UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 25, 2020

MATCH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-37636

|

26-4278917

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

8750 North Central Expressway, Suite 1400

Dallas, TX 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 576-9352

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☑ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Stock, par value $0.001

|

|

MTCH

|

|

The Nasdaq Stock Market LLC

|

|

|

|

|

|

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 25, 2020, Match Group, Inc. (“Match”) held a special meeting of stockholders (the “Match Special Meeting”) to:

1.consider and vote on a proposal to adopt the Transaction Agreement, dated as of December 19, 2019 and amended as of April 28, 2020 and June 22, 2020 (as so amended, the “Transaction Agreement”), by and among IAC/InterActiveCorp (“IAC”), IAC Holdings, Inc., Valentine Merger Sub LLC and Match (the “Transaction Proposal”);

2.consider and vote on an advisory (non-binding) proposal to, following the separation of the businesses of Match from the remaining businesses of IAC pursuant to the Transaction Agreement (the “Separation”), classify the board of directors of IAC, which will be renamed “Match Group, Inc.” (“New Match”) and to allow New Match stockholders to vote on the election of the directors on a staggered three-year basis, rather than on an annual basis (the “New Match Board Classification Advisory Vote Proposal”);

3.consider and vote on an advisory (non-binding) proposal to, following the Separation, prohibit action by written consent of stockholders of New Match in lieu of a stockholder meeting, subject to any rights of holders of preferred stock (the “Prohibition of Stockholder Written Consent Advisory Vote Proposal”); and

4.approve one or more adjournments or postponements of the Match Special Meeting if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes at the time of the Match Special Meeting to adopt the Transaction Proposal (the “Match Adjournment Proposal”).

There were 74,223,779 shares of Match common stock (entitled to one vote per share) and 209,919,402 shares of Match Class B common stock (entitled to ten votes per share) outstanding and entitled to vote on the record date for the Match Special Meeting.

Pursuant to the terms of the Transaction Agreement, adoption of the Transaction Proposal, which was a condition to the completion of the transactions contemplated by the Transaction Agreement, required both (i) the affirmative vote of holders of at least a majority of the aggregate voting power of all outstanding shares of Match capital stock entitled to vote on the proposal, voting together as a single class, and (ii) the affirmative vote of holders of at least a majority of the aggregate voting power of all outstanding shares of Match capital stock entitled to vote on the proposal (other than any shares of Match capital stock owned, directly or indirectly, by IAC and its subsidiaries, the members of the IAC board of directors, any person that IAC has determined to be an “officer” of IAC within the meaning of Rule 16a-1(f) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the members of the Match board of directors, any person that Match has determined to be an “officer” of Match within the meaning of Rule 16a-1(f) of the Exchange Act, and the immediate family members of any of the foregoing), voting together as a single class (the “Disinterested Stockholders”).

At the Match Special Meeting, shares of Match capital stock constituting a quorum to conduct business were present in person or by proxy, and each of the proposals was approved by the requisite voting power of holders of Match capital stock.

The results for each matter voted on were as follows:

1.The Transaction Proposal:

|

|

|

|

|

|

|

|

|

|

|

Number of Votes FOR

|

Number of Votes AGAINST

|

Number of Votes ABSTAINED

|

|

2,159,609,575

|

32,666

|

19,474

|

2.The New Match Board Classification Advisory Vote Proposal:

|

|

|

|

|

|

|

|

|

|

|

Number of Votes FOR

|

Number of Votes AGAINST

|

Number of Votes ABSTAINED

|

|

2,131,236,967

|

28,379,341

|

45,407

|

3.The Prohibition of Stockholder Written Consent Advisory Vote Proposal:

|

|

|

|

|

|

|

|

|

|

|

Number of Votes FOR

|

Number of Votes AGAINST

|

Number of Votes ABSTAINED

|

|

2,135,713,313

|

23,872,569

|

75,833

|

As of the record date of the Match Special Meeting, the Disinterested Stockholders held 55,211,534 shares of Match common stock. The Transaction Proposal was approved by Disinterested Stockholders holding 41,594,128 shares of Match common stock, which represents approximately 75% of the voting power of Match common stock held by the Disinterested Stockholders.

A vote on the Match Adjournment Proposal was not necessary or appropriate because there were sufficient votes at the time of the Match Special Meeting to approve the Transaction Proposal. No other business properly came before the Match Special Meeting.

Item 8.01. Other Events.

Press Release

On June 25, 2020, Match and IAC issued a joint press release announcing the results of the Match Special Meeting, which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Election Results

Under the terms of the Transaction Agreement, if the separation of IAC and Match is completed, each Match stockholder (other than IAC, Match or their wholly owned subsidiaries) will be entitled to receive, with respect to each share of Match common stock, one share of New Match common stock and, at each such stockholder’s election, either:

• $3.00 in cash (a “Cash Election”); or

•a fraction of a share of New Match common stock with a value of $3.00, calculated based on the Match VWAP (as defined in the Transaction Agreement) (an “Additional Stock Election”).

As of 5:00 p.m. New York City time on June 25, 2020, the election deadline, there were 5,228,526 Cash Elections and 23,236,301 Additional Stock Elections made and not withdrawn in respect of shares of Match common stock. Match stockholders who did not validly make an election are deemed to have made an Additional Stock Election with respect to their shares of Match common stock.

***

No Offer or Solicitation / Additional Information and Where To Find It

This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This communication is being made in respect of a proposed transaction involving IAC, New IAC, and Match. In connection with the proposed transaction, on April 28, 2020, IAC and New IAC filed with the Securities and Exchange Commission (the “SEC”) an amendment to the joint registration statement on Form S-4 filed on February 13, 2020 (the “Form S-4”) that includes a joint proxy statement of IAC and Match. The Form S-4 was declared effective by the SEC on April 30, 2020, and IAC and Match commenced mailing the joint proxy statement/prospectus to stockholders of IAC and stockholders of Match on or about May 4, 2020. Each party will file other documents regarding the proposed transaction with the SEC. IAC, New IAC and Match may file one or more other documents with the SEC. This communication is not a substitute for the joint proxy statement/prospectus or any other document that may be filed with the SEC in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF IAC AND MATCH ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by IAC (when they become available) may be obtained free of charge on IAC’s website at www.iac.com. Copies of documents filed with the SEC by Match (when they become available) may also be obtained free of charge on Match’s website at www.mtch.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

|

|

|

104

|

Inline XBRL for the cover page of this Current Report on Form 8-K

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

MATCH GROUP, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Jared Sine

|

|

|

|

Jared Sine

|

|

|

|

Chief Legal Officer and Secretary

|

Date: June 29, 2020

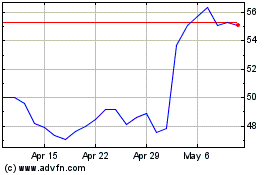

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

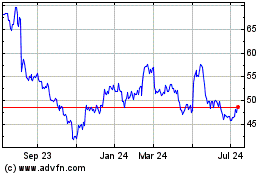

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024