Current Report Filing (8-k)

October 08 2019 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

_______________________

|

Date of Report

(Date of earliest

event reported):

|

October 8, 2019

|

Good Times Restaurants Inc.

(Exact name of registrant as specified in

its charter)

|

NEVADA

|

|

000-18590

|

|

84-1133368

|

|

(State or other

jurisdiction of

incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

141 Union Boulevard, #400, Lakewood,

CO 80228

(Address of principal executive offices,

including zip code)

303-384-1400

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

_______________________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

Common Stock, $0.001 par value per

share

|

|

GTIM

|

|

Nasdaq Stock Exchange

|

Item 5.02 Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

On October 8, 2019,

Boyd Hoback’s employment as Chief Executive Officer of Good Times Restaurants Inc. (the “Company”) ended by mutual

agreement between the Company and Mr. Hoback. Mr. Hoback also resigned from the Company’s Board of Directors.

Under the terms of

a Severance and General Release Agreement dated October 8, 2019 (the “Severance Agreement”) between the Company and

Mr. Hoback, Mr. Hoback will receive $629,828.00 in severance payments (the “Severance”), in addition to his accrued

rights (compensation, paid time off and expense reimbursement). The Company is also providing Mr. Hoback, among other things, 90

days’ salary ($61,880.00) and employer’s portion of health insurance premiums, in lieu of advance notice of termination.

In the event of a change in control of the Company on or before October 8, 2020, Mr. Hoback will also be entitled to $652,112.97

of additional compensation. All payments under the Severance Agreement are subject to applicable withholding. Mr. Hoback will remain

eligible for the safe harbor matching contribution under the current terms of the Company’s 401(k) Plan. The financial terms

of the Severance Agreement supersede the severance obligations to Mr. Hoback under Mr. Hoback’s Employment Agreement, dated

September 27, 2016 (the “Employment Agreement”). The Severance Agreement contains a customary mutual release of claims

by each party thereto, an indemnity in favor of Mr. Hoback and certain post-employment covenants applicable to Mr. Hoback in respect

of confidential information and certain other matters.

The foregoing discussion

is qualified by reference to the Severance Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein

by reference.

In connection with

the termination of employment of Mr. Hoback and execution of the Severance Agreement, the Company and Mr. Hoback also entered into

a Repurchase Option Agreement (the “Repurchase Option Agreement”). Under the terms of the Repurchase Option Agreement,

Mr. Hoback received 40,697 shares of Common Stock in settlement of Mr. Hoback’s unvested Restricted Stock Units granted under

the Company’s 2008 Omnibus Equity Incentive Compensation Plan or its 2018 Omnibus Equity Incentive Plan and, through a cashless

exercise, 2,413 shares of Common Stock in respect of all stock options to acquire shares of Common Stock at an exercise price of

less than $1.75 per share. The Company granted Mr. Hoback the right to sell to the Company up to 43,110 shares of Common Stock

at a price per share of $1.75 (the “Option”) on or before January 3, 2020, subject to any applicable restrictions under

the Company’s credit facilities. The Option may only be exercised to effect one sale of shares Common Stock to the Company

at one time (i.e., it may not be exercised more than once). The Repurchase Option Agreement is in full satisfaction of any “put”

rights of Mr. Hoback under Section 7(f) of his Employment Agreement. Mr. Hoback and the Company made certain customary representations

and warranties as more fully set forth in the Repurchase Option Agreement.

The foregoing discussion

is qualified by reference to the Repurchase Option Agreement, a copy of which is attached hereto as Exhibit 10.2 and incorporated

herein by reference.

On October 8, 2019,

the Company also appointed Ryan M. Zink, 41, as the Company’s acting Chief Executive Officer effective immediately to replace

Mr. Hoback. Mr. Zink is expected to serve as the Company’s acting Chief Executive Officer until the Company has made a permanent

CEO appointment. Mr. Zink has served as the Company’s Chief Financial Officer since August 1, 2017 and will continue to serve

in such role. Prior to his appointment as Chief Financial Officer of the Company, from March 2014 to July 2017, Ryan held positions

with INVISTA, a wholly-owned subsidiary of Koch Industries Inc., most recently as Corporate Finance Director and formerly as Operations

Controller.

On October 8, 2019,

the Company issued a press release announcing Mr. Hoback’s termination of employment and the Company’s appointment

of Mr. Zink as the Company’s acting Chief Executive Officer. A copy of the press release is attached hereto as Exhibit 99.1

and incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

(d) Exhibits.

|

The following exhibits are being filed herewith:

|

Exhibit

Index

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

Good Times Restaurants Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 8, 2019

|

By:

|

|

|

|

|

|

Ryan Zink, Chief Financial Officer

|

|

|

|

|

& acting Chief Executive Officer

|

|

4

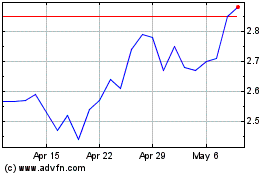

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

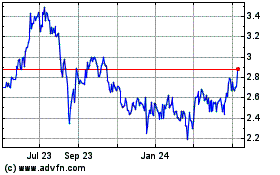

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Apr 2023 to Apr 2024