Highway Holdings Limited (Nasdaq: HIHO) today reported results

for its fiscal 2021 second quarter and six-months ended September

30, 2020.

Net sales for the fiscal 2021 second quarter were $2.7 million

compared with $3.2 million a year earlier. Net income for the same

period was $229,000, or $0.06 per diluted share, compared with a

net loss of $94,000, or $0.02 per share, a year earlier.

Net sales for the first half of fiscal 2021 were $4.8 million

compared with $6.0 million a year earlier. Net income for the same

period was $6,000, or $0.00 per diluted share, compared with a net

loss of $196,000, or $0.05 per share, a year ago.

“Results for the quarter and first half of fiscal 2021 reflect

the worldwide impact of the coronavirus pandemic. Nonetheless,

despite unfavorable year-over-year sales comparisons, sales on a

quarterly sequential basis actually increased 30 percent. Net

income performance, though modest, was encouraging, despite the

continued impact of the pandemic on operations and on our

customers,” said Roland Kohl, chairman, president and chief

executive officer.

Kohl noted that results for the quarter benefited from various

subsidies provided by the governments in Hong Kong and Shenzhen due

to the continued impact of COVID-19, as well as from voluntary

reductions of substantially all staff salaries.

Kohl emphasized the company expects to be effected by the

coronavirus for at least another quarter, and potentially for the

rest of the fiscal year -- reflecting the offset of certain

customer business increases by other customers more sharply

experiencing the impact of COVID-19 and reducing order

activity.

“Nonetheless, new business opportunities are continuing and are

encouraging, though the timing can be difficult to gauge and

closing new business opportunities take longer due to the numerous

travel restrictions caused by COVID-19. We remain optimistic about

the future and believe the trade friction between the United States

and China may actually be to our benefit because of our ability to

manufacture in Myanmar,” Kohl said.

Gross profit for the second quarter of fiscal 2021 was $931,000

compared with $845,000 a year ago. Gross profit as a percentage of

sales for the same period was 34.2 percent compared with 26.4

percent a year earlier. Gross profit for the six-month period of

fiscal 2021 was $1.5 million compared with $1.6 million a year ago.

Gross profit as a percentage of sales for the same period was 30.4

percent compared with 26.3 percent a year earlier. “Gross profit

for both the quarter and six months of 2021 is not truly

representative of the company’s expected annualized financial

performance due to the many operational constraints and

extraordinary income from varies governmental agencies,” Kohl

said.

Net gain for the second quarter reflects a currency exchange

loss of $18,000 compared with a $54,000 currency exchange gain for

the same period last year -- mainly due to weakening of RMB. For

the fiscal 2021 six-month period, the company reported a currency

exchange loss of $38,000 compared with a currency exchange gain of

$95,000 a year earlier. Since the company does not engage in

currency exchange rate hedging, Highway Holdings will in the future

continue to realize currency exchange gains and losses due to the

fluctuation of currency exchange rates.

Kohl noted the company’s balance sheet remains strong, with cash

and cash equivalents in excess of $8.6 million, or approximately

$2.2 per diluted share, exceeding all of its short- and long-term

liabilities by approximately $2.4 million.

Current liabilities at September 30, 2020 totaled $4.4 million

and current assets were $12.2 million. Total shareholders’ equity

at September 30, 2020 was $10.5 million, or $2.64 per diluted

share, compared with $10.9 million, or $2.80 per diluted share, at

March 31, 2020.

About Highway Holdings Limited

Highway Holdings is an international manufacturer of a wide

variety quality parts and products for blue chip equipment

manufacturers based primarily in Germany. Highway Holdings’

administrative offices are located in Hong Kong and its

manufacturing facilities are located in Yangon, Myanmar and

Shenzhen, China.

Except for the historical information contained herein, the

matters discussed in this press release are forward-looking

statements which involve risks and uncertainties, including but not

limited to economic, competitive, governmental, political and

technological factors affecting the company’s revenues, operations,

markets, products and prices, and other factors discussed in the

company’s various filings with the Securities and Exchange

Commission, including without limitation, the company’s annual

reports on Form 20-F.

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIES

Consolidated Statement of

Income

(Dollars in thousands, except per

share data)

(Unaudited)

Three Months Ended

Six Months Ended

September 30,

September 30,

2020

2019

2020

2019

Net sales

$2,719

$3,195

$4,776

$6,040

Cost of sales

1,788

2,350

3,324

4,449

Gross profit

931

845

1452

1,591

Selling, general and administrative

expenses

698

1,014

1,428

1,926

Operating income/(loss)

233

(169

)

24

(335

)

Non-operating items

Exchange gain /(loss), net

(18

)

54

(38

)

95

Interest income

4

19

8

29

Gain/(Loss) on disposal of Asset

8

2

9

3

Other income/(expenses)

7

-

8

1

Total non-operating income/ (expenses)

1

75

(13

)

128

Net income (loss) before income tax and

non-controlling interests

234

(94

)

11

(207

)

Income taxes

0

0

0

0

Net income (loss) before non-controlling

interests

234

(94

)

11

(207

)

Less: net gain/(loss) attributable to

non-controlling interests

5

0

5

(11

)

Net income/(loss) attributable to

Highway

Holdings Limited’s shareholders

229

(94

)

6

(196

)

Net Gain/ (loss) per share – Basic

$0.06

($0.02

)

$0.00

($0.05

)

Net Gain/ (loss) per share - Diluted

$0.06

($0.02

)

$0.00

($0.05

)

Weighted average number of shares

outstanding

Basic

3,909

3,904

3,909

3,853

Diluted

3,981

3,904

3,981

3,853

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIES

Consolidated Balance

Sheet

(Dollars in thousands, except per

share data)

Sept 30

Mar 31

2020

2020

Current assets:

Cash and cash equivalents

$8,642

$8,827

Accounts receivable, net of doubtful

accounts

1,800

2,008

Inventories

1,536

2,000

Prepaid expenses and other current

assets

209

388

Total current assets

12,187

13,223

Property, plant and equipment, (net)

911

878

Operating lease right-of-use assets

3,288

3,710

Long-term deposits

263

263

Long-term loan receivable

95

95

Investments in equity method investees

-

-

Total assets

$16,744

$18,169

Current

liabilities:

Accounts payable

$608

$997

Operating lease liabilities, current

853

782

Other liabilities and accrued expenses

1,917

2,294

Income tax payable

588

564

Dividend payable

399

351

Total current liabilities

4,365

4,988

Long term

liabilities :

Operating lease liabilities,

non-current

1,648

2,034

Deferred income taxes

229

229

Total liabilities

6,242

7,251

Shareholders’

equity:

Preferred shares, $0.01 par value

-

-

Common shares, $0.01 par value

40

40

Additional paid-in capital

11,574

11,537

Accumulated deficit

(1,257)

(865)

Accumulated other comprehensive

income/(loss)

129

196

Treasury shares, at cost – Nil shares as

of Sep 30, 2020; and on March 31, 2020

-

-

Non-controlling interest

16

10

Total shareholders’ equity

10,502

10,918

Total liabilities and shareholders’

equity

$16,744

$18,169

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201007005315/en/

Gary S. Maier (310) 471-1288

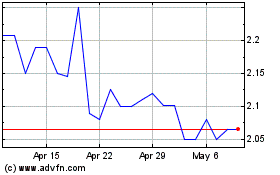

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

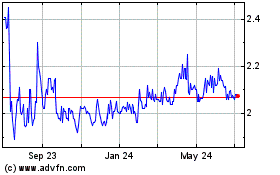

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Apr 2023 to Apr 2024