Statement of Changes in Beneficial Ownership (4)

February 01 2021 - 1:01PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

BAILEY GEOFFREY R |

2. Issuer Name and Ticker or Trading Symbol

Good Times Restaurants Inc.

[

GTIM

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

141 UNION BLVD., STE 400 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/28/2021 |

|

(Street)

LAKEWOOD, CO 80228

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 1/28/2021 | | A(1) | | 3237 | A | $2.78 | 48099 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | $0.00 | | | | | | | 11/16/2020 (2) | 11/16/2021 | Common Stock | 913 | | 914 | D | |

| Restricted Stock Units | $0.00 | | | | | | | 6/27/2020 (3) | 6/27/2021 | Common Stock | 1615 | | 1615 | D | |

| Non-Qualified Stock Options | $1.56 | | | | | | | 12/13/2010 (4) | 12/13/2020 | Common Stock | 666 | | 4108 | D | |

| Non-Qualified Stock Options | $1.31 | | | | | | | 12/14/2011 (5) | 12/14/2021 | Common Stock | 5000 | | 9108 | D | |

| Non-Qualified Stock Options | $2.31 | | | | | | | 1/2/2013 (6) | 1/2/2023 | Common Stock | 2000 | | 11108 | D | |

| Non-Qualified Stock Options | $2.44 | | | | | | | 9/27/2013 (7) | 9/27/2023 | Common Stock | 5000 | | 16108 | D | |

| Non-Qualified Stock Options | $5.29 | | | | | | | 11/23/2015 (8) | 11/23/2025 | Common Stock | 3781 | | 19889 | D | |

| Non-Qualified Stock Options | $4.25 | | | | | | | 7/23/2018 (9) | 7/23/2028 | Common Stock | 2715 | | 22604 | D | |

| Explanation of Responses: |

| (1) | The reporting person received a discretionary grant of common stock. |

| (2) | The Reporting Person was granted 2,740 Restricted Stock Units on November 16, 2018 vesting at 1/3 of the total granted amount over three years. Such Restricted Stock Units were previously reported in Table II on a Form 4 filed with the Securities and Exchange Commission |

| (3) | The Reporting Person was granted 4,865 Restricted Stock Units ("RSU") on June 27, 2018 vesting at 1/3 of the total granted amount over three years. Such Restricted Stock Units were previously reported in Table II on a Form 4 filed with the Securities and Exchange Commission. |

| (4) | The Reporting Person was granted 666 (post-split reflected) Non-Qualified Stock Options (Right to Buy) on December 13, 2010 vesting at 1/5 of the total amount granted over five years. |

| (5) | The Reporting Person was granted 5,000 Non-Qualified Stock Options (Right to Buy) on December 14, 2011 vesting at 1/5 of the total amount granted over five years. |

| (6) | The Reporting Person was granted 2,000 Non-Qualified Stock Options (Right to Buy) on January 1, 2013 vesting at 1/5 of the total amount granted over five years. |

| (7) | The Reporting Person was granted 5,000 Non-Qualified Stock Options (Right to Buy) on September 27, 2013 vesting at 1/5 of the total amount granted over five years. |

| (8) | The Reporting Person was granted 3,781 Non-Qualified Stock Options (Right to Buy) on November 23, 2015 vesting at 1/5 of the total amount granted over five years. |

| (9) | The Reporting Person was granted 2,715 Non-Qualified Stock Options (Right to Buy) on July 23, 2018 vesting at 1/5 of the total amount granted over five years. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

BAILEY GEOFFREY R

141 UNION BLVD., STE 400

LAKEWOOD, CO 80228 | X |

|

|

|

Signatures

|

| Geoffrey R. Bailey | | 1/28/2021 |

| **Signature of Reporting Person | Date |

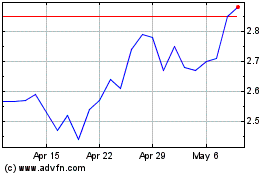

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

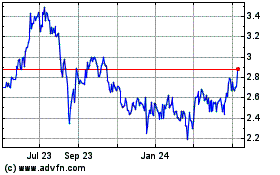

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Apr 2023 to Apr 2024