GAAP Consolidated Net Sales Growth of 14.9%;

Organic Business Net Sales Growth of 13.4% Diluted Loss Per

Share from Continuing Operations of $0.13; Includes Impairment of

$1.43 Adjusted Diluted Earnings per Share from Continuing

Operations Growth of 3.3% to $1.88 Fiscal 2020 Consolidated

Net Sales Growth of 9.2% Fiscal 2020 GAAP Diluted Earnings

per Share from Continuing Operations of $6.02 Fiscal 2020

Adjusted Diluted EPS from Continuing Operations Growth of 15.4% to

$9.30 Fiscal 2020 Free Cash Flow Growth of 45.6%

Designates Mass Market Personal Care Business as Held for

Sale Defers Initiation of Fiscal 2021 Outlook Due to

Uncertainty from COVID-19 Pandemic

Helen of Troy Limited (NASDAQ: HELE), designer, developer

and worldwide marketer of consumer brand-name housewares, health

and home, and beauty products, today reported results for the

three-month period ended February 29, 2020.

Consistent with its strategy of focusing its resources on its

Leadership Brands, during the fourth quarter of fiscal 2020, the

Company committed to a plan to divest certain assets within its

mass market personal care business (Personal Care) and recorded an

after-tax non-cash asset impairment charge of $36.4 million related

to its goodwill and intangible assets. The assets to be divested

include intangible assets, inventory and fixed assets related to

the Company's mass channel liquids, powder and aerosol products

under brands such as Pert, Brut, Sure and Infusium. The Company

expects the divestiture to occur within fiscal 2021. Accordingly,

the Company has classified the identified assets of the disposal

group as held for sale.

In conjunction with this change, the Company now defines Core as

strategic business that it expects to be an ongoing part of its

operations, and Non-Core as business that it expects to divest

within a year of its designation as Non-Core. Previously referred

to as Core business, Organic business now refers to net sales

revenue associated with product lines or brands after the first

twelve months from the date the product line or brand is acquired,

excluding the impact that foreign currency re-measurement had on

reported net sales.

Executive Summary – Fourth Quarter of

Fiscal 2020

- Consolidated net sales revenue increase of 14.9%, including:

- An increase in Leadership Brand net sales of 15.7%

- An increase in online channel net sales of approximately

39%

- Organic business growth of 13.4%

- Core business growth of 16.0%

- GAAP operating loss of $2.7 million, or 0.6% of net sales,

which includes non-cash asset impairment charges of $41.0 million,

acquisition-related expenses of $1.1 million and restructuring

charges of $2.3 million, compared to GAAP operating income of $44.1

million, or 11.5% of net sales, for the same period last year,

which included restructuring charges of $1.0 million

- Non-GAAP adjusted operating income increase of 0.8% to $53.9

million, or 12.2% of net sales, compared to $53.5 million, or 13.9%

of net sales, for the same period last year

- GAAP diluted loss per share from continuing operations of

$0.13, which includes acquisition-related expenses of $0.04 per

share, non-cash asset impairment charges of $1.43 per share, and

restructuring charges of $0.08 per share, compared to GAAP diluted

earnings per share ("EPS") of $1.47 for the same period last year,

which included restructuring charges of $0.04 per share

- Non-GAAP adjusted diluted EPS from continuing operations

increase of 3.3% to $1.88, compared to $1.82 for the same period

last year

Executive Summary - Fiscal

2020

- Consolidated net sales revenue increase of 9.2% including:

- An increase in Leadership Brand net sales of 9.4%

- An increase in online channel net sales of approximately

34%

- Organic business growth of 9.2%

- Core business growth of 9.9%

- GAAP operating income of $178.3 million, or 10.4% of net sales,

which includes non-cash asset impairment charges of $41.0 million,

acquisition-related expenses of $2.5 million, and restructuring

charges of $3.3 million compared to GAAP operating income of $199.4

million, or 12.7% of net sales, for the same period last year,

which included restructuring charges of $3.6 million

- Non-GAAP adjusted operating income increase of 12.6% to $269.3

million, or 15.8% of net sales, compared to $239.2 million, or

15.3% of net sales, for the same period last year

- GAAP diluted EPS from continuing operations of $6.02, which

includes acquisition-related expenses of $0.10 per share, non-cash

asset impairment charges of $1.44 per share, and restructuring

charges of $0.12 per share compared to GAAP diluted EPS of $6.62

for the same period last year, which included restructuring charges

of $0.13 per share

- Non-GAAP adjusted diluted EPS from continuing operations growth

of 15.4% to $9.30 compared to $8.06

- Net cash provided by operating activities from continuing

operations growth of 35.3% to $271.3 million, compared to $200.6

million

- Free cash flow growth of 45.6% to $253.5 million, compared to

$174.2 million

Julien R. Mininberg, Chief Executive Officer, stated: “The

fourth quarter was extremely strong, capping the best year in Helen

of Troy’s history by almost any measure. For the quarter, we

delivered net sales growth of 14.9%. Our Leadership Brands led the

way, growing 15.7%, and we continued to make major gains online,

growing that channel 39% to now represent 24% of total sales. All

three of our business segments grew double digit in the quarter and

we leaned into our flywheel with key new product, marketing and

sustainability programs. On an adjusted basis, EPS for the quarter

grew 3.3% against a strong year-ago comparison. For the full fiscal

year 2020 net sales grew 9.2%, adjusted EPS grew 15.4%, adjusted

operating margin expanded by 50 basis points, and we increased our

free cash flow significantly. We are delighted by the acceleration

of our flywheel in fiscal year 2020 on top of the strength posted

in fiscal 2019 and 2018 and the outstanding first year of Phase II

of Helen of Troy’s Transformation.”

“Our heartfelt thoughts are with people around the globe as the

COVID-19 pandemic has quickly reshaped nearly every aspect of life.

As COVID-19 spread, Helen of Troy moved quickly and decisively to

help ensure the safety and health of our associates around the

world, and the communities where we operate. We were equally

decisive on actions to help improve liquidity and reduce the impact

on cash flow. Even amidst the crisis, we remain focused on our

strategic plans and the long-term interests of our shareholders.

With the resumption of more normalized retail, consumer, and

economic activity unknown, we are now holding cash and cash

equivalents of close to $400 million and have taken difficult but

necessary steps to temporarily reduce our personnel costs and

discretionary spending. We believe acting now, and with an approach

of shared sacrifice, best serves our goal to mitigate a portion of

the business impact of the coronavirus while preserving the

high-performance organization, systems, and brands we have worked

so hard to build and maintain. I could not be prouder of how our

global teams have adapted in order to maintain the health of our

business and support our consumers and customers, while also taking

care of themselves and their families.”

Mr. Mininberg concluded: “As we look to the future, we are

seeing positive sales trends in key Helen of Troy brands after the

initial shock of lock down in early March. Our Braun, Vicks, PUR

and Honeywell products are supporting consumer health at a time of

extreme need, and our OXO products are providing convenience,

comfort and solutions as families spend unprecedented amounts of

time at home. We are working around the clock to meet as much of

the ongoing demand for thermometers, humidifiers, air purifiers and

water purifiers as possible. We are also working with suppliers and

retailers to provide consumers with OXO kitchen, cleaning and

storage products, as well as volumizers in Beauty, where demand is

high in channels that are open. While encouraging, we do expect to

see a net adverse impact to our results for the first quarter and

full year fiscal 2021. Although still very early, we are making

plans to continue selectively investing in the key Phase II

initiatives once the economic situation allows. With our

diversified portfolio of leading, trusted brands, a strong balance

sheet with low net leverage, and a corporate culture driven to rise

to the challenge, we believe Helen of Troy is well positioned to

navigate the current unprecedented situation and emerge

strong.”

Three Months Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

126,069

$

168,140

$

90,634

$

384,843

Organic business (10)

18,911

18,183

14,591

51,685

Impact of foreign currency

(32

)

(469

)

299

(202

)

Acquisition (8)

—

—

6,039

6,039

Change in sales revenue, net

18,879

17,714

20,929

57,522

Fiscal 2020 sales revenue, net

$

144,948

$

185,854

$

111,563

$

442,365

Total net sales revenue growth

15.0

%

10.5

%

23.1

%

14.9

%

Organic business

15.0

%

10.8

%

16.1

%

13.4

%

Impact of foreign currency

—

%

(0.3

)%

0.3

%

(0.1

)%

Acquisition

—

%

—

%

6.7

%

1.6

%

Operating margin (GAAP)

Fiscal 2020

9.6

%

8.8

%

(29.6

)%

(0.6

)%

Fiscal 2019

16.2

%

9.5

%

8.6

%

11.5

%

Adjusted operating margin (non-GAAP)

Fiscal 2020

11.8

%

11.2

%

14.4

%

12.2

%

Fiscal 2019

18.1

%

12.6

%

10.4

%

13.9

%

Three Months Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

126,069

$

168,140

$

90,634

$

384,843

Core business (8)

18,879

17,714

24,792

61,385

Non-core business (Personal Care)

—

—

(3,863

)

(3,863

)

Change in sales revenue, net

18,879

17,714

20,929

57,522

Fiscal 2020 sales revenue, net

$

144,948

$

185,854

$

111,563

$

442,365

Total net sales revenue growth

15.0

%

10.5

%

23.1

%

14.9

%

Core business

15.0

%

10.5

%

27.4

%

16.0

%

Non-core business (Personal Care)

—

%

—

%

(4.3

)%

(1.0

)%

Consolidated Operating Results - Fourth

Quarter Fiscal 2020 Compared to Fourth Quarter Fiscal

2019

- Consolidated net sales revenue increased 14.9% to $442.4

million compared to $384.8 million, driven by an Organic business

increase of $51.7 million, or 13.4%, and growth from the

acquisition of Drybar Products of $6.0 million, or 1.6%. The

Organic business increase primarily reflects growth in both online

and brick and mortar appliance sales in the Beauty segment, higher

sales across core channels in the Housewares segment, and increased

demand driven growth in the Health & Home segment, particularly

in thermometry, related to higher pediatric fever and the impact of

COVID-19 late in the quarter. These factors were partially offset

by a decline in Non-Core business (Personal Care) sales within the

Beauty segment.

- Consolidated gross profit margin increased 2.6 percentage

points to 43.5%, compared to 40.9%. The increase is primarily due

to a more favorable product mix within all three business segments

and a lower mix of shipments made on a direct import basis. These

factors were partially offset by a lower mix of Personal Care sales

in the Beauty segment.

- Consolidated SG&A as a percentage of sales increased by 5.2

percentage points to 34.4% of net sales compared to 29.2%. The

increase is primarily due to higher advertising and new product

development expense, higher royalty expense, an increase in

amortization expense, and higher performance-based annual incentive

compensation expense. These factors were partially offset by lower

share-based compensation expense.

- Consolidated operating loss was $2.7 million, or 0.6% of net

sales, compared to operating income of $44.1 million, or 11.5% of

net sales. The decline in consolidated operating margin is

primarily due to $41.0 million of non-cash asset impairment

charges, higher advertising and new product development expense,

acquisition-related expenses, higher restructuring charges, higher

royalty expense, an increase in amortization expense, and higher

performance-based annual incentive compensation expense. These

factors were partially offset by a more favorable product mix,

lower share-based compensation expense, and increased operating

leverage from sales growth.

- Income tax benefit as a percentage of pre-tax loss was 48.1%,

compared to income tax expense as a percentage of pre-tax income of

7.9% for the same period last year. The year-over-year change is

primarily due to the recognition of a tax benefit from impairment

charges recorded in the fourth quarter of fiscal 2020.

- Loss from continuing operations was $3.2 million, or $0.13 per

diluted share, compared to income from continuing operations of

$37.7 million, or $1.47 per diluted share. Fiscal 2020 includes

after-tax non-cash asset impairment charges, restructuring charges,

and acquisition-related expenses totaling $1.55 per share, compared

to a total of $0.04 per share in after-tax restructuring charges in

the same period last year.

- There was no income or loss from discontinued operations,

compared to a loss of $0.4 million, or $0.02 per diluted share, for

the same period last year.

- Adjusted EBITDA increased 1.2% to $58.4 million compared to

$57.7 million.

On an adjusted basis for the fourth quarters of fiscal 2020 and

2019, excluding asset impairment charges, acquisition-related

expenses, restructuring charges, amortization of intangible assets,

and non-cash share-based compensation, as applicable:

- Adjusted operating income increased $0.4 million, or 0.8%, to

$53.9 million, or 12.2% of net sales, compared to $53.5 million, or

13.9% of net sales. The 1.7 percentage point decrease in adjusted

operating margin primarily reflects higher advertising and new

product development expense, higher performance-based annual

incentive compensation expense, and an increase in royalty expense.

These factors were partially offset by a more favorable product mix

and increased operating leverage from sales growth.

- Adjusted income from continuing operations increased $1.3

million, or 2.7%, to $47.8 million, or $1.88 per diluted share,

compared to $46.6 million, or $1.82 per diluted share. The 3.3%

increase in adjusted diluted EPS from continuing operations was

primarily due to higher adjusted operating income and the impact of

lower weighted average diluted shares outstanding, partially offset

by higher interest expense.

Segment Operating Results - Fourth

Quarter Fiscal 2020 Compared to Fourth Quarter Fiscal

2019

Housewares net sales increased 15.0%, or $18.9 million,

primarily due to point of sale growth with existing domestic brick

and mortar customers, an increase in online sales, and revenue from

new product introductions. These factors were partially offset by

lower club channel sales, a decline in international sales, and

lower closeout channel sales. Operating income decreased 31.5% to

$14.0 million, or 9.6% of segment net sales, compared to $20.4

million, or 16.2% of segment net sales in the same period last

year. The 6.6 percentage point decrease was primarily due to higher

advertising and new product development expense to support

strategic initiatives, higher freight and distribution expense to

support increased retail customer shipments, and higher

restructuring charges. These factors were partially offset by the

impact of a more favorable product mix and increased operating

leverage from sales growth. Adjusted operating income decreased

24.8% to $17.1 million, or 11.8% of segment net sales, compared to

$22.8 million, or 18.1% of segment net sales.

Health & Home net sales increased 10.5%, primarily due to

new product introductions and increased demand, particularly in

thermometry, related to higher pediatric fever and the impact of

COVID-19 toward the end of the fourth quarter. These factors were

partially offset by lower sales due to net distribution changes

year-over-year and the unfavorable impact of net foreign currency

fluctuations of $0.5 million, or 0.3%. Operating income increased

2.4% to $16.3 million, or 8.8% of segment net sales, compared to

$15.9 million, or 9.5% of segment net sales, in the same period

last year. The 0.7 percentage point decrease in operating margin

was primarily due to higher royalty expense and higher new product

development expense. These factors were partially offset by the

margin impact of a more favorable product mix and increased

operating leverage from sales growth. Adjusted operating income

decreased 2.3% to $20.8 million, or 11.2% of segment net sales,

compared to $21.2 million, or 12.6% of segment net sales in the

same period last year.

Beauty net sales increased 23.1%, or $20.9 million, primarily

due to an Organic business increase of 16.1% and 6.7% of growth

from the acquisition of Drybar Products. The Organic business

increase primarily reflects growth in both online and brick and

mortar channel sales in the appliance category. These factors were

partially offset by a decline in Personal Care. Operating loss was

$33.0 million, or 29.6% of segment net sales compared to operating

income of $7.8 million, or 8.6% of segment net sales, in the same

period last year. The operating loss in the fourth quarter of

fiscal 2020 primarily reflects the impact of non-cash asset

impairment charges of $41.0 million, higher amortization expense,

and an increase in advertising and new product development expense.

These factors were partially offset by the margin impact of a more

favorable product mix, increased operating leverage from sales

growth and lower freight expense. Adjusted operating income

increased 69.5% to $16.0 million, or 14.4% of segment net sales,

compared to $9.4 million, or 10.4% of segment net sales in the same

period last year.

Balance Sheet and Cash Flow Highlights

- Fiscal 2020 Compared to Fiscal 2019

- Cash and cash equivalents totaled $24.5 million, compared to

$11.9 million.

- Total short- and long-term debt was $339.3 million, compared to

$320.8 million, a net increase of $18.5 million.

- Accounts receivable turnover for fiscal 2020 was 67.0 days,

compared to 68.3 days for the same period last year.

- Inventory was $256.3 million, compared to $302.3 million.

Inventory turnover for fiscal 2020 was 3.0 times, compared to 3.3

times for the same period last year.

- Net cash provided by operating activities from continuing

operations for fiscal 2020 increased $70.7 million to $271.3

million. The increase was primarily driven by higher cash earnings,

and a decrease in cash used for inventory. These factors were

partially offset by an increase in cash used for receivables.

Subsequent Events

On March 13, 2020, the President of the United States announced

a National Emergency relating to COVID-19. Since then, there has

been widespread infection in the U.S. and abroad, with the

potential for catastrophic impact. As a result of these and other

effects, the Company expects COVID-19 to adversely impact its

business, which could be material. The impact includes the effect

of temporary closures of, and limited hours of operation and

materially lower store traffic at, customer stores. The COVID-19

pandemic is also impacting its third-party manufacturers, most of

which are located in the Far East, principally China. The extent of

the impact of COVID-19 on the business and financial results will

depend largely on future developments, including the duration of

the spread of the COVID-19 outbreak within the U.S. and globally,

the impact on capital and financial markets and the related impact

on consumer confidence and spending. These future developments are

outside of the Company's control, are highly uncertain and cannot

be predicted. If the impact is prolonged, then it can further

increase the difficulty of planning for operations. These and other

potential impacts of the current public health crisis could

therefore materially and adversely affect the business, financial

condition, cash flows and results of operations.

Due to the impacts of COVID-19, the Company is experiencing

favorable demand trends for some of its products, while others are

being adversely impacted due to retail store closures and consumer

uncertainty. At the end of fiscal 2020, the Company began to

experience increased demand for certain products in the Health

& Home segment, particularly thermometers. This trend continued

into the beginning of fiscal 2021 and became more pronounced in

other product categories such as humidification, water purification

and air purification. Additionally, at the beginning of fiscal

2021, the Company began to experience favorable demand trends for

OXO products within the Housewares segment as consumers engage in

pantry stocking, cleaning, nesting and cooking at home. Products

that are more discretionary in nature or more dependent on the

retail brick and mortar channel are generally experiencing

unfavorable demand trends. All products are being adversely

impacted by the effect of temporary closures of, and limited hours

of operation and materially lower store traffic at, customer

stores. The Company is also experiencing supply chain disruptions

with some third-party manufacturers, which is adversely affecting

its ability to meet consumer demand in product categories where it

is strong. Accordingly, the Company expects that the net effect of

COVID-19 will adversely impact its results for the first quarter of

fiscal 2021, as well as the full fiscal 2021, and that impact could

be material. This situation is changing rapidly, and additional

impacts may arise that we are not currently aware of.

On March 13, 2020, the Company entered into a Third Amendment

and Commitment Increase (the "Amendment") to its Amended and

Restated Credit Agreement (as amended, the "Credit Agreement"). The

Amendment extended the maturity of the commitment under the Credit

Agreement from December 7, 2021 to March 13, 2025. Further, the

Amendment increased the unsecured revolving commitment from $1.0

billion to $1.25 billion.

On March 24, 2020, the Company borrowed approximately $200

million under the Credit Agreement as part of a comprehensive

precautionary approach to increase its cash position and maximize

its financial flexibility in light of the volatility in the global

markets resulting from the COVID-19 outbreak. After giving effect

to the borrowing, the remaining amount available for borrowings

under the Credit Agreement was $536.4 million and the Company's

cash and cash equivalents on hand was approximately $393.0 million.

Covenants in the Company's debt agreements can limit the amount of

indebtedness it can incur. The Company may repay amounts borrowed

at any time without penalty.

Fiscal 2021 Business

Update

Due to the evolving COVID-19 pandemic and the related business

uncertainty, the Company is not providing an Outlook for fiscal

2021 at this time. In order to reduce costs and preserve cash flow,

the Company has implemented a number of measures that will remain

in place until there is greater certainty, a reopening of retail

customer brick and mortar stores and improved consumer demand,

which include the following:

- A graduated salary reduction for all associates, including

named executive officers and the other members of the Company’s

executive leadership team;

- A reduction in the cash compensation of the Company's Board of

Directors;

- Suspension of merit increases, promotions and new associate

hiring until further notice;

- The furlough of associates in specific areas directly tied to

sales volume, with assistance to maintain health insurance

coverage, as well as a reduction of external temporary labor and

reduced work hours;

- Reduction or deferral of marketing expense. The Company will

lean into brands with strong current demand and reduce investment

in other key brands without sacrificing brand awareness;

- Limited reduction of investment in new product development and

launches, in anticipation of more normalized economic

activity;

- Elimination of travel expense in the short term, with a

significant reduction planned for the second half of fiscal 2021;

and

- Reduction of consulting fees and capital expenditures for

projects that are not critical.

Conference Call and

Webcast

The Company will conduct a teleconference in conjunction with

today’s earnings release. The teleconference begins at 4:45 p.m.

Eastern Time today, Tuesday, April 28, 2020. Investors and analysts

interested in participating in the call are invited to dial (877)

407-3982 approximately ten minutes prior to the start of the call.

The conference call will also be webcast live at:

http://investor.helenoftroy.com/. A telephone replay of this call

will be available at 7:45 p.m. Eastern Time on April 28, 2020 until

11:59 p.m. Eastern Time on May 5, 2020 and can be accessed by

dialing (844) 512-2921 and entering replay pin number 13700166. A

replay of the webcast will remain available on the website for one

year.

Non-GAAP Financial

Measures

The Company reports and discusses its operating results using

financial measures consistent with accounting principles generally

accepted in the United States of America (“GAAP”). To supplement

its presentation, the Company discloses certain financial measures

that may be considered non-GAAP such as adjusted operating income,

adjusted operating margin, adjusted income from continuing

operations, adjusted diluted earnings per share (“EPS”) from

continuing operations, Core and Non-Core adjusted diluted EPS from

continuing operations, EBITDA, adjusted EBITDA, and free cash flow,

which are presented in accompanying tables to this press release

along with a reconciliation of these financial measures to their

corresponding GAAP-based measures presented in the Company’s

condensed consolidated statements of income and cash flow. All

references to the Company's continuing operations exclude the

Nutritional Supplements segment. For additional information see

Note 1 to the accompanying tables to this Press Release.

About Helen of Troy

Limited

Helen of Troy Limited (NASDAQ: HELE) is a leading global

consumer products company offering creative solutions for its

customers through a strong portfolio of well-recognized and

widely-trusted brands, including OXO, Hydro Flask, Vicks, Braun,

Honeywell, PUR, Hot Tools and Drybar. All trademarks herein belong

to Helen of Troy Limited (or its affiliates) and/or are used under

license from their respective licensors.

For more information about Helen of Troy, please visit

http://investor.helenoftroy.com/

Forward Looking Statements

Certain written and oral statements made by the Company and

subsidiaries of the Company may constitute “forward-looking

statements” as defined under the Private Securities Litigation

Reform Act of 1995. This includes statements made in this press

release. Generally, the words “anticipates”, “believes”, “expects”,

“plans”, “may”, “will”, “should”, “seeks”, “estimates”, “project”,

“predict”, “potential”, “continue”, “intends”, and other similar

words identify forward-looking statements. All statements that

address operating results, events or developments that the Company

expects or anticipates will occur in the future, including

statements related to sales, earnings per share results, and

statements expressing general expectations about future operating

results, are forward-looking statements and are based upon its

current expectations and various assumptions. The Company believes

there is a reasonable basis for these expectations and assumptions,

but there can be no assurance that the Company will realize these

expectations or that these assumptions will prove correct.

Forward-looking statements are subject to risks that could cause

them to differ materially from actual results. Accordingly, the

Company cautions readers not to place undue reliance on

forward-looking statements. The forward-looking statements

contained in this press release should be read in conjunction with,

and are subject to and qualified by, the risks described in the

Company’s Form 10-K for the year ended February 29, 2020, and in

the Company's other filings with the SEC. Investors are urged to

refer to the risk factors referred to above for a description of

these risks. Such risks include, among others, the Company's

ability to manage successfully the demand, supply, and operational

challenges associated with the actual or perceived effects of

COVID-19 and any similar future public health crisis, pandemic or

epidemic, the Company's ability to deliver products to its

customers in a timely manner and according to their fulfillment

standards, the costs of complying with the business demands and

requirements of large sophisticated customers, its dependence on

the strength of retail economies and vulnerabilities to any

prolonged economic downturn, including from the effects of

COVID-19, the Company's relationships with key customers and

licensors, its dependence on sales to several large customers and

the risks associated with any loss or substantial decline in sales

to top customers, expectations regarding any proposed

restructurings, its recent, pending and future acquisitions or

divestitures, including its ability to realize anticipated cost

savings, synergies and other benefits along with its ability to

effectively integrate acquired businesses or separate divested

businesses, circumstances which may contribute to future impairment

of goodwill, intangible or other long-lived assets, the retention

and recruitment of key personnel, the costs, complexity and

challenges of upgrading and managing its global information

systems, the risks associated with cybersecurity and information

security breaches, the risks associated with global legal

developments regarding privacy and data security could result in

changes to its business practices, penalties, increased cost of

operations, or otherwise harm our business, risks associated with

foreign currency exchange rate fluctuations, the risks associated

with accounting for tax positions, tax audits and related disputes

with taxing authorities, the risks of potential changes in laws in

the U.S. or abroad, including tax laws, regulations or treaties,

employment and health insurance laws and regulations, and laws

relating to environmental policy, personal data, financial

regulation, transportation policy and infrastructure policy along

with the costs and complexities of compliance with such laws, its

ability to continue to avoid classification as a controlled foreign

corporation, and legislation enacted in Bermuda and Barbados in

response to the European Union’s review of harmful tax competition

could adversely affect our operations, risks associated with

weather conditions, the duration and severity of the cold and flu

season and other related factors, its dependence on foreign sources

of supply and foreign manufacturing, and associated operational

risks including, but not limited to, long lead times, consistent

local labor availability and capacity, and timely availability of

sufficient shipping carrier capacity, labor and energy on cost of

goods sold and certain operating expenses, the risks associated

with significant tariffs or other restrictions on imports from

China or any retaliatory trade measures taken by China, the

geographic concentration and peak season capacity of certain U.S.

distribution facilities increases its exposure to significant

shipping disruptions and added shipping and storage costs, its

projections of product demand, sales and net income are highly

subjective in nature and future sales and net income could vary in

a material amount from such projections, the risks associated with

the use of trademarks licensed from and to third parties, its

ability to develop and introduce a continuing stream of new

products to meet changing consumer preferences, trade barriers,

exchange controls, expropriations, and other risks associated with

U.S. and foreign operations, the risks to its liquidity as a result

of changes to capital and credit market conditions, limitations

under its financing arrangements and other constraints or events

that impose constraints on its cash resources and ability to

operate its business, the risks associated with product recalls,

product liability, other claims, and related litigation against us,

the risks associated with significant changes in regulations or

product certifications. The Company undertakes no obligation to

publicly update or revise any forward-looking statements as a

result of new information, future events or otherwise.

HELEN OF

TROY LIMITED AND SUBSIDIARIES

Condensed Consolidated

Statements of Income

(Unaudited)

(in thousands, except per

share data)

Three Months Ended Last Day of

February,

2020

2019

Sales revenue, net (8)

$

442,365

100.0

%

$

384,843

100.0

%

Cost of goods sold

249,750

56.5

%

227,313

59.1

%

Gross profit

192,615

43.5

%

157,530

40.9

%

Selling, general and administrative

expense ("SG&A")

152,108

34.4

%

112,457

29.2

%

Asset impairment charges

41,000

9.3

%

—

—

%

Restructuring charges (3)

2,252

0.5

%

977

0.3

%

Operating income

(2,745

)

(0.6

)%

44,096

11.5

%

Nonoperating income, net

81

—

%

165

—

%

Interest expense

(3,414

)

(0.8

)%

(3,306

)

(0.9

)%

Income before income tax

(6,078

)

(1.4

)%

40,955

10.6

%

Income tax expense

(2,923

)

(0.7

)%

3,241

0.8

%

Income (loss) from continuing

operations

(3,155

)

(0.7

)%

37,714

9.8

%

Loss from discontinued operations, net of

tax

—

—

%

(448

)

(0.1

)%

Net income (loss)

$

(3,155

)

(0.7

)%

$

37,266

9.7

%

Earnings (loss) per share - diluted:

Continuing operations

$

(0.13

)

$

1.47

Discontinued operations

—

(0.02

)

Total earnings (loss) per share -

diluted

$

(0.13

)

$

1.45

Weighted average shares of common stock

used in computing diluted earnings (loss) per share

25,175

25,638

Fiscal Year Ended Last Day of

February,

2020

2019

Sales revenue, net (8)

$

1,707,432

100.0

%

$

1,564,151

100.0

%

Cost of goods sold

972,966

57.0

%

923,045

59.0

%

Gross profit

734,466

43.0

%

641,106

41.0

%

SG&A

511,902

30.0

%

438,141

28.0

%

Asset impairment charges

41,000

2.4

%

—

—

%

Restructuring charges (3)

3,313

0.2

%

3,586

0.2

%

Operating income

178,251

10.4

%

199,379

12.7

%

Nonoperating income, net

394

—

%

340

—

%

Interest expense

(12,705

)

(0.7

)%

(11,719

)

(0.7

)%

Income before income tax

165,940

9.7

%

188,000

12.0

%

Income tax expense

13,607

0.8

%

13,776

0.9

%

Income from continuing operations

152,333

8.9

%

174,224

11.1

%

Loss from discontinued operations, net of

tax

—

—

%

(5,679

)

(0.4

)%

Net income

$

152,333

8.9

%

$

168,545

10.8

%

Earnings (loss) per share - diluted:

Continuing operations

$

6.02

$

6.62

Discontinued operations

—

(0.22

)

Total earnings per share - diluted

$

6.02

$

6.41

Weighted average shares of common stock

used in computing diluted earnings per share

25,322

26,303

Condensed Consolidated

Statements of Income and Reconciliation of Non-GAAP Financial

Measures – Adjusted Operating Income, Adjusted Income from

Continuing Operations and Adjusted Diluted Earnings Per Share

(“EPS”) from Continuing Operations (1)

(Unaudited)

(in thousands, except per

share data)

Three Months Ended February

29, 2020

As Reported

(GAAP)

Adjustments

Adjusted

(Non-GAAP)

Sales revenue, net (8)

$

442,365

100.0

%

$

—

$

442,365

100.0

%

Cost of goods sold

249,750

56.5

%

—

249,750

56.5

%

Gross profit

192,615

43.5

%

—

192,615

43.5

%

SG&A

152,108

34.4

%

(8,142

)

(4)

138,709

31.4

%

(4,186

)

(5)

(1,071

)

(9)

Asset impairment charges

41,000

9.3

%

(41,000

)

(7)

—

—

%

Restructuring charges (3)

2,252

0.5

%

(2,252

)

(3)

—

—

%

Operating income

(2,745

)

(0.6

)%

56,651

53,906

12.2

%

Nonoperating income, net

81

—

%

—

81

—

%

Interest expense

(3,414

)

(0.8

)%

—

(3,414

)

(0.8

)%

Income (loss) before income tax

(6,078

)

(1.4

)%

56,651

50,573

11.4

%

Income tax expense

(2,923

)

(0.7

)%

5,676

2,753

0.6

%

Income (loss) from continuing

operations

(3,155

)

(0.7

)%

50,975

47,820

10.8

%

Diluted EPS from continuing operations

$

(0.13

)

$

2.01

$

1.88

Weighted average shares of common stock

used in computing diluted EPS

25,175

25,403

Three Months Ended February

28, 2019

As Reported

(GAAP)

Adjustments

Adjusted

(Non-GAAP)

Sales revenue, net

$

384,843

100.0

%

$

—

$

384,843

100.0

%

Cost of goods sold

227,313

59.1

%

—

227,313

59.1

%

Gross profit

157,530

40.9

%

—

157,530

40.9

%

SG&A

112,457

29.2

%

(3,382

)

(4)

104,051

27.0

%

(5,024

)

(5)

Restructuring charges (3)

977

0.3

%

(977

)

(3)

—

—

%

Operating income

44,096

11.5

%

9,383

53,479

13.9

%

Nonoperating income, net

165

—

%

—

165

—

%

Interest expense

(3,306

)

(0.9

)%

—

(3,306

)

(0.9

)%

Income before income tax

40,955

10.6

%

9,383

50,338

13.1

%

Income tax expense

3,241

0.8

%

540

3,781

1.0

%

Income from continuing operations

37,714

9.8

%

8,843

46,557

12.1

%

Diluted EPS from continuing operations

$

1.47

$

0.35

$

1.82

Weighted average shares of common stock

used in computing diluted EPS

25,638

25,638

Condensed Consolidated

Statements of Income and Reconciliation of Non-GAAP Financial

Measures – Adjusted Operating Income, Adjusted Income from

Continuing Operations and Adjusted Diluted Earnings Per Share

(“EPS”) from Continuing Operations (1)

(Unaudited)

(in thousands, except per

share data)

Fiscal Year Ended February 29,

2020

As Reported

(GAAP)

Adjustments

Adjusted

(Non-GAAP)

Sales revenue, net (8)

$

1,707,432

100.0

%

$

—

$

1,707,432

100.0

%

Cost of goods sold

972,966

57.0

%

—

972,966

57.0

%

Gross profit

734,466

43.0

%

—

734,466

43.0

%

SG&A

511,902

30.0

%

(21,271

)

(4)

465,156

27.2

%

(22,929

)

(5)

(2,546

)

(9)

Asset impairment charges (7)

41,000

2.4

%

(41,000

)

(7)

—

—

%

Restructuring charges (3)

3,313

0.2

%

(3,313

)

(3)

—

—

%

Operating income

178,251

10.4

%

91,059

269,310

15.8

%

Nonoperating income, net

394

—

%

—

394

—

%

Interest expense

(12,705

)

(0.7

)%

—

(12,705

)

(0.7

)%

Income before income tax

165,940

9.7

%

91,059

256,999

15.1

%

Income tax expense

13,607

0.8

%

7,821

21,428

1.3

%

Income from continuing operations

152,333

8.9

%

83,238

235,571

13.8

%

Diluted EPS from continuing operations

$

6.02

$

3.29

$

9.30

Weighted average shares of common stock

used in computing diluted EPS

25,322

25,322

Fiscal Year Ended February 28,

2019

As Reported

(GAAP)

Adjustments

Adjusted

(Non-GAAP)

Sales revenue, net

$

1,564,151

100.0

%

$

—

$

1,564,151

100.0

%

Cost of goods sold

923,045

59.0

%

—

923,045

59.0

%

Gross profit

641,106

41.0

%

—

641,106

41.0

%

SG&A

438,141

28.0

%

(14,204

)

(4)

401,884

25.7

%

(22,053

)

(5)

Restructuring charges (3)

3,586

0.2

%

(3,586

)

(3)

—

—

%

Operating income

199,379

12.7

%

39,843

239,222

15.3

%

Nonoperating income, net

340

—

%

—

340

—

%

Interest expense

(11,719

)

(0.7

)%

—

(11,719

)

(0.7

)%

Income before income tax

188,000

12.0

%

39,843

227,843

14.6

%

Income tax expense

13,776

0.9

%

1,982

15,758

1.0

%

Income from continuing operations

174,224

11.1

%

37,861

212,085

13.6

%

Diluted EPS from continuing operations

$

6.62

$

1.44

$

8.06

Weighted average shares of common stock

used in computing diluted EPS

26,303

26,303

Consolidated and Segment Net

Sales

(Unaudited)

(in thousands)

Three Months Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

126,069

$

168,140

$

90,634

$

384,843

Organic business (10)

18,911

18,183

14,591

51,685

Impact of foreign currency

(32

)

(469

)

299

(202

)

Acquisition (8)

—

—

6,039

6,039

Change in sales revenue, net

18,879

17,714

20,929

57,522

Fiscal 2020 sales revenue, net

$

144,948

$

185,854

$

111,563

$

442,365

Total net sales revenue growth

15.0

%

10.5

%

23.1

%

14.9

%

Organic business

15.0

%

10.8

%

16.1

%

13.4

%

Impact of foreign currency

—

%

(0.3

)%

0.3

%

(0.1

)%

Acquisition

—

%

—

%

6.7

%

1.6

%

Fiscal Year Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

523,807

$

695,217

$

345,127

$

1,564,151

Organic business (10)

118,446

(5,349

)

31,157

144,254

Impact of foreign currency

(1,288

)

(4,471

)

(1,253

)

(7,012

)

Acquisition (8)

—

—

6,039

6,039

Change in sales revenue, net

117,158

(9,820

)

35,943

143,281

Fiscal 2020 sales revenue, net

$

640,965

$

685,397

$

381,070

$

1,707,432

Total net sales revenue growth

(decline)

22.4

%

(1.4

)%

10.4

%

9.2

%

Organic business

22.6

%

(0.8

)%

9.0

%

9.2

%

Impact of foreign currency

(0.2

)%

(0.6

)%

(0.4

)%

(0.4

)%

Acquisition

—

%

—

%

1.7

%

0.4

%

Leadership Brand Net Sales

Revenue (2) (8)

(Unaudited)

(in thousands)

Three Months Ended

Last Day of February,

$ Change

% Change

(in thousands)

2020

2019

20/19

20/19

Leadership Brand sales revenue, net

(8)

$

347,713

$

300,432

$

47,283

15.7

%

All other sales revenue, net

94,652

84,411

10,239

12.1

%

Total sales revenue, net

$

442,365

$

384,843

$

57,522

14.9

%

Fiscal Year Ended

Last Day of February,

$ Change

% Change

(in thousands)

2020

2019

20/19

20/19

Leadership Brand sales revenue, net

(8)

$

1,360,059

$

1,243,600

$

116,459

9.4

%

All other sales revenue, net

347,373

320,551

26,822

8.4

%

Total sales revenue, net

$

1,707,432

$

1,564,151

$

143,281

9.2

%

Consolidated and Segment Net

Sales from Core and Non-Core Business (11)

(Unaudited)

(in thousands)

Three Months Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

126,069

$

168,140

$

90,634

$

384,843

Core business (8)

18,879

17,714

24,792

61,385

Non-core business (Personal Care)

—

—

(3,863

)

(3,863

)

Change in sales revenue, net

18,879

17,714

20,929

57,522

Fiscal 2020 sales revenue, net

$

144,948

$

185,854

$

111,563

$

442,365

Total net sales revenue growth

15.0

%

10.5

%

23.1

%

14.9

%

Core business

15.0

%

10.5

%

27.4

%

16.0

%

Non-core business (Personal Care)

—

%

—

%

(4.3

)%

(1.0

)%

Fiscal Year Ended Last Day of

February,

Housewares

Health & Home

Beauty

Total

Fiscal 2019 sales revenue, net

$

523,807

$

695,217

$

345,127

$

1,564,151

Core business (8)

117,158

(9,820

)

46,796

154,134

Non-core business (Personal Care)

—

—

(10,853

)

(10,853

)

Change in sales revenue, net

117,158

(9,820

)

35,943

143,281

Fiscal 2020 sales revenue, net

$

640,965

$

685,397

$

381,070

$

1,707,432

Total net sales revenue growth

22.4

%

(1.4

)%

10.4

%

9.2

%

Core business

22.4

%

(1.4

)%

13.6

%

9.9

%

Non-core business (Personal Care)

—

%

—

%

(3.1

)%

(0.7

)%

SELECTED OTHER DATA

Reconciliation of Non-GAAP

Financial Measures – GAAP Operating Income

to Adjusted Operating Income

(non-GAAP) (1)

(Unaudited) (in

thousands)

Three Months Ended February

29, 2020

Housewares

Health & Home

Beauty (8)

Total

Operating income (loss), as reported

(GAAP)

$

13,965

9.6

%

$

16,330

8.8

%

$

(33,040

)

(29.6

)%

$

(2,745

)

(0.6

)%

Asset impairment charges (7)

—

—

—

—

41,000

36.8

%

41,000

9.3

%

Acquisition-related expenses (9)

—

—

%

—

—

%

1,071

1.0

%

1,071

0.2

%

Restructuring charges (3)

1,261

0.9

%

93

0.1

%

898

0.8

%

2,252

0.5

%

Subtotal

15,226

10.5

%

16,423

8.8

%

9,929

8.9

%

41,578

9.4

%

Amortization of intangible assets

543

0.4

%

2,451

1.3

%

5,148

4.6

%

8,142

1.8

%

Non-cash share-based compensation

1,365

0.9

%

1,878

1.0

%

943

0.8

%

4,186

0.9

%

Adjusted operating income (non-GAAP)

$

17,134

11.8

%

$

20,752

11.2

%

$

16,020

14.4

%

$

53,906

12.2

%

Three Months Ended February

28, 2019

Housewares

Health & Home

Beauty

Total

Operating income, as reported (GAAP)

$

20,392

16.2

%

$

15,947

9.5

%

$

7,757

8.6

%

$

44,096

11.5

%

Restructuring charges (3)

186

0.1

%

328

0.2

%

463

0.5

%

977

0.3

%

Subtotal

20,578

16.3

%

16,275

9.7

%

8,220

9.1

%

45,073

11.7

%

Amortization of intangible assets

506

0.4

%

2,796

1.7

%

80

0.1

%

3,382

0.9

%

Non-cash share-based compensation

1,701

1.3

%

2,174

1.3

%

1,149

1.3

%

5,024

1.3

%

Adjusted operating income (non-GAAP)

$

22,785

18.1

%

$

21,245

12.6

%

$

9,449

10.4

%

$

53,479

13.9

%

Fiscal Year Ended February 29,

2020

Housewares

Health & Home

Beauty

Total

Operating income (loss), as reported

(GAAP)

$

123,135

19.2

%

$

68,166

9.9

%

$

(13,050

)

(3.4

)%

$

178,251

10.4

%

Asset impairment charges (7)

—

—

%

—

—

%

41,000

10.8

%

41,000

2.4

%

Acquisition-related expenses (9)

—

—

%

—

—

%

2,546

0.7

%

2,546

0.1

%

Restructuring charges (3)

1,351

0.2

%

93

—

%

1,869

0.5

%

3,313

0.2

%

Subtotal

124,486

19.4

%

68,259

10.0

%

32,365

8.5

%

225,110

13.2

%

Amortization of intangible assets

2,055

0.3

%

10,539

1.5

%

8,677

2.3

%

21,271

1.2

%

Non-cash share-based compensation

7,218

1.1

%

9,717

1.4

%

5,994

1.6

%

22,929

1.3

%

Adjusted operating income (non-GAAP)

$

133,759

20.9

%

$

88,515

12.9

%

$

47,036

12.3

%

$

269,310

15.8

%

Fiscal Year Ended February 28,

2019

Housewares

Health & Home

Beauty

Total

Operating income, as reported (GAAP)

$

100,743

19.2

%

$

68,448

9.8

%

$

30,188

8.7

%

$

199,379

12.7

%

Restructuring charges (3)

926

0.2

%

686

0.1

%

1,974

0.6

%

3,586

0.2

%

Subtotal

101,669

19.4

%

69,134

9.9

%

32,162

9.3

%

202,965

13.0

%

Amortization of intangible assets

1,980

0.4

%

10,925

1.6

%

1,299

0.4

%

14,204

0.9

%

Non-cash share-based compensation

7,974

1.5

%

9,204

1.3

%

4,875

1.4

%

22,053

1.4

%

Adjusted operating income (non-GAAP)

$

111,623

21.3

%

$

89,263

12.8

%

$

38,336

11.1

%

$

239,222

15.3

%

SELECTED OTHER DATA

Reconciliation of Non-GAAP

Financial Measures - EBITDA

(Earnings Before Interest,

Taxes, Depreciation and Amortization) and Adjusted EBITDA by

Segment (1)

(Unaudited) (in

thousands)

Three Months Ended February

29, 2020

Housewares

Health & Home

Beauty (8)

Total

Operating income (loss), as reported

(GAAP)

$

13,965

$

16,330

$

(33,040

)

$

(2,745

)

Depreciation and amortization, excluding

amortized interest

2,006

3,791

6,736

12,533

Nonoperating income, net

—

—

81

81

EBITDA (non-GAAP)

15,971

20,121

(26,223

)

9,869

Add: Acquisition-related expenses (9)

—

—

1,071

1,071

Restructuring charges (3)

1,261

93

898

2,252

Non-cash asset impairment charges (7)

—

—

41,000

41,000

Non-cash share-based compensation

1,365

1,878

943

4,186

Adjusted EBITDA (non-GAAP)

$

18,597

$

22,092

$

17,689

$

58,378

Three Months Ended February

28, 2019

Housewares

Health & Home

Beauty

Total

Operating income, as reported (GAAP)

$

20,392

$

15,947

$

7,757

$

44,096

Depreciation and amortization, excluding

amortized interest

1,634

4,355

1,448

7,437

Nonoperating income, net

—

—

165

165

EBITDA (non-GAAP)

22,026

20,302

9,370

51,698

Add: Restructuring charges (3)

186

328

463

977

Non-cash share-based compensation

1,701

2,174

1,149

5,024

Adjusted EBITDA (non-GAAP)

$

23,913

$

22,804

$

10,982

$

57,699

Fiscal Year Ended February 29,

2020

Housewares

Health & Home

Beauty (8)

Total

Operating income (loss), as reported

(GAAP)

$

123,135

$

68,166

$

(13,050

)

$

178,251

Depreciation and amortization, excluding

amortized interest

7,298

16,113

13,998

37,409

Nonoperating income, net

—

—

394

394

EBITDA (non-GAAP)

130,433

84,279

1,342

216,054

Add: Acquisition-related expenses (9)

—

—

2,546

2,546

Restructuring charges (3)

1,351

93

1,869

3,313

Non-cash asset impairment charges (7)

—

—

41,000

41,000

Non-cash share-based compensation

7,218

9,717

5,994

22,929

Adjusted EBITDA (non-GAAP)

$

139,002

$

94,089

$

52,751

$

285,842

Fiscal Year Ended February 28,

2019

Housewares

Health & Home

Beauty

Total

Operating income, as reported (GAAP)

$

100,743

$

68,448

$

30,188

$

199,379

Depreciation and amortization, excluding

amortized interest

6,048

17,058

6,821

29,927

Nonoperating income, net

—

—

340

340

EBITDA (non-GAAP)

106,791

85,506

37,349

229,646

Restructuring charges (3)

926

686

1,974

3,586

Non-cash share-based compensation

7,974

9,204

4,875

22,053

Adjusted EBITDA (non-GAAP)

$

115,691

$

95,396

$

44,198

$

255,285

Reconciliation of GAAP Income

(Loss) and Diluted Earnings Per Share (“EPS”) from Continuing

Operations to Adjusted Income and Adjusted Diluted EPS from

Continuing Operations (non-GAAP) (1) (Unaudited) (dollars in

thousands, except per share data)

Three Months Ended February

29, 2020

Income (loss) from Continuing

Operations

Diluted EPS

Before Tax

Tax

Net of Tax

Before Tax

Tax

Net of Tax

As reported (GAAP)

$

(6,078

)

$

(2,923

)

$

(3,155

)

$

(0.24

)

$

(0.12

)

$

(0.13

)

Acquisition-related expenses (9)

1,071

16

1,055

0.04

—

0.04

Asset impairment charges (7)

41,000

4,574

36,426

1.61

0.18

1.43

Restructuring charges (3)

2,252

93

2,159

0.09

—

0.08

Subtotal

38,245

1,760

36,485

1.51

0.07

1.44

Amortization of intangible assets

8,142

624

7,518

0.32

0.02

0.30

Non-cash share-based compensation

4,186

369

3,817

0.16

0.01

0.15

Adjusted (non-GAAP)

$

50,573

$

2,753

$

47,820

$

1.99

$

0.11

$

1.88

Weighted average shares of common stock

used in computing diluted EPS

25,403

Three Months Ended February

28, 2019

Income from Continuing

Operations

Diluted EPS

Before Tax

Tax

Net of Tax

Before Tax

Tax

Net of Tax

As reported (GAAP)

$

40,955

$

3,241

$

37,714

$

1.60

$

0.13

$

1.47

Restructuring charges (3)

977

30

947

0.04

—

0.04

Subtotal

41,932

3,271

38,661

1.64

0.13

1.51

Amortization of intangible assets

3,382

136

3,246

0.13

0.01

0.13

Non-cash share-based compensation

5,024

374

4,650

0.20

0.01

0.18

Adjusted (non-GAAP)

$

50,338

$

3,781

$

46,557

$

1.96

$

0.15

$

1.82

Weighted average shares of common stock

used in computing diluted EPS

25,638

Fiscal Year Ended February 29,

2020

Income from Continuing

Operations

Diluted EPS

Before Tax

Tax

Net of Tax

Before Tax

Tax

Net of Tax

As reported (GAAP)

$

165,940

$

13,607

$

152,333

$

6.55

$

0.54

$

6.02

Acquisition-related expenses (9)

2,546

38

2,508

0.10

—

0.10

Asset impairment charges (7)

41,000

4,574

36,426

1.62

0.18

1.44

Restructuring charges (3)

3,313

161

3,152

0.13

0.01

0.12

Subtotal

212,799

18,380

194,419

8.40

0.73

7.68

Amortization of intangible assets

21,271

1,245

20,026

0.84

0.05

0.79

Non-cash share-based compensation

22,929

1,803

21,126

0.91

0.07

0.83

Adjusted (non-GAAP)

$

256,999

$

21,428

$

235,571

$

10.15

$

0.85

$

9.30

Weighted average shares of common stock

used in computing diluted EPS

25,322

Fiscal Year Ended February 28,

2019

Income from Continuing

Operations

Diluted EPS

Before Tax

Tax

Net of Tax

Before Tax

Tax

Net of Tax

As reported (GAAP)

$

188,000

$

13,776

$

174,224

$

7.15

$

0.52

$

6.62

Restructuring charges (3)

3,586

215

3,371

0.14

0.01

0.13

Subtotal

191,586

13,991

177,595

7.28

0.53

6.75

Amortization of intangible assets

14,204

372

13,832

0.54

0.01

0.53

Non-cash share-based compensation

22,053

1,395

20,658

0.84

0.05

0.79

Adjusted (non-GAAP)

$

227,843

$

15,758

$

212,085

$

8.66

$

0.60

$

8.06

Weighted average shares of common stock

used in computing diluted EPS

26,303

Consolidated Core and Non-Core

Net Sales and Reconciliation of Core and Non-Core Diluted Earnings

Per Share (“EPS”) from Continuing Operations to Core and Non-Core

Adjusted Diluted EPS from Continuing Operations (non-GAAP) (1)

(Unaudited)

Fiscal Years Ended

Last Day of February,

$ Change

% Change

(in thousands)

2020

2019

2018

20/19

19/18

20/19

19/18

Sales revenue, net

Core

$

1,615,094

$

1,460,960

$

1,370,040

$

154,134

$

90,920

10.6

%

6.6

%

Non-core

92,338

103,191

108,805

(10,853

)

(5,614

)

(10.5

)%

(5.2

)%

Total

$

1,707,432

$

1,564,151

$

1,478,845

$

143,281

$

85,306

9.2

%

5.8

%

Fiscal Years Ended

Last Day of February,

$ Change

% Change

2020

2019

2018

20/19

19/18

20/19

19/18

Adjusted EPS

Core

$

8.72

$

7.27

$

6.51

$

1.45

$

0.76

19.9

%

11.7

%

Non-core

0.58

0.79

0.73

(0.21

)

0.06

(26.6

)%

8.2

%

Total

$

9.30

$

8.06

$

7.24

$

1.24

$

0.82

15.4

%

11.3

%

Fiscal Years Ended

Last Day of February,

Core Business:

2020

2019

2018

Diluted EPS, as reported

$

7.16

$

5.89

$

4.72

Tax Reform

—

—

0.66

Asset impairment charges, net of tax

—

—

—

Restructuring charges, net of tax

0.11

0.11

0.04

Acquisition-related expenses, net of

tax

0.10

—

—

Toys "R" Us bankruptcy charge, net of

tax

—

—

0.12

Subtotal

$

7.37

$

6.00

$

5.54

Amortization of intangible assets, net of

tax

0.53

0.49

0.49

Non-cash share-based compensation, net of

tax

0.82

0.78

0.48

Adjusted Diluted EPS (non-GAAP)

$

8.72

$

7.27

$

6.51

Fiscal Years Ended

Last Day of February,

Non-Core Business:

2020

2019

2018

Diluted EPS, as reported

$

(1.14

)

$

0.73

$

0.01

Tax reform

—

—

—

Asset impairment charges, net of tax

1.44

—

0.51

Restructuring charges, net of tax

0.01

0.02

0.03

Acquisition-related Expenses, net of

tax

—

—

—

Toys "R" Us bankruptcy charge, net of

tax

—

—

—

Subtotal

$

0.31

$

0.75

$

0.55

Amortization of intangible assets, net of

tax

0.26

0.04

0.17

Non-cash share-based compensation, net of

tax

0.01

0.01

0.01

Adjusted Diluted EPS (non-GAAP)

$

0.58

$

0.79

$

0.73

Diluted EPS, as reported (GAAP)

$

6.02

$

6.62

$

4.73

Selected Consolidated Balance

Sheet, Cash Flow and Liquidity Information (6)

(Unaudited)

(in thousands)

Last Day of February,

2020

2019

Balance Sheet:

Cash and cash equivalents

$

24,467

$

11,871

Receivables, net

348,023

280,280

Inventory, net

256,311

302,339

Assets held for sale

44,806

—

Total assets, current

682,836

604,859

Total assets

1,903,883

1,649,535

Total liabilities, current

338,896

312,031

Total long-term liabilities

403,264

340,867

Total debt

339,305

320,784

Consolidated stockholders' equity

1,161,723

996,637

Liquidity:

Working capital

$

343,940

$

292,828

Fiscal Year Ended Last Day of

February,

2020

2019

Cash Flow from continuing operations:

Depreciation and amortization

$

37,409

$

29,927

Net cash provided by operating

activities

271,293

200,568

Capital and intangible asset

expenditures

17,759

26,385

Net debt proceeds

16,900

29,900

Payments for repurchases of common

stock

10,169

217,493

Reconciliation of GAAP Net

Cash Provided by Operating Activities

to Free Cash Flow (Non-GAAP)

(1)

(Unaudited) (in

thousands)

Fiscal Year Ended Last Day of

February,

2020

2019

Net cash provided by operating activities

- continuing operations (GAAP)

$

271,293

$

200,568

Less: Capital and intangible asset

expenditures

(17,759

)

(26,385

)

Free cash flow - continuing operations

(Non-GAAP)

$

253,534

$

174,183

HELEN OF TROY LIMITED AND SUBSIDIARIES

Notes to Press Release

(1)

This press release contains non-GAAP

financial measures. Adjusted operating income, adjusted operating

margin, adjusted effective tax rate, adjusted income from

continuing operations, adjusted diluted EPS from continuing

operations, Core and Non-Core adjusted diluted EPS from continuing

operations, EBITDA, adjusted EBITDA, and free cash flow (“Non-GAAP

measures”) that are discussed in the accompanying press release or

in the preceding tables may be considered non-GAAP financial

information as contemplated by SEC Regulation G, Rule 100.

Accordingly, the Company is providing the preceding tables that

reconcile these measures to their corresponding GAAP-based measures

presented in the Company's Condensed Consolidated Statements of

Income in the accompanying tables to the press release. The Company

believes that these non-GAAP measures provide useful information to

management and investors regarding financial and business trends

relating to its financial condition and results of operations. The

Company believes that these non-GAAP financial measures, in

combination with the Company’s financial results calculated in

accordance with GAAP, provide investors with additional perspective

regarding the impact of certain charges on applicable income,

margin and earnings per share measures. The Company also believes

that these non-GAAP measures facilitate a more direct comparison of

the Company’s performance with its competitors. The Company further

believes that including the excluded charges would not accurately

reflect the underlying performance of the Company’s continuing

operations for the period in which the charges are incurred, even

though such charges may be incurred and reflected in the Company’s

GAAP financial results in the near future. Additionally, the

non-GAAP measures are used by management for measuring and

evaluating the Company’s performance. The material limitation

associated with the use of the non-GAAP measures is that the

non-GAAP measures do not reflect the full economic impact of the

Company’s activities. These non-GAAP measures are not prepared in

accordance with GAAP, are not an alternative to GAAP financial

information, and may be calculated differently than non-GAAP

financial information disclosed by other companies. Accordingly,

undue reliance should not be placed on non-GAAP information.

(2)

Leadership Brand net sales consists of

revenue from the OXO, Honeywell, Braun, PUR, Hydro Flask, Vicks,

Hot Tools and Drybar brands.

(3)

Charges incurred in conjunction with the

Company’s restructuring plan (Project Refuel).

(4)

Amortization of intangible assets.

(5)

Non-cash share-based compensation.

(6)

Amounts presented are from continuing

operations with the exception of stockholders’ equity, which is

presented on a consolidated basis and includes discontinued

operations.

(7)

Non-cash asset impairment charges related

to goodwill and intangible assets. The charges were related to

assets of the Personal Care business classified as held for sale

within the Beauty segment.

(8)

Fiscal 2020 includes approximately five

weeks of operating results from the acquisition of Drybar Products

on January 23, 2020, which is reported in the Beauty segment.

(9)

Acquisition-related expense pertaining to

the Drybar Products acquisition.

(10)

Previously referred to as Core business,

Organic business refers to net sales revenue associated with

product lines or brands after the first twelve months from the date

the product line or brand is acquired, excluding the impact that

foreign currency re-measurement had on reported net sales. Net

sales revenue from internally developed brands or product lines is

considered Organic business activity.

(11)

The Company defines Core as strategic

business that it expects to be an ongoing part of its operations,

and Non-Core as business that it expects to divest within a year of

its designation as non-core.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428005996/en/

Investor Contact: Helen of Troy Limited Anne Rakunas,

Director, External Communications (915) 225-4841 ICR, Inc. Allison

Malkin, Partner (203) 682-8200

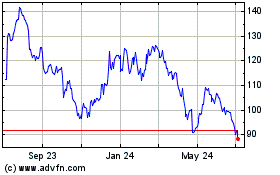

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Mar 2024 to Apr 2024

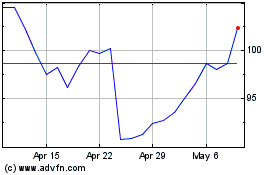

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Apr 2023 to Apr 2024