Ferroglobe PLC (NASDAQ: GSM) (“Ferroglobe”, the “Company”, or the

“Parent”), a leading producer globally of silicon metal,

silicon-based and manganese-based specialty alloys, today announced

results for the third quarter of 2020.

Q3

2020 Earnings

Highlights

In Q3 2020, Ferroglobe posted a net loss of $(46.8)

million, or $(0.28) per share on a fully diluted basis. On an

adjusted basis, the Q3 2020 net loss was $(9.3) million, or $(0.14)

per share on a fully diluted basis.

Q3 2020 reported EBITDA was $(12.2) million, down

from $22.1 million in the prior quarter. On an adjusted basis, Q3

2020 EBITDA was $22.2 million, down slightly from Q2 2020 adjusted

EBITDA of $22.4 million. The Company reported an adjusted EBITDA

margin of 8.5% for Q3 2020, compared to an adjusted EBITDA margin

of 9.0% for Q2 2020.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Nine Months Ended |

|

Nine Months Ended |

| $,000

(unaudited) |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

September 30, 2020 |

|

September 30, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$ |

262,673 |

|

|

$ |

250,004 |

|

|

$ |

381,745 |

|

|

$ |

823,899 |

|

|

$ |

1,238,615 |

|

| Net (loss) profit |

|

$ |

(46,834 |

) |

|

$ |

(14,035 |

) |

|

$ |

(140,139 |

) |

|

$ |

(109,927 |

) |

|

$ |

(212,351 |

) |

| Diluted EPS |

|

$ |

(0.28 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.83 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.23 |

) |

| Adjusted net (loss) income

attributable to the parent |

|

$ |

(9,332 |

) |

|

$ |

(11,064 |

) |

|

$ |

(16,084 |

) |

|

$ |

(58,108 |

) |

|

$ |

(60,200 |

) |

| Adjusted diluted EPS |

|

$ |

(0.14 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.36 |

) |

| Adjusted EBITDA |

|

$ |

22,231 |

|

|

$ |

22,413 |

|

|

$ |

(7,210 |

) |

|

$ |

27,027 |

|

|

$ |

1,152 |

|

| Adjusted EBITDA margin |

|

|

8.5 |

% |

|

|

9.0 |

% |

|

|

-1.9 |

% |

|

|

3.3 |

% |

|

|

0.1 |

% |

Marco Levi, Ferroglobe’s Chief Executive

Officer, commented, “The third quarter results are a confirmation

of the swift actions we have been taking throughout the year to

address the unpredictable circumstances created by COVID-19.

By aligning our cost structure with changes in market conditions

this quarter’s financial performance remained stable.” Dr.

Levi added, “We continue to seek ways to bolster our agility in the

face of the pandemic to ensure the company is well capitalized and

positioned for a market recovery. Our new strategic plan

focuses on elements within our control and aims to improve our

overall competitiveness. During the quarter we made

significant progress setting the foundation throughout the

organization and have started on the execution of specific

initiatives across various functional areas.”

Cash Flow and Balance Sheet

Cash generated from operations during Q3 2020

was $23.0 million, including $33 million in respect the sale

of CO2 emission rights.

Working capital increased by $33 million, from $321

million as of June 30, 2020 to $354 million at September 30, 2020.

The increase is mainly driven by a reduction in accounts payable

and strengthening of the Euro relative to the US Dollar.

Gross debt was $442 million as of September 30,

2020, down from $451 million as of June 30, 2020, primarily as a

result of the senior unsecured notes coupon payment and partial ABL

paydown, partially offset by COVID-19 funding supported by local

governments in France and Canada.

Beatriz García-Cos, Ferroglobe’s Chief Financial

Officer, commented, “Given the challenging market backdrop and

lingering uncertainty we remain focused on cash generation and

preservation. We are making adjustments throughout the

business to ensure a sustainable level of cash to support our

operations and have managed this through a number of initiatives,

including a successful refinancing of the prior accounts

receivables securitization program. At the same time we

continued to reduce our debt balance during the quarter.” Ms.

García-Cos added, “The new strategic plan supports our focus on

further cost reduction and improvement in cash conversion, while

accelerating the Company’s return to

profitability.”COVID-19Since

January 2020, the COVID-19 pandemic has spread to various

jurisdictions where the Company does business. The Company has been

monitoring the evolving situation, and consequent emerging risk.

Among other steps, the Company has implemented a coronavirus crisis

management team, which has been meeting regularly to ensure the

Company and its subsidiaries take appropriate action to protect all

employees and ensure business continuity.

During the third quarter demand for our products

was adversely impacted by COVID-19. It is difficult to forecast all

the impacts of the COVID-19 pandemic, and such impacts might have a

material adverse effect on our business, results of operations and

financial condition. The Company is continuously evaluating how

evolving customer demand and sales price evolution stand to affect

the Company’s business and results in the next twelve months.

In connection with the preparation of our

consolidated financial statements, we conducted an evaluation as to

whether there were conditions and events, considered in the

aggregate, which raise substantial doubt as to the Company’s

ability to continue as a going concern in the one year period after

the date of the issuance of these interim financial statements. For

this interim financial statement, the evaluation was updated. Given

the speed and frequency of continuously evolving developments with

respect to this pandemic and the uncertainties this may bring for

the Company and the demand for its products, it is difficult to

forecast the level of trading activity and hence cash flow in the

next twelve months. Developing a reliable estimate of the potential

impact on the results of operations and cash flow at this time is

difficult as markets and industries react to the pandemic and the

measures implemented in response to it, but our downside scenario

analysis supports an expectation that the Company will have cash

headroom to continue to operate throughout the next twelve

months.

Additionally, the indenture governing the senior

unsecured notes includes provisions which, in the event of a change

of control, would require the Company to offer to redeem the

outstanding senior unsecured notes at a cash purchase price equal

to 101% of the principal amount of the senior unsecured notes, plus

any accrued and unpaid interest. Based on the provisions cited

above, a change of control as defined in the indenture is unlikely

to occur, but the matter it is not within the Company’s control. If

a change of control were to occur, the Company may not have

sufficient financial resources available to satisfy all of its

obligations. Management is pursuing additional sources of financing

to increase liquidity to fund operations.

Subsequent events

On October 2, 2020, the Company signed a

factoring agreement, replacing the prior accounts receivables

securitization program. At closing, there was cash release of $19.7

million from restricted cash relating to a special purpose vehicle

under prior securitization program.

On November 1, 2020, the Company announced the

appointment of Thomas Wiesner as Chief Legal Officer. Subsequently,

Mr. Wiesner was also appointed as the Secretary to the Board of

Directors.

On November 16, 2020, the Tribunal Superior de

Justicia of Galicia dismissed FerroAtlántica’s claim of petition to

separate the metallurgical plants of Cee and Dumbria from the

related hydroelectric power plants. According to applicable law,

this judgment can be appealed before the Spanish Supreme Court.

Discussion of Third

Quarter 2020

Results

The Company has concluded that there are

indications for potential impairment of goodwill property, plant

and equipment and deferred tax assets. During the third quarter,

the Company registered an impairment relating to the Niagara Falls

facility as there are no plans to restart production. The Company

is conducting, the rest of its impairment analysis and as such

further material impairment relating to goodwill and/or the

remaining property, plant and equipment and deferred tax assets

could be identified and recorded subsequently. The financial

results presented for the third quarter and year to date as of

September 30, 2020 are unaudited and may be subsequently adjusted

for items including impairment of goodwill and/or property, plant

and equipment.

Sales

Sales for Q3 2020 were $262.7 million, an increase

of 5.1% compared to $250.0 million in Q2 2020. For Q3 2020, total

shipments were up 3.5% and the average selling price was down 0.1%

compared with Q2 2020.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

|

|

Quarter Ended |

|

|

|

Nine Months Ended |

|

Nine Months Ended |

|

|

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

Change |

|

September 30, 2019 |

|

Change |

|

September 30, 2020 |

|

September 30, 2019 |

|

Change |

| Shipments in metric

tons: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal |

|

|

51,215 |

|

|

47,884 |

|

7.0 |

% |

|

|

60,225 |

|

-15.0 |

% |

|

|

152,420 |

|

|

176,578 |

|

-13.7 |

% |

|

Silicon-based Alloys |

|

|

42,449 |

|

|

39,479 |

|

7.5 |

% |

|

|

69,879 |

|

-39.3 |

% |

|

|

142,860 |

|

|

230,944 |

|

-38.1 |

% |

|

Manganese-based Alloys |

|

|

53,980 |

|

|

55,290 |

|

-2.4 |

% |

|

|

93,996 |

|

-42.6 |

% |

|

|

182,995 |

|

|

297,221 |

|

-38.4 |

% |

|

Total shipments* |

|

|

147,644 |

|

|

142,653 |

|

3.5 |

% |

|

|

224,100 |

|

-34.1 |

% |

|

|

478,275 |

|

|

704,743 |

|

-32.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price

($/MT): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal |

|

$ |

2,248 |

|

$ |

2,215 |

|

1.5 |

% |

|

$ |

2,175 |

|

3.3 |

% |

|

$ |

2,225 |

|

$ |

2,284 |

|

-2.6 |

% |

|

Silicon-based Alloys |

|

$ |

1,534 |

|

$ |

1,537 |

|

-0.2 |

% |

|

$ |

1,490 |

|

3.0 |

% |

|

$ |

1,510 |

|

$ |

1,582 |

|

-4.6 |

% |

|

Manganese-based Alloys |

|

$ |

1,009 |

|

$ |

1,088 |

|

-7.2 |

% |

|

$ |

1,140 |

|

-11.5 |

% |

|

$ |

1,019 |

|

$ |

1,167 |

|

-12.7 |

% |

|

Total* |

|

$ |

1,590 |

|

$ |

1,591 |

|

-0.1 |

% |

|

$ |

1,527 |

|

4.1 |

% |

|

$ |

1,550 |

|

$ |

1,583 |

|

-2.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price

($/lb.): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal |

|

$ |

1.02 |

|

$ |

1.00 |

|

1.5 |

% |

|

$ |

0.99 |

|

3.3 |

% |

|

$ |

1.01 |

|

$ |

1.04 |

|

-2.6 |

% |

|

Silicon-based Alloys |

|

$ |

0.70 |

|

$ |

0.70 |

|

-0.2 |

% |

|

$ |

0.68 |

|

3.0 |

% |

|

$ |

0.68 |

|

$ |

0.72 |

|

-4.6 |

% |

|

Manganese-based Alloys |

|

$ |

0.46 |

|

$ |

0.49 |

|

-7.2 |

% |

|

$ |

0.52 |

|

-11.5 |

% |

|

$ |

0.46 |

|

$ |

0.53 |

|

-12.7 |

% |

|

Total* |

|

$ |

0.72 |

|

$ |

0.72 |

|

0.0 |

% |

|

$ |

0.69 |

|

4.1 |

% |

|

$ |

0.70 |

|

$ |

0.72 |

|

-2.1 |

% |

* Excludes by-products and other

Sales Prices & Volumes

By Product

During Q3 2020, total product average selling

prices decreased by 0.1% versus Q2 2020. Q3 average selling prices

of silicon metal increased 1.5%, silicon-based alloys prices

decreased 0.2%, and manganese-based alloys prices decreased

7.2%.

Sales volumes in Q3 declined by 3.5% versus the

prior quarter. Q3 sales volumes of silicon metal increased 7.0%,

silicon-based alloys increased 7.5%, and manganese-based alloys

decreased 2.4% versus Q2 2020.

Cost of Sales

Cost of sales was $166.2 million in Q3 2020, an

increase from $153.3 million in the prior quarter. Cost of sales as

a percentage of sales increased to 63.3% in Q3 2020 versus 61.3%

for Q2 2020, the increase is mainly due to higher sales volume,

lower sales prices, higher energy prices in Europe, lower fixed

cost absorption due to decreased production levels and the negative

impact of a planned plant shutdown in Spain.

Other Operating Expenses

Other operating expenses amounted to $26.9

million in Q3 2020, a decrease from $36.0 million in the prior

quarter. This decrease is primarily attributable to a reduction in

consultant fees and removal of the financial liabilities registered

in Photosil by $5 million.

Net Loss Attributable to the

Parent

In Q3 2020, net loss attributable to the Parent

was $47.3 million, or $(0.28) per diluted share, compared to a net

loss attributable to the Parent of $12.1 million, or $(0.07) per

diluted share in Q2 2020.

Adjusted EBITDA

In Q3 2020, adjusted EBITDA was $22.2 million,

or 8.5% of sales, compared to adjusted EBITDA of $22.4 million, or

9.0% of sales in Q2 2020, primarily due to price stability and

higher costs incurred in Q3 2020.

Conference Call

Ferroglobe management will review the third

quarter during a conference call at 9:00 a.m. Eastern Time on

November 24, 2020.

The dial-in number for participants in the

United States is 8772935491 (conference ID 9939707).

International callers should dial +1 9144958526 (conference ID

9939707). Please dial in at least five minutes prior to the call to

register. The call may also be accessed via an audio webcast

available at https://edge.media-server.com/mmc/p/itnuz76f

About Ferroglobe

Ferroglobe is one of the world’s leading

suppliers of silicon metal, silicon-based and manganese-based

specialty alloys and ferroalloys, serving a customer base across

the globe in dynamic and fast-growing end markets, such as solar,

automotive, consumer products, construction and energy. The Company

is based in London. For more information,

visit http://investor.ferroglobe.com.

Forward-Looking Statements

This release contains “forward-looking

statements” within the meaning of U.S. securities laws.

Forward-looking statements are not historical facts but are based

on certain assumptions of management and describe the Company’s

future plans, strategies and expectations. Forward-looking

statements often use forward-looking terminology, including words

such as “anticipate”, “believe”, “could”, “estimate”, “expect”,

“forecast”, “guidance”, “intends”, “likely”, “may”, “plan”,

“potential”, “predicts”, “seek”, “target”, “will” and words of

similar meaning or the negative thereof.

Forward-looking statements contained in this

press release are based on information currently available to the

Company and assumptions that management believe to be reasonable,

but are inherently uncertain. As a result, Ferroglobe’s actual

results, performance or achievements may differ materially from

those expressed or implied by these forward-looking statements,

which are not guarantees of future performance and involve known

and unknown risks, uncertainties and other factors that are, in

some cases, beyond the Company’s control.

Forward-looking financial information and other

metrics presented herein represent the Company’s goals and are not

intended as guidance or projections for the periods referenced

herein or any future periods.

All information in this press release is as of

the date of its release. Ferroglobe does not undertake

any obligation to update publicly any of the forward-looking

statements contained herein to reflect new information, events or

circumstances arising after the date of this press release. You

should not place undue reliance on any forward-looking statements,

which are made only as of the date of this press release.

Non-IFRS Measures

Adjusted EBITDA, adjusted EBITDA margin,

adjusted net profit, adjusted profit per share, working capital and

net debt, are non-IFRS financial metrics that, we believe, are

pertinent measures of Ferroglobe’s success. Ferroglobe has included

these financial metrics to provide supplemental measures of its

performance. The Company believes these metrics are important

because they eliminate items that have less bearing on the

Company’s current and future operating performance and highlight

trends in its core business that may not otherwise be apparent when

relying solely on IFRS financial measures.

INVESTOR CONTACT:

Gaurav MehtaEVP – Investor

Relations Email: investor.relations@ferroglobe.com

Ferroglobe PLC and

SubsidiariesUnaudited Condensed Consolidated

Income Statement(in thousands of U.S.

dollars, except per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Nine Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

September 30, 2020 |

|

September 30, 2019 |

| Sales |

|

$ |

262,673 |

|

|

$ |

250,004 |

|

|

$ |

381,745 |

|

|

$ |

823,899 |

|

|

$ |

1,238,615 |

|

| Cost of sales |

|

|

(166,231 |

) |

|

|

(153,291 |

) |

|

|

(277,692 |

) |

|

|

(562,882 |

) |

|

|

(899,492 |

) |

| Other operating income |

|

|

7,598 |

|

|

|

10,160 |

|

|

|

13,215 |

|

|

|

25,526 |

|

|

|

41,766 |

|

| Staff costs |

|

|

(56,329 |

) |

|

|

(48,912 |

) |

|

|

(72,536 |

) |

|

|

(160,338 |

) |

|

|

(221,651 |

) |

| Other operating expense |

|

|

(26,896 |

) |

|

|

(35,953 |

) |

|

|

(50,060 |

) |

|

|

(102,915 |

) |

|

|

(166,901 |

) |

| Depreciation and amortization

charges, operating allowances and write-downs |

|

|

(26,524 |

) |

|

|

(27,459 |

) |

|

|

(29,591 |

) |

|

|

(82,651 |

) |

|

|

(90,165 |

) |

| Impairment losses |

|

|

(34,269 |

) |

|

|

— |

|

|

|

(174,018 |

) |

|

|

(34,269 |

) |

|

|

(175,353 |

) |

| Other gain (loss) |

|

|

1,212 |

|

|

|

85 |

|

|

|

(3,774 |

) |

|

|

625 |

|

|

|

(3,896 |

) |

| Operating (loss)

profit |

|

|

(38,766 |

) |

|

|

(5,365 |

) |

|

|

(212,711 |

) |

|

|

(93,005 |

) |

|

|

(277,077 |

) |

| Net finance expense |

|

|

(13,985 |

) |

|

|

(16,693 |

) |

|

|

(16,491 |

) |

|

|

(47,162 |

) |

|

|

(45,361 |

) |

| Financial derivatives (loss)

gain |

|

|

— |

|

|

|

— |

|

|

|

2,913 |

|

|

|

3,168 |

|

|

|

3,882 |

|

| Exchange differences |

|

|

13,157 |

|

|

|

2,633 |

|

|

|

(5,083 |

) |

|

|

18,226 |

|

|

|

(1,482 |

) |

| (Loss) profit before

tax |

|

|

(39,594 |

) |

|

|

(19,425 |

) |

|

|

(231,372 |

) |

|

|

(118,773 |

) |

|

|

(320,038 |

) |

| Income tax benefit

(expense) |

|

|

(1,841 |

) |

|

|

5,390 |

|

|

|

14,322 |

|

|

|

14,245 |

|

|

|

27,422 |

|

| (Loss) profit for the

period from continuing operations |

|

|

(41,435 |

) |

|

|

(14,035 |

) |

|

|

(217,050 |

) |

|

|

(104,528 |

) |

|

|

(292,616 |

) |

| Profit for the period from

discontinued operations |

|

|

(5,399 |

) |

|

|

— |

|

|

|

76,911 |

|

|

|

(5,399 |

) |

|

|

80,265 |

|

| (Loss) profit for the

period |

|

|

(46,834 |

) |

|

|

(14,035 |

) |

|

|

(140,139 |

) |

|

|

(109,927 |

) |

|

|

(212,351 |

) |

| Loss (profit) attributable to

non-controlling interest |

|

|

(450 |

) |

|

|

1,928 |

|

|

|

(385 |

) |

|

|

2,638 |

|

|

|

4,174 |

|

| (Loss) profit

attributable to the parent |

|

$ |

(47,284 |

) |

|

$ |

(12,107 |

) |

|

$ |

(140,524 |

) |

|

$ |

(107,289 |

) |

|

$ |

(208,177 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

(12,242 |

) |

|

$ |

22,093 |

|

|

$ |

(183,120 |

) |

|

$ |

(10,354 |

) |

|

$ |

(186,912 |

) |

| Adjusted EBITDA |

|

$ |

22,231 |

|

|

$ |

22,413 |

|

|

$ |

(7,210 |

) |

|

$ |

27,027 |

|

|

$ |

1,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

169,261 |

|

|

|

169,254 |

|

|

|

169,123 |

|

|

|

169,261 |

|

|

|

169,123 |

|

|

Diluted |

|

|

169,261 |

|

|

|

169,254 |

|

|

|

169,123 |

|

|

|

169,261 |

|

|

|

169,123 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) profit per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.28 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.83 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.23 |

) |

|

Diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.83 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.23 |

) |

Ferroglobe PLC and

SubsidiariesUnaudited Condensed Consolidated

Statement of Financial Position(in thousands of

U.S. dollars)

| |

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

June 30, |

|

December 31, |

| |

|

2020 |

|

2020 |

|

2019 |

|

ASSETS |

| Non-current

assets |

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

$ |

|

29,702 |

|

$ |

29,702 |

|

$ |

29,702 |

|

Other intangible assets |

|

|

|

18,876 |

|

|

45,655 |

|

|

51,267 |

|

Property, plant and equipment |

|

|

|

640,211 |

|

|

677,081 |

|

|

740,906 |

|

Other non-current financial assets |

|

|

|

6,227 |

|

|

6,404 |

|

|

2,618 |

|

Deferred tax assets |

|

|

|

50,939 |

|

|

43,102 |

|

|

59,551 |

|

Non-current receivables from related parties |

|

|

|

2,343 |

|

|

2,240 |

|

|

2,247 |

|

Other non-current assets |

|

|

|

4,960 |

|

|

4,228 |

|

|

1,597 |

|

Non-current restricted cash and cash equivalents |

|

|

|

28,551 |

|

|

28,366 |

|

|

28,323 |

| Total non-current

assets |

|

|

|

781,809 |

|

|

836,778 |

|

|

916,211 |

| Current

assets |

|

|

|

|

|

|

|

|

|

|

|

Inventories |

|

|

|

311,269 |

|

|

305,438 |

|

|

354,121 |

|

Trade and other receivables |

|

|

|

179,432 |

|

|

172,036 |

|

|

309,064 |

|

Current receivables from related parties |

|

|

|

3,055 |

|

|

2,955 |

|

|

2,955 |

|

Current income tax assets |

|

|

|

11,264 |

|

|

12,151 |

|

|

27,930 |

|

Other current financial assets |

|

|

|

2,360 |

|

|

4,791 |

|

|

5,544 |

|

Other current assets |

|

|

|

18,199 |

|

|

22,602 |

|

|

23,676 |

|

Cash and cash equivalents * |

|

|

|

118,874 |

|

|

124,876 |

|

|

94,852 |

| Total current

assets |

|

|

|

644,453 |

|

|

644,849 |

|

|

818,142 |

| Total

assets |

|

$ |

|

1,426,262 |

|

$ |

1,481,627 |

|

$ |

1,734,353 |

| |

|

|

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

| Equity |

|

$ |

|

483,487 |

|

$ |

519,974 |

|

$ |

602,297 |

| Non-current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

Deferred income |

|

|

|

7,454 |

|

|

4,983 |

|

|

1,253 |

|

Provisions |

|

|

|

84,779 |

|

|

81,659 |

|

|

84,852 |

|

Bank borrowings |

|

|

|

31,958 |

|

|

92,552 |

|

|

144,388 |

|

Lease liabilities |

|

|

|

12,655 |

|

|

13,512 |

|

|

16,972 |

|

Debt instruments |

|

|

|

345,941 |

|

|

345,284 |

|

|

344,014 |

|

Other financial liabilities |

|

|

|

32,554 |

|

|

33,316 |

|

|

43,157 |

|

Other non-current liabilities |

|

|

|

16,678 |

|

|

25,785 |

|

|

25,906 |

|

Deferred tax liabilities |

|

|

|

47,633 |

|

|

40,162 |

|

|

74,057 |

| Total non-current

liabilities |

|

|

|

579,652 |

|

|

637,252 |

|

|

734,599 |

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

Provisions |

|

|

|

38,121 |

|

|

37,367 |

|

|

46,091 |

|

Bank borrowings |

|

|

|

59,318 |

|

|

245 |

|

|

14,611 |

|

Lease liabilities |

|

|

|

7,960 |

|

|

8,592 |

|

|

8,900 |

|

Debt instruments |

|

|

|

2,697 |

|

|

10,994 |

|

|

10,937 |

|

Other financial liabilities |

|

|

|

28,016 |

|

|

26,318 |

|

|

23,382 |

|

Payables to related parties |

|

|

|

4,162 |

|

|

2,056 |

|

|

4,830 |

|

Trade and other payables |

|

|

|

136,371 |

|

|

156,053 |

|

|

189,229 |

|

Current income tax liabilities |

|

|

|

140 |

|

|

2,146 |

|

|

3,048 |

|

Other current liabilities |

|

|

|

86,338 |

|

|

80,630 |

|

|

96,429 |

|

Liabilities associated with assets classified as held for sale |

|

|

|

— |

|

|

— |

|

|

— |

| Total current

liabilities |

|

|

|

363,123 |

|

|

324,401 |

|

|

397,457 |

| Total equity and

liabilities |

|

$ |

|

1,426,262 |

|

$ |

1,481,627 |

|

$ |

1,734,353 |

*Cash and cash equivalents at September 30, 2020

includes the cash balance of the group’s European A/R

securitization program of $41,016 ($38,961 and $38,778 at June 30,

2020 and December 31, 2019, respectively)

Ferroglobe PLC and

SubsidiariesUnaudited Condensed Consolidated

Statement of Cash Flows(in thousands of U.S.

dollars)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended * |

|

|

Nine Months Ended |

|

|

Nine Months Ended * |

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

|

September 30, 2020 |

|

|

September 30, 2019 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) profit for the

period |

|

$ |

(46,834 |

) |

|

$ |

(14,035 |

) |

|

$ |

(140,139 |

) |

|

|

$ |

(109,926 |

) |

|

|

$ |

(212,351 |

) |

| Adjustments to

reconcile net (loss) profit to net cash used by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Income tax (benefit) expense |

|

|

1,841 |

|

|

|

(5,390 |

) |

|

|

(14,489 |

) |

|

|

|

(14,245 |

) |

|

|

|

(26,408 |

) |

|

Depreciation and amortization charges, operating allowances and

write-downs |

|

|

26,524 |

|

|

|

27,459 |

|

|

|

29,591 |

|

|

|

|

82,651 |

|

|

|

|

92,995 |

|

|

Net finance expense |

|

|

13,985 |

|

|

|

16,693 |

|

|

|

20,893 |

|

|

|

|

47,162 |

|

|

|

|

51,794 |

|

|

Financial derivatives loss (gain) |

|

|

— |

|

|

|

— |

|

|

|

(2,913 |

) |

|

|

|

(3,168 |

) |

|

|

|

(3,882 |

) |

|

Exchange differences |

|

|

(13,157 |

) |

|

|

(2,633 |

) |

|

|

5,083 |

|

|

|

|

(18,226 |

) |

|

|

|

1,482 |

|

|

Impairment losses |

|

|

34,269 |

|

|

|

— |

|

|

|

174,018 |

|

|

|

|

34,269 |

|

|

|

|

175,353 |

|

|

Net loss (gain) due to changes in the value of asset |

|

|

— |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Bargain purchase gain |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

Gain on disposal of discontinued operation |

|

|

5,399 |

|

|

|

— |

|

|

|

(80,729 |

) |

|

|

|

5,399 |

|

|

|

|

(80,729 |

) |

|

Share-based compensation |

|

|

323 |

|

|

|

704 |

|

|

|

1,015 |

|

|

|

|

1,749 |

|

|

|

|

3,280 |

|

|

Other adjustments |

|

|

(8,774 |

) |

|

|

(85 |

) |

|

|

3,774 |

|

|

|

|

(8,188 |

) |

|

|

|

3,896 |

|

| Changes in operating

assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(Increase) decrease in inventories |

|

|

3,725 |

|

|

|

(12,471 |

) |

|

|

5,953 |

|

|

|

|

42,831 |

|

|

|

|

(40,962 |

) |

|

(Increase) decrease in trade receivables |

|

|

(4,731 |

) |

|

|

45,537 |

|

|

|

5,568 |

|

|

|

|

124,638 |

|

|

|

|

1,623 |

|

|

Increase (decrease) in trade payables |

|

|

(20,359 |

) |

|

|

(4,875 |

) |

|

|

(10,693 |

) |

|

|

|

(50,738 |

) |

|

|

|

(12,035 |

) |

|

Other |

|

|

31,410 |

|

|

|

(16,287 |

) |

|

|

(59,689 |

) |

|

|

|

3,525 |

|

|

|

|

(21,430 |

) |

| Income taxes paid |

|

|

(633 |

) |

|

|

3,522 |

|

|

|

(846 |

) |

|

|

|

13,008 |

|

|

|

|

(3,066 |

) |

| Net cash provided

(used) by operating activities |

|

|

22,988 |

|

|

|

38,139 |

|

|

|

(63,603 |

) |

|

|

|

150,741 |

|

|

|

|

(70,440 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and finance income

received |

|

|

278 |

|

|

|

85 |

|

|

|

626 |

|

|

|

|

617 |

|

|

|

|

1,502 |

|

| Payments due to

investments: |

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Acquisition of subsidiary |

|

|

— |

|

|

|

— |

|

|

|

9,088 |

|

|

|

|

— |

|

|

|

|

9,088 |

|

|

Other intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

(184 |

) |

|

Property, plant and equipment |

|

|

(8,734 |

) |

|

|

(5,056 |

) |

|

|

(6,269 |

) |

|

|

|

(18,396 |

) |

|

|

|

(26,845 |

) |

|

Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

(627 |

) |

|

Disposals: |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Disposal of subsidiaries |

|

|

— |

|

|

|

— |

|

|

|

171,058 |

|

|

|

|

— |

|

|

|

|

171,058 |

|

|

Other non-current assets |

|

|

46 |

|

|

|

— |

|

|

|

— |

|

|

|

|

46 |

|

|

|

|

— |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

19 |

|

|

|

|

— |

|

|

|

|

3,416 |

|

| Net cash (used)

provided by investing activities |

|

|

(8,410 |

) |

|

|

(4,971 |

) |

|

|

174,522 |

|

|

|

|

(17,733 |

) |

|

|

|

157,408 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

| Payment for debt issuance

costs |

|

|

(608 |

) |

|

|

(279 |

) |

|

|

(2,093 |

) |

|

|

|

(2,463 |

) |

|

|

|

(2,798 |

) |

| Repayment of hydro leases |

|

|

— |

|

|

|

— |

|

|

|

(55,352 |

) |

|

|

|

— |

|

|

|

|

(55,352 |

) |

| Repayment of other financial

liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

| Increase/(decrease) in

bank borrowings: |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Borrowings |

|

|

8,022 |

|

|

|

— |

|

|

|

— |

|

|

|

|

8,022 |

|

|

|

|

71,499 |

|

|

Payments |

|

|

(7,800 |

) |

|

|

(20,680 |

) |

|

|

(21,038 |

) |

|

|

|

(73,360 |

) |

|

|

|

(60,101 |

) |

| Proceeds from stock option

exercises |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

| Amounts paid due to

leases |

|

|

(2,463 |

) |

|

|

(2,418 |

) |

|

|

— |

|

|

|

|

(7,342 |

) |

|

|

|

(22,268 |

) |

| Other amounts received/(paid)

due to financing activities |

|

|

— |

|

|

|

— |

|

|

|

(9,324 |

) |

|

|

|

3,608 |

|

|

|

|

— |

|

| Payments to acquire or redeem

own shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

| Interest paid |

|

|

(17,130 |

) |

|

|

(1,131 |

) |

|

|

(18,713 |

) |

|

|

|

(37,085 |

) |

|

|

|

(40,562 |

) |

| Net cash (used)

provided by financing activities |

|

|

(19,979 |

) |

|

|

(24,508 |

) |

|

|

(106,520 |

) |

|

|

|

(108,620 |

) |

|

|

|

(109,582 |

) |

| Total net cash flows

for the period |

|

|

(5,401 |

) |

|

|

8,660 |

|

|

|

4,399 |

|

|

|

|

24,388 |

|

|

|

|

(22,614 |

) |

|

Beginning balance of cash and cash equivalents |

|

|

153,242 |

|

|

|

144,489 |

|

|

|

188,045 |

|

|

|

|

123,175 |

|

|

|

|

216,647 |

|

|

Exchange differences on cash and cash equivalents in foreign

currencies |

|

|

(416 |

) |

|

|

93 |

|

|

|

(4,401 |

) |

|

|

|

(138 |

) |

|

|

|

(5,990 |

) |

| Ending balance of cash

and cash equivalents |

|

$ |

147,425 |

|

|

$ |

153,242 |

|

|

$ |

188,043 |

|

|

|

$ |

147,425 |

|

|

|

$ |

188,043 |

|

| Cash from continuing

operations |

|

|

118,874 |

|

|

|

124,876 |

|

|

|

177,154 |

|

|

|

|

118,874 |

|

|

|

|

177,154 |

|

| Non-current restricted cash

and cash equivalents |

|

|

28,551 |

|

|

|

28,366 |

|

|

|

10,889 |

|

|

|

|

28,551 |

|

|

|

|

10,889 |

|

| Cash and restricted

cash in the statement of financial position |

|

$ |

147,425 |

|

|

$ |

153,242 |

|

|

$ |

188,043 |

|

|

|

$ |

147,425 |

|

|

|

$ |

188,043 |

|

* While in previous periods Ferroglobe presented

interest paid as cash flows from operating activities, management

deems interest paid as among activities that alter the borrowing

structure of the Company and therefore most appropriately presented

as among financing activities. This change allows for a more fair

presentation of cash flow to users of the financial statements.

Previous periods have been restated in order to show interest paid

as net cash used in financing activities.

Adjusted EBITDA

($,000):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Nine Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

September 30, 2020 |

|

September 30, 2019 |

| (Loss) profit

attributable to the parent |

|

$ |

(47,284 |

) |

|

$ |

(12,107 |

) |

|

$ |

(140,524 |

) |

|

$ |

(107,289 |

) |

|

$ |

(208,177 |

) |

| (Loss) profit for the period

from discontinued operations |

|

|

5,399 |

|

|

|

— |

|

|

|

(76,911 |

) |

|

|

5,399 |

|

|

|

(80,265 |

) |

| Loss (profit) attributable to

non-controlling interest |

|

|

450 |

|

|

|

(1,928 |

) |

|

|

385 |

|

|

|

(2,638 |

) |

|

|

(4,174 |

) |

| Income tax (benefit)

expense |

|

|

1,841 |

|

|

|

(5,390 |

) |

|

|

(14,322 |

) |

|

|

(14,245 |

) |

|

|

(27,422 |

) |

| Net finance expense |

|

|

13,985 |

|

|

|

16,693 |

|

|

|

16,491 |

|

|

|

47,162 |

|

|

|

45,361 |

|

| Financial derivatives loss

(gain) |

|

|

— |

|

|

|

— |

|

|

|

(2,913 |

) |

|

|

(3,168 |

) |

|

|

(3,882 |

) |

| Exchange differences |

|

|

(13,157 |

) |

|

|

(2,633 |

) |

|

|

5,083 |

|

|

|

(18,226 |

) |

|

|

1,482 |

|

| Depreciation and amortization

charges, operating allowances and write-downs |

|

|

26,524 |

|

|

|

27,459 |

|

|

|

29,591 |

|

|

|

82,651 |

|

|

|

90,165 |

|

| EBITDA |

|

|

(12,242 |

) |

|

|

22,093 |

|

|

|

(183,120 |

) |

|

|

(10,354 |

) |

|

|

(186,912 |

) |

| Impairment |

|

|

34,269 |

|

|

|

— |

|

|

|

174,008 |

|

|

|

34,269 |

|

|

|

174,008 |

|

| Revaluation of biological

assets |

|

|

— |

|

|

|

— |

|

|

|

1,080 |

|

|

|

— |

|

|

|

1,080 |

|

| Contract termination

costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,260 |

|

| Restructuring and termination

costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,894 |

|

| Energy: France |

|

|

— |

|

|

|

(55 |

) |

|

|

— |

|

|

|

70 |

|

|

|

— |

|

| Energy: South Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Staff Costs: South

Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

155 |

|

|

|

— |

|

| Other Idling Costs |

|

|

204 |

|

|

|

375 |

|

|

|

— |

|

|

|

2,887 |

|

|

|

— |

|

| (Loss)profit on disposal of

non-core businesses |

|

|

— |

|

|

|

— |

|

|

|

822 |

|

|

|

— |

|

|

|

822 |

|

| Adjusted

EBITDA |

|

$ |

22,231 |

|

|

$ |

22,413 |

|

|

$ |

(7,210 |

) |

|

$ |

27,027 |

|

|

$ |

1,152 |

|

Adjusted profit

attributable to Ferroglobe

($,000):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Nine Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

September 30, 2020 |

|

September 30, 2019 |

| (Loss) profit

attributable to the parent |

|

$ |

(47,284 |

) |

|

$ |

(12,107 |

) |

|

$ |

(140,524 |

) |

|

$ |

(107,289 |

) |

|

$ |

(208,177 |

) |

|

Tax rate adjustment |

|

|

14,511 |

|

|

|

826 |

|

|

|

59,717 |

|

|

|

23,761 |

|

|

|

74,990 |

|

|

Impairment |

|

|

23,303 |

|

|

|

— |

|

|

|

118,325 |

|

|

|

23,303 |

|

|

|

118,325 |

|

|

Revaluation of biological assets |

|

|

— |

|

|

|

— |

|

|

|

734 |

|

|

|

— |

|

|

|

734 |

|

|

Contract termination costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,297 |

|

|

Restructuring and termination costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,968 |

|

|

Energy: France |

|

|

— |

|

|

|

(37 |

) |

|

|

— |

|

|

|

48 |

|

|

|

— |

|

|

Energy: South Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Staff Costs: South Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

105 |

|

|

|

— |

|

|

Other Idling Costs |

|

|

139 |

|

|

|

255 |

|

|

|

— |

|

|

|

1,963 |

|

|

|

— |

|

|

(Loss) profit on disposal of non-core businesses |

|

|

— |

|

|

|

— |

|

|

|

(54,337 |

) |

|

|

— |

|

|

|

(54,337 |

) |

| Adjusted (loss) profit

attributable to the parent |

|

$ |

(9,332 |

) |

|

$ |

(11,064 |

) |

|

$ |

(16,084 |

) |

|

$ |

(58,108 |

) |

|

$ |

(60,200 |

) |

Adjusted diluted profit

per share:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Nine Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2020 |

|

June 30, 2020 |

|

September 30, 2019 |

|

September 30, 2020 |

|

September 30, 2019 |

| Diluted (loss) profit

per ordinary share |

|

$ |

(0.28 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.83 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.23 |

) |

|

Tax rate adjustment |

|

|

— |

|

|

|

0.00 |

|

|

|

0.35 |

|

|

|

0.14 |

|

|

|

0.44 |

|

|

Impairment |

|

|

0.14 |

|

|

|

— |

|

|

|

0.70 |

|

|

|

0.14 |

|

|

|

0.70 |

|

|

Revaluation of biological assets |

|

|

— |

|

|

|

— |

|

|

|

0.00 |

|

|

|

— |

|

|

|

0.00 |

|

|

Contract termination costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.04 |

|

|

Restructuring and termination costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Energy: France |

|

|

— |

|

|

|

(0.00 |

) |

|

|

— |

|

|

|

0.00 |

|

|

|

— |

|

|

Energy: South Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Staff Costs: South Africa |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.00 |

|

|

|

— |

|

|

Other Idling Costs |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

(Loss) profit on disposal of non-core businesses |

|

|

— |

|

|

|

— |

|

|

|

(0.32 |

) |

|

|

— |

|

|

|

(0.32 |

) |

| Adjusted diluted

(loss) profit per ordinary share |

|

$ |

(0.14 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.36 |

) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

| |

Date: November

23, 2020 |

| |

FERROGLOBE PLC |

| |

|

|

| |

by |

/s/

Marco Levi |

| |

|

Name: Marco Levi |

| |

|

Title: Chief Executive Officer

(Principal Executive Officer) |

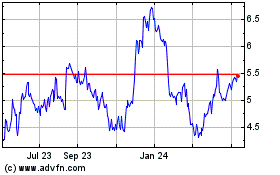

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

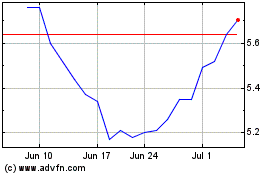

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Apr 2023 to Apr 2024