Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered

|

|

Proposed Maximum

Offering Price Per

Share

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

|

Common Stock, par value $0.001 per share

|

|

32,993,518(1)

|

|

$106.96(2)

|

|

$3,528,986,685.28

|

|

$458,062.47(3)

|

|

|

-

(1)

-

Represents

the maximum number of shares of Match Group Common Stock that Match Group expects could be issued upon exchange of the Notes, at an exchange rate

corresponding to (i) for the 0.875% Exchangeable Senior Notes due 2022 (the "2022 Notes"), the maximum exchange rate of 30.1135 shares of Match Group Common Stock per $1,000 principal amount of

the 2022 Notes, (ii) for the 0.875% Exchangeable Senior Notes due 2026 (the "2026 Notes"), the maximum exchange rate of 15.13894 shares of Match Group Common Stock per $1,000 principal amount

of the 2026 Notes and (iii) for the 2.00% Exchangeable Senior Notes due 2030 (the "2030 Notes" and together with the 2022 Notes and the 2026 Notes, the "Notes"), the maximum exchange rate of

15.13894 shares of Match Group Common Stock per $1,000 principal amount of the 2030 Notes.

-

(2)

-

Estimated

solely for the purposes of computing the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended (the "Securities

Act"), based on the average of the high and low prices of the Common Stock on the NASDAQ Global Select Market on August 3, 2020.

-

(3)

-

Calculated

in accordance with Rule 457(r) under the Securities Act. Pursuant to Rule 457(p) of the Securities Act, (i) $75,106.76 of previously

paid fees associated with the registration of unsold securities on Registration Statement No. 333-222643 on Form S-3, which was filed by the registrant on January 22, 2018 and

subsequently withdrawn on August 10, 2020, (ii) $68,245.22 of previously paid fees associated with the registration of unsold securities on Registration Statement No. 333-234632

on Form S-3, which was filed by the registrant on November 12, 2019 and subsequently withdrawn on August 10, 2020 and (iii) $68,245.22 of previously paid fees associated

with the registration of unsold securities on Registration Statement No. 333-234618 on Form S-3, which was filed by the registrant on November 12, 2019 and subsequently withdrawn

on August 10, 2020, will be used to offset the fees that are due hereunder.

Filed pursuant to Rule 424(b)(3)

Registration No. 333-243708

PROSPECTUS SUPPLEMENT

(to prospectus dated August 10, 2020)

Match Group, Inc.

Common Stock

This prospectus supplement relates to the offer and sale, from time to time, of up to 32,993,518 shares of Match Group, Inc.

("Match Group") Common Stock, par value $0.001 ("Match Group Common Stock"), by persons who receive such

shares upon exchange of the 0.875% Exchangeable Senior Notes due 2022 (the "2022 Notes"), the 0.875% Exchangeable Senior Notes due 2026 (the

"2026 Notes") and the 2.00% Exchangeable Senior Notes due 2030 (the "2030 Notes" and together with the 2022

Notes and the 2026 Notes, the "Notes"). An aggregate of $517.5 million principal amount of 2022 Notes was issued by a wholly-owned subsidiary of

Match Group, Match Group FinanceCo, Inc. ("FinanceCo 1"), in a private transaction that closed on October 2, 2017. An aggregate of

$575.0 million principal amount of 2026 Notes was issued by a wholly-owned subsidiary of Match Group, Match Group FinanceCo 2, Inc. ("FinanceCo

2"), and an aggregate of $575.0 million principal amount of 2030 Notes was issued by a wholly-owned subsidiary of Match Group, Match Group FinanceCo 3, Inc.

("FinanceCo 3"), in private transactions that closed on May 28 and June 3, 2019. The Notes were offered only to (and may be reoffered, sold

or otherwise transferred only to) investors that are both qualified institutional buyers (as defined in Rule 144A under the Securities Act of 1933, as amended (the

"Securities Act")), and qualified purchasers (for purposes of Section 3(c)(7) of the Investment Company Act of 1940, as amended (the

"Investment Company Act")). The Notes have not been, and will not be, registered under the Securities Act or any state securities laws and may not be

offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state laws. The Notes are guaranteed by

Match Group on a senior unsecured basis. Under certain circumstances, the Notes of any series are exchangeable at the option of the noteholders into shares of Match Group Common Stock. The applicable

issuer of the Notes may, at its election, deliver (or cause to be delivered) cash instead of shares of Match Group Common Stock (or a combination thereof) to noteholders upon exchange of their Notes.

Noteholders who receive shares of Match Group Common Stock upon exchange of their Notes (the "Selling Stockholders") may use this prospectus supplement to

resell, from time to time, such shares, so long as they satisfy certain conditions set forth in the applicable registration rights agreement between us, the applicable issuer and the applicable

Selling Stockholder (collectively, the "Registration Rights Agreements").

If

one or more Selling Stockholders satisfy certain conditions set forth in the applicable Registration Rights Agreement, then in accordance with the terms of such Registration Rights

Agreement, Match Group will file a prospectus supplement or a post-effective amendment naming such Selling Stockholder(s) and stating the number of shares of Match Group Common Stock to be

offered and sold by such Selling Stockholder(s). The registration of the shares of Match Group Common Stock covered by this prospectus supplement does not necessarily mean that: (i) any

noteholders will elect to exchange their Notes, (ii) upon any exchange of the Notes of any series, the applicable issuer will elect to exchange some or all of the Notes of such series for

shares of Match Group Common Stock rather than cash (or a combination thereof) or (iii) any shares of Match Group Common Stock received upon exchange of the Notes of a series will be ultimately

offered or sold by the Selling Stockholders.

While

neither Match Group nor the applicable issuer of the Notes will receive any of the proceeds from any issuance of shares of Match Group Common Stock to the Selling Stockholders or

from any sale of such shares by the Selling Stockholders, Match Group has agreed to pay certain expenses relating to the registration of such shares. See "Selling Stockholders" and "Plan of

Distribution." The Selling Stockholders may, from time to time, offer and sell the shares held by them directly or indirectly through agents or broker-dealers on terms to be determined at the time of

sale. See "Plan of Distribution."

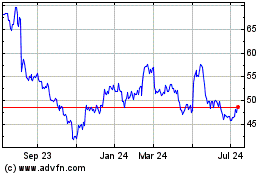

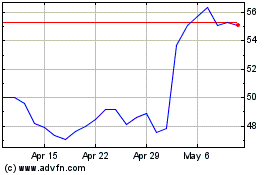

Shares

of Match Group Common Stock are traded on the Nasdaq Global Select Market, or NASDAQ, under the ticker symbol "MTCH." On August 7, 2020, the last reported sales price of

shares of Match Group Common Stock on the NASDAQ was $115.88 per share.

Investing in Match Group Common Stock involves risks. You should carefully read and consider the risks described in "Risk

Factors" on page S-2 of this prospectus supplement and as incorporated by reference herein before investing in Match Group Common Stock.

Neither the Securities and Exchange Commission (the "SEC") nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal

offense.

The

date of this prospectus supplement is August 10, 2020.

Table of Contents

TABLE OF CONTENTS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document contains two parts. The first part consists of this prospectus supplement, which describes the specific terms of the offering of

Match Group Common Stock. The second part, the accompanying prospectus which is dated August 10, 2020, provides more general information, some of which may not apply to the offering of Match

Group Common Stock. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

Before

purchasing any shares of Match Group Common Stock, you should carefully read both this prospectus supplement and the accompanying prospectus, together with the additional

information described under the heading "Where You Can Find More Information" in the accompanying prospectus.

S-1

Table of Contents

RISK FACTORS

Investing in Match Group Common Stock involves risk. Before you invest in Match Group Common Stock, you should carefully consider all of the

risk factors incorporated by reference in this prospectus supplement, including the risk factors set forth in our

Annual Report on Form 10-K for the year ended December 31,

2019, our Quarterly Report on Form 10-Q for the quarter ended

March 31, 2020 and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. You should also carefully consider all of the other information

included or incorporated by reference in this prospectus supplement. The occurrence of any of these risks could materially and adversely affect our business, financial condition, liquidity, cash

flows, results of operations, prospects, and our ability to make or sustain distributions to our stockholders, which could result in a partial or complete loss of your investment in Match Group Common

Stock. Some statements in this prospectus supplement constitute forward-looking statements. See "Cautionary Statement Regarding Forward-Looking Statements" in the accompanying prospectus.

S-2

Table of Contents

USE OF PROCEEDS

Neither Match Group nor the applicable issuer of the Notes will receive any of the proceeds from any issuance of shares of Match Group Common

Stock to the Selling Stockholders or from any sale of such shares by the Selling Stockholders.

The

Selling Stockholders will pay any underwriting fees, discounts or commissions attributable to the sale of the shares registered under this prospectus supplement, or any fees and

expenses of any broker-dealer or other financial intermediary engaged by any Selling Stockholder. Match Group will bear all other costs, fees and expenses incurred in connection with the registration

of the shares covered by this prospectus supplement. See "Selling Stockholders" and "Plan of Distribution."

S-3

Table of Contents

SELLING STOCKHOLDERS

The Notes were originally sold by the initial purchasers of the Notes in transactions exempt from the registration requirements of the

Securities Act to persons reasonably believed by such initial purchasers to be both qualified institutional buyers (as defined in Rule 144A under the Securities Act) and qualified purchasers

(for purposes of Section 3(c)(7) of the Investment Company Act). Under certain circumstances, Match Group may issue shares of Match Group Common Stock upon the exchange of the Notes of any

series. In such circumstances, the Selling Stockholders may use this prospectus supplement to resell, from time to time, the shares of Match Group Common Stock received upon the exchange of the Notes

of the relevant series.

If

one or more Selling Stockholders satisfy certain conditions set forth in the applicable Registration Rights Agreement, then in accordance with the terms of the applicable Registration

Rights Agreement, Match Group will file a further prospectus supplement naming such Selling Stockholders and stating the number of shares of Match Group Common Stock offered by such Selling

Stockholders.

Information

about certain Selling Stockholders is set forth herein, and information about additional Selling Stockholders (if any) will be set forth in a further prospectus supplement or

in filings that Match Group makes with the SEC under the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), incorporated by reference in this prospectus supplement. Selling

Stockholders, including their transferees, pledgees or donees or their successors, may, from time to time, offer and sell pursuant to this prospectus supplement any or all of the shares of Match Group

Common Stock that Match Group may issue to such Selling Stockholder upon the exchange of the Notes of any series.

Based

upon information provided by the Selling Stockholders, except to the extent provided in the footnotes below, none of the Selling Stockholders nor any of their affiliates, officers,

directors or principal equity holders, has held any positions or office (or has had any material relationship) with Match Group within the three years prior to the date they furnished such

information.

To

the extent any of the Selling Stockholders identified below are broker-dealers, they may be deemed to be, under interpretations of the staff of the SEC, "underwriters" within the

meaning of the Securities Act. Unless otherwise indicated in the footnotes below, Match Group believes that the persons and entities named in the tables below have sole voting and investment power

with respect to all shares of Match Group Common Stock listed as beneficially owned by them.

The

Selling Stockholders may offer and sell all, some or none of the shares of Match Group Common Stock that Match Group may issue upon the exchange of the Notes of any series. Because

the Selling Stockholders may offer all or some portion of such shares of Match Group Common Stock, Match Group cannot estimate the number of shares of Match Group Common Stock that will be held by the

Selling Stockholders upon the termination of any of these sales. In addition, the Selling Stockholders identified below may have sold, transferred or otherwise disposed of all or a portion of their

Notes since the date on which they provided the information regarding their Notes in transactions exempt from the registration requirements of the Securities Act. This information is based on

information provided by or on behalf of the Selling Stockholders. The number of shares of Match Group Common Stock owned by the Selling Stockholders (or any of their future transferees) assumes that

they do not beneficially own any shares of Match Group Common Stock other than the Match Group Common Stock that Match Group may issue to them upon the exchange of the Notes of the relevant series.

Percentage ownership information in the following tables is based on 260,016,024 shares of Match Group Common Stock outstanding on July 31, 2020.

S-4

Table of Contents

The 2022 Notes

The following table sets forth information, as of January 22, 2018 with respect to the Selling Stockholders and the number of shares of

Match Group Common Stock that would become beneficially owned by each Selling Stockholder, should Match Group issue the maximum number of shares of Match Group Common Stock to such Selling Stockholder

upon exchange of the 2022 Notes, that may be offered pursuant to this prospectus supplement. Accordingly, the number of shares of Match Group Common Stock issuable upon the exchange of the 2022 Notes

shown in the following table assumes exchange of the full amount of 2022 Notes held by each Selling Stockholder at the maximum exchange rate of 30.1135 shares of Match Group Common Stock per $1,000

principal amount of 2022 Notes and a cash payment in lieu of any fractional shares. This exchange rate is subject to adjustment upon the occurrence of certain events. Accordingly, the number of shares

of Match Group Common Stock issued upon the exchange of the 2022 Notes may increase or decrease from time to time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

Exchange of

Outstanding

2022 Notes(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following Exchange

|

|

|

|

|

|

|

|

|

|

Share of

Match Group

Common Stock

Beneficially

Owned Prior

to Exchange

|

|

|

|

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

1290 Convertible Securities Fund-Palisade Capital(5)

|

|

|

—

|

|

|

2,076

|

|

|

2,076

|

|

*

|

|

|

2,076

|

|

|

—

|

|

|

—

|

|

|

1290 VT Convertible Securities Fund-Palisade Capital(5)

|

|

|

—

|

|

|

1,114

|

|

|

1,114

|

|

*

|

|

|

1,114

|

|

|

—

|

|

|

—

|

|

|

Allianz Global Investors US LLC(6)

|

|

|

4,400

|

|

|

2,492,949

|

|

|

2,497,349

|

|

*

|

|

|

2,492,949

|

|

|

4,400

|

|

|

*

|

|

|

Associated British Foods Pension Trustees Limited(7)

|

|

|

—

|

|

|

13,309

|

|

|

13,309

|

|

*

|

|

|

13,309

|

|

|

—

|

|

|

—

|

|

|

Bancroft Fund Ltd.(8)

|

|

|

—

|

|

|

14,665

|

|

|

14,665

|

|

*

|

|

|

14,665

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible and High Income Fund(9)

|

|

|

—

|

|

|

111,056

|

|

|

111,056

|

|

*

|

|

|

111,056

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible Fund(9)

|

|

|

—

|

|

|

89,797

|

|

|

89,797

|

|

*

|

|

|

89,797

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible Opportunities and Income Fund(9)

|

|

|

—

|

|

|

98,017

|

|

|

98,017

|

|

*

|

|

|

98,017

|

|

|

—

|

|

|

—

|

|

|

Calamos Dynamic Convertible & Income Fund(9)

|

|

|

—

|

|

|

89,797

|

|

|

89,797

|

|

*

|

|

|

89,797

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Convertible Fund Calamos Investment Trust(9)

|

|

|

—

|

|

|

7,528

|

|

|

7,528

|

|

*

|

|

|

7,528

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Dynamic Income Fund(9)

|

|

|

—

|

|

|

39,026

|

|

|

39,026

|

|

*

|

|

|

39,026

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Growth & Income Fund(9)

|

|

|

—

|

|

|

16,771

|

|

|

16,771

|

|

*

|

|

|

16,771

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Opportunities Fund LP(7)

|

|

|

—

|

|

|

11,593

|

|

|

11,593

|

|

*

|

|

|

11,593

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Total Return Fund(9)

|

|

|

—

|

|

|

13,129

|

|

|

13,129

|

|

*

|

|

|

13,129

|

|

|

—

|

|

|

—

|

|

|

Calamos Growth and Income Fund(9)

|

|

|

—

|

|

|

150,476

|

|

|

150,476

|

|

*

|

|

|

150,476

|

|

|

—

|

|

|

—

|

|

|

Calamos Market Neutral Income Fund(9)

|

|

|

—

|

|

|

120,451

|

|

|

120,451

|

|

*

|

|

|

120,451

|

|

|

—

|

|

|

—

|

|

|

Calamos Strategic Total Return Fund(9)

|

|

|

—

|

|

|

152,974

|

|

|

152,974

|

|

*

|

|

|

152,974

|

|

|

—

|

|

|

—

|

|

|

CAN 2 LLC Convertible Acct(10)

|

|

|

—

|

|

|

42,157

|

|

|

42,157

|

|

*

|

|

|

42,157

|

|

|

—

|

|

|

—

|

|

S-5

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

Exchange of

Outstanding

2022 Notes(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following Exchange

|

|

|

|

|

|

|

|

|

|

Share of

Match Group

Common Stock

Beneficially

Owned Prior

to Exchange

|

|

|

|

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

CGF PLC Calamos Global Convertible Fund(7)

|

|

|

—

|

|

|

12,042

|

|

|

12,042

|

|

*

|

|

|

12,042

|

|

|

—

|

|

|

—

|

|

|

Dow Retirement Group Trust(11)

|

|

|

—

|

|

|

59,624

|

|

|

59,624

|

|

*

|

|

|

59,624

|

|

|

—

|

|

|

—

|

|

|

Eaton Vance Oaktree Diversified Credit NextShares(11)

|

|

|

—

|

|

|

1,204

|

|

|

1,204

|

|

*

|

|

|

1,204

|

|

|

—

|

|

|

—

|

|

|

Ellsworth Growth and Income Fund Ltd.(8)

|

|

|

—

|

|

|

15,114

|

|

|

15,114

|

|

*

|

|

|

15,114

|

|

|

—

|

|

|

—

|

|

|

FCA US LLC Master Retirement Trust(11)

|

|

|

—

|

|

|

65,346

|

|

|

65,346

|

|

*

|

|

|

65,346

|

|

|

—

|

|

|

—

|

|

|

FCA US LLC. Master Retirement Trust-Palisade Capital(5)

|

|

|

—

|

|

|

16,201

|

|

|

16,201

|

|

*

|

|

|

16,201

|

|

|

—

|

|

|

—

|

|

|

First Trust Convertible Securities(12)

|

|

|

—

|

|

|

14,000

|

|

|

14,000

|

|

*

|

|

|

14,000

|

|

|

—

|

|

|

—

|

|

|

FPL Group Employee Pension Plan-Palisade Capital(5)

|

|

|

—

|

|

|

15,747

|

|

|

15,747

|

|

*

|

|

|

15,747

|

|

|

—

|

|

|

—

|

|

|

Global Opportunities Trust Calamos Advisors LLC Master Group Trust(7)

|

|

|

—

|

|

|

7,528

|

|

|

7,528

|

|

*

|

|

|

7,528

|

|

|

—

|

|

|

—

|

|

|

Growth Fixed Income Sector Trust(11)

|

|

|

—

|

|

|

6,324

|

|

|

6,324

|

|

*

|

|

|

6,324

|

|

|

—

|

|

|

—

|

|

|

Incarnate Word Charitable Trust(11)

|

|

|

—

|

|

|

11,444

|

|

|

11,444

|

|

*

|

|

|

11,444

|

|

|

—

|

|

|

—

|

|

|

Jefferies LLC(13)

|

|

|

—

|

|

|

36,138

|

|

|

36,138

|

|

*

|

|

|

36,138

|

|

|

—

|

|

|

—

|

|

|

JNL-Nicholas Convert Arb Fund(10)

|

|

|

—

|

|

|

65,494

|

|

|

65,494

|

|

*

|

|

|

65,494

|

|

|

—

|

|

|

—

|

|

|

LGT Select Funds-LGT Select Convertibles(11)

|

|

|

—

|

|

|

34,027

|

|

|

34,027

|

|

*

|

|

|

34,027

|

|

|

—

|

|

|

—

|

|

|

Mackay Shields LLC(14)

|

|

|

—

|

|

|

873,171

|

|

|

873,171

|

|

*

|

|

|

873,171

|

|

|

—

|

|

|

—

|

|

|

National Railroad Retirement Investment Trust(11)

|

|

|

—

|

|

|

129,038

|

|

|

129,038

|

|

*

|

|

|

129,038

|

|

|

—

|

|

|

—

|

|

|

NIC Convertible Fund LP(10)

|

|

|

—

|

|

|

4,366

|

|

|

4,366

|

|

*

|

|

|

4,366

|

|

|

—

|

|

|

—

|

|

|

Oaktree (Lux.) Funds-Oaktree Global Convertible Bond Fund(11)

|

|

|

—

|

|

|

91,997

|

|

|

91,997

|

|

*

|

|

|

91,997

|

|

|

—

|

|

|

—

|

|

|

Oaktree Global Credit Holdings (Delaware), L.P.(11)

|

|

|

—

|

|

|

5,269

|

|

|

5,269

|

|

*

|

|

|

5,269

|

|

|

—

|

|

|

—

|

|

|

OCM Convertible Trust(11)

|

|

|

—

|

|

|

18,218

|

|

|

18,218

|

|

*

|

|

|

18,218

|

|

|

—

|

|

|

—

|

|

|

Palisade Strategic Master Fund (Cayman), Limited(5)

|

|

|

—

|

|

|

70,255

|

|

|

70,255

|

|

*

|

|

|

70,255

|

|

|

—

|

|

|

—

|

|

|

TETON Convertible Securities Fund(8)

|

|

|

—

|

|

|

1,353

|

|

|

1,353

|

|

*

|

|

|

1,353

|

|

|

—

|

|

|

—

|

|

|

The Claude Marie Dubuis Religious and Charitable Trust(11)

|

|

|

—

|

|

|

8,583

|

|

|

8,583

|

|

*

|

|

|

8,583

|

|

|

—

|

|

|

—

|

|

|

The Congregations of the Sisters of Charity of the Incarnate Word (Houston, Texas)(11)

|

|

|

—

|

|

|

27,101

|

|

|

27,101

|

|

*

|

|

|

27,101

|

|

|

—

|

|

|

—

|

|

|

The Gabelli Convertible and Income Securities Fund Inc.(8)

|

|

|

—

|

|

|

6,504

|

|

|

6,504

|

|

*

|

|

|

6,504

|

|

|

—

|

|

|

—

|

|

|

UI-E(11)

|

|

|

—

|

|

|

58,873

|

|

|

58,873

|

|

*

|

|

|

58,873

|

|

|

—

|

|

|

—

|

|

S-6

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

Exchange of

Outstanding

2022 Notes(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following Exchange

|

|

|

|

|

|

|

|

|

|

Share of

Match Group

Common Stock

Beneficially

Owned Prior

to Exchange

|

|

|

|

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

Vanguard Convertible Securities Fund(11)

|

|

|

—

|

|

|

460,738

|

|

|

460,738

|

|

*

|

|

|

460,738

|

|

|

—

|

|

|

—

|

|

|

Virginia Retirement System(11)

|

|

|

—

|

|

|

307,006

|

|

|

307,006

|

|

*

|

|

|

307,006

|

|

|

—

|

|

|

—

|

|

-

*

-

Less

than one percent of the shares of Match Group Common Stock outstanding on July 31, 2020.

-

(1)

-

Additional

Selling Stockholders not named in this prospectus supplement will not be able to use this prospectus supplement for resales until they are named in the

selling stockholders table by way of a further prospectus supplement. Transferees, successors and donees of identified Selling Stockholders will not be able to use this prospectus supplement for

resales until they are named in the selling stockholders table by way of a further prospectus supplement. If required, Match Group will add transferees, successors and donees by way of a further

prospectus supplement in instances where the transferee, successor or donee has acquired its shares from Selling Stockholders named in this prospectus supplement after the date of this prospectus

supplement.

-

(2)

-

The

maximum aggregate number of shares of Match Group Common Stock issuable upon the exchange of the 2022 Notes that may be sold under this prospectus supplement is

15,583,736 (based on an assumed maximum exchange rate of 30.1135 Match Group Common Stock shares per $1,000 principal amount of 2022 Notes). This number does not take into account any shares of Match

Group Common Stock issued upon the exchange of the 2026 Notes or the 2030 Notes.

-

(3)

-

Calculated

based on Rule 13d-3(d)(1)(i) under the Exchange Act using 260,016,024 shares of Match Group Common Stock outstanding on July 31, 2020. In

calculating this percentage for a particular holder, Match Group treated as outstanding the maximum number of shares of Match Group Common Stock held and/or received in exchange for 2022 Notes by that

particular holder and excluded all shares of Match Group Common Stock held and/or received in exchange for 2022 Notes by any other holder.

-

(4)

-

Assumes

that all shares of Match Group Common Stock issued in exchange for 2022 Notes have been sold by the Selling Stockholders.

-

(5)

-

Selling

Stockholder is an investment company, or a subsidiary of an investment company, registered under the Investment Company Act and is required to file, or is a

wholly-owned subsidiary of a company that is required to file, periodic and other reports with the SEC pursuant to Section 13(a) or Section 15(d) of the Exchange Act. Dennison "Dan" T.

Veru, Chief Investment Officer of Palisade Capital Management, LLC., is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(6)

-

Selling

Stockholder is an affiliate of a limited purpose registered broker-dealer, and is an investment company, or a subsidiary of an investment company, registered

under the Investment Company Act. Allianz Global Investors US LLC ("Allianz"), an investment adviser that is registered under the Investment

Advisers Act of 1940, furnishes investment advice to and manages onshore and offshore investment funds and separate managed accounts (such investment funds and accounts, the

"Allianz Funds"). In its role as investment adviser, or manager, Allianz possesses voting and/or investment power over the securities listed above that

are owned by the Allianz Funds. All securities so listed are owned by the applicable Allianz Fund. Allianz disclaims beneficial ownership of such securities.

-

(7)

-

John

P. Calamos, Sr., President, Chairman, and Global CIO of the advisor, Calamos Advisors LLC is the natural person that exercises sole or shared voting or

dispositive power over the securities listed.

-

(8)

-

Selling

Stockholder is an investment company, or a subsidiary of an investment company, registered under the Investment Company Act and is required to file, or is a

wholly-owned subsidiary of a company that is required to file, periodic and other reports with the SEC pursuant to Section 13(a) or Section 15(d) of the Exchange Act. Gabelli

Funds, LLC exercises sole or shared voting or dispositive power over the securities listed.

S-7

Table of Contents

-

(9)

-

Selling

Stockholder is an investment company, or a subsidiary of an investment company, registered under the Investment Company Act. John P. Calamos, Sr., President,

Chairman, and Global CIO of the advisor, Calamos Advisors LLC is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(10)

-

Nicholas

Investment Partners LP exercises sole or shared voting or dispositive power over the securities listed.

-

(11)

-

Oaktree

Capital Management L.P. ("Oaktree") is the investment manager for the Selling Stockholder. Oaktree is

an investment company, or a subsidiary of an investment company, registered under the Investment Company Act and is required to file, or is a wholly-owned subsidiary of a company that is required to

file, periodic and other reports with the SEC pursuant to Section 13(a) or Section 15(d) of the Exchange Act. Oaktree has an affiliate that is a broker dealer, OCM

Investments, LLC ("OCM"). Oaktree is the majority owner of OCM.

-

(12)

-

Michael

Opre exercises sole or shared voting or dispositive power over the securities listed.

-

(13)

-

Selling

Stockholder is a broker-dealer, registered pursuant to Section 15 of the Exchange Act, is an investment company, or a subsidiary of an investment

company, registered under the Investment Company Act and is required to file, or is a wholly-owned subsidiary of a company that is required to file, periodic and other reports with the SEC pursuant to

Section 13(a) or Section 15(d) of the Exchange Act. Leucadia National exercises sole or shared voting or dispositive power over the securities listed.

-

(14)

-

The

securities listed are owned by a number of clients (including one or more investment companies registered under the Investment Company Act) for whom MacKay

Shields LLC ("MacKay") is the discretionary investment advisor or sub-advisor. To the best of MacKay's knowledge, its clients who own these

securities are not the beneficial or registered owner of any other securities of Match Group. To the best of MacKay's knowledge, it and its officers have not held any position or had any material

relationship with Match Group. MacKay is an indirect wholly-owned subsidiary of New York Life Insurance Company, an extensive organization that provides insurance and other financial products to a

wide range of clients and has extensive activities, and as a result MacKay is unable to respond as to its affiliates. MacKay, Mainstay Convertible Fund and Mainstay VP Convertible Portfolio are

affiliated with the registered broker dealers, NYLIFE Securities and NYLIFE Distributors LLC.

2026 Notes

The following table sets forth information, as of November 8, 2019, with respect to the Selling Stockholders and the number of shares of

Match Group Common Stock that would become beneficially owned by each Selling Stockholder, should Match Group issue the maximum number of shares of Match Group Common Stock to such Selling Stockholder

upon exchange of the 2026 Notes, that may be offered pursuant to this prospectus supplement. Accordingly, the number of shares of Match Group Common Stock issuable upon the exchange of the 2026 Notes

shown in the following table assumes exchange of the full amount of 2026 Notes held by each Selling Stockholder at the maximum exchange rate of 15.1389 shares of Match Group Common Stock per $1,000

principal amount of 2026 Notes and a cash payment in lieu of any fractional shares. This exchange rate is subject to adjustment upon the occurrence of certain events. Accordingly, the number of shares

of Match Group Common Stock issued upon the exchange of the 2026 Notes may increase or decrease from time to time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

the Exchange

of Outstanding

2026 Notes(2)

|

|

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following the Exchange

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially

Owned Prior to

the Exchange

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

Funds advised by Capital Research and Management Company(19)

|

|

|

—

|

|

|

76,160

|

|

|

76,160

|

|

*

|

|

|

76,160

|

|

|

—

|

|

|

—

|

|

|

Arkansas Public Employees Retirement System(17)

|

|

|

—

|

|

|

58,358

|

|

|

58,358

|

|

*

|

|

|

58,358

|

|

|

—

|

|

|

—

|

|

S-8

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

the Exchange

of Outstanding

2026 Notes(2)

|

|

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following the Exchange

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially

Owned Prior to

the Exchange

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

Calamos Growth and Income Fund(8)(12)

|

|

|

—

|

|

|

45,416

|

|

|

45,416

|

|

*

|

|

|

45,416

|

|

|

—

|

|

|

—

|

|

|

Calamos Strategic Total Return Fund(8)(12)(13)

|

|

|

—

|

|

|

45,416

|

|

|

45,416

|

|

*

|

|

|

45,416

|

|

|

—

|

|

|

—

|

|

|

CAN 2 LLC Convertible(5)

|

|

|

—

|

|

|

36,560

|

|

|

36,560

|

|

*

|

|

|

36,560

|

|

|

—

|

|

|

—

|

|

|

Chesapeake Employers' Insurance Company(16)

|

|

|

—

|

|

|

17,712

|

|

|

17,712

|

|

*

|

|

|

17,712

|

|

|

—

|

|

|

—

|

|

|

Cipav Lazard Convertibles Globales(6)

|

|

|

—

|

|

|

30,277

|

|

|

30,277

|

|

*

|

|

|

30,277

|

|

|

—

|

|

|

—

|

|

|

Citigroup Pension Plan(16)

|

|

|

—

|

|

|

7,355

|

|

|

7,355

|

|

*

|

|

|

7,355

|

|

|

—

|

|

|

—

|

|

|

City of Boca Raton General Employees' Pension Plan(17)

|

|

|

—

|

|

|

1,149

|

|

|

1,149

|

|

*

|

|

|

1,149

|

|

|

—

|

|

|

—

|

|

|

City of Pensacola Firefighters' Relief and Pension Plan(17)

|

|

|

—

|

|

|

771

|

|

|

771

|

|

*

|

|

|

771

|

|

|

—

|

|

|

—

|

|

|

City of Pensacola General Pension Retirement Plan(17)

|

|

|

—

|

|

|

664

|

|

|

664

|

|

*

|

|

|

664

|

|

|

—

|

|

|

—

|

|

|

Fidelity Convertible Securities Investment Trust(10)(11)

|

|

|

—

|

|

|

28,309

|

|

|

28,309

|

|

*

|

|

|

28,309

|

|

|

—

|

|

|

—

|

|

|

Fidelity Financial Trust: Fidelity Convertible Securities Fund(10)(18)

|

|

|

—

|

|

|

74,482

|

|

|

74,482

|

|

*

|

|

|

74,482

|

|

|

—

|

|

|

—

|

|

|

Fidelity Salem Street Trust: Fidelity Strategic Dividend & Income Fund(8)(10)(18)

|

|

|

—

|

|

|

46,021

|

|

|

46,021

|

|

*

|

|

|

46,021

|

|

|

—

|

|

|

—

|

|

|

First Trust Convertible Securities(17)

|

|

|

—

|

|

|

36,937

|

|

|

36,937

|

|

*

|

|

|

36,937

|

|

|

—

|

|

|

—

|

|

|

Florida Baptist Foundation(17)

|

|

|

—

|

|

|

377

|

|

|

377

|

|

*

|

|

|

377

|

|

|

—

|

|

|

—

|

|

|

General Retirement System of the City of Detroit(17)

|

|

|

—

|

|

|

7,569

|

|

|

7,569

|

|

*

|

|

|

7,569

|

|

|

—

|

|

|

—

|

|

|

Grange Insurance Company(16)

|

|

|

—

|

|

|

6,888

|

|

|

6,888

|

|

*

|

|

|

6,888

|

|

|

—

|

|

|

—

|

|

|

Hawaii Electricians Annuity Fund(16)

|

|

|

—

|

|

|

4,252

|

|

|

4,252

|

|

*

|

|

|

4,252

|

|

|

—

|

|

|

—

|

|

|

Hawaii Electricians Pension(16)

|

|

|

—

|

|

|

2,134

|

|

|

2,134

|

|

*

|

|

|

2,134

|

|

|

—

|

|

|

—

|

|

|

Hawaii Health & Welfare Trust Fund for Operating Engineers(16)

|

|

|

—

|

|

|

242

|

|

|

242

|

|

*

|

|

|

242

|

|

|

—

|

|

|

—

|

|

|

Hawaii Iron Workers Pension Trust Fund(16)

|

|

|

—

|

|

|

1,678

|

|

|

1,678

|

|

*

|

|

|

1,678

|

|

|

—

|

|

|

—

|

|

|

Hawaii Masons' and Plasterers' Annuity Fund(16)

|

|

|

—

|

|

|

135

|

|

|

135

|

|

*

|

|

|

135

|

|

|

—

|

|

|

—

|

|

|

Hawaii Masons' Health & Welfare Fund(16)

|

|

|

—

|

|

|

59

|

|

|

59

|

|

*

|

|

|

59

|

|

|

—

|

|

|

—

|

|

|

Hawaii Masons' Pension Fund Investment Grade Convertible Strategy(16)

|

|

|

—

|

|

|

256

|

|

|

256

|

|

*

|

|

|

256

|

|

|

—

|

|

|

—

|

|

|

Hawaii Masons' Pension Fund Convertible Investment Strategy(16)

|

|

|

—

|

|

|

605

|

|

|

605

|

|

*

|

|

|

605

|

|

|

—

|

|

|

—

|

|

|

HI Masons' and Plasterers' Annuity Fund(16)

|

|

|

—

|

|

|

270

|

|

|

270

|

|

*

|

|

|

270

|

|

|

—

|

|

|

—

|

|

|

JNL-Nicholas Convert Arb Fund(5)

|

|

|

—

|

|

|

32,699

|

|

|

32,699

|

|

*

|

|

|

32,699

|

|

|

—

|

|

|

—

|

|

S-9

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

the Exchange

of Outstanding

2026 Notes(2)

|

|

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following the Exchange

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially

Owned Prior to

the Exchange

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

Lazard Convertible Global(7)

|

|

|

—

|

|

|

840,209

|

|

|

840,209

|

|

*

|

|

|

840,209

|

|

|

—

|

|

|

—

|

|

|

NIC Convertible Fund LP(5)

|

|

|

—

|

|

|

3,632

|

|

|

3,632

|

|

*

|

|

|

3,632

|

|

|

—

|

|

|

—

|

|

|

Ohana Holdings, LLC.(17)

|

|

|

—

|

|

|

39,739

|

|

|

39,739

|

|

*

|

|

|

39,739

|

|

|

—

|

|

|

—

|

|

|

Palm Bay Firefighters' Pension Fund(17)

|

|

|

—

|

|

|

726

|

|

|

726

|

|

*

|

|

|

726

|

|

|

—

|

|

|

—

|

|

|

Palm Bay Police Pension Fund(17)

|

|

|

—

|

|

|

754

|

|

|

754

|

|

*

|

|

|

754

|

|

|

—

|

|

|

—

|

|

|

Prisma Fondation suisse d'investissement(9)

|

|

|

—

|

|

|

7,569

|

|

|

7,569

|

|

*

|

|

|

7,569

|

|

|

—

|

|

|

—

|

|

|

Republic of Palau Compact of Free Association (COFA) Trust Fund(16)

|

|

|

—

|

|

|

1,301

|

|

|

1,301

|

|

*

|

|

|

1,301

|

|

|

—

|

|

|

—

|

|

|

Sarasota Police Officers' Pension Fund(17)

|

|

|

—

|

|

|

1,574

|

|

|

1,574

|

|

*

|

|

|

1,574

|

|

|

—

|

|

|

—

|

|

|

St. Lucie County Fire District Firefighters' Pension Trust Fund(17)

|

|

|

—

|

|

|

1,391

|

|

|

1,391

|

|

*

|

|

|

1,391

|

|

|

—

|

|

|

—

|

|

|

The Omidyar Network Fund, Inc.(17)

|

|

|

—

|

|

|

8,099

|

|

|

8,099

|

|

*

|

|

|

8,099

|

|

|

—

|

|

|

—

|

|

|

Thrivent Financial for Lutherans(10)(15)

|

|

|

—

|

|

|

45,416

|

|

|

45,416

|

|

*

|

|

|

45,416

|

|

|

—

|

|

|

—

|

|

|

Virginia Retirement System(14)

|

|

|

—

|

|

|

31,035

|

|

|

31,035

|

|

*

|

|

|

31,035

|

|

|

—

|

|

|

—

|

|

|

Zazove Convertible Securities Fund, Inc.(14)

|

|

|

—

|

|

|

11,354

|

|

|

11,354

|

|

*

|

|

|

11,354

|

|

|

—

|

|

|

—

|

|

-

*

-

Less

than one percent of the shares of Match Group Common Stock outstanding on July 31, 2020.

-

(1)

-

Additional

Selling Stockholders not named in this prospectus supplement will not be able to use this prospectus supplement for resales until they are named in the

Selling Stockholders table by a further prospectus supplement. Transferees, successors and donees of identified Selling Stockholders will not be able to use this prospectus supplement for resales

until they are named in the Selling Stockholders table by a further prospectus supplement. If required, Match Group will add transferees, successors and donees by a further prospectus supplement in

instances where the transferee, successor or donee has acquired its shares from Selling Stockholders named in this prospectus supplement after the date of this prospectus supplement.

-

(2)

-

The

maximum aggregate number of shares of Match Group Common Stock issuable upon the exchange of the 2026 Notes that may be sold under this prospectus supplement is

8,704,891 (based on an assumed maximum exchange rate of 15.1389 shares of Match Group Common Stock per $1,000 principal amount of 2026 Notes). This number does not take into account any shares of

Match Group Common Stock issued upon the exchange of the 2022 Notes or the 2030 Notes.

-

(3)

-

Calculated

based on Rule 13d-3(d)(1)(i) under the Exchange Act using 260,016,024 shares of Match Group Common Stock outstanding on July 31, 2020. In

calculating this percentage for a particular holder, Match Group treated as outstanding the maximum number of shares of Match Group Common Stock held and/or received in exchange for 2026 Notes by that

particular holder and excluded all shares of Match Group Common Stock held and/or received in exchange for 2026 Notes by any other holder.

-

(4)

-

Assumes

that all of the shares of Match Group Common Stock issued in exchange for the 2026 Notes have been sold by the Selling Stockholders.

-

(5)

-

Nicholas

Investment Partners LP exercises sole or shared voting or dispositive power over the securities listed. John Wylie is the natural person that

exercises sole or shared voting or dispositive power over the securities listed.

S-10

Table of Contents

-

(6)

-

Francois-Marc

Durand is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(7)

-

Arnaud

Brillois is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(8)

-

Selling

stockholder is an investment company, or a subsidiary of an investment company, registered under the Investment Company Act.

-

(9)

-

Robert

Seiler is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(10)

-

Selling

Stockholder is an affiliate of a registered broker-dealer. Selling Stockholder acquired the 2026 Notes (and any Match Group Common Stock issuable upon the

exchange of the 2026 Notes) in the ordinary course of business and at the time Selling Stockholder acquired the 2026 Notes, it had no agreements, understandings or arrangements with any person, either

directly or indirectly, to dispose of the 2026 Notes or Match Group Common Stock.

-

(11)

-

Fidelity

Investments Canada ULC ("FIC") serves as the manager, trustee and portfolio adviser to the Selling

Stockholder. FIC has engaged FMR Co., Inc. ("FMRC") to serve as sub-adviser to the Selling Stockholder and has delegated voting discretion

and investment authority over the securities held by the Selling Stockholder to FMRC. FMRC is a wholly-owned subsidiary of FMR LLC. Abigail P. Johnson is a Director, the Chairman and the Chief

Executive Officer of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of

FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under

which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares

and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to

FMR LLC.

-

(12)

-

To

the best of Selling Stockholder's knowledge, it and its officers have not held any positions or office (or have not had any material relationship with) Match

Group. Morgan Stanley and its affiliates are holders of record of more than 5% of the outstanding securities in certain funds controlled by Calamos Advisors LLC, the investment advisor for

Selling Stockholder. Morgan Stanley is an extensive organization that provides services and financial products to a wide range of clients and has extensive activities, and as a result, Selling

Stockholder is unable to respond as to its affiliates.

-

(13)

-

Selling

Stockholder is required to file, or is a wholly-owned subsidiary of a company that is required to file, periodic and other reports with the SEC pursuant to

Section 13(a) or Section 15(d) of the Exchange Act.

-

(14)

-

Gene

T. Pretti is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(15)

-

Thrivent

Financial for Lutherans ("Thrivent") is a member-owned, not-for-profit fraternal benefit society that offers

insurance products to its over two million members. Thrivent is also registered with the U.S. Securities and Exchange Commission (the "SEC") as an

investment advisor. Thrivent is not a publicly traded entity, nor does Thrivent have any principal owners. Accordingly, Thrivent does not have a natural person with sole or shared voting or

dispositive power over the securities listed.

-

(16)

-

Ravi

Malik is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(17)

-

Michael

Opre is the natural person that exercises sole or shared voting or dispositive power over the securities listed.

-

(18)

-

Selling

stockholder is an investment company, or a subsidiary of an investment company, registered under the Investment Company Act. These accounts are managed by

direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family,

including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of

S-11

Table of Contents

FMR LLC.

The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be

voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting

agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail

P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act

("Fidelity Funds") advised by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC, which power resides with the

Fidelity Funds' Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees.

-

(19)

-

Consists

of 7,279 shares of Match Group Common Stock issuable upon the exchange of outstanding 2026 Notes held of record by American Funds Insurance

Series—High-Income Bond Fund ("VIHIB") and 68,881 shares of Match Group Common Stock issuable upon the exchange of outstanding 2026 Notes held of record by American High-Income Trust

("AHIT," and, together with VIHIB, the "CRMC Holders"). Capital Research and Management Company ("CRMC") is the investment adviser to each of the CRMC Holders. CRMC and/or Capital Fixed Income

Investors ("CFII") may be deemed to be the beneficial owner of all of the securities held by the CRMC Holders; however, each of CRMC and CFII expressly disclaims that it is the beneficial owner of

such securities. Tom Chow, David A. Daigle, Tara L. Torrens and Shannon Ward, as portfolio managers, have voting and investment power over the securities held by each of the CRMC Holders. Each of the

CRMC Holders acquired the securities being registered hereby in the ordinary course of its business. The address of CRMC and each of the CRMC Holders is 333 South Hope Street, 50th Floor, Los

Angeles, California 90071.

2030 Notes

The following table sets forth information, as of November 8, 2019, with respect to the Selling Stockholders and the number of shares of

Match Group Common Stock that would become beneficially owned by each Selling Stockholder, should Match Group issue the maximum number of shares of Match Group Common Stock to such Selling Stockholder

upon exchange of the 2030 Notes, that may be offered pursuant to this prospectus supplement. Accordingly, the number of shares of Match Group Common Stock issuable upon the exchange of the 2030 Notes

shown in the following table assumes exchange of the full amount of 2030 Notes held by each Selling Stockholder at the maximum exchange rate of 15.1389 shares of Match Group Common Stock per $1,000

principal amount of 2030 Notes and a cash payment in lieu of any fractional shares. This exchange rate is subject to adjustment upon the occurrence of certain events. Accordingly, the number of shares

of Match Group Common Stock issued upon the exchange of the 2030 Notes may increase or decrease from time to time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

the Exchange of

Outstanding

2030 Notes(2)

|

|

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following the Exchange

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially

Owned Prior to

the Exchange

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

1290 Convertible Securities Fund—Palisade Capital(5)(10)

|

|

|

—

|

|

|

4,539

|

|

|

4,539

|

|

*

|

|

|

4,539

|

|

|

—

|

|

|

—

|

|

|

1290 VT Convertible Securities Portfolio—Palisade Capital(5)(10)

|

|

|

—

|

|

|

3,131

|

|

|

3,131

|

|

*

|

|

|

3,131

|

|

|

—

|

|

|

—

|

|

|

4 Ever Life Insurance Company(11)

|

|

|

—

|

|

|

4,995

|

|

|

4,995

|

|

*

|

|

|

4,995

|

|

|

—

|

|

|

—

|

|

|

ACCC Insurance Company(11)

|

|

|

—

|

|

|

3,027

|

|

|

3,027

|

|

*

|

|

|

3,027

|

|

|

—

|

|

|

—

|

|

|

American Beacon SSI Alternative Fund(6)

|

|

|

—

|

|

|

17,104

|

|

|

17,104

|

|

*

|

|

|

17,104

|

|

|

—

|

|

|

—

|

|

|

Amerisure Mutual Insurance Company(17)

|

|

|

—

|

|

|

17,408

|

|

|

17,408

|

|

*

|

|

|

17,408

|

|

|

—

|

|

|

—

|

|

S-12

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Number of

Shares of

Match Group

Common Stock

Issuable Upon

the Exchange of

Outstanding

2030 Notes(2)

|

|

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Beneficially Owned

after Resale(4)

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially Owned

Following the Exchange

|

|

|

|

|

|

Shares of

Match Group

Common Stock

Beneficially

Owned Prior to

the Exchange

|

|

|

|

|

|

Number of

Shares of

Match Group

Common Stock

Offered

|

|

Name(1)

|

|

Shares

|

|

Percent(3)

|

|

Shares

|

|

Percent(3)

|

|

|

Aviva Investors(14)

|

|

|

—

|

|

|

319,429

|

|

|

319,429

|

|

*

|

|

|

319,429

|

|

|

—

|

|

|

—

|

|

|

Badger Mutual Insurance Company(11)

|

|

|

—

|

|

|

2,570

|

|

|

2,570

|

|

*

|

|

|

2,570

|

|

|

—

|

|

|

—

|

|

|

BCBS MS Core(11)

|

|

|

—

|

|

|

9,081

|

|

|

9,081

|

|

*

|

|

|

9,081

|

|

|

—

|

|

|

—

|

|

|

Brotherhood Mutual Insurance Company(11)

|

|

|

—

|

|

|

2,117

|

|

|

2,117

|

|

*

|

|

|

2,117

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible and High Income Fund(5)(9)(16)

|

|

|

—

|

|

|

123,382

|

|

|

123,382

|

|

*

|

|

|

123,382

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible Fund(9)(16)

|

|

|

—

|

|

|

117,324

|

|

|

117,324

|

|

*

|

|

|

117,324

|

|

|

—

|

|

|

—

|

|

|

Calamos Convertible Opportunities and Income Fund(5)(9)(16)

|

|

|

—

|

|

|

112,782

|

|

|

112,782

|

|

*

|

|

|

112,782

|

|

|

—

|

|

|

—

|

|

|

Calamos Dynamic Convertible and Income Fund(5)(9)(16)

|

|

|

—

|

|

|

100,674

|

|

|

100,674

|

|

*

|

|

|

100,674

|

|

|

—

|

|

|

—

|

|

|

Calamos Global Convertible Fund(9)(16)

|

|

|

—

|

|

|

10,140

|

|

|

10,140

|

|

*

|

|

|

10,140

|

|