By Angus Loten

Retailers more than ever are leaning on cloud computing to

capitalize on a surge in online shopping without overloading their

information-technology systems.

Sparked by the coronavirus pandemic, the upswing in e-commerce

is a boon to most cloud vendors, but especially Google's

cloud-services unit.

Google Cloud, a division of Alphabet Inc., trails far behind

front-runners Amazon.com Inc.'s Amazon Web Services and Microsoft

Corp.'s Azure, with a 6% share of the global cloud market,

according to research firm Canalys. AWS and Azure together account

for more than half the market, the firm estimates. But a strategic

focus on retail-sector services, which predates the crisis by

roughly a year, has attracted deep-pocketed customers like Wayfair

Inc. and Etsy Inc.

While the crisis has been devastating for bricks-and-mortar

sellers of nonessential goods, online sales are booming at grocery

stores, building material and garden stores, and some general

merchandise stores, according to U.S. Commerce Department data.

Mike Fisher, Etsy's chief technology officer, said the online

marketplace in February completed a lengthy migration of its IT

systems into Google Cloud, from 2,000 on-premises servers.

The company was initially drawn to Google's cloud-based search

and machine-learning capabilities as a way to boost ranking and

recommendation tools for online shoppers by inputting a wider set

of variables into smart algorithms, he said.

"We couldn't have predicted better timing," Mr. Fisher said.

Since the pandemic struck, he added, "we've doubled the amount of

data we process."

Between April and June, Etsy's revenue more than doubled to

$428.7 million from $181.1 million a year earlier, with categories

such as homewares and craft supplies among the top performers. Over

the same three-month period, online shoppers bought more than 29

million protective masks from the site's independent sellers, Etsy

said.

Similar spikes in traffic, such as on Black Friday or in the

holiday shopping season, ordinarily require millions of dollars in

additional spending on data centers and servers to provide enough

computer capacity to handle massive amounts of data processing, Mr.

Fisher said. With its IT systems in the cloud, he added, "we could

spin that up in days rather than months."

Cloud providers charge companies a negotiated rate to rent

computing capacity and applications on an as-needed basis

"Many customers are scaling beyond their wildest projections,"

said Carrie Tharp, who oversees retail and consumer strategy at

Google Cloud.

She said companies that were gradually expanding their use of

cloud services have accelerated those efforts during the pandemic.

Others came to Google for a rapid response to shifting demand, such

as curbside pickup apps, sales and inventory tracking tools, or

digital call centers.

Google in July reported a 43% rise in revenue from its

cloud-computing services over the second quarter -- slightly slower

growth than Microsoft's cloud unit, which is more than four times

its size by revenue. Though Google doesn't break out cloud revenue

data by sector, it says as of August seven of the world's largest

retailers are cloud customers.

"Google Cloud is highly focused on six core verticals, with

retail being one of them," rather than general-purpose cloud

services, said Alex Smith, senior director of channels at

Canalys.

Mr. Smith said Google has tailored its cloud services to fit the

needs of large retailers sitting on massive amounts of data,

offering cloud-based analytics tools, contact-center services and

recommendation engines -- all increasingly powered by artificial

intelligence.

But as a wave of consumers took to shopping from home, amid

lockdowns and other safety measures, most retailers simply needed

flexible computer capacity to keep up with unpredictable highs and

lows, Google's Ms. Tharp said.

"The ability to store and process vast amounts of operational

data has played a significant role in meeting sustained peak

demand" during the crisis, said Jim Miller, Wayfair's chief

technology officer.

Wayfair, an online home-decorating marketplace which reported an

84% jump in second-quarter revenue to $4.3 billion, had shifted IT

systems to Google Cloud in January, as part of a broader

hybrid-cloud strategy.

The move was aimed at supporting bursts in capacity needed for

Way Day, an annual online sales promotion in April, tapping Google

for computing power, storage, networking and other capabilities,

the company said.

"When the pandemic materialized in mid-March, online capacity

was our focus," said Hesham Fahmy, vice president of technology at

Loblaw Digital, a division of Canadian grocery store giant Loblaw

Cos.

Mr. Fahmy said the chain had migrated its e-commerce platforms

into Google Cloud before the crisis, enabling the company to scale

up rapidly. The extra computing power was needed to both process

increased online orders and fulfill them, he said.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

August 24, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

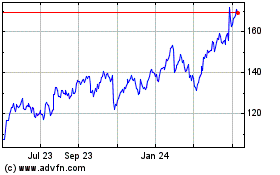

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

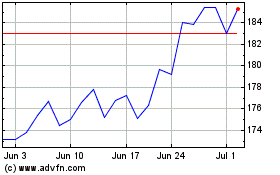

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024