

%

|

|

87

|

%

|

|

69

|

%

|

|

70

|

%

|

|

72

|

%

|

|

Total

Revenue

|

|

31

|

%

|

|

29

|

%

|

|

30

|

%

|

|

23

|

%

|

|

17

|

%

|

|

16

|

%

|

|

22

|

%

|

|

27

|

%

|

|

29

|

%

|

|

Search

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ask Media Group

Revenue

|

|

-1

|

%

|

|

9

|

%

|

|

-4

|

%

|

|

-22

|

%

|

|

-26

|

%

|

|

-11

|

%

|

|

-13

|

%

|

|

-12

|

%

|

|

6

|

%

|

|

Desktop

Revenue

|

|

-42

|

%

|

|

-43

|

%

|

|

-47

|

%

|

|

-47

|

%

|

|

-51

|

%

|

|

-47

|

%

|

|

-44

|

%

|

|

-44

|

%

|

|

-42

|

%

|

|

Total

Revenue

|

|

-21

|

%

|

|

-17

|

%

|

|

-25

|

%

|

|

-33

|

%

|

|

-37

|

%

|

|

-27

|

%

|

|

-26

|

%

|

|

-25

|

%

|

|

-14

|

%

|

|

Emerging

& Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Revenue

|

|

8

|

%

|

|

26

|

%

|

|

63

|

%

|

|

67

|

%

|

|

49

|

%

|

|

65

|

%

|

|

77

|

%

|

|

71

|

%

|

|

97

|

%

|

|

|

(1)

|

As of the date of this report, the Registrant has not yet

completed its financial close process for the quarter ended September 30, 2020 and its monthly results continue to

be volatile as the global COVID–19 pandemic continues to change consumer and business behavior in unpredictable ways. As a

result, the information set forth above is preliminary and based upon information available to the Registrant as of the date

of this report. During the course of the Registrant’s financial close process for the quarter ended September 30, 2020,

it may identify items that would require adjustments to the information set forth above, which could be material.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IAC/InterActiveCorp

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregg Winiarski

|

|

|

Name:

|

Gregg Winiarski

|

|

|

Title:

|

Executive Vice President,

|

|

|

|

General Counsel & Secretary

|

|

|

|

|

Date: October 7, 2020

|

|

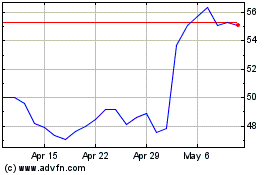

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

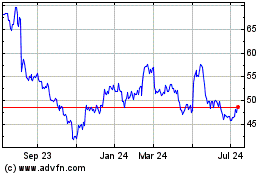

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024