SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of September, 2019

Commission File Number: 001-37668

FERROGLOBE PLC

(Name of Registrant)

2nd Floor West Wing, Lansdowne House

57 Berkeley Square

London, W1J 6ER

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

This Form 6-K consists of the following materials, which appear immediately following this page:

|

|

·

|

|

Press release dated September 3, 2019 announcing results for the quarter ended June 30, 2019

|

|

|

·

|

|

Second quarter earnings call presentation

|

Ferroglobe Reports Second Quarter Results of 2019

Sales of $409.5 million; Net Loss of $(43.7) million; Adjusted EBITDA of $5.0 million

|

|

·

|

|

Q2 sales of $409.5 million, compared to $447.4 million in Q1 2019 and $577.9 million in Q2 2018

|

|

|

·

|

|

Q2 net loss of $(43.7) million compared to a net loss of $(28.6) million in Q1 2019 and a net profit of $66.0 million in Q2 2018

|

|

|

·

|

|

Q2 adjusted net loss attributable to parent of $(22.2) million compared to a net loss of $(21.9) million in Q1 2019 and a net profit of $25.6 million in Q2 2018

|

|

|

·

|

|

Q2 adjusted EBITDA of $5.0 million compared to $3.3 million in Q1 2019 and $83.0 million in Q2 2018

|

|

|

·

|

|

Successful closing of the divestiture of FerroAtlántica, S.A.U. on August 30, 2019, resulting in gross proceeds of €156.4 million

|

|

|

·

|

|

Suspension of 39,000 tons of annual silicon metal production capacity

|

|

|

·

|

|

Progress ongoing in the refinancing of the existing Revolving Credit Facility, targeting closing around the end of Q3 2019

|

LONDON, September 03, 2019 (GLOBE NEWSWIRE) – Ferroglobe PLC (NASDAQ: GSM) (“Ferroglobe”, the “Company”, or the “Parent”), the world’s leading producer of silicon metal, and a leading silicon- and manganese-based specialty alloys producer, today announced results for the second quarter of 2019.

Earnings Highlights

In Q2 2019, Ferroglobe posted a net loss of $(43.7) million, or $(0.24) per share on a fully diluted basis. On an adjusted basis, Q2 2019 net loss was $(22.2) million, or $(0.13) per share on a fully diluted basis.

Q2 2019 reported EBITDA was $(7.1) million, down from $3.3 million in the prior quarter. On an adjusted basis, Q2 2019 EBITDA was $5.0 million, up from Q1 2019 adjusted EBITDA of $3.3 million. The Company reported an adjusted EBITDA margin of 1.2% for Q2 2019, compared to an adjusted EBITDA margin of 0.7% for Q1 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Six Months Ended

|

|

Six Months Ended

|

|

$,000 (unaudited)

|

|

June 30, 2019

|

|

March 31, 2019

|

|

June 30, 2018

|

|

June 30, 2019

|

|

June 30, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

409,479

|

|

$

|

447,391

|

|

$

|

577,881

|

|

$

|

856,870

|

|

$

|

1,126,543

|

|

Net (loss) profit

|

|

$

|

(43,658)

|

|

$

|

(28,554)

|

|

$

|

66,030

|

|

$

|

(72,212)

|

|

$

|

101,644

|

|

Diluted EPS

|

|

$

|

(0.24)

|

|

$

|

(0.16)

|

|

$

|

0.39

|

|

$

|

(0.40)

|

|

$

|

0.60

|

|

Adjusted net (loss) income attributable to the parent

|

|

$

|

(22,221)

|

|

$

|

(21,894)

|

|

$

|

25,648

|

|

$

|

(44,115)

|

|

$

|

59,323

|

|

Adjusted diluted EPS

|

|

$

|

(0.13)

|

|

$

|

(0.13)

|

|

$

|

0.14

|

|

$

|

(0.26)

|

|

$

|

0.33

|

|

Adjusted EBITDA

|

|

$

|

5,035

|

|

$

|

3,327

|

|

$

|

83,000

|

|

$

|

8,362

|

|

$

|

163,003

|

|

Adjusted EBITDA margin

|

|

|

1.2%

|

|

|

0.7%

|

|

|

14.4%

|

|

|

1.0%

|

|

|

14.5%

|

* The amounts for prior periods have been restated to reflect the impact of the profit / (loss) from discontinued operations associated with the sale of our Spanish hydroelectric plants.

Cash Flow and Balance Sheet

Cash used in operations during Q2 2019 was $(37.4) million, with working capital increasing by $59.3 million. Net debt was $478.3 million as of June 30, 2019, up from $419.7 million as of March 31, 2019.

Pedro Larrea, Ferroglobe’s Chief Executive Officer commented, “The decline in end market demand continues to put pressure on our sales prices resulting in disappointing results for the quarter. We expect these headwinds to linger in the second half of the year. Accordingly, we are focused on operational adjustments and cash generating initiatives, designed to reduce the Company’s risk profile and provide adequate resources to weather this cyclical downturn.” Mr. Larrea continued, “We are also cutting silicon production and monitoring other parts of the business for further cost reductions and operating efficiencies. The inherent flexibility in the Company’s operating platform and product base is key to positioning the Company for recovery.”

Successful closing of the divestiture of FerroAtlántica, S.A.U.

On August 30, 2019 Ferroglobe successfully completed and closed the previously-announced sale of its 100% interest in subsidiary FerroAtlántica, S.A.U. (“FerroAtlántica”) to investment vehicles affiliates with TPG Sixth Street Partners. The transaction, valued at €170 million, provides the Company with gross proceeds of €156.4 million, after closing adjustments. Further details on this transaction appear in a separate press release issued concurrently herewith.

Other recent developments

Ferroglobe is making progress in pursuing financing alternatives and other opportunities to improve its capital structure. The terms, timing and structure of such transaction(s) will depend on market conditions and ongoing discussions in the coming weeks. The Company is targeting closing this refinancing around the end of Q3 2019.

To reduce corporate overhead costs and optimize operations, the Company is moving its headquarters from London (U.K.) to Madrid (Spain). This move – expected to conclude in Q4 2019 - will consolidate key corporate functions in a single location, enhancing efficiency and management effectiveness in a lower cost environment.

To improve its production platform and release working capital, the Company has idled its silicon metal production facility at Polokwane (South Africa) and restarted one furnace at Sabon (Spain), reducing annual production capacity by 39,000 tons.

Discussion of Second Quarter 2019 Results

Sales

Sales for Q2 2019 were $409.5 million, down 8.5% compared to $447.4 million in Q1 2019. For Q2 2019, total shipments were down 6.0% and the average selling price was down 3.2% compared with Q1 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

|

|

Quarter Ended

|

|

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

|

|

June 30, 2019

|

|

March 31, 2019

|

|

Change

|

|

June 30, 2018

|

|

Change

|

|

June 30, 2019

|

|

June 30, 2018

|

|

Change

|

|

Shipments in metric tons:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal

|

|

|

54,084

|

|

|

62,269

|

|

-13.1%

|

|

|

85,913

|

|

-37.0%

|

|

|

116,353

|

|

|

177,528

|

|

-34.5%

|

|

Silicon-based Alloys

|

|

|

79,264

|

|

|

81,801

|

|

-3.1%

|

|

|

78,214

|

|

1.3%

|

|

|

161,065

|

|

|

154,542

|

|

4.2%

|

|

Manganese-based Alloys

|

|

|

99,555

|

|

|

103,669

|

|

-4.0%

|

|

|

107,457

|

|

-7.4%

|

|

|

203,224

|

|

|

178,633

|

|

13.8%

|

|

Total shipments*

|

|

|

232,903

|

|

|

247,739

|

|

-6.0%

|

|

|

271,584

|

|

-14.2%

|

|

|

480,642

|

|

|

510,703

|

|

-5.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average selling price ($/MT):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal

|

|

$

|

2,320

|

|

$

|

2,358

|

|

-1.6%

|

|

$

|

2,773

|

|

-16.3%

|

|

$

|

2,340

|

|

$

|

2,767

|

|

-15.4%

|

|

Silicon-based Alloys

|

|

$

|

1,572

|

|

$

|

1,669

|

|

-5.8%

|

|

$

|

1,908

|

|

-17.6%

|

|

$

|

1,621

|

|

$

|

1,932

|

|

-16.1%

|

|

Manganese-based Alloys

|

|

$

|

1,188

|

|

$

|

1,172

|

|

1.4%

|

|

$

|

1,304

|

|

-8.9%

|

|

$

|

1,180

|

|

$

|

1,332

|

|

-11.4%

|

|

Total*

|

|

$

|

1,582

|

|

$

|

1,634

|

|

-3.2%

|

|

$

|

1,943

|

|

-18.6%

|

|

$

|

1,609

|

|

$

|

2,013

|

|

-20.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average selling price ($/lb.):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Metal

|

|

$

|

1.05

|

|

$

|

1.07

|

|

-1.6%

|

|

$

|

1.26

|

|

-16.3%

|

|

$

|

1.06

|

|

$

|

1.26

|

|

-15.4%

|

|

Silicon-based Alloys

|

|

$

|

0.71

|

|

$

|

0.76

|

|

-5.8%

|

|

$

|

0.87

|

|

-17.6%

|

|

$

|

0.74

|

|

$

|

0.88

|

|

-16.1%

|

|

Manganese-based Alloys

|

|

$

|

0.54

|

|

$

|

0.53

|

|

1.4%

|

|

$

|

0.59

|

|

-8.9%

|

|

$

|

0.54

|

|

$

|

0.60

|

|

-11.4%

|

|

Total*

|

|

$

|

0.72

|

|

$

|

0.74

|

|

-3.2%

|

|

$

|

0.88

|

|

-18.6%

|

|

$

|

0.73

|

|

$

|

0.91

|

|

-20.1%

|

* Excludes by-products and other

Sales Prices & Volumes By Product

During Q2 2019, total product average selling prices decreased by 3.2% versus Q1 2019. Q2 average selling prices of silicon metal decreased 1.6%, silicon-based alloys decreased 5.8%, and manganese-based alloys increased 1.4%. During Q2 2019, sales volumes decreased by 6.0% versus Q1 2019. Q2 sales volumes of silicon metal decreased 13.1%, silicon-based alloys decreased 3.1%, and manganese-based alloys decreased 4.0% versus Q1 2019.

Cost of Sales

Cost of sales was $292.4 million in Q2 2019, a decrease from $329.4 million from Q1 2019. Cost of sales as a percentage of sales decreased to 71.4% in Q2 2019 from 73.6% for Q1 2019.

Other Operating Expenses

Other operating expenses was $62.9 million in Q2 2019, an increase from $53.9 million from Q1 2019, which is primarily due to contract termination costs.

Net Loss Attributable to the Parent

In Q2 2019, net loss attributable to the Parent was $(40.8) million, or $(0.24) per diluted share, compared to a net loss attributable to the Parent of $(26.8) million, or $(0.16) per diluted share in Q1 2019.

Adjusted EBITDA

In Q2 2019, adjusted EBITDA was $5.0 million, or 1.2% of sales, compared to adjusted EBITDA of $3.3 million, or 0.7% of sales in Q1 2019.

Conference Call

Ferroglobe management will review the second quarter results of 2019 during a conference call at 9:00 a.m. Eastern Time on September 4, 2019.

The dial-in number for participants in the United States is 877‑293‑5491 (conference ID 8287856). International callers should dial +1 914‑495‑8526 (conference ID 8287856). Please dial in at least five minutes prior to the call to register. The call may also be accessed via an audio webcast available at https://edge.media-server.com/mmc/p/9678r4sf.

About Ferroglobe

Ferroglobe is one of the world’s leading suppliers of silicon metal, silicon-based and manganese-based specialty alloys and other ferroalloys, serving a customer base across the globe in dynamic and fast-growing end markets, such as solar, automotive, consumer products, construction and energy. The Company is based in London. For more information, visit http://investor.ferroglobe.com.

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of U.S. securities laws. Forward-looking statements are not historical facts but are based on certain assumptions of management and describe the Company’s future plans, strategies and expectations. Forward-looking statements often use forward-looking terminology, including words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “forecast”, “guidance”, “intends”, “likely”, “may”, “plan”, “potential”, “predicts”, “seek”, “target”, “will” and words of similar meaning or the negative thereof.

Forward-looking statements contained in this press release are based on information currently available to the Company and assumptions that management believe to be reasonable, but are inherently uncertain. As a result, Ferroglobe’s actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements, which are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control.

Forward-looking financial information and other metrics presented herein represent the Company’s goals and are not intended as guidance or projections for the periods referenced herein or any future periods.

All information in this press release is as of the date of its release. Ferroglobe does not undertake any obligation to update publicly any of the forward-looking statements contained herein to reflect new information, events or circumstances arising after the date of this press release. You should not place undue reliance on any forward-looking statements, which are made only as of the date of this press release.

Non-IFRS Measures

EBITDA, adjusted EBITDA, adjusted profit per ordinary share, and adjusted profit are non-IFRS financial metrics that, we believe, are pertinent measures of Ferroglobe’s success. Ferroglobe has included these financial metrics to provide supplemental measures of its performance. The Company believes these metrics are important because they eliminate items that have less bearing on the Company’s current and future operating performance and highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures.

INVESTOR CONTACT:

Gaurav Mehta

EVP – Investor Relations

Email: investor.relations@ferroglobe.com

Ferroglobe PLC and Subsidiaries

Unaudited Condensed Consolidated Income Statement

(in thousands of U.S. dollars, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

June 30, 2019

|

|

March 31, 2019*

|

|

June 30, 2018*

|

|

June 30, 2019

|

|

June 30, 2018*

|

|

Sales

|

|

$

|

409,479

|

|

$

|

447,391

|

|

$

|

577,881

|

|

$

|

856,870

|

|

$

|

1,126,543

|

|

Cost of sales

|

|

|

(292,432)

|

|

|

(329,368)

|

|

|

(343,753)

|

|

|

(621,800)

|

|

|

(664,289)

|

|

Other operating income

|

|

|

14,530

|

|

|

14,021

|

|

|

8,512

|

|

|

28,551

|

|

|

15,295

|

|

Staff costs

|

|

|

(74,852)

|

|

|

(74,263)

|

|

|

(88,180)

|

|

|

(149,115)

|

|

|

(170,072)

|

|

Other operating expense

|

|

|

(62,924)

|

|

|

(53,917)

|

|

|

(74,212)

|

|

|

(116,841)

|

|

|

(143,303)

|

|

Depreciation and amortization charges, operating allowances and write-downs

|

|

|

(30,204)

|

|

|

(30,370)

|

|

|

(29,118)

|

|

|

(60,574)

|

|

|

(55,905)

|

|

Bargain purchase gain

|

|

|

—

|

|

|

—

|

|

|

44,633

|

|

|

—

|

|

|

44,633

|

|

Impairment losses

|

|

|

(1,195)

|

|

|

(140)

|

|

|

—

|

|

|

(1,335)

|

|

|

—

|

|

Other gain (loss)

|

|

|

275

|

|

|

(397)

|

|

|

2,752

|

|

|

(122)

|

|

|

2,715

|

|

Operating (loss) profit

|

|

|

(37,323)

|

|

|

(27,043)

|

|

|

98,515

|

|

|

(64,366)

|

|

|

155,617

|

|

Net finance expense

|

|

|

(15,047)

|

|

|

(13,823)

|

|

|

(13,233)

|

|

|

(28,870)

|

|

|

(25,300)

|

|

Financial derivatives (loss) gain

|

|

|

(295)

|

|

|

1,264

|

|

|

2,832

|

|

|

969

|

|

|

1,067

|

|

Exchange differences

|

|

|

5,080

|

|

|

(1,479)

|

|

|

(8,708)

|

|

|

3,601

|

|

|

(7,979)

|

|

(Loss) profit before tax

|

|

|

(47,585)

|

|

|

(41,081)

|

|

|

79,406

|

|

|

(88,666)

|

|

|

123,405

|

|

Income tax benefit (expense)

|

|

|

4,890

|

|

|

8,210

|

|

|

(13,970)

|

|

|

13,100

|

|

|

(27,687)

|

|

(Loss) profit for the period from continuing operations

|

|

|

(42,695)

|

|

|

(32,871)

|

|

|

65,436

|

|

|

(75,566)

|

|

|

95,718

|

|

(Loss) profit for the period from discontinued operations

|

|

|

(963)

|

|

|

4,317

|

|

|

594

|

|

|

3,354

|

|

|

5,926

|

|

(Loss) profit for the period

|

|

|

(43,658)

|

|

|

(28,554)

|

|

|

66,030

|

|

|

(72,212)

|

|

|

101,644

|

|

Loss attributable to non-controlling interest

|

|

|

2,835

|

|

|

1,724

|

|

|

1,408

|

|

|

4,559

|

|

|

2,474

|

|

(Loss) profit attributable to the parent

|

|

$

|

(40,823)

|

|

$

|

(26,830)

|

|

$

|

67,438

|

|

$

|

(67,653)

|

|

$

|

104,118

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

(7,119)

|

|

$

|

3,327

|

|

$

|

127,633

|

|

$

|

(3,792)

|

|

$

|

211,522

|

|

Adjusted EBITDA

|

|

$

|

5,035

|

|

$

|

3,327

|

|

$

|

83,000

|

|

$

|

8,362

|

|

$

|

163,003

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

169,123

|

|

|

169,123

|

|

|

171,987

|

|

|

169,123

|

|

|

171,982

|

|

Diluted

|

|

|

169,123

|

|

|

169,123

|

|

|

172,127

|

|

|

169,123

|

|

|

172,144

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) profit per ordinary share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.24)

|

|

$

|

(0.16)

|

|

$

|

0.39

|

|

$

|

(0.40)

|

|

$

|

0.61

|

|

Diluted

|

|

$

|

(0.24)

|

|

$

|

(0.16)

|

|

$

|

0.39

|

|

$

|

(0.40)

|

|

$

|

0.60

|

* The amounts for prior periods have been restated to reflect the impact of the profit / (loss) from discontinued operations associated with the sale of our Spanish hydroelectric plants.

Ferroglobe PLC and Subsidiaries

Unaudited Condensed Consolidated Statement of Financial Position

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

March 31,

|

|

December 31,

|

|

|

|

2019

|

|

2019

|

|

2018

|

|

ASSETS

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill

|

|

$

|

|

204,089

|

|

$

|

203,472

|

|

$

|

202,848

|

|

Other intangible assets

|

|

|

|

62,778

|

|

|

69,399

|

|

|

51,822

|

|

Property, plant and equipment

|

|

|

|

784,272

|

|

|

890,436

|

|

|

888,862

|

|

Other non-current financial assets

|

|

|

|

20,042

|

|

|

54,979

|

|

|

70,343

|

|

Deferred tax assets

|

|

|

|

22,915

|

|

|

7,135

|

|

|

14,589

|

|

Non-current receivables from related parties

|

|

|

|

2,276

|

|

|

2,247

|

|

|

2,288

|

|

Other non-current assets

|

|

|

|

9,746

|

|

|

10,435

|

|

|

10,486

|

|

Total non-current assets

|

|

|

|

1,106,118

|

|

|

1,238,103

|

|

|

1,241,238

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

|

504,527

|

|

|

451,753

|

|

|

456,970

|

|

Trade and other receivables

|

|

|

|

158,252

|

|

|

127,992

|

|

|

155,996

|

|

Current receivables from related parties

|

|

|

|

3,000

|

|

|

6,556

|

|

|

14,226

|

|

Current income tax assets

|

|

|

|

31,610

|

|

|

26,855

|

|

|

27,404

|

|

Other current financial assets

|

|

|

|

7,840

|

|

|

2,191

|

|

|

2,523

|

|

Other current assets

|

|

|

|

12,289

|

|

|

13,721

|

|

|

8,813

|

|

Cash and cash equivalents

|

|

|

|

187,673

|

|

|

216,627

|

|

|

216,647

|

|

Assets and disposal groups classified as held for sale

|

|

|

|

97,862

|

|

|

—

|

|

|

—

|

|

Total current assets

|

|

|

|

1,003,053

|

|

|

845,695

|

|

|

882,579

|

|

Total assets

|

|

$

|

|

2,109,171

|

|

$

|

2,083,798

|

|

$

|

2,123,817

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

|

Equity

|

|

$

|

|

816,080

|

|

$

|

855,099

|

|

$

|

884,372

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income

|

|

|

|

8,108

|

|

|

11,676

|

|

|

1,434

|

|

Provisions

|

|

|

|

80,218

|

|

|

76,613

|

|

|

75,787

|

|

Bank borrowings

|

|

|

|

—

|

|

|

131,366

|

|

|

132,821

|

|

Lease liabilities

|

|

|

|

18,629

|

|

|

66,992

|

|

|

53,472

|

|

Debt instruments

|

|

|

|

342,806

|

|

|

342,222

|

|

|

341,657

|

|

Other financial liabilities

|

|

|

|

24,585

|

|

|

27,109

|

|

|

32,788

|

|

Other non-current liabilities

|

|

|

|

25,246

|

|

|

25,080

|

|

|

25,030

|

|

Deferred tax liabilities

|

|

|

|

64,520

|

|

|

61,887

|

|

|

77,379

|

|

Total non-current liabilities

|

|

|

|

564,112

|

|

|

742,945

|

|

|

740,368

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Provisions

|

|

|

|

44,007

|

|

|

47,619

|

|

|

40,570

|

|

Bank borrowings

|

|

|

|

172,890

|

|

|

19,100

|

|

|

8,191

|

|

Lease liabilities

|

|

|

|

8,692

|

|

|

20,616

|

|

|

12,999

|

|

Debt instruments

|

|

|

|

10,938

|

|

|

2,734

|

|

|

10,937

|

|

Other financial liabilities

|

|

|

|

52,594

|

|

|

51,618

|

|

|

52,524

|

|

Payables to related parties

|

|

|

|

9,884

|

|

|

12,199

|

|

|

11,128

|

|

Trade and other payables

|

|

|

|

252,372

|

|

|

228,649

|

|

|

256,823

|

|

Current income tax liabilities

|

|

|

|

1,766

|

|

|

4,369

|

|

|

2,335

|

|

Other current liabilities

|

|

|

|

95,150

|

|

|

98,850

|

|

|

103,570

|

|

Liabilities associated with assets classified as held for sale

|

|

|

|

80,686

|

|

|

—

|

|

|

—

|

|

Total current liabilities

|

|

|

|

728,979

|

|

|

485,754

|

|

|

499,077

|

|

Total equity and liabilities

|

|

$

|

|

2,109,171

|

|

$

|

2,083,798

|

|

$

|

2,123,817

|

Ferroglobe PLC and Subsidiaries

Unaudited Condensed Consolidated Statement of Cash Flows

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

June 30, 2019

|

|

March 31, 2019

|

|

June 30, 2018

|

|

|

June 30, 2019

|

|

June 30, 2018

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) profit for the period

|

|

$

|

(43,658)

|

|

$

|

(28,554)

|

|

$

|

66,030

|

|

|

$

|

(72,212)

|

|

$

|

101,644

|

|

Adjustments to reconcile net (loss) profit

to net cash used by operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense

|

|

|

(5,215)

|

|

|

(6,704)

|

|

|

14,302

|

|

|

|

(11,919)

|

|

|

29,970

|

|

Depreciation and amortization charges,

operating allowances and write-downs

|

|

|

31,327

|

|

|

32,077

|

|

|

30,309

|

|

|

|

63,404

|

|

|

58,325

|

|

Net finance expense

|

|

|

16,145

|

|

|

14,756

|

|

|

14,412

|

|

|

|

30,901

|

|

|

27,568

|

|

Financial derivatives loss (gain)

|

|

|

295

|

|

|

(1,264)

|

|

|

(2,832)

|

|

|

|

(969)

|

|

|

(1,067)

|

|

Exchange differences

|

|

|

(5,080)

|

|

|

1,479

|

|

|

8,708

|

|

|

|

(3,601)

|

|

|

7,979

|

|

Impairment losses

|

|

|

1,195

|

|

|

140

|

|

|

—

|

|

|

|

1,335

|

|

|

—

|

|

Bargain purchase gain

|

|

|

—

|

|

|

—

|

|

|

(44,633)

|

|

|

|

—

|

|

|

(44,633)

|

|

Share-based compensation

|

|

|

933

|

|

|

1,332

|

|

|

33

|

|

|

|

2,265

|

|

|

732

|

|

Other adjustments

|

|

|

(275)

|

|

|

397

|

|

|

(2,752)

|

|

|

|

122

|

|

|

(2,715)

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in inventories

|

|

|

(46,950)

|

|

|

35

|

|

|

(59,050)

|

|

|

|

(46,915)

|

|

|

(166,531)

|

|

(Increase) decrease in trade receivables

|

|

|

(32,316)

|

|

|

28,371

|

|

|

(19,257)

|

|

|

|

(3,945)

|

|

|

(19,770)

|

|

Increase (decrease) in trade payables

|

|

|

21,625

|

|

|

(22,967)

|

|

|

476

|

|

|

|

(1,342)

|

|

|

70,851

|

|

Other

|

|

|

28,472

|

|

|

9,787

|

|

|

6,817

|

|

|

|

38,259

|

|

|

(42,953)

|

|

Income taxes paid

|

|

|

(540)

|

|

|

(1,680)

|

|

|

(14,186)

|

|

|

|

(2,220)

|

|

|

(24,168)

|

|

Interest paid

|

|

|

(3,341)

|

|

|

(18,508)

|

|

|

(2,957)

|

|

|

|

(21,849)

|

|

|

(20,258)

|

|

Net cash (used) provided by operating activities

|

|

|

(37,383)

|

|

|

8,697

|

|

|

(4,580)

|

|

|

|

(28,686)

|

|

|

(25,026)

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and finance income received

|

|

|

486

|

|

|

390

|

|

|

2,273

|

|

|

|

876

|

|

|

2,352

|

|

Payments due to investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of subsidiary

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

—

|

|

|

(20,379)

|

|

Other intangible assets

|

|

|

(50)

|

|

|

(134)

|

|

|

(2,221)

|

|

|

|

(184)

|

|

|

(2,924)

|

|

Property, plant and equipment

|

|

|

(7,128)

|

|

|

(13,448)

|

|

|

(29,786)

|

|

|

|

(20,576)

|

|

|

(52,317)

|

|

Other

|

|

|

(627)

|

|

|

—

|

|

|

—

|

|

|

|

(627)

|

|

|

—

|

|

Disposals:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other non-current assets

|

|

|

—

|

|

|

—

|

|

|

12,734

|

|

|

|

—

|

|

|

12,734

|

|

Other

|

|

|

1,638

|

|

|

1,759

|

|

|

1,904

|

|

|

|

3,397

|

|

|

5,914

|

|

Net cash used by investing activities

|

|

|

(5,681)

|

|

|

(11,433)

|

|

|

(15,096)

|

|

|

|

(17,114)

|

|

|

(54,620)

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

—

|

|

|

—

|

|

|

(10,321)

|

|

|

|

—

|

|

|

(10,321)

|

|

Payment for debt issuance costs

|

|

|

—

|

|

|

(705)

|

|

|

—

|

|

|

|

(705)

|

|

|

(4,476)

|

|

Repayment of other financial liabilities

|

|

|

—

|

|

|

—

|

|

|

(33,096)

|

|

|

|

—

|

|

|

(33,096)

|

|

Increase/(decrease) in bank borrowings:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings

|

|

|

39,649

|

|

|

31,850

|

|

|

37,668

|

|

|

|

71,499

|

|

|

220,032

|

|

Payments

|

|

|

(18,252)

|

|

|

(20,811)

|

|

|

—

|

|

|

|

(39,063)

|

|

|

(106,514)

|

|

Proceeds from stock option exercises

|

|

|

—

|

|

|

—

|

|

|

240

|

|

|

|

—

|

|

|

240

|

|

Other amounts paid due to financing activities

|

|

|

(7,236)

|

|

|

(5,708)

|

|

|

(4,648)

|

|

|

|

(12,944)

|

|

|

(7,635)

|

|

Net cash provided (used) by financing activities

|

|

|

14,161

|

|

|

4,626

|

|

|

(10,157)

|

|

|

|

18,787

|

|

|

58,230

|

|

Total net cash flows for the period

|

|

|

(28,903)

|

|

|

1,890

|

|

|

(29,833)

|

|

|

|

(27,013)

|

|

|

(21,416)

|

|

Beginning balance of cash and cash equivalents

|

|

|

216,627

|

|

|

216,647

|

|

|

197,669

|

|

|

|

216,647

|

|

|

184,472

|

|

Exchange differences on cash and

cash equivalents in foreign currencies

|

|

|

321

|

|

|

(1,910)

|

|

|

(11,852)

|

|

|

|

(1,589)

|

|

|

(7,072)

|

|

Ending balance of cash and cash equivalents

|

|

$

|

188,045

|

|

$

|

216,627

|

|

$

|

155,984

|

|

|

$

|

188,045

|

|

$

|

155,984

|

|

Ending balance of cash and cash equivalents from statement of financial position

|

|

|

187,673

|

|

|

216,627

|

|

|

155,984

|

|

|

|

187,673

|

|

|

155,984

|

|

Ending balance of cash and cash equivalents included within assets and disposal groups classified as held for sale

|

|

|

372

|

|

|

—

|

|

|

—

|

|

|

|

372

|

|

|

—

|

Adjusted EBITDA ($,000):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

June 30, 2019

|

|

March 31, 2019

|

|

June 30, 2018

|

|

June 30, 2019

|

|

June 30, 2018

|

|

(Loss) profit attributable to the parent

|

|

$

|

(40,823)

|

|

$

|

(26,830)

|

|

$

|

67,438

|

|

$

|

(67,653)

|

|

$

|

104,118

|

|

Loss (profit) for the period from discontinued operations

|

|

|

963

|

|

|

(4,317)

|

|

|

(594)

|

|

|

(3,354)

|

|

|

(5,926)

|

|

Loss attributable to non-controlling interest

|

|

|

(2,835)

|

|

|

(1,724)

|

|

|

(1,408)

|

|

|

(4,559)

|

|

|

(2,474)

|

|

Income tax (benefit) expense

|

|

|

(4,890)

|

|

|

(8,210)

|

|

|

13,970

|

|

|

(13,100)

|

|

|

27,687

|

|

Net finance expense

|

|

|

15,047

|

|

|

13,823

|

|

|

13,233

|

|

|

28,870

|

|

|

25,300

|

|

Financial derivatives loss (gain)

|

|

|

295

|

|

|

(1,264)

|

|

|

(2,832)

|

|

|

(969)

|

|

|

(1,067)

|

|

Exchange differences

|

|

|

(5,080)

|

|

|

1,479

|

|

|

8,708

|

|

|

(3,601)

|

|

|

7,979

|

|

Depreciation and amortization charges, operating allowances and write-downs

|

|

|

30,204

|

|

|

30,370

|

|

|

29,118

|

|

|

60,574

|

|

|

55,905

|

|

EBITDA

|

|

|

(7,119)

|

|

|

3,327

|

|

|

127,633

|

|

|

(3,792)

|

|

|

211,522

|

|

Contract termination costs

|

|

|

9,260

|

|

|

—

|

|

|

—

|

|

|

9,260

|

|

|

—

|

|

Restructuring and termination costs

|

|

|

2,894

|

|

|

—

|

|

|

—

|

|

|

2,894

|

|

|

—

|

|

Bargain purchase gain

|

|

|

—

|

|

|

—

|

|

|

(44,633)

|

|

|

—

|

|

|

(44,633)

|

|

Share-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(3,886)

|

|

Adjusted EBITDA

|

|

$

|

5,035

|

|

$

|

3,327

|

|

$

|

83,000

|

|

$

|

8,362

|

|

$

|

163,003

|

Adjusted profit attributable to Ferroglobe ($,000):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

June 30, 2019

|

|

March 31, 2019

|

|

June 30, 2018

|

|

June 30, 2019

|

|

June 30, 2018

|

|

(Loss) profit attributable to the parent

|

|

$

|

(40,823)

|

|

$

|

(26,830)

|

|

$

|

67,438

|

|

$

|

(67,653)

|

|

$

|

104,118

|

|

Tax rate adjustment

|

|

|

10,337

|

|

|

4,936

|

|

|

(11,440)

|

|

|

15,273

|

|

|

(11,803)

|

|

Contract termination costs

|

|

|

6,297

|

|

|

—

|

|

|

—

|

|

|

6,297

|

|

|

—

|

|

Restructuring and termination costs

|

|

|

1,968

|

|

|

—

|

|

|

—

|

|

|

1,968

|

|

|

—

|

|

Bargain purchase gain

|

|

|

—

|

|

|

—

|

|

|

(30,350)

|

|

|

—

|

|

|

(30,350)

|

|

Share-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(2,642)

|

|

Adjusted (loss) profit attributable to the parent

|

|

$

|

(22,221)

|

|

$

|

(21,894)

|

|

$

|

25,648

|

|

$

|

(44,115)

|

|

$

|

59,323

|

Adjusted diluted profit per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Quarter Ended

|

|

Six Months Ended

|

|

Six Months Ended

|

|

|

|

June 30, 2019

|

|

March 31, 2019

|

|

June 30, 2018

|

|

June 30, 2019

|

|

June 30, 2018

|

|

Diluted (loss) profit per ordinary share

|

|

$

|

(0.24)

|

|

$

|

(0.16)

|

|

$

|

0.39

|

|

$

|

(0.40)

|

|

$

|

0.60

|

|

Tax rate adjustment

|

|

|

0.06

|

|

|

0.03

|

|

|

(0.07)

|

|

|

0.09

|

|

|

(0.07)

|

|

Contract termination costs

|

|

|

0.04

|

|

|

—

|

|

|

—

|

|

|

0.04

|

|

|

—

|

|

Restructuring and termination costs

|

|

|

0.01

|

|

|

—

|

|

|

—

|

|

|

0.01

|

|

|

—

|

|

Bargain purchase gain

|

|

|

—

|

|

|

—

|

|

|

(0.18)

|

|

|

—

|

|

|

(0.18)

|

|

Share-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(0.02)

|

|

Adjusted diluted (loss) profit per ordinary share

|

|

$

|

(0.13)

|

|

$

|

(0.13)

|

|

$

|

0.14

|

|

$

|

(0.26)

|

|

$

|

0.33

|

|

|

Advancing Materials Innovation NASDAQ: GSM Second Quarter 2019

|

|

|

Forward-Looking Statements and non-IFRS Financial Metrics This presentation contains forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts but are based on certain assumptions of management and describe our future plans, strategies and expectations. Forward-looking statements can generally be identified by the use of forward-looking terminology, including, but not limited to, "may," “could,” “seek,” “guidance,” “predict,” “potential,” “likely,” "believe," "will," "expect," "anticipate," "estimate," "plan," "intend," "forecast," “aim,” “target,” or variations of these terms and similar expressions, or the negative of these terms or similar expressions. Forward-looking statements contained in this presentation are based on information presently available to Ferroglobe PLC (“we,” “us,” “Ferroglobe,” the “Company” or the “Parent”) and assumptions that we believe to be reasonable, but are inherently uncertain. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements, which are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond our control. You are cautioned that all such statements involve risks and uncertainties, including without limitation, risks that Ferroglobe will not successfully integrate the businesses of Globe Specialty Metals, Inc. and Grupo FerroAtlántica SAU, that we will not realize estimated cost savings, value of certain tax assets, synergies and growth, and/or that such benefits may take longer to realize than expected. Important factors that may cause actual results to differ include, but are not limited to: (i) risks relating to unanticipated costs of integration, including operating costs, customer loss and business disruption being greater than expected; (ii) our organizational and governance structure; (iii) the ability to hire and retain key personnel; (iv) regional, national or global political, economic, business, competitive, market and regulatory conditions including, among others, changes in metals prices; (v) increases in the cost of raw materials or energy; (vi) competition in the metals and foundry industries; (vii) environmental and regulatory risks; (viii) ability to identify liabilities associated with acquired properties prior to their acquisition; (ix) ability to manage price and operational risks including industrial accidents and natural disasters; (x) ability to manage foreign operations; (xi) changes in technology; (xii) ability to acquire or renew permits and approvals; (xiii) changes in legislation or governmental regulations affecting Ferroglobe; (xiv) conditions in the credit markets; (xv) risks associated with assumptions made in connection with critical accounting estimates and legal proceedings; (xvi) Ferroglobe's international operations, which are subject to the risks of currency fluctuations and foreign exchange controls; and (xvii) the potential of international unrest, economic downturn or effects of currencies, tax assessments, tax adjustments, anticipated tax rates, raw material costs or availability or other regulatory compliance costs. The foregoing list is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect our business, including those described in the “Risk Factors” section of our Registration Statement on Form F-1, Annual Reports on Form 20-F, Current Reports on Form 6-K and other documents we file from time to time with the United States Securities and Exchange Commission. We do not give any assurance (1) that we will achieve our expectations or (2) concerning any result or the timing thereof, in each case, with respect to any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results. Forward- looking financial information and other metrics presented herein represent our key goals and are not intended as guidance or projections for the periods presented herein or any future periods. We do not undertake or assume any obligation to update publicly any of the forward-looking statements in this presentation to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this presentation. EBITDA, adjusted EBITDA, adjusted diluted profit (loss) per ordinary share and adjusted profit (loss) attributable to Ferroglobe are, we believe, pertinent non-IFRS financial metrics that Ferroglobe utilizes to measure its success. The Company has included these financial metrics to provide supplemental measures of its performance. We believe these metrics are important because they eliminate items that have less bearing on the Company’s current and future operating performance and highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. For additional information, including a reconciliation of the differences between such non-IFRS financial measures and the comparable IFRS financial measures, refer to the press release dated September 3, 2019 accompanying this presentation, which is incorporated by reference herein.

|

|

|

Table of Contents Q2 2019 overview Update on corporate initiatives Near-term outlook Appendix — supplemental financial information

|

|

|

Opening remarks Q2 results reflect the continued slowdown in end-market demand and weak pricing environment Successful closing of FerroAtlántica1 divestiture significantly improves balance sheet Focus on improving operational and financial flexibility Note: 1 FerroAtlántica, SAU is the owner of ten hydroelectric facilities, and of the Cee-Dumbría ferroalloys plant

|

|

|

I. Q2 2019 overview

|

|

|

* Adjusted net loss attributable to parent Note: The amounts for prior periods have been restated to show the results of Spanish hydroelectric plants within (Loss) profit for the period from discontinued operations Volumes slowdown driven by shift in end customer sentiment (Volume change vs Q1 2019) Si Metal -13.1% Si alloys -3.1% Mn alloys -4.0% (ASP change vs Q1 2019) Si Metal -1.6% Si alloys -5.8% Mn alloys +1.4% Adjusted EBITDA $5.0 million +51.3% vs Q1 2019 Adjusted EBITDA margin increase of 49 bps to 1.2% Q2 adjusted net loss $-22.2 million* Additional production cutbacks to address demand slowdown Focus on strengthening the balance sheet Cost cutting and cash generation initiatives in place Review of power contracts and other constraints that reduce operating flexibility Adjusting commercial strategy for the current environment Ongoing actions to ‘right-size’ the platform Revenue $409.5 million -8.5% vs Q1 2019 Q2 2019 impacted by demand slowdown and continued pricing pressures, partially offset by cost improvements

|

|

|

Quarterly trend – revenue contribution per family of products ($m) Quarterly trend – adjusted EBITDA ($m) Quarterly sales decreased by 8.5% in Q2 vs. Q1, while Adjusted EBITDA increased 51% Note: The amounts for prior periods have been restated to show the results of Spanish hydroelectric plants within (Loss) profit for the period from discontinued operations. 447 409 591 525 578 549 466 452 424 391 388 363 12.2 7.2 27.8 44.0 56.7 54.2 80.0 83.0 43.8 23.2 3.3 5.0 Q3-2016 Q4-2016 Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Q2-2018 Q3-2018 Q4-2018 Q1-2019 Q2-2019 169 174 158 183 194 204 253 238 215 227 147 125 97 105 111 112 110 123 149 149 137 140 137 125 51 70 83 84 99 97 98 140 119 171 122 118 46 39 39 45 49 42 49 51 54 53 41 41 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Silicon Metal Si-based Alloys Mn-based Alloys Energy & Other Business

|

|

|

Declining pricing environment driving weaker quarter performance Declining pricing environment continues to constrain quarterly performance Lower commodity prices and increased operating efficiency have improved cost profile Adjusted EBITDA bridge Q2 2019 vs Q1 2019 Quarter-over-quarter evolution ($m) Note: 1 Represents the results of Spanish hydroelectric plants Includes: $3.5m of Mn ore cost improvements $5.8m savings from power prices in Spain, France and the U.S. 1 11.8 3.3 5.0 - 8.5 - 2.7 - 6.5 14.2 0.7 - 4.0 Adjusted EBITDA Q1 2019 Adjusted EBITDA from Discontinued Assets Pro Forma Adjusted EBITDA Q1 2019 Volume Price Cost Mining Other Adjusted EBITDA Q2 2019

|

|

|

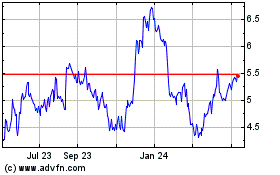

Volume trends Sequential quarters EBITDA evolution ($m) Commentary Pricing trends ($/mt) Silicon metal snapshot Significant demand slowdown across the auto, chemicals and solar end markets Continuous effort to right-size the production base: Additional production cutback in Polokwane (South Africa) also addresses working capital build up Selling prices in Q2 bolstered by fixed price contracts and by floors in some index priced contracts Index prices appear to be stabilizing during Q3, with signs of support in China and Europe 8.3 8.1 - 1.4 - 1.9 3.1 Q1'19 Volume Price Cost Q2'19 75,753 82,881 83,465 83,785 91,615 85,913 81,686 93,364 62,269 54,084 1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 2Q-18 3Q-18 4Q-18 Q1- 19 Q2- 19 1,500 1,700 1,900 2,100 2,300 2,500 2,700 2,900 3,100 3,300 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 SiMe US Index ($) SiMe EU Index ($) SiMe FG Avg. Selling Price ($)

|

|

|

Pro forma silicon metal capacity (‘000 tons annual production capacity, excl. third party share of JV) Source: Ferroglobe End of 2017: all SiM furnaces running except: 2 furnaces Polokwane 1 furnace Sabón (FeSi) + 2 furnaces Polokwane - 2 furnaces Selma - 1 furnace Beverly - 2 furnaces Château-Feuillet - 1 furnace Laudun - 2 furnaces Niagara Falls - 1 furnace Sabón Plan for 2019 Enough capacity for sales of 300kt, with inventory reduction Fast response additional capacity - 3 furnaces Polokwane + 1 furnace Sabón Adapted plan for H2 2019 Release working capital Minimize loss-making operations Capacity management is adapting to demand slowdown by idling facilities that can be swiftly restarted when demand recovers 364 404 328 281 242 Q4 2017 Q2 2018 Dec 2018 Q1 2019 Q3 2019

|

|

|

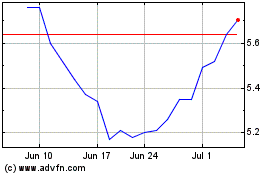

Volume trends Commentary Sequential quarters EBITDA evolution ($m) Silicon-based alloys snapshot Pricing trends ($/mt) FeSi index pricing has continued to erode during Q2 and into Q3 to levels likely to generate losses across a significant part of the industry Volumes remain strong, despite ongoing perception of steel industry slowdown resulting from the trade war Foundry products and CaSi (44% of Si-based alloys revenues) remain at healthy stable prices and strong volumes Focus on increasing sales of more profitable specialty-grade FeSi (19% of Si-based alloys revenues) 7.8 11.4 - 1.0 - 7.2 11.8 Q1'19 Volume Price Cost Q2'19 75,386 70,913 66,873 70,399 76,328 78,214 75,964 81,197 81,801 79,264 1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 2Q-18 3Q-18 4Q-18 Q1- 19 Q2- 19 1,000 1,200 1,400 1,600 1,800 2,000 2,200 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 FeSi US Index ($) Si Alloys FG Avg. Selling Price ($) FeSi EU Index ($)

|

|

|

Volume trends Commentary Sequential quarters EBITDA evolution ($m) Manganese-based alloys snapshot Pricing trends ($/mt) Index prices in Europe largely stable throughout the past 12 months Continuous ore price decline is starting to have positive impact on production costs Other production costs negatively impacted by various operational incidents, with improvements in operational efficiency starting positively to affect underlying cost base Volumes strong, adapted to reduced production capacity in 2019 0.9 1.9 - 0.4 1.2 3.5 - 3.3 Q1'19 Volume Price Manganese Ore Cost Q2'19 63,700 64,403 73,642 72,374 71,176 107,457 98,280 147,445 103,669 99,555 1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 2Q-18 3Q-18 4Q-18 1Q-19 2Q-19 800 1,000 1,200 1,400 1,600 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 FeMn EU HC 76% Mn EXW ($) SiMn EU 65% Mn DDP ($) Mn Alloys FG Avg. Selling Price ($)

|

|

|

Working capital due to an increase in finished goods inventories Cash decreased but remained at healthy levels of $188m 389 376 280 389 Q2 2019 +$59m Working capital trends ($m) Cash trends ($m) Working capital increase driven by inventory build 353 389 376 280 337 407 443 356 351 410 Mar'17 Jun'17 Sep'17 Dec'17 Mar'18 Jun'18 Sept'18 Dec'18 Mar'19 Jun'19 173 184 190 184 198 156 132 217 217 188 Mar'17 Jun'17 Sep'17 Dec'17 Mar'18 Jun'18 Sept'18 Dec'18 Mar'19 Jun'19

|

|

|

FY2019 free cash-flow evolution Increase in net debt attributable to an increase in working capital Gross Debt ($m) Net Debt ($m) Note: Free cash-flow defined as “Net cash provided by operating activities“ minus “Payments for property, plant & equipment” Debt evolution 647 631 643 645 636 666 449 475 511 429 420 478 Mar\'18 Jun'18 Sept'18 Dec'18 Mar'19 Jun'19 Profit for the period (43.7) (72.2) Adjustment for non-cash items 39.3 81.5 Profit adjusted for non-cash items (4.3) 9.3 Changes in Operating Assets / Liabilities (29.2) (13.9) Interest paid (3.3) (21.8) Income tax paid (0.5) (2.2) Net cash generated by operating activities (37.4) (28.7) Payments for property, plant and equipment (7.1) (20.6) Free cash-flow 1 (44.5) (49.2) Disposals 1.6 3.4 Free cash-flow including disposals (42.9) (45.8) $m H1 2019 Q2-19

|

|

|

II. Update on Corporate Initiatives

|

|

|

Positive progress across corporate initiatives 1 2 3 Successful closing of FerroAtlántica, S.A.U. divestiture Refinancing process ongoing Cost savings plan on-track 4 Positive update on other strategic and cash generating initiatives

|

|

|

Divestiture of FerroAtlántica, S.A.U. successfully closed at an attractive valuation of 12.7x1 1 Transaction highlights Closing Transaction closed on August 30, 2019 Tolling agreement and supply agreement effective immediately Transaction value: €170m (approx. $188m) Gross proceeds: €156.4m (approx. $173m) following adjustments for net debt, working capital and cash flow from operations After cancellation and repayment of financial lease on the hydro assets (€55m or approx. $61m) on closing, the transaction results in net cash proceeds to Ferroglobe of approx. $112m Closing mechanism takes account of (i) net debt, (ii) working capital and (iii) cash flow from operations for 2019 Ferroglobe granted long-term exclusivity over the commercialization and sale of the output of the smelting factory €10m in escrow to secure seller payment obligations under the SPA to be released in 24 months. Earn-out structure in case of subsequent divestiture of assets by buyer Anti-trust clearance regarding only the ferrosilicon business of Cee-Dumbría in Spain Authorization of Ferroglobe lenders under the RCF Administrative authorization for the termination of the lease facility agreement and the amendment of the co-ownership regime of the concessions Cancellation of the existing pledge over FAT shares and pledges over a number of FAT assets Conditions precedent fulfilled July 15th July 5th August 13th Note 1. Based on average EBITDA for the past 5 years August 30th

|

|

|

The divestiture significantly enhances Ferroglobe´s balance sheet Pro forma net debt reduced to $308 million Pro forma cash of $298 million 1 ILLUSTRATIVE SOURCES OF FUNDS FROM TRANSACTON ILLUSTRATIVE USES OF FUNDS FROM TRANSATION ($m) ($m) Acquisition price 188.0 Mandatory repayments relating to the transaction (1) 60.3 Closing adjustments to transaction value -15.1 Est. cash and cash equivalents from transaction (2)(3) 110.1 Est. transaction related fees and expenses 2.5 Total Sources of Funds 172.9 Total Uses of Funds 172.9 ILLUSTRATIVE - PRO FORMA BALANCE SHEET IMPACT (AS OF 6/30/2019) ` Transaction Pro Forma ($m) 6/30/2019 Adjustment 6/30/2019 Cash and cash equivalents 187.7 110.1 297.8 Total Debt 666.0 -60.3 605.7 Net Debt 478.3 307.9 Notes: 1. As part of the transaction, a portion of the proceeds have been used for mandatory repayment of oustanding leases, loans, swaps and other indebtedness of target assets for sale 2. Illustration assumes that the balance of any proceeds following the mandatory repayments will be added to the cash and cash equivalents balance 3. Cash set aside in escrow considered as part of cash and cash equivalents in this illustration

|

|

|

Update on refinancing 2 Currently making progress in the refinancing of the RCF, aiming to increase access to cash and improve leverage based financial covenants and minimum liquidity thresholds Different refinancing alternatives being analyzed, focusing on asset backed facilities (i.e., ABL, term loan) De-risking the balance sheet Negotiations well advanced during June-July Prospect of imminent closing of FerroAtlántica divestiture changed the balance sheet profile and closing of refinancing was postponed until after completion of the divestiture All the terms of the refinancing are being reviewed in light of a significantly enhanced balance sheet following the divestiture Update on the process New credit facility is intended to eliminate leverage-based covenants, providing greater flexibility to our balance sheet Targeting completion of refinancing around the end of Q3 2019

|

|

|

KTM program Corporate Overheads Focus areas 2019 Target savings $10m $15m Savings 1H SAVINGS $7.7m $1.5m Consolidation of corporate offices (London HQ moving to Madrid) Reduction in personnel costs Reduction in use of third party consultants and services Reduction in audit fees, accounting consultancy fees, etc. Revised travel policies and guidelines KTM (Key Technical Metrics) achieves performance improvements focusing on increased productivity and efficiencies Changes to raw materials mix and focus on by-product recycling Changes in electrode technology 1H savings adversely impacted by extraneous factors $40m $16.4m Plant level fixed costs $15m $7.2m Permanent staff reductions Improved purchasing processes for services and materials Reduction and optimization of inventories for spare parts and consumables Cost savings plan implemented at various levels of the organization 3 FY19E Run rate $25m $25m $75m $25m

|

|

|