Current Report Filing (8-k)

March 14 2023 - 4:06PM

Edgar (US Regulatory)

0001383701false00013837012023-03-102023-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2023

Histogen Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-36003 |

20-3183915 |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

10655 Sorrento Valley Road, Suite 200, San Diego CA |

|

92121 |

(Address of principal executive offices) |

|

(Zip Code) |

(858) 526-3100

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.0001 par value |

HSTO |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 10, 2023, the Board of Directors (the “Board”) of Histogen Inc. (the “Company”) approved removing the interim title of Steven J. Mento, Ph.D. In connection with Dr. Mento now serving as the President and Chief Executive Officer of the Company, the Board appointed Daniel L. Kisner, M.D. as the Non-Executive Chairman of the Board and eliminated the positions of Executive Chairman, formerly held by Dr. Mento, and Lead Independent Director, formerly held by David H. Crean, Ph.D.

In connection with Dr. Mento’s status as President and Chief Executive Officer, the Company entered into an amendment and restatement of his executive employment agreement (“CEO Agreement”), pursuant to which he is entitled to twelve (12) months’ severance, including target bonus, and reimbursement of COBRA premium reimbursement in the event of a termination without cause (as defined in the CEO Agreement) or termination by Good Reason (as defined in the CEO Agreement), which such severance and COBRA reimbursement is increased to eighteen (18) months in the event of a termination after a change of control event. The CEO Agreement also provides for accelerated vesting of certain of his outstanding options in the event of termination in connection with a change in control.

Dr. Mento was granted stock option to purchase (i) 158,055 shares of the Company’s common stock and (ii) 55,532 shares of the Company’s common stock (collectively the “Mento Option Awards”) under the 2020 Incentive Award Plan (the “Plan”), with the 55,532 shares subject to forfeiture in the event that the shares available pursuant to the Plan are not increased prior to the one year anniversary and vesting of the award by an amount required to be available for issuance for all outstanding stock awards containing this forfeiture condition. The Mento Option Awards will vest as to one-fourth (1/4th) of the shares subject to the options one year after the effective date, and as to one- thirty-sixth (1/36th) of the remaining shares subject to the options monthly thereafter. The exercise price of the Mento Option Awards will be the fair market value of the Company’s common stock on the date of grant. The Mento Option Awards, to the extent vested, shall be exercisable only for a term of ten (10) years, subject to earlier expiration as provided in the Plan. The grant of the Mento Option Awards to Dr. Mento will be subject to the terms and conditions of the Plan and the employee stock option grant notice and option agreement. Dr. Mento simultaneously agreed to cancel certain outstanding stock options.

Also on March 10, 2023, the Company’s Board approved the appointment of Susan A. Knudson as the Company’s Chief Operations Officer and Chief Financial Officer. In connection with Ms. Knudson’s new appointment, the Company entered into an amendment and restatement of her executive employment agreement (the “COO/CFO Agreement”), pursuant to which she is entitled to twelve (12) months’ severance, including target bonus, and reimbursement of COBRA premium reimbursement in the event of a termination without cause (as defined in the COO/CFO Agreement) or termination by Good Reason (as defined in the COO/CFO Agreement). The COO/CFO Agreement also provides for accelerated vesting of certain of her outstanding options, in the event of termination in connection with a change in control.

Ms. Knudson was granted stock option to purchase (i) 79,027 shares of the Company’s common stock and (ii) 27,766 shares of the Company’s common stock (collectively the “Knudson Option Awards”) under the Plan, with the 27,766 shares subject to forfeiture in the event that the shares available pursuant to the Plan are not increased prior to the one year anniversary and vesting of the award by an amount required to be available for issuance for all outstanding stock awards containing this forfeiture condition. The Knudson Option Awards will vest as to one-fourth (1/4th) of the shares subject to the options one year after the effective date, and as to one- thirty-sixth (1/36th) of the remaining shares subject to the options monthly thereafter. The exercise price of the Knudson Option Awards will be the fair market value of the Company’s common stock on the date of grant. The Knudson Option Awards, to the extent vested, shall be exercisable only for a term of ten (10) years, subject to earlier expiration as provided in the Plan. The grant of the Knudson Option Awards to Ms. Knudson will be subject to the terms and conditions of the Plan and the employee stock option grant notice and option agreement. Ms. Knudson simultaneously agreed to cancel certain outstanding stock options.

The foregoing description of the CEO Agreement and COO/CFO Agreement are qualified in their entirety by reference to the form of Company executive employment agreement, which will be filed with the Company’s next periodic filing.

* * *

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Histogen Inc. |

|

|

|

|

Date: March 14, 2023 |

|

By: |

/s/ Susan A. Knudson |

|

|

|

Name: Susan A. Knudson |

|

|

|

Title: Chief Operations Officer and Chief Financial Officer |

2

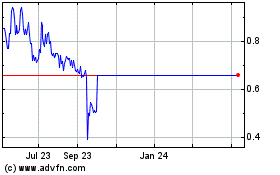

Histogen (NASDAQ:HSTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Histogen (NASDAQ:HSTO)

Historical Stock Chart

From Apr 2023 to Apr 2024