UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Consent Solicitation Statement Pursuant to

Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

|

☐

|

|

Preliminary

Proxy Statement

|

|

☐

|

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

|

Definitive

Proxy Statement

|

|

☐

|

|

Definitive

Additional Materials

|

|

☐

|

|

Soliciting

Material Pursuant to §240.14a-12

|

GROM SOCIAL

ENTERPRISES, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

|

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

Per unit price or other underlying value

of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state

how it was determined):

|

|

|

|

(4)

|

Proposed maximum aggregate value of the transaction:

|

|

|

|

(5)

|

Total fee paid:

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

o

|

Check box if any part of the fee is offset

as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

(4)

|

Date Filed:

|

2060 NW Boca

Raton Blvd., #6 Boca Raton, FL 33431

NOTICE OF CONSENT SOLICITATION

November 5, 2021

Dear Shareholder of Grom Social Enterprises, Inc.:

Notice is hereby given to all our stockholders

of all classes as October 7, 2021 (the “Record Date”) that we are seeking the written consents of stockholders (the “Consents”)

for the approval of a financing transaction that would result in the issuance of promissory notes and warrants convertible into or

exercisable for common stock, that in the aggregate equals or exceeds 20% of the outstanding float prior to the offering.

Nasdaq Rule 5635 (d) (the “Nasdaq Rule”)

requires that a company obtain approval from its shareholders prior to issuance of shares of common stock or any securities convertible

into or exercisable for common stock, that in the aggregate equals or exceeds 20% of the outstanding float prior to the offering.

We are requesting your consent therefore, for the following proposal (the “Proposal”).

To approve the issuance of (i) $6,000,000

principal amount 10% Original Issue Discount Senior Secured Convertible Note, convertible into Common Stock at $4.20 per share, due 18

months from issuance (the “Second Tranche Note”), (ii) a five-year common stock purchase warrant to purchase 1,041,194 shares

of common stock at $4.20 per share (the “Second Tranche Warrant”), and (iii) shares of common stock upon conversion or

redemption of the Second Tranche Note, and upon exercise of the Second Tranche Warrant in accordance with their respective terms,

as the second tranche of a private placement offering totaling up to $10,400,000.

The details of this transaction are outlined

in this Consent Solicitation and other public filings we have made.

We intend to close on the $6,000,000 second tranche

as soon as possible after receipt of properly executed Consents from the holders of a majority of our stock of all classes, voting together

as a single class, and satisfaction of all other conditions to closing, as more fully described herein.

Consent of a holders of a majority of our common

stock, and Series C Preferred Stock which vote on an as converted basis with the Common Stock, are entitled to vote in this matter (the

“Majority Stockholders”). Certain members of management that hold proxies for almost all the Series C Stock as well as certain

other common stock including their own, comprise greater than a majority of the voting power, and have already agreed to approve the Proposal.

Our Board of Directors (“Board”) has

fixed October 7, 2021, as the Record Date for holders of the Company’s Common Stock and Series C Stock entitled to participate in

this Consent Solicitation and to provide Consents. This Notice of Consent Solicitation is being issued by the Company and is intended

to be mailed on or about November 5, 2021, to all holders of our Common Stock and Series C Preferred Stock as of the Record Date. The

Consent Solicitation Statement on the following pages describes the matters presented to stockholders herein. The entire Consent Solicitation

Statement is available for review by each stockholder on https://gromsocial.com/proxymaterials.

The Board requests that you sign, date and

return your Consent included as Annex A to the Consent Solicitation Statement in the enclosed envelope (or via the Internet)

as soon as possible, but no later than November 26, 2021.

By Order of the Board of Directors,

Darren Marks

Chairman and Chief Executive Officer

November 5, 2021

2060 NW Boca

Raton Blvd., #6 Boca Raton, FL 33431

CONSENT SOLICITATION STATEMENT

November 5, 2021

This Consent Solicitation Statement is being

furnished to all stockholders of the common stock, par value $0.001 per share (the “Common Stock”), and Series C 8% Convertible

Preferred Stock, par value $0.001 per share (the “Series C Stock”) of Grom Social Enterprises, Inc., a Florida corporation

(“Grom,” the “Company,” “we,” “our” or “us”), as of October 7, 2021, the

record date (the “Record Date”) fixed by our Board of Directors (“Board”) in connection with the solicitation

of written consents (“Consents”) from the stockholders of the Company. We are soliciting the Consents in lieu of a special

meeting of the stockholders to approve the following proposal (“Proposal”):

To approve the issuance of (i) $6,000,000

principal amount 10% Original Issue Discount Senior Secured Convertible Note, convertible into Common Stock at $4.20 per share, due 18

months from issuance (the “Second Tranche Note”), (ii) a five-year common stock purchase warrant to purchase 1,041,194 shares

of common stock at $4.20 per share (the “Second Tranche Warrant”), and (iii) shares of common stock upon conversion or redemption

of the Second Tranche Note, and upon exercise of the Second Tranche Warrant in accordance with their respective terms, as the second

tranche of a private placement offering totaling up to $10,400,000.

On September 14, 2021, the Company entered into

a Securities Purchase Agreement (as amended and in effect on the date hereof, the “Purchase Agreement”) with L1 Capital Global

Opportunities Master Fund (the “Investor”) pursuant to which it sold (i) a $4,400,000 principal amount 10% Original Issue

Discount Senior Secured Convertible Note, due March 13, 2023 (the “First Tranche Note”) and, (ii) a five year warrant to

purchase 813,278 shares of common stock at an exercise price of $4.20 per share (the “Warrant”) in exchange for consideration

of $3,960,000 (the “First Tranche”). No shareholder approval is required in connection with, and we are not seeking your

consent for approval of, the First Tranche note and warrant issuances.

The terms of this offering however, as amended

on October 20, 2021, contemplated a second tranche (the “Second Tranche”) to the offering in the amount of $6,000,000 of

convertible notes substantially identical to the initial notes (the “Second Tranche Notes”) and warrants to purchase 1,041,194

shares of common stock at $4.20 per share exercisable for five years (the “Second Tranche Warrants”).

There are other conditions to the closing on the

additional $6,000,000 Second Tranche, other than obtaining the approval of a majority of shareholders in this Consent. Specifically, the

closing of the Second Tranche is conditioned upon, among other conditions, a registration statement being declared effective by the SEC

covering the shares issuable upon conversion or redemption of the First Tranche Note and the exercise of the First Tranche Warrants, and,

a limitation on the principal amount of notes that may be issued to such principal amount that is no more than 30% of the Company’s

market capitalization as reported by Bloomberg L.P., which requirement may be waived by the Investor. If the foregoing 30% amount is exceeded,

the parties may issue such lesser amount in the Second Tranche that does not exceed such threshold.

The Second Tranche Note, if approved and all

conditions are satisfied, will be convertible into common stock at a rate of $4.20 per share (the “Conversion Price”) into

1,428,571 shares if converted by the Investor and, is repayable in 16 equal monthly installments by payment of cash. Alternatively, the

monthly payment installments on the note may be satisfied, at the discretion of the Company and if the Equity Conditions (as hereinafter

defined) are met as provided in the note, by the issuance of shares at a price of 95% of the VWAP prior to the respective monthly redemption

dates (with a floor of $1.92) multiplied by 102% of the amount due on such date, or, approximately 3,187,500 shares if redeemed in full

at the lowest price. In the event that the ten-day VWAP drops below $1.92 the Company will have the right to pay in stock at said VWAP

with any shortfall paid in cash. The Conversion Price may be adjusted in the event of dilutive issuances but in no event to less than

$0.54.

The Company’s right to make monthly payments

in stock in lieu of cash is conditioned on certain conditions (the “Equity Conditions”). The Equity Conditions required to

be met in order to redeem the notes with stock in lieu of a monthly cash payment, among other conditions set forth therein, include without

limitation, that a registration statement be in effect with respect to the resale of the shares issuable upon conversion or redemption

of the First Tranche Note and Second Tranche Note respectively (or, that an exemption under Rule 144 is available), and that the average

daily trading volume of the Company’s common stock would have to be at least $550,000 immediately prior to the date of the monthly

redemption.

The Nasdaq 20% Rule

Nasdaq Rule 5635 (d) (the “Nasdaq Rule”)

requires that a Company listed on Nasdaq is required to obtain approval from its shareholders prior to issuance of shares of Common Stock

or any securities convertible into or exercisable for Common Stock, that equals or exceeds 20% of the outstanding float prior to the

offering. We are requesting shareholder consents hereby because the issuance of shares upon conversion of the Second Tranche Note and

upon exercise of the Second Tranche Warrants, when combined with previously issued notes and warrants in the First Tranche of the Offering,

would exceed twenty percent (20%) or more of the issued and outstanding number of shares of our Common Stock outstanding prior to the

Offering.

As of September 19, 2021, the Board unanimously

approved, subject to receipt of written Consents from our Majority Shareholders, the Proposal.

Under Section 607.0704 of the Florida Business

Corporations Act (“FBCA”), and in accordance with Article 2, Section 12 our Bylaws, any action required or permitted by the

FBCA to be taken at an annual or special meeting of our stockholders may be taken without a meeting, without prior notice and without

a vote, if Consents in writing, setting forth the action so taken, are signed by the holders of outstanding stock having at least the

voting power that would be necessary to authorize or take such action at a meeting. Pursuant to our Articles of Incorporation, as amended,

the holders of our Series C Stock have the right to vote on an as-converted basis voting together as a single class with the holders

of the Company’s Common Stock, with each share entitling the holder to 1.5625 votes per share. We are sending this Consent Solicitation

Statement to all record and beneficial owners of our Common Stock and Series C Stock as of the Record Date. As of the Record Date, there

were (i) 12,422,106 shares of Common Stock outstanding, with each share of Common Stock entitled to one vote, and (ii) 9,400,309 shares

of Series C Stock outstanding, with each share of Series C Stock voting as 1.5625 shares of Common Stock, or the equivalent of 14,687,982

Common Stock votes in the aggregate). Only stockholders of record of our Common Stock and Series C Stock as of the Record Date will be

entitled to submit written Consents for the Proposal.

Consents signed by at least the majority shareholders

of the Common Stock and Series C Stock when counting both classes together on an as converted basis (the “Majority Shareholders”),

are required to approve the Proposal set forth herein (“Shareholder Approval”). To be counted towards the Consents required

for approval of the transactions described herein, your Consent must be received by November 26, 2021; provided, however, that if sufficient

votes in favor of the Proposal prior to such time, we reserve the right to accept such Proposal as approved.

In order to register your Consent to the matters

set forth herein, you should return your signed and dated written Consent in the enclosed envelope. You may also register your Consent

by telephone or the Internet by following the instructions on Annex A.

We intend to close on the Second Tranche of the

offering and to issue the Additional Securities immediately upon receipt of properly executed Consents from the Majority Shareholders,

presuming satisfaction of all other conditions. A copy of the form of written Consent to be executed by stockholders is annexed to this

Consent Solicitation Statement as Annex A.

You may revoke your written Consent at any time

prior to the time that we have received a sufficient number of Consents to approve the Proposal set forth herein. A revocation may be

in any written form validly signed and dated by you, as long as it clearly states that the Consent previously given is no longer effective.

The revocation should be sent to us at Grom Social Enterprises, Inc., c/o Equinity Shareowner Services, 1110 Centre Pointe Curve, Suite

101, Mendota Heights MN 55120; Attention: Mr. Chad Dalton.

There are no rights of appraisal or similar rights of

dissenters with respect to the Proposal.

Darren Marks and Melvin Leiner, both executive

officers and directors of the Company, hold proxies from all of the holders of Series C Stock As well as some shares of Common Stock,

granting each of Messrs. Marks and Leiner the power to vote almost all of the shares held by the Series C Preferred Stock until May 20,

2023. These persons have already approved and recommended the Proposal in their capacities as directors and have agreed to vote all of

their own shares as well as shares of common stock and Series C Stock that they hold a proxy for, in favor of the Proposal.

The Company will pay the costs of soliciting

these Consents. In addition to soliciting Consents by mail, our officers, directors and other regular employees, without additional compensation,

may solicit Consents personally, by facsimile, by e-mail, or by other appropriate means. Banks, brokers, fiduciaries and other custodians

and nominees who forward written Consents soliciting materials to their principals will be reimbursed for their customary and reasonable

out-of-pocket expenses.

Our executive offices are located at 2060 NW

Boca Raton Blvd., #6, Boca Raton, FL 33431 and our telephone number there is (561) 287-5776.

FREQUENTLY ASKED QUESTIONS

The following questions and answers are intended

to respond to frequently asked questions by the holders of our voting equity (i.e. our Common Stock and Series C Stock) concerning the

actions approved by our Board and our stockholders entitled to provide Consents. These questions do not, and are not intended to, address

all the questions that may be important to you. You should carefully read the entire Consent Solicitation Statement, as well as its exhibits,

annexes and the documents incorporated by reference in this Consent Solicitation Statement.

Q: WHO IS ENTITLED TO CONSENT TO THE PROPOSAL

DESCRIBED IN THIS CONSENT SOLICITATION STATEMENT?

A: All holders of our Common Stock and Series

C Stock as of the Record Date. As of October 7, 2021, the Record Date, there were (a) 12,422,106 shares of our Common Stock issued and

outstanding, and (b) 9,400,309 shares of Series C Stock issued and outstanding. The holders of Series C Stock vote on an as-converted

basis, with 1.5625 votes for each share of Series C Stock, resulting in voting power equivalent to14,687,982 shares of Common Stock, or

54.2%. Our executives that hold the proxies for the Series C Stock have already agreed to consent and have also agreed to consent with

respect to their owns shares of Common Stock.

Q: WHAT IS THE DIFFERENCE BETWEEN HOLDING

SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER?

A: If you hold stock that is registered directly

in your name (whether in physical paper form or electronically) with our transfer agent, EQ Shareholder Services, you are considered,

with respect to those shares, a “stockholder of record.”

If however, your shares are held in a stock brokerage

account or by a bank or other nominee (also known as being held in “street name”) then such entity is the actual “record

holder” and you are considered the beneficial owner of those shares in your account. If you hold shares in a brokerage,

this Consent Solicitation Statement is first being sent to your broker, bank or nominee as the stockholder of record, and they will forward

you this Consent Solicitation with instructions on how to vote your shares. As the beneficial owner, you have the right to direct your

broker, bank or nominee to then provide your Consent or to withhold Consent to the Proposal set forth herein.

Your broker, bank or nominee has enclosed an

instruction card for you to use in directing the broker, bank or nominee regarding whether to consent or to withhold consents to the

Proposal set forth herein. Your broker, bank, or other nominee will only be able to vote your shares with respect to the Proposal set

forth herein if you have instructed them to provide your Consent. Please return your completed written Consent form that you received

from your broker, bank or other nominee and contact the person responsible for your account so that your vote can be counted. If your

broker, bank, or other nominee permits you to provide instructions via the Internet or by telephone, you may vote that way as well.

Q: WILL THERE BE A MEETING OF STOCKHOLDERS

TO CONSIDER THE PROPOSAL SET FORTH IN THIS CONSENT SOLICITATION STATEMENT?

A: No. We will not hold a meeting of stockholders.

In accordance with Section 607.0704 of the FBCA and Article 2, Section 12 our Bylaws, our stockholders are permitted to take action without

a meeting if the votes represented by Consents in writing, that would be necessary to authorize or approve the proposed actions set forth

in this Consent Solicitation Statement, represent at least a majority of our outstanding voting power. Once we have a sufficient number

of votes, the Proposal will be deemed approved.

Q: WHAT IS THE RECOMMENDATION OF OUR BOARD

AS TO THE PROPOSAL DESCRIBED IN THIS CONSENT SOLICITATION STATEMENT?

A: Our Board unanimously recommends that our

stockholders provide their CONSENTS IN FAVOR of the Proposal set forth in this Consent Solicitation Statement.

Q: WHAT IS THE REQUIRED VOTE TO APPROVE THE

PROPOSAL?

A. The

Proposal must receive signed written Consents from holders of record on the Record Date of at least a majority our voting equity consisting

of our issued and outstanding Common Stock and Series C Stock, voting on an as-converted basis with the Common Stock as a single class.

Our Series C Stock proxy holders have already agreed to consent to the Proposal.

Q: WHAT DO I NEED TO DO NOW TO REGISTER MY

CONSENTS?

A: You may Consent to the Proposal set forth

herein by registering your Consent by mail, facsimile or via electronic mail on the Internet by following the instructions on Annex

A that are provided to you by your broker or the transfer agent.

Q: WHAT IF I DO NOT RETURN THE WRITTEN CONSENTS?

A: Your failure to respond will have the same

effect as voting “Against” the Proposal set forth in this Consent Solicitation.

Q: CAN I VOTE AGAINST THE PROPOSAL?

A: We are not holding a special meeting of

our stockholders, so there will be no “yea” or “nay” vote. However, because the Proposal is being voted for by

written consent, simply not delivering an executed written Consent in favor of our Proposal will have the same practical effect as a Consents

Withheld (AGAINST) the Proposal at a special meeting of stockholders.

Q: CAN I REVOKE MY CONSENTS AFTER I HAVE DELIVERED

IT?

A: If you are the stockholder of record, you

may revoke your written Consent at any time prior to the time that we receive a sufficient number of written Consents to approve the

Proposal set forth herein. A revocation may be in any written form validly signed and dated by you, as long as it clearly states that

the Consents previously given is no longer effective. The revocation should be sent to us at Grom Social Enterprises, Inc., c/o Equinity

Shareowner Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights MN 55120; Attention: Mr. Chad Dalton.

If your shares are held in a brokerage account

by a broker, bank, or other nominee, you should follow the instructions provided by your broker, bank, or other nominee, provided that

such revocation is made prior to the time that we receive a sufficient number of written Consents to approve the Proposal set forth herein.

A revocation may be in any written form validly signed and dated by you, as long as it clearly states that the Consent previously given

is no longer effective.

Q: BY WHEN MUST WE RECEIVE A SUFFICIENT NUMBER

OF CONSENTS?

A: We are requesting you to send us your written

Consents by November 26, 2021. Our Board may extend the deadline to receive written Consents in its sole discretion.

Under the FBCA, written Consents will remain

in effect until a sufficient number of Consents are received by us to take the actions proposed herein; provided, however, that such

written Consents will not remain effective after 60 days from the date of the earliest dated and delivered Consents.

Q: WHAT IS THE REASON FOR THE PROPOSAL

A We

are requesting shareholder consents to satisfy Nasdaq “20% Rule” also known as Rule 5635(d). Nasdaq Rule 5635(d) requires

listed companies such as us, to obtain stockholder approval prior to issuance of shares of Common Stock or any securities, convertible

into shares of Common Stock that could be equal to twenty percent (20%) or more of the issued and outstanding number of shares of our

Common Stock. The issuance of shares underlying the Second Tranche Note and Second Tranche Warrants, when combined with previously issued

notes and warrants in the First Tranche of the Offering, would exceed twenty percent (20%) or more of the issued and outstanding number

of shares of our Common Stock outstanding prior to the Offering. Accordingly, your consent is required issue these securities.

Q: WHAT HAPPENS IF THE PROPOSAL DOES NOT RECEIVE

CONSENTS FROM OUR MAJORITY STOCKHOLDERS?

A: We will not issue the Additional Securities

in the Second Tranche in the event that we fail to receive properly executed written Consents from the Majority Shareholders for the

Proposal. However, if this happens, we will be required to find financing elsewhere depending on our capital needs and, no assurance

can be made that we will be able to do so.

Q: WHO WILL PAY THE COSTS OF SOLICITING CONSENTS?

A: The Company will pay all of the costs of

sending and tabulating votes relating to this Consent Solicitation Statement. We may also pay brokerage firms and other custodians for

their reasonable expenses for forwarding information materials to the beneficial owners of our Common Stock. We are not soliciting any

proxies and will not contract for other services in connection with the shareholder action approving the Proposal.

PROPOSAL

On October 19, 2021, our Board unanimously approved

and recommended to the shareholders that they approve, the closing of the Second Tranche of the Offering and issuance of the Second Tranche

Notes and Second Tranche Warrants. The Proposal requires written Consents from holders of record of at least a majority of our voting

power consisting of the issued and outstanding shares of our Common Stock and Series C Stock on the Record Date entitled to submit such

Consents. The holders of our Series C Stock vote on an as-converted basis, with 1.5625 votes for each share of Series C Stock, which will

result in voting power by them equivalent to 14,570,795 shares (or, approximately 53% of our voting power).

The Proxy holders for most of the Series C Stock

holders as well as certain members of management, have already signed voting agreements to approve the Proposal, making it unlikely that

the proposal will fail.

Background; $10,400,000 Offering of Convertible

Notes and Warrants

On September 14, 2021 the Company entered into

the Purchase Agreement with the Investor pursuant to which it sold (i) a $4,400,000 principal amount First Tranche Note, convertible

at $4.20 per share and due March 13, 2023 and, (ii) a five year First Tranche Warrant to purchase 813,278 shares of common stock at an

exercise price of $4.20 per share, in exchange for consideration of $3,960,000 (the “First Tranche”), with a contemplated

Second Tranche of $1,500,000 of identical notes and warrants. The Second Tranche was increased by agreement of the parties to $6,000,000

and 1,041,194 warrants on October 20, 2021.

No shareholder approval is required in connection

with, and we are not seeking your consent for approval of, the First Tranche note and warrant issuances.

The terms of this offering however, as amended

on October 20, 2021, contemplated a Second Tranche to the offering in the amount of $6,000,000 of convertible notes substantially identical

to the initial notes (the “Second Tranche Notes”) and warrants to purchase 1,041,194 shares of common stock at $4.20 per

share exercisable for five years (the “Second Tranche Warrants”).

Other Conditions to Closing of $6,000,000

Second Tranche

In addition to requiring stockholder consent

prior to the closing of the $6,000,000 Second Tranche, other conditions must be satisfied as well. Specifically, the closing of the Second

Tranche is conditioned upon, among other conditions, a registration statement being declared effective by the SEC covering the shares

issuable upon conversion or redemption of the First Tranche Note and the exercise of the First Tranche Warrants, and, a limitation on

the principal amount of notes that may be issued to such principal amount that is no more than 30% of the Company’s market capitalization

as reported by Bloomberg L.P., which requirement may be waived by the Investor.

Shares That May Be Issued Upon Conversion

or Repayment of Second Tranche Note

The Second Tranche Note, if approved and all

conditions are satisfied, will be convertible into common stock at a Conversion Price of $4.20 per share, into 1,428,571 shares if converted

by the Investor and, is repayable in 16 equal monthly installments by payment of cash. Alternatively, the monthly payment installments

on the note may be satisfied, at the discretion of the Company and if the Equity Conditions (as hereinafter defined) are met as provided

in the note, by the issuance of shares at a price of 95% of the VWAP prior to the respective monthly redemption dates (with a floor of

$1.92) multiplied by 102% of the amount due on such date, or, approximately 3,187,500 shares if redeemed in full at the lowest price.

In the event that the ten-day VWAP drops below $1.92 the Company will have the right to pay in stock at said VWAP with any shortfall

paid in cash. The Conversion Price may be adjusted in the event of dilutive issuances but in no event to less than $0.54.

The Company’s right to make monthly payments

in stock in lieu of cash is conditioned on certain conditions (the “Equity Conditions”). The Equity Conditions required to

be met in order to redeem the notes with stock in lieu of a monthly cash payment, among other conditions set forth therein, include without

limitation, that a registration statement be in effect with respect to the resale of the shares issuable upon conversion or redemption

of the First Tranche Note and Second Tranche Note, as the case may be, (or, that an exemption under Rule 144 is available), and that the

average daily trading volume of the Company’s common stock would have to be at least $550,000 immediately prior to the date of the

monthly redemption.

In the event that the conditions to closing the

Second Tranche investment are satisfied the Company intends on issuing (i) a $6,000,000 principal amount note identical to the First

Note but due 16 months from the closing of the Second Tranche and, (ii) a warrant exercisable for five years to purchase 1,041,194 at

an exercise price of $4.20 per share for consideration of $5,400,000.

The conversion and redemption terms as well as

all other material terms of the Second Tranche Note, and exercise price of terms of the warrants to be issued in the Second Tranche are

identical in all other material respects.

In the event that the Second Tranche Note is

converted by the Investor, it would result in the issuance of at least 1,428,572 shares of common stock plus additional shares for interest.

In the event that it is repaid by redemption each month, up to approximately 3,125,000 shares if redeemed at the lowest redemption price

of $1.92 per share. The note may be converted and redeemed in any combinations of the foregoing.

In addition, if the Second Tranche is approved

hereby, it will result in the issuance of an additional 1,041,194 warrants exercisable at $4.20 per share, with anti-dilution adjustments

for subsequent share issuances below said price, with a floor of $0.54.

The closing of the additional investment in the

Second Tranche closing is subject to a registration statement being declared effective by the SEC covering the shares issuable upon conversion

or redemption of the First Tranche Note and Warrants, shareholder consent being obtained as required by Nasdaq Rule 5635(d), and limits

the principal amount of notes that may be issued to an aggregate of 30% of the Company’s market capitalization as reported by Bloomberg

L.P., which requirement may be waived by the Investor. If the foregoing 30% amount is exceeded, the parties may issue such lesser amount

in the Second Tranche that does not exceed such threshold.

Default Rate

In the event of an event of default, if the stock

price is below the Conversion Price at time of default and only for so long as a default is continuing, the notes would be convertible

at a rate of 80% of the lowest VWAP in the ten prior trading days, provided, that if the default is cured the default conversion rate

elevates back to the normal Conversion Price.

The Investor currently has the right to accelerate

up to 3 of the 16 monthly repayment amounts. This amount will increase to 6 months in the event that the Second Tranche Note is approved

and issued as more fully detailed in the Note.

Warrant Terms

Pursuant to the Amended

Purchase Agreement, in the First Tranche, Investor acquired a First Tranche Warrant to purchase 813,278 shares at an exercise price of

$4.20 per share, and in the Second Tranche, and if approved hereby and presuming a closing on the maximum amount of $6,000,000 notes,

the Investor will acquire warrants to purchase 1,041,194 shares. The Warrants are exercisable for 5 years from the date of their respective

issuances. The Warrants issued in both tranches have the same anti-dilution protection as the Notes and same adjustment floor. The Warrants

are exercisable via cashless exercise only for so long as no registration statement covering resale of the shares is in effect.

Lockup Agreements

The Purchase Agreement,

as amended, provides for the continuation of the existing lockup agreements entered into between various executive officers, directors

through June 21, 2022 and 5% beneficial owners of common stock through December 16, 2021, and EF Hutton, as underwriter relating to the

June 16, 2021 public offering and NASDAQ up-listing.

Registration Rights

The Company and L1 executed

a Registration Rights Agreement pursuant to which the Company was required to file a registration statement with the SEC, registering

all Conversion Shares and Warrant Shares for resale, which is required to go effective no later than 75 days after September 14, 2021,

the date of the closing of the 1st Tranche of the Offering.

Security Agreement

The Company entered

into a Security Agreement L1 pursuant to which L1 was granted a security interest in all of the assets of the Company and certain of

its subsidiaries. As part of the entry into the Security Agreement, certain pre-existing secured creditors agreed to give up their exclusive

senior security interest in our TDH subsidiary assets, in exchange for a shared senior secured interest with L1 on a pari pasu

basis on all assets of the Company.

The foregoing description

of the Purchase Agreement, the Note, the Warrant, the Subsidiary Guaranty, the Registration Rights Agreement, the Security Agreement

and the Intercreditor Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the full

text of such agreements, copies of which were filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6 and 10.7 to our Current Report

on Form 8-K filed with the Securities and Exchange Commission on September 20, 2021.

Reasons for Shareholder

Approval

Our Common Stock is

listed on the Nasdaq Stock Market and, therefore, we are subject to the Nasdaq Stock Market Listing Rules.

Pursuant to Nasdaq Rule 5635(d), the Company is

required to obtain approval from its shareholders prior to issuance of shares of Common Stock or any securities, convertible into shares

of Common Stock that could be equal to twenty percent (20%) or more of the issued and outstanding number of shares of our Common Stock.

Accordingly, prior to selling the securities in the Offering that could potentially result in the

issuance of twenty (20%) or more of the issued and outstanding number of the Company’s Common Stock, the Company needs to obtain

the approval from its shareholders as required by Nasdaq Rule 5635 (d).

The closing of the First

Tranche of the offering did not exceed this limit. However, the issuance of notes and warrants in the Second Tranche, when combined with

the first or on its own, would exceed the 20% limit. Accordingly, shareholder consent is required.

We intend to close on

the Second Tranche of the Offering and to issue the Additional Securities immediately upon receipt of properly executed Consents from

the Majority Shareholders.

Use of Proceeds

The Company intends

on utilizing the proceeds from the sale of Second Tranche Notes and Second Tranche Warrants for purposes of general working capital,

and further developing its strategic relationships and possible joint ventures and acquisitions. The Company does not have any specific

acquisition or joint venture transactions at this time or at the time of entry into the Purchase Agreement.

Consequences of the Issuances to L1

The issuance of the

Conversion Shares and Warrant Shares will result in a significant increase in the number of shares of our Common Stock outstanding and,

as a result, our shareholders will own a smaller percentage of the outstanding Common Stock and, accordingly, a smaller percentage interest

in the voting power, liquidation value and aggregate book value of the Company.

Our shareholders will

incur dilution of their percentage ownership in the Company as a result of the issuances to L1. Immediately prior to the closing on the

Purchase Agreement, there were approximately 12,422,106 shares of Common Stock outstanding. An additional 4,330,662 shares of Common

Stock could be issued to L1 upon the conversion or redemption of the Notes and Warrants issued to L1 on both tranches. In the event that

the stock price declines and the Company elects to repay the Notes with stock, the redemption price could go as low as $1.92 per share,

thereby increasing the shares issued to them substantially.

As a result of the foregoing

issuances (assuming no other issuances by the Company), L1 will have the right to acquire (subject to limitations in their Notes and

Warrants) 25.9% of our outstanding shares of Common Stock. As a result, L1 will have a significant voting power to determine the outcome

of any corporate transaction or other matter submitted to our stockholders for approval, including, but not limited to, the election

of directors and the approval of corporate transactions.

Finally, the Conversion Price of the Notes and exercise price of the Warrants

will be adjusted downward pursuant to the full ratchet anti-dilution protections provided therein, in the event of lower priced share

issuances, with a floor of $0.54 per share. This could lead to additional shares and even further dilution to current stockholders.

Recommendation of the Board of Directors

Our Board of Directors recommends that you

CONSENT (FOR) to the Proposal.

Two of our directors, Mel Leiner and Darren

Marks, hold proxies for (i) 9,325,309 shares of Series C Preferred Stock which effectively

have 1.5625 votes per share for an aggregate of approximately 14,570,795 votes or approximately 53.5% of the voting control of the Company,

and (ii) 1,638,772 shares of Common Stock, in addition to shares of their own that they will vote in favor of the Proposal.

PRINCIPAL STOCKHOLDERS

The following table lists,

as of October 20, 2021, the number of shares of common stock beneficially owned by (i) each person, entity or group (as that term is

used in Section 13(d)(3) of the Securities Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of the

outstanding common stock; (ii) each of our directors (iii) each of our Named Executive Officers and (iv) all executive officers and directors

as a group. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information

furnished by each person using "beneficial ownership" concepts under the rules of the SEC. Under these rules, a person is deemed

to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to

vote or direct the voting of the security, or investment power, which includes the power to dispose or direct the disposition of the

security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership

within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person

may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest. Except as noted below,

each person has sole voting and investment power with respect to the shares beneficially owned and each stockholder's address is c/o

Grom Social Enterprises, Inc., 2060 NW Boca Raton Blvd., #6, Boca Raton, Florida, 33431.

The percentages below are

calculated based on 12,552,106 shares of common stock (which reflects a reverse stock split of our shares of common stock at a ratio

of 1-for-32, which was effective on May 13, 2021) and 9,400,309 shares of Series C Stock issued and outstanding as of October 15, 2021.

|

Name of Beneficial Owner

|

|

Common

Stock

|

|

|

Percentage

of

Common

Stock

|

|

Series C

Preferred

Stock

|

|

|

Percentage

of

Series C

Stock

|

|

Combined

Voting

Power

|

|

|

|

Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Darren Marks

|

|

711,611

|

|

(1)

|

5.7%

|

|

–

|

|

|

–

|

|

62.1%

|

|

(11)

|

|

Melvin Leiner

|

|

342,495

|

|

(2)

|

2.7%

|

|

–

|

|

|

–

|

|

60.8%

|

|

(12)

|

|

Robert Stevens

|

|

7,813

|

|

(3)

|

*

|

|

–

|

|

|

–

|

|

*

|

|

|

|

Norman Rosenthal

|

|

9,117

|

|

(4)

|

*

|

|

–

|

|

|

–

|

|

*

|

|

|

|

Thomas J. Rutherford

|

|

89,515

|

|

|

*

|

|

–

|

|

|

–

|

|

*

|

|

|

|

All officers and directors as a group (6 persons)

|

|

1,170,217

|

|

(5)

|

9.3%

|

|

–

|

|

|

–

|

|

63.8%

|

|

(14)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Holders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denis J. Kerasotes

31 Fairview Lane

Springfield, Illinois 62711

|

|

**

|

|

|

*

|

|

3,816,105

|

|

(6)(13)

|

41.4%

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condor Equities, LLC (7)

2535 Webb Girth Road

Gainesville, Georgia 30507

|

|

**

|

|

(8)(13)

|

8.6%

|

|

3,031,300

|

|

(13)

|

32.9%

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 3 Developments (9)

2415 Alta Monte Drive

Cedar Park, Texas 78613

|

|

**

|

|

|

*

|

|

520,000

|

|

(13)

|

5.6%

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eileen F. Kerasotes Family Trust (10)

4747 County Road 501

Bayfield, CO 81122

|

|

*

|

|

|

*

|

|

472,420

|

|

(13)

|

5.1%

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russell Hicks

|

|

692,291

|

|

(15)

|

5.5%

|

|

–

|

|

|

–

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brent Watts

|

|

692,291

|

|

(16)

|

5.5%

|

|

–

|

|

|

–

|

|

–

|

|

|

______________

*Less than 1%

**Less than 5%

(1) Represents 711,611 shares held by Family Tys,

LLC (“Family Tys”), of which Mr. Marks is the managing member and over which Mr. Marks has voting and dispositive power. Does

not include an aggregate of (i) 9,325,309 shares of Series C Stock (with 1.5625 votes per share, or 14,570,795 votes in the aggregate)

and (ii) 1,638,722 shares, for which Mr. Marks and Mr. Leiner have a voting proxy until May 20, 2023.

(2) Represents 342,495 shares held by 4 Life LLC

(“4 Life”), of which Mr. Leiner is the managing member and over which Mr. Leiner has voting and dispositive power. Does not

include an aggregate of (i) 9,325,309 shares of Series C Stock (with 1.5625 votes per share, or 14,570,795 votes in the aggregate), or

(ii) 1,638,722 shares of common stock, for which Mr. Leiner and Mr. marks have a voting proxy until May 20, 2023.

(3) Represents shares held by Thistle Investments,

LLC, of which Mr. Stevens is managing member and over which Mr. Stevens has sole voting and dispositive power.

(4) Represents shares held by Tempest Systems,

Inc., of which Mr. Rosenthal is chief executive officer and over which Mr. Rosenthal has sole voting and dispositive power.

(5) Does not include an aggregate of (i) 9,325,309

shares of Series C Stock (with 1.5625 votes per share, or 14,570,795 votes in the aggregate), and (ii) 1,638,722 shares of common stock,

for which Messrs. Marks and Leiner have a voting proxy until May 20, 2023.

(6) Includes 782 shares held by the Denis J.

Kerasotes Trust, dated June 13, 2017, of which Mr. Kerasotes as trustee has sole voting and dispositive power.

(7) Dale Nabb, manager of Condor Equities, LLC

(“Condor”), has sole voting and dispositive power of the shares held by Condor.

(8) Includes (i) an aggregate of 100,000 shares

underlying currently exercisable warrants at an average exercise price of $7.36 per share, and (ii) 23,438 shares held by Dale Nabb,

manager of Condor.

(9) Michael Tapajna, chief executive officer

of Section 3 Developments, Inc. (“Section 3”), has sole voting and dispositive power of the shares held by Section 3.

(10) John G. Kerasotes, as trustee of the Eileen

F. Kerasotes Trust, has sole voting and dispositive power over the shares held by such Trust.

(11) Based upon (i) 711,611 shares of common stock

held by Family Tys of which Mr. Marks is the managing member and over which Mr. Marks has voting and dispositive power and (ii) the voting

rights to an aggregate of (A) 1,638,722 shares of common stock held by certain holders of our Series C Stock, and (B) 9,325,309

shares of Series C Stock, having the right to 1.5625 votes for each share of Series C Stock for which Mr. Marks has a voting proxy

until May 20, 2023.

(12) Based upon (i) 342,495 shares held by 4 Life

of which Mr. Leiner is the managing member and over which Mr. Leiner has voting and dispositive power and (ii) and the voting rights to

an aggregate of (A) 1,638,722 shares of common stock held by certain holders of our Series C Stock, and (B) 9,325,309

shares of Series C Stock, having the right to 1.5625 votes for each share of Series C Stock for which Mr. Leiner has a voting proxy

until May 20, 2023.

(13) Darren Marks, the Company’s Chief

Executive Officer, President, and a director and Melvin Leiner, the Company’s Executive Vice President, Chief Financial Officer,

Chief Operating Officer, Treasurer, Secretary and a director, have the voting rights to such shares of Series C Stock and common stock

until August 6, 2022, pursuant to voting proxies from such shareholders.

(14) Includes 9,325,309 shares of Series C Stock

(with 1.5625 votes per share, or 14,570,795 votes in the aggregate).

(15) As of September 26, 2021, Russell Hicks

was appointed as President and Chief Content Officer of Curiosity Ink Media, and as President of Top Draw Animation. Address for Mr.

Hicks is c/o the Company 2060 NW Boca Raton Blvd., #6 Boca Raton, FL 33431

(16) As of September 26, 2021, Brent Watts

was appointed as Chief Creative Officer of Curiosity Ink Media. Address for Mr. Watts is c/o the Company 2060 NW Boca Raton Blvd.,

#6 Boca Raton, FL 33431.

Proxies and Voting Control by Certain Members

of Management

Darren Marks, the Company’s

Chief Executive Officer, President, and a director, and Melvin Leiner, the Company’s Executive Vice President, Chief Operating

Officer, and a director, have all of the voting rights of the Series C Stock until May 20, 2023, pursuant to a proxy from the Series

C shareholders.

As October 24, 2021, the number of our issued

and outstanding shares of (i) Common Stock is 12,552,106 and (ii) Series C Preferred Stock is 9,400,309. The shares of Series C Preferred

Stock effectively have 1.5625 votes per share (an aggregate of approximately 14,687,982 votes or approximately 53.9% of the voting control

of the company).

The holders of our Series C Preferred Stock gave

Darren Marks and Mel Leiner a proxy to vote 9,325,309 issued and outstanding shares of preferred stock that they have which accounts for

an aggregate of approximately 14,570,795 votes or approximately 53.5% of the voting control of the company). In addition, the Series C

Holders granted proxies over an additional 1,638,722 shares of Common Stock they hold.

Finally, Mr. Marks is the managing member of Family

Tys, LLC which holds an additional 711,611 shares of common stock and over which Mr. Marks has voting and dispositive power.

As a result, as of today, Mr. Marks has 16,921,128

votes, representing a combined voting power (i.e., Common Stock and Series C Preferred Stock voting together) of 62.1%.

APPRAISAL RIGHTS

No dissent or appraisal rights are available

under the Florida Business Corporation Act or under our Articles of Incorporation, as amended, as a result of the corporate action referenced

herein. This means that no shareholder is entitled to receive any cash or other payment as a result of, or in connection with the corporate

action, even if a shareholder has not been given an opportunity to vote.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this Information Statement, which means that we can disclose important information to you by referring you to other

documents that we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this

Information Statement. This Information Statement incorporates by reference the following documents:

|

|

1.

|

Our Annual Report on Form 10-K for the year ended December 31,

2020, filed with the SEC on April 13, 2021;

|

|

|

2.

|

Our Quarterly Report on Form 10-Q for the quarter ended March 31,

2021, filed with the SEC on May 17, 2021;

|

|

|

3.

|

Our Quarterly Report on Form 10-Q for the quarter ended June 30,

2021, filed with the SEC on August 23, 2021;

|

|

|

4.

|

Our Current Report on Form 8-K, Date of Event September 14, 2021,

Filed September 20, 2021; and

|

|

|

5.

|

Our Current Report on Form 8-K, filed October 20, 2021.

|

“HOUSEHOLDING” OF PROXY MATERIALS

Some banks, brokers and other nominee record

holders may employ the practice of “householding” proxy statements and annual reports. This means that only one copy of this

Consent Solicitation Statement may have been sent to multiple stockholders residing at the same household. If you would like to obtain

an additional copy of this Consent Solicitation Statement, please contact us at Grom Social Enterprises, Inc., c/o Equinity Shareowner

Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights MN 55120; Attention: Mr. Chad Dalton. If you want to receive separate

copies of our proxy statements and annual reports in the future, or if you are receiving multiple copies and would like to receive only

one copy for your household, you should contact your bank, broker or other nominee record holder.

STOCKHOLDER PROPOSALS

There are no proposals by any security holder which are or could have

been included within this Consent Solicitation Statement.

STOCKHOLDERS SHARING THE SAME LAST NAME AND

ADDRESS

The SEC has adopted rules that permit companies

and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing

the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to

as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. We and some brokers

household proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions

have been received from the affected stockholders. Once you have received notice from your broker or us that they are or we will be householding

materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time,

you no longer wish to participate in householding and would prefer to receive a separate proxy statement, or if you currently receive

multiple proxy statements and would prefer to participate in householding, please notify your broker if your shares are held in a brokerage

account or us if you hold registered shares. You can notify us by sending a written request to Grom Social Enterprises, Inc., c/o Equinity

Shareowner Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights MN 55120; Attention: Mr. Chad Dalton.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are required to comply with the reporting

requirements of the Exchange Act. For further information about us, you may refer to our Annual Report and our Quarterly Reports. You

can review these filings at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, DC 20549. These filings

are also available electronically on the World Wide Web at http://www.sec.gov.

The entire Consent Solicitation Statement is

available for review by each stockholder on https://gromsocial.com/proxymaterials.

In accordance with Rule 14a-3(e)(1) under

the Exchange Act, one Consent Solicitation Statement will be delivered to two or more stockholders who share an address, unless we have

received contrary instructions from one or more of the stockholders. We will deliver promptly upon written or oral request a separate

copy of the Consent Solicitation Statement to a stockholder at a shared address to which a single copy of the Consent Solicitation Statement

was delivered. Requests for additional copies of the Consent Solicitation Statement, and requests that in the future separate proxy statements

be sent to stockholders who share an address, should be directed to Grom Social Enterprises, Inc., c/o Equinity Shareowner Services,

1110 Centre Pointe Curve, Suite 101, Mendota Heights MN 55120; Attention: Mr. Chad Dalton. In addition, stockholders who share a single

address but receive multiple copies of the Consent Solicitation Statement may request that in the future they receive a single copy by

contacting us at the address set forth in the prior sentence.

By Order of the Board of Directors

Darren Marks

Chairman and Chief Executive Officer

November 5, 2021

Signature(s) in Box Please sign exactly as your name(s) appears on the Request for Instruction . If held in joint tenancy, all persons should sign . Trustees, administrators, etc . , should include title and authority . Corporations should provide full name of corporation and title of authorized officer signing the Request for Instruction . Shareowner Services P.O. Box 64945 St. Paul, MN 55164 - 0945 The Grom Social Enterprises Inc. Board of Directors proposes the following proposal: To approve the issuance of (i) $6,000,000 principal amount 10% Original Issue Discount Senior Secured Convertible Note, convertible into Common Stock at $4.20 per share, due 18 months from issuance (the “Second Tranche Note”), (ii) a five - year common stock purchase warrant to purchase 1,041,194 shares of common stock at $4.20 per share (the “Second Tranche Warrant”), and (iii) shares of common stock upon conversion or redemption of the Second Tranche Note, and upon exercise of the Second Tranche Warrant in accordance with their terms, which note and warrant are both anticipated to be issued by the Company as part of the second tranche of a private placement offering totaling up to $10,400,000. For Against Abstain THIS REQUEST FOR INSTRUCTION WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED AS WITHHOLDING CONSENT. Address Change? Mark box, sign, and indicate changes below: Date : INTERNET/MOBILE – www.proxypush.com/GROM ( PHONE – 1 - 866 - 883 - 3382 * MAIL – Mark, sign and date your instruction card and return it in the postage - paid envelope provided.

GROM SOCIAL ENTERPRISES INC . REQUEST FOR INSTRUCTION Shareowner Services, P . O . Box 64945 , St . Paul, MN 55164 - 0945 Notice is hereby given that we are seeking the written consents of stockholders holding a majority of shares (the “Majority Shareholders”) of the common stock, par value $ 0 . 001 per share (the “Common Stock”), and Series C 8 % convertible preferred stock, par value $ 0 . 001 per share (the “Series C Stock”) voting on an as converted basis, of Grom Social Enterprises, Inc . , a Florida corporation (the “Company), as of the close of business on the record date, October 7 , 2021 (the “Record Date”), acting in lieu of a special meeting by written consents (the “Consents”) to authorize and approve the proposal (the “Proposal”) on the reverse of this page . See reverse for voting instructions. We are requesting shareholder consents hereby because Nasdaq Rule 5635 (d) (the “Nasdaq Rule”) requires that a Company obtain approval from its shareholders prior to issuance of shares of Common Stock or any securities convertible into or exercisable for Common Stock, that in the aggregate equals or exceeds 20 % of the outstanding float prior to the offering . The issuance of shares upon conversion or redemption of the $ 6 , 000 , 000 of notes and exercise of the 1 , 041 , 194 warrants that are part of this Proposal, when combined with previously issued $ 4 . 4 M note and warrants in the same offering, will exceed twenty percent ( 20 % ) or more of the issued and outstanding number of shares of our Common Stock outstanding prior to said offering, thereby requiring this request for shareholder Consents . We intend to close on the $ 6 , 000 , 000 second tranche as soon as possible after receipt of properly executed Consents from the Majority Shareholders of all classes, voting together as a single class, and satisfaction of all other conditions to closing, as more fully described herein . The Proxy holders for the Series C Stock holders as well as certain members of management holding greater than a majority of the voting power, have already agreed to approve the Proposal . Our Board of Directors (“Board”) has fixed October 7 , 2021 , as the Record Date for holders of the Company’s Common Stock and Series C Stock entitled to participate in this Consent Solicitation and to provide Consents . This Notice of Consent Solicitation is being issued by the Company and is intended to be mailed on or about November 5 , 2021 , to all holders of our Common Stock and Series C Preferred Stock as of the Record Date . We are not holding a special meeting of stockholders in connection with the Proposal described herein . The Consent Solicitation Statement on the following pages describes the matters presented to stockholders herein . The entire Consent Solicitation Statement is available for review by each stockholder on https : //gromsocial . com/proxymaterials .

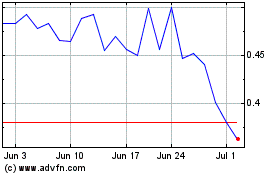

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Apr 2023 to Apr 2024